|

市场调查报告书

商品编码

1690753

美国MEP 服务:市场占有率分析、产业趋势与成长预测(2025-2030 年)United States (US) MEP Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

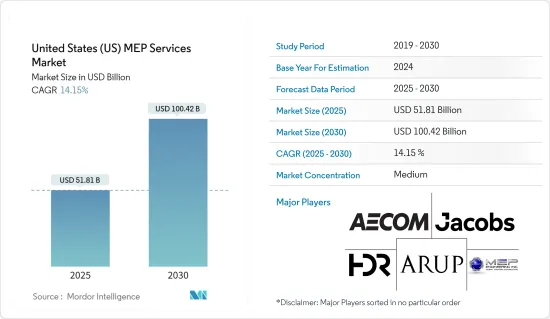

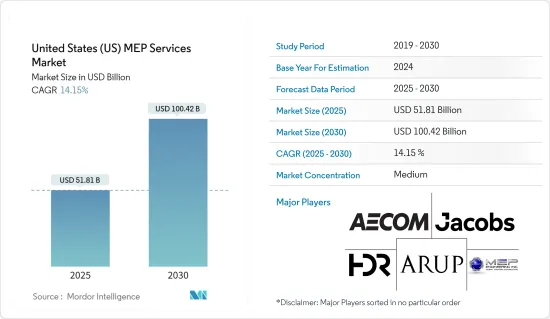

美国MEP 服务市场规模预计在 2025 年为 518.1 亿美元,预计到 2030 年将达到 1,004.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.15%。

关键亮点

- 机械、电气和管道 (MEP) 涉及建筑物各种 MEP 系统的规划、设计和管理,随着 BIM 在建筑施工、规划和管理中的活性化普及,MEP 服务也越来越受到关注。

- 机电工程占计划建设成本的很大一部分。该地区的建设计划正在增加,例如丹佛国际机场的维修和纽约市的交通升级,预计这些项目将推动市场成长。

- COVID-19 疫情爆发对 MEP 服务市场造成了供应链中断的影响。工厂停工导致一些产品的前置作业时间延长。然而,随着工厂目前满载运作,生产水准开始显着提高。

- 设计在 MEP 服务中发挥着至关重要的作用。对于任何服务供应商来说,收益的很大一部分来自于MEP设计。根据Consulting-Specifying Engineer的调查,2019年MEP巨头们超过一半(58%)的总收益来自MEP设计,每家公司的平均MEP设计收益为8390万美元,较前一年有大幅增长。

- 美国对 MEP 服务的需求是由新建和维修/重建需求推动的,这两个部分都占据了相当大的市场份额。不过,就该国的 MEP 服务市场占有率而言,新建筑领域略有优势。

- 永续性的概念在建筑设计产业中越来越受到重视。业界的共识是,实施环保系统最终将有利于环境和您的预算。根据美国环保署(EPA)的数据,美国发电量占总能源消耗的40%。因此,当地供应商正在提供服务来满足需求,利用太阳能集热器和热回收通风等 MEP 技术。

- 根据美国能源资讯署(EIA)的数据,商业建筑的主要能源消耗是空调,占建筑物总能耗的35%,照明占11%,冰箱、热水器和冷冻库等电器产品占18%,其他电子设备占剩余部分。这时,MEP服务供应商就变得至关重要,他们可以开发出可以为消费者节省成本的强大设计。

- 但在目前的市场情势下,新冠疫情对承接建筑计划的企业和政府机构的影响,导致部分建筑计划延期甚至取消。例如,终端用户公司从中国进口的近30%的建筑材料因供应链限製而减少了製造产量。这些案例显示 MEP 服务市场存在一些负面前景,可能会阻碍市场成长。

美国MEP服务市场趋势

新建设推动市场成长

- 据美国总承包商协会(AGC)称,建筑业是美国经济的主要贡献者。该行业拥有超过 733,000 名雇主,僱用超过 700 万人,每年建筑产值约为 1.4 兆美元。建设业是製造业、采矿业和各种 MEP 服务的主要客户之一。在经济衰退时期,它也是重要的经济助推器。

- 住宅建筑业一直是美国经济从新冠疫情危机中復苏的领导人物,自2020年第三季以来一直保持两位数的成长率,为经济復苏和整体建筑业成长做出了重大贡献。许多计划机会封锁措施加快了进度,从而增加了新冠疫情期间的收入。在预测期内,市场预计将纠正承接计划的急剧增加。

- 此外,企业收益稳定上升,但获利压力仍较大。该行业面临的挑战包括持续的成本压力、影响生产力的持续劳动力短缺,以及固定竞标计划的趋势,这些项目通常需要传统系统难以实现的定价和业务准确性水平。持续采用数位技术可以缓解其中的一些问题。

- 在成功实施和提高员工技能以吸收技术方面可能还有其他障碍。儘管面临这些挑战,MEP 公司仍有望从该行业中的各种重大机会中受益,包括美国交通基础设施改善计划和智慧大型企划的成长。

医疗机构的需求正在推动市场成长

- 该地区的卫生部门被认为是经济最佳运作的关键部门之一。然而,它面临着规划效率低下和医疗设施资源匮乏的重大挑战。例如,根据 2012 年 1 月至 2019 年 5 月的资料,Humana 和匹兹堡大学的研究人员报告称,约 25% 的医疗保健支出效率低。

- 因此,医疗保健领域的最终用户开始意识到 MEP 服务可以利用其设施内的低效率。此外,在医疗机构内,每个部门(例如手术室、妇科或小儿科)都有独特的要求。此外,不良的设计可能会对患者护理产生毁灭性的影响。例如,室内空气品质差会对患者的健康产生负面影响。透过这种方式,MEP 服务有可能支援医疗业务的核心系统。

- 此外,正在发生的新冠肺炎疫情暴露了该地区缺乏疫情防范,以及其卫生系统的低效和不公平现象。例如,卫生基础设施无法容纳新冠肺炎患者,人均病床数量低于其他已开发国家。

- 因此,该地区的政府机构已开始分配更多资源用于建立高效的医疗设施,预计案例将导致对 MEP 服务的需求激增。例如,2020 年 5 月,AECOM 宣布已完成纽约市设计和建设局 (DDC) 的计划,该项目将建造两所临时医院,作为 COVID-19 紧急设施。

美国MEP服务业概况

美国MEP 服务市场区隔程度适中。主要企业包括 Jacobs Engineering Group Inc、HDR Inc、AECOM 和 Arup Group。该市场的供应商正在利用伙伴关係和协作来获取市场占有率。近期市场走势如下:

- 2020 年 6 月,AECOM 与全球另类资产管理公司 Canyon Partners, LLC 宣布,将与马丁集团合作,开始开发以交通为导向的中层学生住宅计划Wexler。该公司宣布已从太平洋西部银行借入 7,330 万美元的优先建设贷款融资。计划预计于2020年秋季完工。

- 2020 年 10 月,加州大学旧金山分校 (UCSF) 选定奥雅纳 (Arup) 和旧金山的医疗专家 Mazzetti 担任新医院——位于帕纳苏斯高地的 UCSF 海伦迪勒医疗中心的首席 MEP 工程师。 Arup 也可能为该计划提供附加服务,如土木工程服务、声学、振动和物流咨询。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对设计和工程服务业的影响评估

- 美国机电工程师当前就业指数

- 技术进步对 MEP 服务业的影响(CAD、BIM、MEP 软体等)

第五章市场动态

- 市场驱动因素

- 更重视外包 MEP 服务,进而实现核心服务的集中化

- 商业和医疗设施需求稳定

- 经营模式的演变以及公司和服务供应商之间的合作

- 市场限制

- 市场集中度高以及对端到端产品的需求不断增长将为中小企业带来挑战

第六章市场区隔

- 按类型

- 新建筑

- 维修整修

- 性能验证活动

- 其他的

- 按行业

- 医疗保健

- 商业办公室

- 教育机构

- 公共空间和设施

- 工业设施和仓库

- 其他商业设施(资料中心、研究等)

第七章竞争格局

- 公司简介

- Jacobs Engineering Group Inc.

- HDR Inc

- Arup Group

- AECOM

- MEP Engineering

- Stantec Inc.

- Affiliated Engineers Inc.

- Macro Services

- WSP Group

- AHA Consulting

- Burns Engineering

- Wiley Wilson

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 71420

The United States MEP Services Market size is estimated at USD 51.81 billion in 2025, and is expected to reach USD 100.42 billion by 2030, at a CAGR of 14.15% during the forecast period (2025-2030).

Key Highlights

- Mechanical electrical and plumbing (MEP) involves planning, designing, and managing various MEP systems of a building, and with the increasing incorporation of BIM in building construction, planning, and management, MEP services are further gaining traction.

- The MEP contribute to the significant portion of projects' construction cost. With the growing number of construction projects in the region, such as Denver International Airport renovation and New York City transit upgrades, it is expected to drive the growth of the market.

- The COVID-19 pandemic has impacted the MEP services market with respect to disruptions in the supply chain. Lead times for some products were increased due to factory shutdowns. However, now with factories functioning at full capacities, production levels are beginning to see significant improvements.

- Design plays a vital role in MEP services as a significant share of the revenue for any service provider is generated from MEP design. According to a study by Consulting-Specifying Engineer, over half (58%) of the revenue from all of MEP giants combined during 2019 was generated from MEP design, with an average MEP design revenue of USD 83.9 million per firm and observed a significant increase compared to the previous year.

- The US demand for MEP services is driven by new construction and retrofit and renovation demand with both segments, driving a prominent share of the market. However, the new construction segment commands a slight upper hand when it comes to the MEP services market share in the country.

- The concept of sustainability is gaining momentum in the construction design industry; the industry consensus is that installing eco-friendly systems would eventually benefit the environment and the budget. According to the EPA, electricity generation in the US accounts for 40% of the total energy consumption. Thereby vendors in the regions are leveraging the MEP technologies such as solar collectors and ventilation with heat recovery accompanied by their services to counter the demand.

- According to the US Energy Information Administration (EIA), in a commercial building, major energy-consuming sections are HVAC systems at 35% of the total building energy, lighting at 11%, appliances, such as refrigerators, water heaters, and freezers at 18%, and the remaining is shared among various other electronics. This is where MEP service providers become vital in developing robust designs that enable consumers to reduce costs.

- However, in the current market scenario, some of the construction projects have been delayed, and some resulted in cancellation as the result of the impact of COVID-19 on the companies and government bodies that commissioned them. For instance, nearly 30% of imported construction material deployed by the end-user firms from China due to supply chain constraints manufacturing output has declined. These instances showcase some of the negative outlooks of the MEP services market that holds the potential to hinder market growth.

US MEP Services Market Trends

New Construction to Drive the Market Growth

- As per the Associated General Contractors (AGC) of America, the construction industry is a major contributor to the US economy. The industry has more than 733,000 employers with over 7 million employees and creates nearly USD 1.4 trillion worth of structures each year. Construction is one of the major customers for manufacturing, mining, and a variety of MEP services. It is also seen as a significant economic reviver during the recession period.

- The residential construction sector has been the star performer of the United States' economic recovery from the COVID-19 crisis, posting double-digit growth rates since the third quarter of 2020 and making significant contributions to the rebound of the economy and the overall construction industry growth. Many construction projects were fast-tracked to utilize the opportunity of the lockdown and resulted in an increased revenue during the COVID-19 phase. Over the forecast period, the market is expected to correct the sudden increase in projects undertaken.

- Moreover, firm revenues are steadily rising, and the bottom lines are still under considerable pressure. Among the challenges that the industry face is sustained cost pressures, ongoing labor shortages that affect productivity, and trends toward fixed-bid projects that often demand a level of pricing and operations precision that is difficult to obtain with traditional systems. While the industry still trails broader digital acceptance maturity, the continued adoption of digital technologies could alleviate some of these issues.

- It can also present additional hurdles in terms of successful implementations and upskilling the workforce to absorb the technologies. Despite these challenges, MEP firms are poised to potentially benefit from various significant industry opportunities, including the US transportation and infrastructure upgrade initiative and the growth of smart city mega-projects.

Demand from Healthcare Institutions to Drive Market Growth

- The healthcare sector in the region is considered one of the crucial sectors for the optimal functioning of the economy. However, it faces the huge problem of inefficient planning and insufficient resources at the healthcare facilities. For instance, Humana and the University of Pittsburgh researchers reported that based on the data from January 2012 to May 2019, approximately 25% of healthcare spending could be characterized as inefficient.

- Thereby, end-user from the healthcare sector are starting to realize the potential offered by MEP services to leverage inefficiencies in the facilities. Moreover, In a healthcare facility, each department has its specific requirements: operation theatre, Gynaecological Department, or the Paediatrics Department. Additionally, incompetent designs could lead to a catastrophic effect on patient treatment. For instance, low internal air quality could cause adverse effects on the health of the patients. Thus, MEP services hold the potential to support the systems that are the backbone of healthcare operations.

- Furthermore, the ongoing pandemic COVID-19 has showcased the region's lack of preparation to counter the pandemic and has exposed the health system's inefficiencies and inequities. For instance, the healthcare infrastructure cannot accommodate COVID-19 patients and has fewer hospital beds per capita than other developed countries.

- Thereby these instances are expected to surge the demand for MEP service as the government bodies in the region are starting to allocate many resources into the construction of efficient medical facilities. For instance, In May 2020, AECOM announced it had completed the New York City Department of Design and Construction's (DDC) project to construct two temporary hospitals that are aimed to serve as COVID-19 emergency facilities.

US MEP Services Industry Overview

The United States MEP Services Market is moderately fragmented. The major companies include Jacobs Engineering Group Inc, HDR Inc, AECOM, and Arup Group. Vendors in the market are leveraging partnerships and collaborations to capture the market share. Some of the recent developments in the market are:

- June 2020: AECOM, in partnership with Canyon Partners, LLC, a global alternative asset management firm, announced a joint venture with The Martin Group to begin the transit-oriented development of Wexler, a mid-rise student housing project. The company announced that it had taken a USD 73.3 million senior construction loan from Pacific Western Bank. The project is scheduled to be completed by fall 2020.

- October 2020: The University of California, San Francisco (UCSF) selected Arup and San Francisco-based healthcare specialists Mazzetti as the lead MEP engineers of record for its new hospital, UCSF Helen Diller Medical Center at Parnassus Heights (Parnassus Heights). Arup could also be providing additional services for the project, including civil engineering services and acoustics/vibration and logistics consulting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Design and Engineering Services Industry

- 4.4 Current Employment Index of MEP Engineers in the United States

- 4.5 Impact of Technological Advancements on the MEP Services Industry (CAD, BIM, MEP Software, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Outsourcing of MEP Services to Focus on Core Offering

- 5.1.2 Steady Demand from Commercial and Healthcare Institutions

- 5.1.3 Evolving Business Models and Nature of Collaboration between Firms and Service Vendors

- 5.2 Market Restraints

- 5.2.1 Operational Challenges in High Market Concentration and Growing Demand for End-to-end Offering Affect Smaller Firms

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 New Construction

- 6.1.2 Retrofit & Renovation

- 6.1.3 Commissioning Activity

- 6.1.4 Other Types

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Commercial Offices

- 6.2.3 Educational Institutions

- 6.2.4 Public Spaces and Institutions

- 6.2.5 Industrial establishments & Warehouses

- 6.2.6 Other Commercial entities (Data centers, Research, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jacobs Engineering Group Inc.

- 7.1.2 HDR Inc

- 7.1.3 Arup Group

- 7.1.4 AECOM

- 7.1.5 MEP Engineering

- 7.1.6 Stantec Inc.

- 7.1.7 Affiliated Engineers Inc.

- 7.1.8 Macro Services

- 7.1.9 WSP Group

- 7.1.10 AHA Consulting

- 7.1.11 Burns Engineering

- 7.1.12 Wiley Wilson

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219