|

市场调查报告书

商品编码

1940695

资料中心发电机:市场占有率分析、产业趋势与统计资料、成长预测(2026-2031 年)Data Center Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

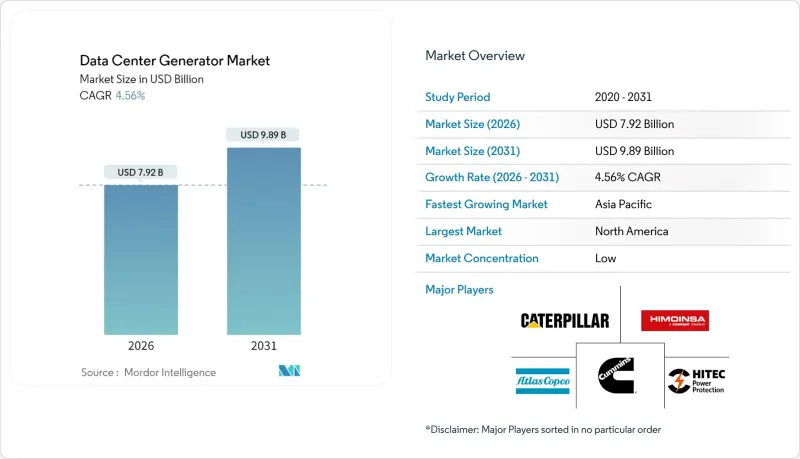

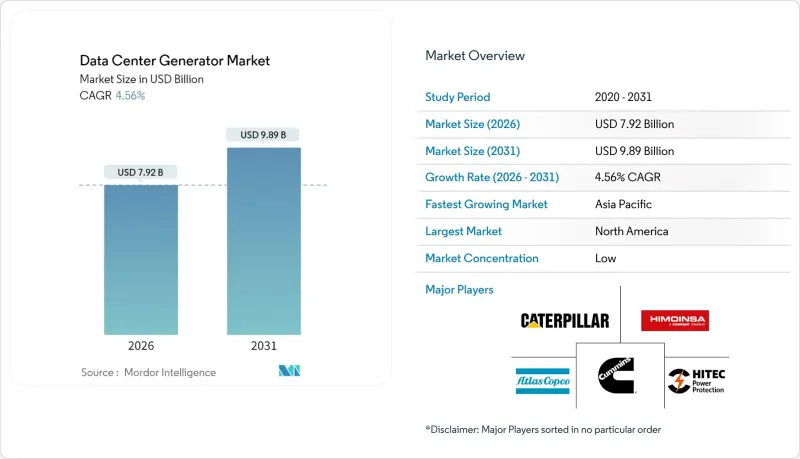

预计到 2026 年,资料中心发电机市场价值将达到 79.2 亿美元,从 2025 年的 75.7 亿美元成长到 2031 年的 98.9 亿美元。

预计从 2026 年到 2031 年,其复合年增长率将达到 4.56%。

这一稳步增长得益于超大规模设施的激增和新一轮人工智慧丛集的兴起,它们正将机架密度推向兆瓦级,从根本上改变了备用电源的设计。儘管柴油机组仍占据安装基础的大多数,但碳减排政策、燃料价格波动以及更严格的Tier 4排放法规正在加速人们对天然气、氢气和HVO平台的兴趣。大缸径发动机的供应链限制延长了交货时间,促使营运商签订多年框架协议或改用从区域组装中心发货的模组化机组。同时,创纪录的铜价推高了发电机製造成本,促使原始设备製造商(OEM)更加垂直整合,并在技术允许的情况下扩大铝绕组的使用。竞争压力正从单纯的功率转向更广泛的因素,例如燃料柔软性、排放规性以及提供预测性维护分析的数位化服务,以确保发电机的运作。

全球资料中心发电市场趋势与洞察

快速建造超大规模和託管设施

如今,超大规模计划的装置容量通常超过100兆瓦,迫使营运商将数十个2.5兆瓦的机组聚合起来,建造N+2环网,以确保即使在断电情况下也运作。 2024年,Google累计50亿美元,将新加坡资料中心的容量扩大35%,相当于新增超过150兆瓦的备用电源。託管服务供应商也在进行类似的扩张,例如普林斯顿数位集团在其位于马来西亚的150兆瓦园区部署了并联开关设备,以优化负载削减流程。合约内容越来越涵盖发电机供应、试运行和长期维护,从而降低了前置作业时间风险和价格波动。随着对超大规模设施建设的需求不断增长,原始设备製造商(OEM)正在加强其在东南亚和美国中西部的本地组装基地,以解决物流瓶颈并利用国内采购激励政策。

透过人工智慧工作负载提高机架功率密度

装满GPU的机架,每个GPU的功耗高达1兆瓦,正在考验传统发电机组的安全裕度,迫使其重新评估容量,甚至彻底更换。康明斯宣布,其电力系统业务在第一季的营收成长了19%,并将成长归功于人工智慧资料中心订单。业者要求更严格的电压调节频宽和小于10秒的动态反应时间,以保护数千个无法承受电压骤降的互联加速器。为了解决这个问题,发电机组正在采用更大的交流发电机、主动谐波滤波器和液冷迴路,以散发高位定子产生的热量。韧体升级还实现了与飞轮式UPS缓衝器的即时同步,确保在电网发生故障时实现无缝切换。

柴油发电机碳排放法规

加州空气资源委员会限制了非紧急运作时间并强制要求即时监测,迫使营运商安装昂贵的选择性催化还原(SCR)设备和颗粒物过滤烟囱。在欧盟,工业排放指令收紧了许可程序,对于严重依赖柴油的校园,核准最多会延迟14个月。遵守法规会增加生命週期拥有成本,因为废气后处理组件必须每15,000个运作小时更换一次。虽然一些校园已透过将备用发电机组迁移到监管较少的地区来应对,但这种策略与对延迟敏感的用户需求相衝突,迫使原始设备製造商(OEM)创新研发更清洁的燃烧技术和混合动力解决方案。

细分市场分析

至2025年,柴油发电机将占需求的81.25%,但随着营运商对碳排放责任进行财务量化,其成长潜力已趋于平缓。 2028年更严格的配额最终确定后,预计资料中心柴油发电机市场规模将略有成长,之后趋于稳定。氢能和氢化植物油(HVO)平台虽然基数小规模,但得益于即时的兼容性和政府税收优惠政策,正展现出强劲的成长势头。随着1%混合燃料在欧洲天然气管网的普及,氢能发电机在资料中心发电机市场的份额预计将稳步提升。

监管激励措施进一步推动了这一趋势。德国494号设施拨款5.5亿欧元用于维修绿色备用电源,并鼓励订购可自动调节至甲烷-氢气混合燃料的双燃料引擎。同时,超大规模资料中心业者正在签署可再生柴油采购协议,以确保2030年之前的价格可预测性。製造商则透过空中韧体更新来应对,根据燃料特性的变化重新校准喷射图,从而延长引擎寿命并提供针对生物柴油污染的保固保护。儘管柴油因其能量密度和普遍可用性仍然十分重要,但替代燃料正在获得创新动力。

由于需要数千个小规模边缘站点来确保本地内容传送,1MW 以下的机组仍然占据主导地位。然而,随着超大规模营运的不断精简,对 2MW 以上单一机组的需求正在加速成长。预计到 2031 年,资料中心发电机市场 2MW 以上的细分市场将以 13.78% 的复合年增长率成长,几乎与长期以来在 1MW 以下细分市场占据领先地位的机组持平。营运商青睐这些更大功率的机组,因为更少的发动机可以简化燃料物流,减少备件库存,并缩小面积——这对于沿海光纤登陆点附近的高成本地区来说至关重要。

原始设备製造商 (OEM) 正在透过引入配备工厂预装配电盘和控制设备的模组化验收测试间来解决供应链拥塞问题,将现场试运行时间缩短至 10 天以内。同时,租赁设备供应商也在扩展其 1-2 兆瓦功率范围的产品组合,以填补交付缺口。合约通常包含在设备发货后购买永久设备的选项;这些灵活的模式有助于保持资本预算的可预测性,并避免因託管合约中承诺在特定日期前交付机架而产生的逾期罚款。

资料中心发电机市场按产品类型(柴油、天然气、氢/HVO相容型、其他)、容量(<1MW、1-2MW、>2MW)、等级(Tier I/II、Tier III、Tier IV)、资料中心类型(超大规模、企业级、主机)和地区进行细分。市场预测以美元计价。

区域分析

北美地区占2025年总收入的40.55%,这主要得益于北维吉尼亚、达拉斯和凤凰城等高密度资料中心走廊的强劲发展。目前,投资重点已从购买新土地转向提高电力密度,营运商正用3.5兆瓦的Tier 4-Fital型号发电机替换老旧的2兆瓦柴油发电机,从而在不扩建墙体的情况下充分利用閒置频段。联邦政府对氢气和沼气生产的税额扣抵也进一步推动了向低碳发电机的转型。

亚太地区展现最强劲的成长潜力,预计2031年复合年增长率将达到10.42%。新加坡已解除资料中心许可的暂停发放限制(前提是效率提升),并正在推动五个总合300兆瓦的计划计画。印度的《数位个人资料保护法》正在刺激国内云端运算建设,光是孟买一地就计画新增700兆瓦的IT负荷。在日本,Softbank Corporation位于北海道的园区(300兆瓦)正在与水力发电电网对接,并配备双燃料备用电源以应对地震造成的停电。同时,马来西亚和印尼正透过向超大规模资料中心业者营运商提供土地赠款和可再生能源认证,成为具有成本主导的地区。欧洲在绝对值方面排名第三,但在永续性要求方面却处于领先地位。阿姆斯特丹市政府透过限制柴油车运作时间和对年二氧化碳排放超过500吨的车辆课税,鼓励业者改用燃气引擎和电池混合动力汽车。都柏林输电能力的限制迫使开发商将目光转向西班牙和葡萄牙,导致电力需求向南转移。中东地区正充分利用其丰富的天然气和太阳能资源:杜拜数位园区正在安装燃气发电机组,并配备吸收式製冷机,将废热用于区域供冷系统。非洲虽然仍处于起步阶段,但已展现出巨大潜力,内罗毕和拉各斯正在部署配备400千伏安柴油发电机的微型模组化资料中心,以应对不稳定的电网。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速建造超大规模和託管设施

- 透过人工智慧工作负载提高机架功率密度

- 新兴市场边缘资料中心的扩张

- 向天然气和氢化植物油发电机过渡以永续性

- 引进临时拖车式临时电力

- 采用模组化微电网相容型发电单元

- 市场限制

- 柴油发电机碳排放法规

- 向电池和燃料电池替代技术过渡

- 高功率引擎供应链中的瓶颈

- 都市区获得噪音和空气品质许可证的障碍

- 价值/供应链分析

- 监管环境

- 技术展望

第五章 市场规模与成长预测

- 依产品类型

- 柴油引擎

- 天然气

- 氢气和HVO兼容

- 其他产品类型

- 按产能

- 小于1兆瓦

- 1~2MW

- 超过2兆瓦

- 依层级类型

- 一级和二级

- 三级

- 四级

- 依资料中心类型

- 超大规模(自有和租赁)

- 企业版(本地部署)

- 搭配

- 按地区

- 北美洲

- 南美洲

- 欧洲

- 亚太地区

- 中东和非洲

第六章 竞争情势

- 市占率分析

- 公司简介

- Caterpillar Inc.

- Cummins Inc.

- Generac Power Systems Inc.

- Rolls-Royce plc(mtu Solutions)

- Kohler Co.

- Mitsubishi Heavy Industries Group

- Atlas Copco AB

- Himoinsa SL

- Aksa Power Generation

- HITEC Power Protection BV

- INNIO Group(Jenbacher/Waukesha)

- Aggreko Ltd.

- Wartsila Corp.

- ABB Ltd.

- Doosan Enerbility Co., Ltd.

- FG Wilson

- Yanmar Holdings Co., Ltd.

- Perkins Engines Co. Ltd.

- Briggs & Stratton LLC

- Baudouin(Weichai)

- HIPOWER SYSTEMS

- GE Vernova

第七章 市场机会与未来展望

The data center generator market size in 2026 is estimated at USD 7.92 billion, growing from 2025 value of USD 7.57 billion with 2031 projections showing USD 9.89 billion, growing at 4.56% CAGR over 2026-2031.

This steady climb is rooted in the surge of hyperscale facilities and the new wave of artificial-intelligence clusters that now push rack densities into the megawatt range, fundamentally transforming backup-power design. Diesel units still anchor most installations, but carbon-reduction policies, volatile fuel prices, and stricter Tier 4 rules accelerate interest in natural-gas, hydrogen, and HVO-ready platforms. Supply-chain shortages for large-bore engines lengthen delivery cycles, prompting operators to lock in multi-year framework agreements or pivot toward modular blocks shipped from regional assembly hubs. Meanwhile, copper prices at record highs squeeze alternator manufacturing costs, driving OEMs to intensify vertical-integration moves and to substitute aluminum windings where technical requirements allow. Competitive pressure is therefore shifting from pure horsepower to a broader mix of fuel flexibility, emissions compliance, and digital service offerings that guarantee a generator's readiness with predictive maintenance analytics.

Global Data Center Generator Market Trends and Insights

Surging Hyperscale and Colocation Build-out

Hyperscale projects now regularly exceed 100 MW, forcing operators to aggregate dozens of 2.5 MW units into N+2 rings that guarantee uptime during grid loss. In 2024, Google earmarked USD 5 billion to lift Singapore capacity by 35%, translating into more than 150 MW of incremental standby generation Colocation specialists mirror that scale, exemplified by a 150 MW campus under Princeton Digital Group in Malaysia designed with parallel switchgear lineups to streamline load-shed sequencing. Contract structures increasingly bundle genset supply, commissioning, and long-term service to curb lead-time risk and price volatility. As hyperscale pipelines swell, OEMs strengthen local assembly bases in Southeast Asia and the U.S. Midwest to reduce logistics bottlenecks and to align with domestic-content incentives.

Rising Rack-Power Densities from AI Workloads

GPU-rich racks that consume up to 1 MW each compress the safety margin of legacy generator fleets, prompting capacity re-rating or wholesale replacement. Cummins posted a 19% jump in Power Systems revenue in Q1-2025, attributing the rise to AI-driven data center orders . Operators now specify tighter voltage-regulation bands and dynamic-response times below 10 seconds to protect thousands of interconnected accelerators that cannot tolerate brownouts. Generator skids therefore integrate larger alternators, active harmonic filters, and liquid-cooling circuits that dissipate elevated stator heat. Firmware upgrades also enable real-time synchronization with flywheel UPS buffers, ensuring seamless transition when grid events occur.

Carbon-Emission Regulations Targeting Diesel Gensets

California's Air Resources Board limits non-emergency runtime and enforces real-time monitoring, compelling operators to fit costly SCR and particulate-filter stacks. In the European Union, the Industrial Emissions Directive intensifies permitting scrutiny, delaying approvals by up to 14 months for diesel-heavy campuses. Compliance lifts lifecycle ownership costs as exhaust-after-treatment parts must be replaced every 15,000 engine hours. Some campuses respond by relocating backup yards to less-regulated jurisdictions, yet that strategy collides with latency-sensitive user demands, keeping pressure on OEMs to innovate cleaner combustion or hybrid solutions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Edge Data Centers in Emerging Markets

- Transition to Natural-Gas and HVO Gensets for Sustainability

- Shift Toward Battery and Fuel-Cell Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diesel sets anchored 81.25% of 2025 demand, yet their headroom is capped as operators quantify carbon liabilities in financial terms. The data center generator market size for diesel solutions is projected to expand marginally before plateauing post-2028 once stricter quotas lock in. Hydrogen and HVO-ready platforms, though starting from a small base, exhibit outlier growth, propelled by immediate drop-in compatibility and government tax credits. The data center generator market share for hydrogen-ready units is forecast to climb steadily as 1% blends become commonplace in European gas grids.

Regulatory incentives further tilt momentum. Germany's funding line 494 directs EUR 550 million toward green backup power retrofits, funneling orders toward dual-fuel engines that self-calibrate to methane-hydrogen blends. Simultaneously, hyperscalers sign offtake agreements for renewable diesel to lock price visibility through 2030. Manufacturers respond with over-the-air firmware updates that retune injection maps when fuel properties shift, prolonging engine life and protecting warranties against biodiesel contamination. Diesel therefore remains critical for its energy density and universal availability, but alternative fuels capture the innovation spotlight.

Less than 1 MW units retain dominance because thousands of small edge sites must guarantee local content delivery. However, hyperscale rationalization accelerates demand for single-block ratings beyond 2 MW. Greater than 2 MW slice of the data center generator market is forecast to compound at 13.78% annually, and by 2031 it will nearly equal the long-time less than 1 MW leader. Operators favor these larger frames because fewer engines simplify fuel logistics, reduce spares inventory, and shrink the real-estate footprint-an important consideration on high-cost plots near coastal fiber landings.

OEMs tackle supply-chain congestions with modular factory-acceptance testing booths that pre-wire switchgear and controllers so that field commissioning falls below 10 days. Rental-fleet providers simultaneously grow their 1-2 MW portfolio to bridge delivery gaps; contracts often include a purchase option once permanent gear ships. Such flex models keep capital budgets predictable and guard against late penalties in colocation contracts that promise rack readiness by preset dates.

Data Center Generator Market is Segmented by Product Type (Diesel, Natural Gas, Hydrogen and HVO-Ready, Other Product Types), Capacity (Less Than 1 MW, 1-2 MW, Greater Than 2 MW), Tier Type (Tier I and II, Tier III, Tier IV), Data Center Type (Hyperscale, Enterprise, Colocation), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America claimed 40.55% of 2025 revenue on the strength of dense data center corridors in Northern Virginia, Dallas, and Phoenix. Investment now centers on power-density upgrades rather than new land acquisition; operators swap aging 2 MW diesels for 3.5 MW Tier 4-Final models to unlock white-space without expanding walls. Federal production tax credits for hydrogen and biogas further sweeten the switch to low-carbon gensets.

Asia-Pacific showcases the strongest momentum with a 10.42% CAGR through 2031. Singapore lifts its moratorium on data center permits in return for efficiency pledges, unlocking a pipeline of 300 MW across five projects. India's Digital Personal Data Protection Act fuels domestic cloud builds, with Mumbai alone planning 700 MW of fresh IT load. In Japan, SoftBank's 300 MW Hokkaido campus integrates hydro-backed grids but still specifies dual-fuel backup to counter seismic-related outages. Meanwhile, Malaysia and Indonesia emerge as cost-competitive hubs by offering land concessions and renewable-energy certificates tailored to hyperscalers. Europe ranks third in absolute value but leads in sustainability mandates. Amsterdam's municipality now caps diesel runtime and levies CO2 fees above 500 t/year, nudging operators toward gas engines and battery hybrids. Dublin's grid-capacity crunch pushes developers to Spain and Portugal, thereby redistributing generator demand southward. The Middle East leverages abundant natural gas and solar resources; Dubai's Digital Park installs gas-fired gensets with absorption chillers that recycle waste heat into district-cooling loops. Africa remains early-stage yet promising, with Nairobi and Lagos deploying micro-modular data centers backed by 400 kVA diesels to overcome unreliable grids.

List of Companies Covered in this Report:

- Caterpillar Inc.

- Cummins Inc.

- Generac Power Systems Inc.

- Rolls-Royce plc (mtu Solutions)

- Kohler Co.

- Mitsubishi Heavy Industries Group

- Atlas Copco AB

- Himoinsa SL

- Aksa Power Generation

- HITEC Power Protection BV

- INNIO Group (Jenbacher/Waukesha)

- Aggreko Ltd.

- Wartsila Corp.

- ABB Ltd.

- Doosan Enerbility Co., Ltd.

- FG Wilson

- Yanmar Holdings Co., Ltd.

- Perkins Engines Co. Ltd.

- Briggs & Stratton LLC

- Baudouin (Weichai)

- HIPOWER SYSTEMS

- GE Vernova

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging hyperscale and colocation build-out

- 4.2.2 Rising rack-power densities from AI workloads

- 4.2.3 Expansion of edge data centers in emerging markets

- 4.2.4 Transition to natural-gas and HVO gensets for sustainability

- 4.2.5 Deployment of trailer-mounted temporary generation fleets

- 4.2.6 Adoption of modular micro-grid-ready generator blocks

- 4.3 Market Restraints

- 4.3.1 Carbon-emission regulations targeting diesel gensets

- 4.3.2 Shift toward battery and fuel-cell alternatives

- 4.3.3 High-horsepower engine supply-chain bottlenecks

- 4.3.4 Urban permitting hurdles on noise and air quality

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Diesel

- 5.1.2 Natural Gas

- 5.1.3 Hydrogen and HVO-Ready

- 5.1.4 Other Product Types

- 5.2 By Capacity

- 5.2.1 Less than 1 MW

- 5.2.2 1 - 2 MW

- 5.2.3 Greater than 2 MW

- 5.3 By Tier Type

- 5.3.1 Tier I and II

- 5.3.2 Tier III

- 5.3.3 Tier IV

- 5.4 By Data Center Type

- 5.4.1 Hyperscale (Owned and Leased)

- 5.4.2 Enterprise (On-premise)

- 5.4.3 Colocation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia-Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.2.1 Caterpillar Inc.

- 6.2.2 Cummins Inc.

- 6.2.3 Generac Power Systems Inc.

- 6.2.4 Rolls-Royce plc (mtu Solutions)

- 6.2.5 Kohler Co.

- 6.2.6 Mitsubishi Heavy Industries Group

- 6.2.7 Atlas Copco AB

- 6.2.8 Himoinsa SL

- 6.2.9 Aksa Power Generation

- 6.2.10 HITEC Power Protection BV

- 6.2.11 INNIO Group (Jenbacher/Waukesha)

- 6.2.12 Aggreko Ltd.

- 6.2.13 Wartsila Corp.

- 6.2.14 ABB Ltd.

- 6.2.15 Doosan Enerbility Co., Ltd.

- 6.2.16 FG Wilson

- 6.2.17 Yanmar Holdings Co., Ltd.

- 6.2.18 Perkins Engines Co. Ltd.

- 6.2.19 Briggs & Stratton LLC

- 6.2.20 Baudouin (Weichai)

- 6.2.21 HIPOWER SYSTEMS

- 6.2.22 GE Vernova

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment