|

市场调查报告书

商品编码

1690751

汽车产业巨量资料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Big Data In The Automotive Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

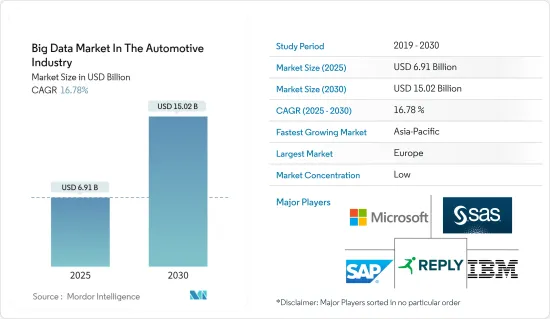

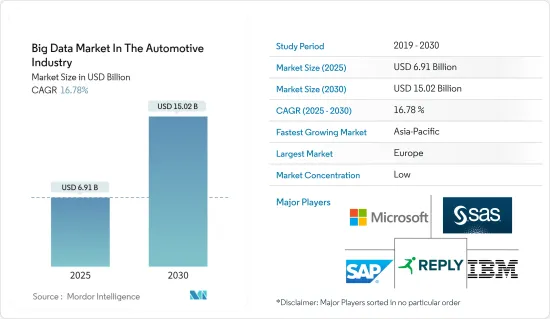

汽车产业巨量资料市场预计将从 2025 年的 69.1 亿美元成长到 2030 年的 150.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.78%。

汽车产业正在透过采用从感测器到人工智慧和巨量资料分析等技术、应用和服务而发生转变。因此,不断有新参与企业涌入生态系统,从而推动未来汽车的持续发展。联网汽车数量的不断增长,加上各相关人员越来越多地利用汽车产生的资料,正在推动市场成长。

关键亮点

- 巨量资料分析使汽车製造业能够从 ERP 系统收集资料,并结合业务和供应链成员的多个功能单元的资讯。随着网路化系统、工业物联网和 M2M通讯的出现,汽车产业正在为工业 4.0 做好准备。感测器、RFID、条码阅读器和机器人现已成为工业製造车间的标准。这些设备正在倍增资料产生点的数量。

- 家用电子电器产业很大程度受供需因素驱动。巨量资料分析的使用极大地帮助了这个行业领域,使其能够从推动型市场策略转变为拉动型市场策略。巨量资料分析使产业更了解消费者的行为模式,并可以据此生产计画。随着物联网的发展和电子元件成为汽车不可或缺的一部分,汽车领域也出现了同样的潜力。

- 此外,巨量资料分析帮助汽车製造商提高销售和行销效率。它还透过帮助整合预测性维护和服务调度等公共产业来改善业务。它还透过分析需求预测资料来帮助汽车供应商简化采购流程并提高成本效益。

- 资料对于OEM来说变得越来越重要。这就是为什么透过强有力的隐私策略确保遵守一般资料保护规范 (GDPR) 至关重要。资料保护的细节,尤其是 GDPR,需要清楚了解,因为许多产业仍然不熟悉现有的法规和措施。这可能会导致与公众的沟通不良。因此,资料保护法对于连网和自动驾驶汽车至关重要,因为自动收集的资料范围非常广泛。

汽车巨量资料市场趋势

产品开发、供应链和製造环节占主要份额

- 在当今科技主导的企业环境中,巨量资料是製造商提高生产力和效率的关键驱动力之一。感测器和连网型设备的快速普及以及机器对机器 (M2M)通讯的增强,正在急剧增加汽车产业的资料点数量。

- 虽然汽车产业在製造、行销和供应链等领域采用资料分析方面取得了长足的进步,但产品本身的资料产生和分析的使用仍处于相对起步的阶段。然而,随着物联网 (IoT) 的兴起和运算技术的进步,更具成本效益的资料收集方法开始出现。

- 联网汽车有可能大幅改变用户体验。根据通讯报道,到2023年,汽车业预计将在全球生产7,630万辆联网汽车。我们提供设备和软体将它们连接到云端并产生可以提供有用见解的资料。让汽车公司取得即时道路资料有可能加快产品开发速度,并彻底改变效能监控、产品品质维护和安全保障的方式。

- 通用汽车是美国最大的汽车製造商,也是汽车领域使用巨量资料和分析技术的先驱。如今,汽车配备感测器和中央处理器(CPU)已很常见。透过将感测器和远端资讯处理置于汽车的中心,通用汽车可以降低许多成本,同时提高车辆的安全性和可靠性。例如,DataFlair 声称远端资讯处理是一座金矿,因为它可以为每辆车节省高达 800 美元的巨额费用。

预计亚太地区市场在预测期内将大幅成长

- 在所有地区中,亚太地区人口最多。由于城市人口不断增长和购买力不断上升,亚太地区被认为是汽车行业最大的市场之一。

- 根据中国工业协会统计,2022年4月,中国乘用车销量约96.5万辆,季减48%,商用车销量约21.6万辆,较上季下降42%。预计如此大规模的汽车销售将为所研究的行业提供成长机会。

- 各公司正在共同努力,提高在多个领域的影响力,以扩大市场占有率、进入不同的市场并实现产品供应多样化。例如,2022年6月,日本电信电话公司(NTT)与丰田汽车合作开发收集和共用资料的联网汽车。 NTT资料网路资料部门执行执行长本间彰在受访时表示,公司将积极考虑併购,以加速向海外市场的扩张。本间表示,该公司未来四年可能完成价值高达 4,000 亿日圆(30 亿美元)的交易。

- 例如,SG Holdings Co. 的子公司佐川急便株式会社于 2021 年 6 月推出了首款电动车原型,这是其实现所有小型送货车电气化目标的一部分。该车辆是与Start-Ups东京的新创公司 ASF 合作製造的。该国最大的宅配服务计划在 2030 年改用电动车,每年减少 28,000 吨二氧化碳排放。这些变化应该能够扩大研究目标市场。

汽车产业巨量资料概述

汽车产业巨量资料市场竞争激烈,由许多全球和区域参与企业组成。这些参与企业拥有相当大的市场占有率,并致力于扩大基本客群。这些供应商专注于研发活动、策略伙伴关係以及其他有机和无机成长策略,以在预测期内获得竞争优势。

2022 年 3 月,美国国家仪器公司 (NIC) 宣布收购 Heinzinger GmbH 的电子车辆系统部门。此次收购将使 NIC 扩大其在电气化、电池测试和永续能源的能力,同时扩大基本客群。在汽车产业零件测试方面,NI 和 Heinzinger 具有高度互补的作用。这将推动汽车电气化快速创新并实现零愿景。

2022 年 1 月,为了扩大在北美的业务,Reply SpA 宣布收购 Enowa LLC,后者专门利用 SAP 技术提供咨询和建置解决方案。 Enowa LLC 利用 SAP 技术提供附加价值服务和云端设计。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章市场动态

- 市场驱动因素

- 各相关人员加大力度利用车辆产生的资料

- 安装联网汽车的数量不断增加

- 市场问题

- 车辆资料保护的隐私问题和法规

第六章市场区隔

- 按应用

- 产品开发、供应链和製造

- OEM保固、售后服务/经销商

- 联网汽车和智慧交通

- 销售、行销和其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- N-iX LTD

- Future Processing Sp.zoo

- Reply SpA(Data Reply)

- Phocas Ltd

- Positive Thinking Company

- Qburst Technologies Private Limited

- Monixo SAS

- Allerin Tech Private Limited

- Driver Design Studio Limited

- Sight Machine Inc.

- SAS Institute Inc.

- IBM Corporation

- SAP SE

- Microsoft Corporation

- National Instruments Corp.

第八章投资分析

第九章 市场机会与未来趋势

The Big Data Market In The Automotive Industry is expected to grow from USD 6.91 billion in 2025 to USD 15.02 billion by 2030, at a CAGR of 16.78% during the forecast period (2025-2030).

The automobile industry is being transformed by adopting technologies, applications, and services ranging from sensors to artificial intelligence to big data analysis; thus, the ecosystem is witnessing a steady influx of new players, resulting in the continuous evolution of the future car. Increasing efforts from various stakeholders in utilizing the vehicle-generated data coupled with a growing installed base of connected cars drive the market growth.

Key Highlights

- Big data analytics allows the automobile manufacturing industry to collect data from ERP systems to combine information from multiple functional units of the business and the supply chain members. With the emergence of industry IoT, a networked system, and M2M communication, the automotive industry is positioning itself toward industry 4.0. Sensors, RFIDs, barcode readers, and robots are now standard on the industry's manufacturing floor. These devices have increased data generation points exponentially.

- The consumer electronics industry is highly dependent on the demand and supply factors. The use of big data analytics helped this industry segment drastically and allowed it to switch to a pull market strategy instead of the push market strategy. With big data analytics, the industry is now more aware of consumer behavior patterns and may plan production based on these. A similar potential has been exposed in the automotive sector, with IoT evolutions and electronics components becoming an integral part of automobiles.

- Furthermore, big data analytics helped automobile manufacturers boost their efficiency in terms of sales and marketing. It also improved its operations by aiding in the incorporation of utilities like predictive maintenance and service schedule. It also aided automotive vendors in streamlining the procurement process, making it more cost-efficient by analyzing the data for demand prediction.

- Data is increasingly becoming crucial for OEMs. Therefore, it is essential to ensure that they comply with the General Data Protection Regulation (GDPR) through a strong privacy strategy. An evident appreciation for data protection, and in particular the details of the GDPR, are required, as many in the industry are not yet familiar with existing regulations and internal policies. This may lead to miscommunication with the public. Therefore, data protection law is important in connected and autonomous mobility because the breadth of data captured automatically is tremendous.

Big Data in Automotive Market Trends

Product Development, Supply Chain and Manufacturing Segment Accounts for a Major Share

- Big data is one of the key drivers of productivity and efficiency for manufacturers in the contemporary technology-driven corporate climate. There has been a significant increase in the number of data points for the automobile industry due to the rapid adoption of sensors and connected devices, as well as the facilitation of machine-to-machine (M2M) communication.

- While the car industry has made significant strides in adopting data analytics in areas such as manufacturing, marketing, and supply chain, the utilization of data generation and analysis within the product itself has been relatively nascent. However, with the increasing popularity of the Internet of Things (IoT) and advancements in computing, more cost-effective data collection methods are beginning to emerge.

- A significant change in the user experience may result from connected automobiles. According to the Associated Press, by 2023, it is predicted that 76.3 million connected cars will be produced worldwide by the automobile industry. By offering gear and software, you can connect them to the cloud so they can generate data and gain useful insight. When automotive companies get access to real-time, on-the-road data, it speeds up product development and may revolutionize how they monitor performance, maintain product quality, and ensure safety.

- The largest American automaker, General Motors, was a pioneer in the use of big data and analytics in the automotive sector. These days, sensors and central processing units (CPUs) in cars are the norm. With sensors and telematics within the automobile as its focus, General Motors can save a lot of money while also improving the safety and dependability of its vehicles. For instance, DataFlair claims that telematics is like a gold mine because it offers significant savings of up to USD 800 per vehicle.

Asia Pacific Segment is Expected to Grow at a Significant Rate Over the Forecast Period

- Of all the regions, the Asia-Pacific has the largest population. Asia-Pacific is regarded as one of the biggest markets for the automotive industry due to the region's growing urban population and rising purchasing power.

- Around 965,000 passenger cars and 216,000 commercial vehicles were sold in China in April 2022, according to the China Association of Automobile Manufacturers (CAAM); these figures reflect a 48% and a 42% reduction, respectively, from the previous month. Such massive vehicle sales are anticipated to present a growth opportunity for the sector under investigation.

- Businesses are working together to grow their presence in numerous areas to increase their market share, penetrate diverse markets, and diversify their product offerings. For instance, in June 2022, Nippon Telegraph & Telephone (NTT) and Toyota Motor collaborated to develop connected cars to collect and share data. Yo Honma, the chief executive of NTT's data networking and data division, stated in an interview that the business would actively investigate mergers and acquisitions to hasten its drive into foreign markets. According to Honma, the company could spend as much as JPY 400 billion (USD 3 billion) on deals over the next four years.

- For instance, Sagawa Express Co. of SG Holdings Co. debuted a prototype of its first electric vehicle in June 2021 as part of its goal to electrify all small delivery vans. This vehicle was constructed in collaboration with the Tokyo startup ASF. The biggest delivery service in the country intends to switch to electric vehicles by 2030 and reduce its CO2 emissions by 28,000 tonnes yearly. These changes should make it possible for the market under study to expand.

Big Data in Automotive Industry Overview

The big data market in the automotive industry is competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their customer base. These vendors focus on research and development activities, strategic partnerships, and other organic and inorganic growth strategies to earn a competitive edge over the forecast period.

In March 2022, the purchase of Heinzinger GmbH's electronic vehicle systems division by National Instruments Corporation (NIC) was made public. The acquisition would increase NIC's capacity for electrification, battery testing, and sustainable energy while increasing its customer base. When it comes to testing automotive industry components, NI and Heinzinger play roles that are extremely complementary to one another. This allows for quick innovation to electrify vehicles and achieve vision zero.

In January 2022, to increase its footprint in North America, Reply SpA announced the acquisition of Enowa LLC, a business that specializes in advising and building solutions based on SAP technology. Enowa LLC uses SAP technology to provide value-added services and cloud design.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Efforts from Various Stakeholders in Utilizing the Vehicle Generated Data

- 5.1.2 Growing Installed-Base of Connected Cars

- 5.2 Market Challenges

- 5.2.1 Privacy Issues and Regulations on Vehicle Data Protection

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Product Development, Supply Chain and Manufacturing

- 6.1.2 OEM Warranty and Aftersales/Dealers

- 6.1.3 Connected Vehicle and Intelligent Transportation

- 6.1.4 Sales, Marketing and Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 N-iX LTD

- 7.1.2 Future Processing Sp.z.o.o

- 7.1.3 Reply SpA (Data Reply)

- 7.1.4 Phocas Ltd

- 7.1.5 Positive Thinking Company

- 7.1.6 Qburst Technologies Private Limited

- 7.1.7 Monixo SAS

- 7.1.8 Allerin Tech Private Limited

- 7.1.9 Driver Design Studio Limited

- 7.1.10 Sight Machine Inc.

- 7.1.11 SAS Institute Inc.

- 7.1.12 IBM Corporation

- 7.1.13 SAP SE

- 7.1.14 Microsoft Corporation

- 7.1.15 National Instruments Corp.