|

市场调查报告书

商品编码

1690749

中东资料中心:市场占有率分析、产业趋势与成长预测(2025-2030 年)Middle East Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

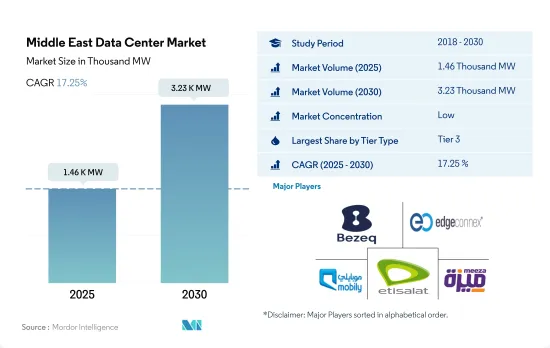

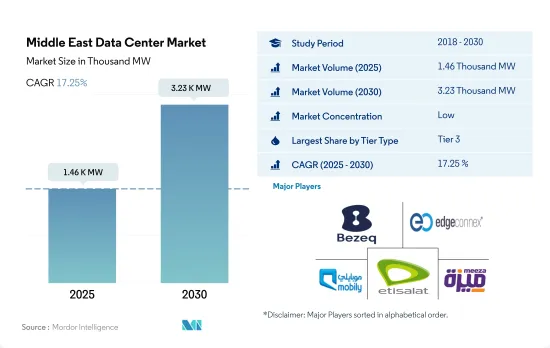

预计 2025 年中东资料中心市场规模为 1,460 千瓦,到 2030 年将达到 3,230 千瓦,复合年增长率为 17.25%。

预计主机託管收益将在 2025 年达到 15.763 亿美元,到 2030 年将达到 47.029 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.44%。

2023 年, 层级 3资料中心将占据大部分市场占有率,而层级 4 资料中心在预测期内将快速成长

- 在中东,层级市场凭藉其显着的功能优势,目前占据了大部分市场占有率。这些层级具有高水准的冗余度以及多种电源和冷却路径。 层级 3资料中心的运转率约为 99.982%,每年停机时间为 1.6 小时。随着边缘和云端连接的采用率不断提高,预计层级 3 细分市场将进一步成长。

- 中东市场的层级 3 部分将在 2022 年以 464.68 MW 的 IT 负载容量运作。在预测期内(2022-2029 年),IT 负载容量预计将从 2023 年的 621.78 MW 成长到 2029 年的 1,214.86 MW,复合年增长率为 11.81%。

- 预计层级细分市场的复合年增长率最快,为 26.51%。一些新兴国家正致力于获得层级 4 认证,以受益于所有组件的完全容错和冗余。鑑于这些优势,新兴国家也越来越多地采用层级 4 区域。

- 5G应用的实施需要资料中心等数位基础设施的发展。最近,全天候业务永续营运服务的扩展导致越来越多的全球企业对 3层级和 4 级资料中心的偏好日益增加。资料对于 BFSI 公司来说是一个至关重要的元素,因为市场对资料储存和保护有严格的法律规定。 BFSI 产业的特征是数位化。由于各种银行应用程式的使用不断增加,BFSI 领域的资料呈指数级增长。

到 2023 年,阿拉伯联合大公国将占据最大份额,而沙乌地阿拉伯将在整个预测期内经历最快的成长。

- 预计未来几年中东地区资料中心市场的投资将会成长。有几个因素推动了该地区资料中心的扩张。该地区政府的智慧城市愿景正在推动现代社区建设方式的转变。未来的城市在数位科技的推动下,预计将产生大量资料。优化资料撷取、储存和处理是关键。

- 家庭资料的兴起和5G网路的出现将推动对社区资料中心的需求,以加快资料传输。海湾合作委员会等某些司法管辖区的资料主权法规不确定,将推动资料中心投资。这凸显了银行等机构在国内保存客户资料的重要性。

- 阿联酋在建立强大、有竞争力的数位经济的竞赛中处于领先地位,这使其成为该地区资料中心的首选地点。根据 Arcadis 的资料中心位置指数,阿联酋凭藉其「成熟的光纤宽频网路」在行动宽频普及率方面位居榜首。同时,获得建筑许可证的便利性和新的智慧城市概念使其成为资料中心投资的热门位置。

- 沙乌地阿拉伯于2021年7月启动了一项耗资180亿美元的策略,旨在建立全国性的海量资料中心网路。根据沙乌地阿拉伯通讯与资讯技术部介绍,首批投资合作伙伴包括当地公司海湾资料中心、Al-Moammar资讯系统和沙乌地阿拉伯FAS控股。

中东资料中心市场趋势

行动用户数量的增加和5G人口覆盖范围的扩大将推动市场成长

- 过去二十年,海湾合作委员会国家的资讯通信技术使用发生了显着变化,数位基础设施的发展对向用户提供的服务产生了重大影响。与世界其他地区相比,该地区的网路和通讯服务最为普遍,其中海湾合作委员会的网路用户比例最高,为 98.21%,而全球平均为 63%。

- 在海湾合作委员会国家,行动用户总数约占总人口的137.66%,高于全球约55%的平均值。海湾合作委员会地区的ICT服务正在快速发展,新的商业行动服务供应商不断涌入,导致用户数量激增。中东地区约三分之二的无线网路营运商推出5G网络,扩大了全部区域。大部分中东国家已推出商用4G服务。

- OTT 消费的增加也增加了每部智慧型手机的资料流量。例如,Etisalat 于 2013 年发布了其 Life TV iOS 应用程序,一年后它超越 MBC 的 Shahid TV 应用程式成为中东下载次数最多的应用程式。 OSN 已宣布向非付费电视用户推出 Go。中东地区在超高速网路存取和成本方面存在显着差异。各种 OTT 平台的推出和速度的提高可能会推动对机架空间的需求并增加中东的资料中心数量。

优先发展5G、数位付款等数位化措施以及吸引大量劳动力流动人口将刺激市场需求。

- 在向知识密集型经济体转型的过程中,阿联酋和沙乌地阿拉伯政府优先考虑 5G 等数位化措施。在数位付款等国家消费措施的推动下,智慧型手机正主导数位化生活方式的转变。该地区商务和休閒旅游的快速復苏,加上黄金签证等慷慨的长期签证政策,正在刺激从房地产到新兴企业等各个领域的投资,支持智慧型手机市场在短期内强劲復苏。国际赛事,特别是2022年在卡达举行的国际足总世界杯,也可能为邻国的各个商业领域创造机会。

- 该地区极其富裕,儘管它接收了大量的劳工移民,对大众市场产品产生了新的需求。除土耳其外,中东地区占全球销售额的一半以上。在智慧型手机领域,苹果和三星占据市场主导地位,合计占总合货量的约 96%。

- 中东的设备启动量预计将与前一年同期比较增,到 2022 年平均成长 23%。伊拉克和埃及等较大的市场是这项扩张的主要驱动力,因为儘管它们目前拥有庞大的用户群,但仍在继续成长。由于智慧型手机和 5G 设备的广泛应用,原始资料量预计会增加。智慧型手机用户的增加可能会带来更多的资料和网路使用量。将会需要更多的资料中心,并且区域利用率的提高可能会导致对储存和处理资料所需的伺服器的需求增加。

中东资料中心产业概况

中东资料中心市场较为分散,前五大企业占36.27%。市场的主要企业有:Bezeq International General Partner Ltd、EdgeConneX Inc.、Etihad Etisalat Company (Mobily)、Etisalat 和 MEEZA

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装的机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的资料流量

- 行动资料速度

- 宽频资料速度

- 光纤连接网路

- 法律规范

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 价值炼和通路分析

第六章市场区隔

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 超大规模

- 小规模

- 层级类型

- 1层级和2级

- 层级

- 层级

- 吸收

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他的

- 国家

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介.

- Bezeq International General Partner Ltd

- Bynet Data Communications Ltd

- EdgeConneX Inc.

- Electronia

- Etihad Etisalat Company(Mobily)

- Etisalat

- Gulf Data Hub

- HostGee Cloud Hosting Inc.

- Injazat

- Khazna Data Center

- MedOne IC-1(1999)Ltd

- MEEZA

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

The Middle East Data Center Market size is estimated at 1.46 thousand MW in 2025, and is expected to reach 3.23 thousand MW by 2030, growing at a CAGR of 17.25%. Further, the market is expected to generate colocation revenue of USD 1,576.3 Million in 2025 and is projected to reach USD 4,702.9 Million by 2030, growing at a CAGR of 24.44% during the forecast period (2025-2030).

Tier 3 data centers accounts for majority market share in 2023, Tier-4 is the fastest growing in forecasted period

- The tier 3 segment currently holds the majority of the market share in the Middle East due to the significant advantages of its features. These tiers have a high level of redundancy and multiple power and cooling paths. The tier 3 data centers have an uptime of around 99.982%, resulting in 1.6 hours of downtime per year. With the increased adoption of edge and cloud connectivity, the tier 3 segment is expected to grow further.

- The tier 3 segment of the Middle Eastern market operated at an IT load capacity of 464.68 MW in 2022. During the forecast period (2022-2029), the IT load capacity is expected to grow from 621.78 MW in 2023 to 1,214.86 MW in 2029, with a CAGR of 11.81%.

- The tier 4 segment is expected to record the fastest CAGR of 26.51%. Several developing countries are focusing on getting Tier 4 certifications to benefit from complete fault tolerance and redundancy for all components. Due to such advantages, even developing countries are adopting tier 4 zones.

- The development of digital infrastructures such as data centers is required to implement 5G applications. More recently, the expansion of 24/7 business continuity services has increased the preference for tier 3 and 4 data centers due to the growing number of global companies. Data is an essential component of BFSI companies due to the stringent laws governing data storage and protection in the market. The BFSI sector is defined by digitalization. Due to the growing usage of various banking applications, data in the BFSI sector is growing exponentially.

UAE accounted for majority share in terms of volume in 2023, Saudi Arabis is fastest growing throughout the forecasted period

- In the coming years, the Middle East region is expected to increase its investment in the data center market. Several factors are facilitating the expansion of data centers in the area. The region's governments' smart city ambitions are driving a shift in how modern communities are built. Cities of the future, supported by digital technologies, are expected to generate massive amounts of data. It is critical to optimize data capture, storage, and processing.

- Domestic data growth and the emergence of 5G networks drive demand for localized data centers to speed up data transfer. Uncertain data sovereignty regulations in certain jurisdictions, including the GCC, drive data center investments. This emphasizes the importance of organizations such as banks retaining customer data within the country.

- The United Arab Emirates has been a prime location for data centers in the region as one of the frontrunners in the race to establish a robust and competitive digital economy. According to Arcadis' Data Centre Location Index, the UAE's "well-established fiber broadband network" helped the country secure the top spot for mobile broadband penetration. At the same time, the ease of obtaining construction permits and new smart city initiatives make it an emerging location for data center investment.

- Saudi Arabia launched a USD 18 billion strategy in July 2021 to establish a nationwide network of large-scale data centers. According to the Saudi Ministry of Communications and Information Technology, the first batch of investment partners includes local firms Gulf Data Hub, Al-Moammar Information Systems, and Saudi FAS Holding.

Middle East Data Center Market Trends

Growing number of mobile users and expanding 5G population coverage across the regional countries boosts the market growth

- The GCC countries have experienced substantial changes in ICT use over the past two decades, resulting in a considerable impact on the services offered to users due to developing digital infrastructure. Internet and telecommunications services are much more common in the region than they are globally, especially in GCC, with the proportion of internet users to the total population in GCC reaching 98.21%, compared to the global average of 63%, which is practically the highest in all geographic areas.

- In GCC, the total number of mobile users makes up roughly 137.66% of the population, compared to the global average of about 55%. ICT services in the GCC region are developing quickly due to the region's continued influx of new commercial mobile service providers, causing a sharp rise in the number of users. Around two-thirds of wireless network operators in the Middle East launched 5G networks, expanding 5G population coverage across the regional countries. The majority of Middle Eastern countries have already implemented commercial 4G services.

- The increasing OTT consumption also boosted data traffic for each smartphone. For instance, Etisalat released its Life TV iOS app in 2013, a year after MBC's Shahid TV app surpassed it as the most downloaded Middle Eastern app. OSN revealed the debut of Go for non-pay TV users. In the Middle East, there are large regional differences in the accessibility and cost of super-fast networks. The deployment of various OTT platforms and speed improvements may result in a greater demand for rack space, leading to a rise in the number of data centers in the Middle East.

Prioritizing digital initiatives, such as 5G, digital payment and attracting sizable population of working immigrants boost the market demand

- To shift toward a knowledge-based economy, the UAE and Saudi Arabian governments are prioritizing digital initiatives, such as 5G. Due to state-wide consumer initiatives like digital payment, smartphones are leading the move to a digital lifestyle. The region's quick rebound of business and leisure travel, as well as permissive long-term visa policies like Golden Visas, which are stimulating investments across sectors from real estate to start-ups, are supporting the robust smartphone market recovery in the short term. International events, especially the FIFA World Cup in Qatar in 2022, may also present opportunities for various corporate sectors in neighboring nations.

- Though the region is attracting a sizable population of working immigrants, creating fresh demand for mass-market products, it is extremely wealthy. The Middle East accounts for more than half of global sales value except for Turkey. Apple and Samsung are the market leaders in the smartphone segment, accounting for approximately 96% of shipping volume combined.

- Device activations in the Middle East increased Y-o-Y, growing by an average of 23% in 2022. Larger markets like Iraq and Egypt, which continued to grow despite having enormous current user bases, were the main drivers of this expansion. The amount of raw data is expected to increase due to smartphone penetration and the use of 5G devices. The number of smartphone users may lead to the use of more data and the internet. The need for more data centers and higher regional utilization rates may boost the demand for the servers required to store and process the data.

Middle East Data Center Industry Overview

The Middle East Data Center Market is fragmented, with the top five companies occupying 36.27%. The major players in this market are Bezeq International General Partner Ltd, EdgeConneX Inc., Etihad Etisalat Company (Mobily), Etisalat and MEEZA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Israel

- 5.6.2 Saudi Arabia

- 5.6.3 United Arab Emirates

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Data Center Size

- 6.1.1 Large

- 6.1.2 Massive

- 6.1.3 Medium

- 6.1.4 Mega

- 6.1.5 Small

- 6.2 Tier Type

- 6.2.1 Tier 1 and 2

- 6.2.2 Tier 3

- 6.2.3 Tier 4

- 6.3 Absorption

- 6.3.1 Non-Utilized

- 6.3.2 Utilized

- 6.3.2.1 By Colocation Type

- 6.3.2.1.1 Hyperscale

- 6.3.2.1.2 Retail

- 6.3.2.1.3 Wholesale

- 6.3.2.2 By End User

- 6.3.2.2.1 BFSI

- 6.3.2.2.2 Cloud

- 6.3.2.2.3 E-Commerce

- 6.3.2.2.4 Government

- 6.3.2.2.5 Manufacturing

- 6.3.2.2.6 Media & Entertainment

- 6.3.2.2.7 Telecom

- 6.3.2.2.8 Other End User

- 6.4 Country

- 6.4.1 Israel

- 6.4.2 Saudi Arabia

- 6.4.3 United Arab Emirates

- 6.4.4 Rest of Middle East

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Bezeq International General Partner Ltd

- 7.3.2 Bynet Data Communications Ltd

- 7.3.3 EdgeConneX Inc.

- 7.3.4 Electronia

- 7.3.5 Etihad Etisalat Company (Mobily)

- 7.3.6 Etisalat

- 7.3.7 Gulf Data Hub

- 7.3.8 HostGee Cloud Hosting Inc.

- 7.3.9 Injazat

- 7.3.10 Khazna Data Center

- 7.3.11 MedOne I.C.-1 (1999) Ltd

- 7.3.12 MEEZA

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms