|

市场调查报告书

商品编码

1690731

真空断路器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Vacuum Interrupter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

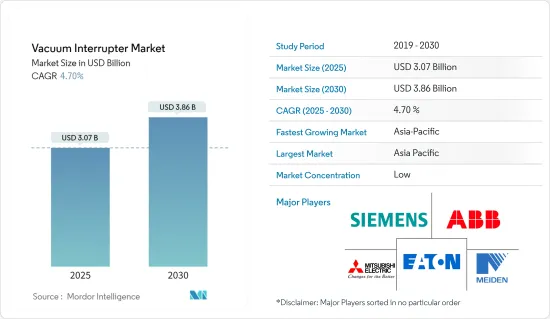

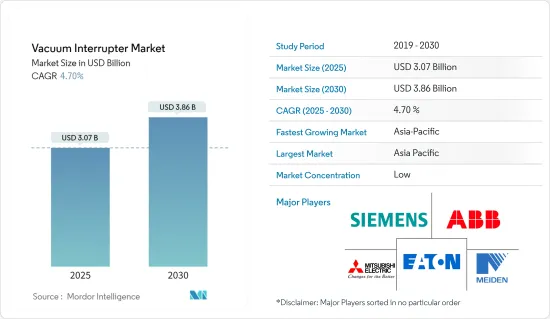

真空断路器市场规模预计在 2025 年为 30.7 亿美元,预计到 2030 年将达到 38.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.7%。

主要亮点

- 对安全配电的需求不断增加,导致老化基础设施的升级,从而推动了真空断路器市场的需求。技术进步也推动了现有基础设施的现代化,已开发国家和新兴国家都投入大量资金升级基础设施以满足日益增长的电力需求。此外,能源领域的环境问题和永续性法规进一步推动了市场成长。

- 真空断路器环保,采用优质材料製成,在维护和处置过程中可以安全处理。然而,真空断路器的製造需要先进的技术,这阻碍了市场的成长。运输过程中的损坏或故障可能导致真空损失,导致断路器失效且无法在现场修復。此外,高压应用真空断路器的高成本进一步限制了市场的成长。

- 儘管面临这些挑战,但新冠疫情作为工业4.0发展的催化剂,推动了真空断路器的技术创新,高效改善了能源消耗。全球领先的供应商正在创新其产品以满足日益增长的真空断路器需求,电力经销商也在其网站上展示这些新产品。

真空断路器市场趋势

智慧电网基础设施的成长将推动市场

- 在许多国家,电力基础设施正在老化,需要比最初设计的性能更好。全球发电和输电产业正在进行电网现代化改造,利用先进的技术、设备和控製手段使电网更加智慧、更具弹性。智慧电网能够通讯和协同工作,以更有效率、更可靠地输送电力。这些电网可以显着减少停电持续时间和频率,减轻风暴的影响,并在停电时快速恢復服务。

- 例如,美国能源局几年前推出了电网现代化倡议(GMI)。这是塑造美国电网基础设施未来的全面努力。

- 全球各地的已开发国家和新兴国家政府越来越多地将智慧电网技术视为一项战略基础设施投资,以促进永续的长期经济繁荣并有助于实现碳排放目标。预计这一趋势将在不久的将来为参与智慧电网市场的公司创造商机。

- 真空中断技术可以实现更好的控制,因为它可用于重复切换、故障保护、过流和短路保护。这种控制是自动化的,从而提高了效率。

- 此外,随着越来越多的再生能源来源和分散式能源来源被纳入智慧电网,监测和计量对于平衡供需至关重要。真空断路器产业依赖关键基础设施的扩建和电网自动化程度的提高。因此,智慧电网有望推动市场成长。

- 此外,美国能源局于 2022 年 9 月宣布了一项 105 亿美元的智慧电网和其他升级计划,以加强该国的电网。电网復原资金将以补助的形式提供,用于支持电网现代化活动,减少极端天气和自然灾害的影响。

亚太地区成长迅速

- 亚太地区的发电厂安装计划成长强劲,尤其是印度、日本和中国等主要国家。然而,该地区的许多公用事业公司在获取新方法铺设电力线路方面面临挑战,尤其是在都市区。

- 必须安装新的负载开关设备来优化电力容量并实现可再生能源的整合,但气体绝缘类型由于其使用寿命长、开关设备系统尺寸小而越来越受欢迎。随着该地区各国重点关注大型可再生能源计划,预计气体绝缘类型将在各种类型的断路器开关中变得更加流行。

- 例如,菲律宾近期根据第三轮公开竞争选择程序(OCSP3)开放了可再生能源计划申请,允许外资100%参与大型地热探勘、开发和利用计划。同样,根据印尼国家电力公司 PLN 的电力供应产业计画草案(RUPTL),印尼计划在 2021 年至 2030 年期间将使用可再生能源的新建发电厂的比例从 30% 提高到 48%。

- 随着该地区转型的进展,智慧电网蓝图预计将变得更加普遍,同时分散式发电和公共产业IT 和分析市场的支出也将增加。印度有几个农村地区无法获得稳定的电力供应,最近的电气化倡议预计将更加专注于向这些地区供电,从而增加对电路断流器开关的需求。

- 此外,电力公司被迫将电网接入部署到偏远地区,这是一个重大挑战,因为他们没有人力在停电期间访问这些地方来打开断路器开关或保险丝开关。远端发电工程也促进了断路器市场的成长。

真空断路器产业概况

真空断路器市场竞争激烈,已有老字型大小企业对其产品进行了大规模投资。进入市场的新玩家需要大量投资才能保持竞争优势。强大的竞争策略将使公司能够保持在市场中的地位。市场的主要企业包括伊顿公司、明电舍株式会社、三菱电机株式会社、西门子股份公司、ABB 和陕西宝光真空电气设备有限公司。这些公司也采取了多种扩大策略来获得竞争优势。

2023年2月,武汉菲特电器为海外客户生产的15.5KV、630A、31.5KA真空断路器及自动复闭器顺利通过荷兰KEMA实验室型式试验。 5.5KV、630A、31.5KA是菲特的另一款真空断路器,已通过国际知名实验室的测试。测试标准为IEC 62271-111:2019/IEEE Std C37.60:2018标准。这样的认证将保持客户对公司产品的信心。

2023 年 2 月,ABB 在 2023 年 ELECRAMA 上推出了 ConVac Hoover Contractor,展示其电气化和运动业务的创新。为确保电力传输的安全、智慧和永续性,ABB电气业务提供从电线杆到插座的全套电气设备、技术解决方案和服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 智慧电网基础设施的成长

- 加强现有基础设施的现代化和升级

- 市场限制/挑战

- 高压成本过高

第六章 市场细分

- 按应用

- 电路断流器

- 接触器

- 重合器

- 负荷开关

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Eaton Corporation PLC

- Meidensha Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- ABB Ltd

- Wuhan Feite Electric Co. Ltd

- Toshiba Corporation

- Shaanxi Joyelectric International Co. Ltd

- Kirloskar Electric Company Ltd

- Zhejiang Xuhong Vacuum Electricappiliance Co. Ltd

第八章 市场机会与未来趋势

The Vacuum Interrupter Market size is estimated at USD 3.07 billion in 2025, and is expected to reach USD 3.86 billion by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for safe and secure electrical distribution has led to the upgradation of outdated infrastructure, boosting the market demand for vacuum interrupters. Modernization work is also increasing in existing infrastructure due to technological advancements, with both developed and developing countries investing heavily in infrastructure upgrades to meet rising electricity demands. Additionally, environmental concerns and sustainability regulations in the energy sector are further driving the market growth.

- Vacuum interrupters are highly environmentally friendly, comprised of benign materials, and safe to handle during maintenance and disposal. However, the production of vacuum interrupters requires high technology, hindering the market growth. Transit damage or failure can cause a loss of vacuum, rendering the interrupter useless and impossible to repair on-site. Moreover, the high cost of vacuum interrupters for high-voltage applications further limits the market growth.

- Despite these challenges, the COVID-19 pandemic acting as a catalyst for Industry 4.0 developments led to innovations in vacuum interrupters, improving energy consumption with high-efficiency levels. Major global vendors are innovating their products, and electrical distributors are showcasing these new products on their websites to meet the growing need for vacuum interrupters.

Vacuum Interrupter Market Trends

Growth of Smart Electricity Grid Infrastructure to Drive the Market

- In many countries, electric infrastructure is aging, and it is being pushed to do more than it was originally designed for. Globally, the power generation and transmission sectors are witnessing a trend of modernizing the grid to make it smarter and more resilient using advanced technologies, equipment, and controls. Smart grids are able to communicate and work together to deliver electricity more efficiently and reliably. These grids can vastly reduce the duration and frequency of power outages, reduce storm impacts, and restore service at a faster rate when outages occur.

- For instance, the United States Department of Energy launched the Grid Modernization Initiative (GMI) a few years back. It is a comprehensive effort to help shape the future of the US grid infrastructure.

- Governments of both developed and emerging countries across the world are increasingly seeing smart grid technology as a strategic infrastructural investment that will enable sustainable long-term economic prosperity and aid them in achieving carbon emission reduction targets. This trend is expected to provide opportunities to the companies involved in the smart grid network market in the near future.

- Vacuum interrupter technology is used for repetitive switching, fault protection, overcurrent, and short-circuit protection; hence, it allows greater control. Such controls are automated for greater efficiency.

- Moreover, as more renewable and distributed energy sources are integrated into smart grids, monitoring and measurement become essential to balancing supply and demand. The vacuum interrupter industry depends on the extension of crucial infrastructures and the increase in grid automation. Therefore, smart grids are expected to drive market growth.

- Moreover, in September 2022, the US Department of Energy announced a USD 10.5 billion program for smart grids and other upgrades to strengthen the country's electricity grid. The grid resilience funding will be in the form of grants to support activities to modernize the grid to reduce the impacts due to extreme weather and natural disasters.

Asia-Pacific to Witness Significant Growth

- The Asia-Pacific region has experienced significant growth in power plant installation projects, particularly in major countries such as India, Japan, and China. However, many utilities in the region are facing challenges in acquiring new ways to install transmission lines, especially within urban areas.

- To optimize power capacity and enable the integration of renewable energy, new load break switches need to be installed, with the gas-insulated type gaining popularity due to its longer life cycles and smaller size of the switchgear system. As countries in the region focus on large-scale renewable energy projects, the gas-insulated type is expected to grow in popularity among the different types of circuit breaker switches.

- For example, the Philippines recently opened applications for renewable energy projects under the third Open and Competitive Selection Process (OCSP3), allowing for 100% foreign participation in large-scale geothermal exploration, development, and utilization projects. Similarly, Indonesia plans to increase the portion of new and renewable energy-based power plants from 30% to 48% within 2021-2030, according to a draft electric power supply business plan (RUPTL) of the state electricity company (PLN).

- As the region's transformation continues, smart grid roadmaps are expected to become more popular, along with increased spending in distributed generation and utility IT and analytics markets. The presence of several rural areas in India without a stable power supply and recent electrification initiatives are expected to increase the emphasis on providing power to these areas, contributing to the demand for circuit breaker switches.

- In addition, utilities face pressure to deploy remote grid access as a major agenda, as they cannot afford personnel to visit remote sites to open circuit break switches and fuse switches during outages. Remote power generation projects also contribute to the growth of the circuit switch markets.

Vacuum Interrupter Industry Overview

The vacuum interrupter market is highly competitive, with well-established players who have invested significantly in the product. New players entering the market require high investments to compete. Companies can sustain their position in the market through powerful competitive strategies. Some of the leading companies in the market include Eaton Corporation PLC, Meidensha Corporation, Mitsubishi Electric Corporation, Siemens AG, ABB, Shaanxi Baoguang Vacuum Electric Device Co., Ltd., and many others. These companies are also involved in several expansion strategies to gain a competitive advantage.

In February 2023, the 15.5 KV, 630 A, 31.5 KA vacuum interrupter produced by Wuhan Feite Electric Co. Ltd with the automatic recloser of overseas customers passed the type test in KEMA Laboratories in the Netherlands. 5.5 KV, 630 A, 31.5 KA is another vacuum interrupter from Feite company that has passed the test in the famous international laboratory. The test standard is IEC 62271-111: 2019/IEEE Std C37.60:2018 standard. Such type of certification would maintain the customer's trust in the company's products.

In February 2023, ABB introduced the ConVac Hoover Contractor at ELECRAMA 2023, showcasing innovations from its Electrification and Motion businesses. In order to ensure the safety, intelligence, and sustainability of electricity transmission, ABB's Electrification will offer a wide range of electrical equipment, technology solutions, and services ranging from poles to sockets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes of Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Smart Electricity Grid Infrastructure

- 5.1.2 Increasing Modernization and Upgrading of Existing Infrastructure

- 5.2 Market Restraint/Challenge

- 5.2.1 Excessive Cost at Higher Voltage

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Circuit Breaker

- 6.1.2 Contactor

- 6.1.3 Recloser

- 6.1.4 Load Break Switch

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Middle East and Africa

- 6.2.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Eaton Corporation PLC

- 7.1.2 Meidensha Corporation

- 7.1.3 Mitsubishi Electric Corporation

- 7.1.4 Siemens AG

- 7.1.5 ABB Ltd

- 7.1.6 Wuhan Feite Electric Co. Ltd

- 7.1.7 Toshiba Corporation

- 7.1.8 Shaanxi Joyelectric International Co. Ltd

- 7.1.9 Kirloskar Electric Company Ltd

- 7.1.10 Zhejiang Xuhong Vacuum Electricappiliance Co. Ltd