|

市场调查报告书

商品编码

1690724

印度零售燃料:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Retail Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

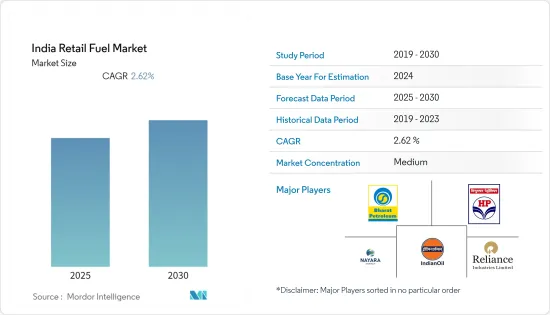

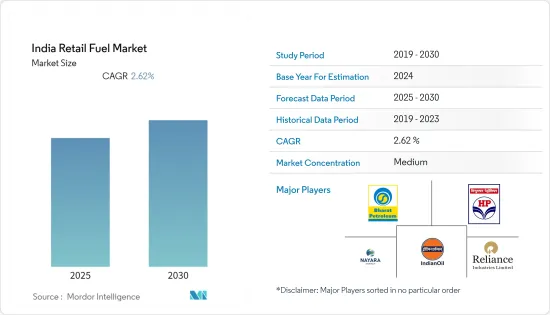

预计预测期内印度零售燃料市场的复合年增长率将达到 2.62%。

从中期来看,预计政府的支持措施和不断增长的燃料需求将在预测期内推动市场发展。

然而,预计原油价格波动加剧将阻碍预测期内的市场成长。

燃料分销网络的扩张预计将为印度零售燃料市场创造重大机会。

印度零售燃料市场趋势

公共业务部门预计将占据市场主导地位

- 印度石油公司(IOC)、巴拉特石油有限公司(BPCL)和印度斯坦石油有限公司(HPCL)等石油和天然气领域的公共部门企业(PSU)历史悠久,在市场上占有重要地位。政府拥有这些石油公司并对该行业享有相当大的控制权。

- 国有企业拥有完善的基础设施网络,包括加油站、管道、终端和仓储设施。国有企业正在将燃料配送到更广泛的地区,特别是偏远和农村地区,使全国各地的消费者更容易获得燃料。

- 2023年2月,国营精製和零售商印度石油有限公司(IOCL)宣布,计划在2023财年向西孟加拉邦投资2,544万美元。该公司表示,这项投资将用于扩大和开发更环保的零售燃料基础设施。截至 2022 年,环保汽车燃料已在全国 275 家零售店有售,但该公司计划在 2024 年底将这一数量增加到 1,000 多家。

- 此外,国有企业通常能够透过政府措施控制燃料价格。这使我们能够保持有竞争力的价格并稳定燃料成本,为消费者提供稳定性。

- 据印度石油天然气部称,2022 年 4 月至 2023 年 4 月期间,印度石油产品总消费量增加了 6% 以上。其中很大一部分归功于国营企业零售商。

- 此外,PSU 在市场上赢得了可靠性、安全性和品质的声誉。国有企业长期存在以及政府的支持增强了消费者的信心,这可能会影响他们对燃料供应商的选择。

- 因此,鑑于上述情况,PSU 很可能在预测期内占据市场主导地位。

汽车保有量的增加可能促进市场成长

- 印度道路上行驶的车辆数量的增加是零售燃料市场的主要驱动力。可支配收入的增加和都市化导致汽车持有激增,从而导致燃料需求增加。

- 路上的汽车越多,燃料需求就越大。随着汽车保有量的增加,汽油和柴油等零售燃料的消费量也增加。这将转化为燃料零售商销售的增加,从而推动市场成长。

- 车辆保有量的增加直接意味着燃料零售商的商机增加。路上的汽车越多,代表人们去加油站的次数越多,增加了零售燃料市场的销售和收益。

- 根据印度汽车工业协会预测,2021-2022年印度汽车销售量将成长20%以上,销售量将增加。

- 此外,BMW在 2023 年 5 月宣布,准备在不久的将来将 X3 M40i 引入印度,有兴趣的客户现在就可以预订这款高性能 SUV。 X3 M40i 将配备与 BMW M340i 相同的动力传动系统,包括 3.0 升六缸涡轮汽油引擎。

- 因此,如上所述,预计在预测期内,汽车销售的成长将主导市场。

印度零售燃料产业概况

印度零售燃料市场适度整合。该市场的主要企业(不分先后顺序)包括印度石油有限公司、巴拉特石油公司、印度斯坦石油有限公司、纳亚拉能源有限公司和信实工业有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 至2028年的市场规模及需求预测(单位:千吨)

- 印度各公司零售店数量(2013-2022 年)

- 印度各邦和各公司的零售店数量(2022 年)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 汽车持有增加

- 政府倡议

- 限制因素

- 油价波动

- 驱动程式

- 供应链分析

- PESTLE分析

第五章市场区隔

- 拥有者

- 公部门

- 私部门

- 最终用户

- 公共部门

- 私部门

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Indian Oil Corporation Ltd

- Bharat Petroleum Corp. Ltd

- Hindustan Petroleum Corporation Limited

- Nayara Energy Limited

- Reliance Industries Limited

- Shell PLC

- TotalEnergies SA

第七章 市场机会与未来趋势

- 扩大分销网络

The India Retail Fuel Market is expected to register a CAGR of 2.62% during the forecast period.

Over the medium term, supportive government policies and increasing demand for fuels are expected to drive the market during the forecasted period.

On the other hand, the increasing fluctuations in crude oil prices are expected to hinder the market's growth during the forecasted period.

Nevertheless, the increasing fuel distribution network is expected to create huge opportunities for the India retail fuel market.

India Retail Fuel Market Trends

The Public Sector Undertakings Segment is Expected to Dominate the Market

- Public Sector Undertakings (PSUs) in the oil and gas sector, such as Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL), have long been established and have a strong presence in the market. The government owns these PSUs and enjoys significant control over the sector.

- PSUs have a well-developed infrastructure network, including fuel stations, pipelines, terminals, and storage facilities. They have a wider reach, especially in remote and rural areas, ensuring better availability of retail fuel to consumers across the country.

- In February 2023, Indian Oil Corporation Limited (IOCL), a state-owned refiner and oil retailer, announced that the company plans to invest USD 25.44 million in FY2023 in West Bengal. The company announced that the investment was made to expand and develop the infrastructure for greener retail fuels. As of 2022, the green auto fuel is available at 275 retail outlets across the country, but the company plans to increase the number to more than 1,000 by the end of 2024.

- Furthermore, PSUs often have more control over fuel pricing, as government policies guide them. This allows them to maintain competitive pricing and stabilize fuel costs, offering stability to consumers.

- According to the Ministry of Petroleum and Natural Gas, India, the total consumption of petroleum products in India increased by more than 6% between April 2022 and April 2023. The majority of these shares were from PSU retail outlets.

- Additionally, PSUs have built a reputation for reliability, safety, and quality in the market. Their long-standing presence and government backing instill a sense of trust among consumers, which can influence their choice of fuel provider.

- Therefore, as per the above points, PSUs will likely dominate the market studied during the forecasted period.

Rise in Car Penetration May Help the Market Grow

- The increasing number of vehicles on Indian roads is a significant driving factor for the retail fuel market. Rising disposable incomes and urbanization have led to a surge in vehicle ownership, leading to higher fuel demand.

- More cars on the road mean a higher demand for fuel. As the number of car owners increases, there is a corresponding increase in the consumption of retail fuels such as gasoline and diesel. This leads to greater sales volume for fuel retailers, driving the market growth.

- The growth in car penetration directly translates to increased revenue opportunities for fuel retailers. More vehicles on the road mean more frequent visits to fuel stations, resulting in higher sales and revenue generation for the retail fuel market.

- According to the Society of Indian Automobile Manufacturers, vehicle sales in India increased by more than 20% between 2021 and 2022, signifying increased sales, consequently leading to increased demand for retail fuels in the country.

- Furthermore, in May 2023, BMW announced that it is preparing to introduce the X3 M40i in India in the near future, and interested customers can already book this high-performance SUV. The X3 M40i will feature the same powertrain as the BMW M340i, which consists of a 3.0-liter six-cylinder turbocharged petrol engine.

- Therefore, as per the points discussed above the increase in car sales is expected to dominate the market during the forecasted period.

India Retail Fuel Industry Overview

The India Retail Fuel Market is moderately consolidated. Some of the key players in this market (in no particular order) include Indian Oil Corporation Ltd, Bharat Petroleum Corp. Ltd, Hindustan Petroleum Corporation Limited, Nayara Energy Limited, and Reliance Industries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in Thousand Tons, till 2028

- 4.3 Company-wise Retail Outlets in India, 2013-2022

- 4.4 State-wise and Company-wise Retail Outlets in India, 2022

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Growing Vehicle Ownership

- 4.7.1.2 Government Initiatives

- 4.7.2 Restraints

- 4.7.2.1 Volatile Crude Oil Prices

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Ownership

- 5.1.1 Public Sector Undertakings

- 5.1.2 Private Owned

- 5.2 End User

- 5.2.1 Public Sector

- 5.2.2 Private Sector

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Indian Oil Corporation Ltd

- 6.3.2 Bharat Petroleum Corp. Ltd

- 6.3.3 Hindustan Petroleum Corporation Limited

- 6.3.4 Nayara Energy Limited

- 6.3.5 Reliance Industries Limited

- 6.3.6 Shell PLC

- 6.3.7 TotalEnergies SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Distribution Network