|

市场调查报告书

商品编码

1690755

英国宅配、快捷邮件和小包裹(CEP)-市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)United Kingdom Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

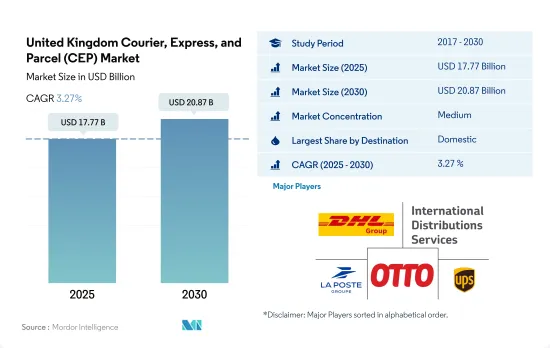

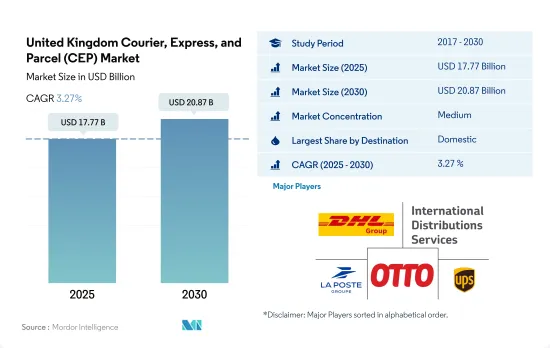

英国宅配、快捷邮件和小包裹(CEP) 市场规模预计在 2025 年达到 177.7 亿美元,预计到 2030 年将达到 208.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.27%。

由于电子商务 CEP订单的增加,减少碳足迹的倡议不断增多,预计将对 CEP 行业产生积极影响。

- 电子商务产业正在推动国内和国际 CEP 领域的成长。时尚产品是2022年英国消费者在网路上购买最常见的商品,其中服饰占63%,鞋子占47%。其次是家用电子电器产品(35%)以及书籍、电影和游戏(33%)。所有这些因素都推动了英国对 CEP 的需求。

- 拥有最大市场占有率的CEP 公司正在采取重大措施减少运送大量小包裹所产生的碳排放。例如,皇家邮政允许 90,000 名邮递员步行递送包裹。三分之二的送货都是纯步行或采用「停车绕行」方式,绝大多数的送货都是步行完成。该公司还计划在 2023 年之前在其车队中拥有 5,500 辆电动货车,以进一步减少其碳排放。亚马逊也于 2022 年开始在伦敦透过步行和电动货运自行车进行送货。两家公司的努力都是到 2040 年实现所有货物净零碳排放承诺的一部分。

英国宅配、快捷邮件和小包裹(CEP)市场趋势

预计到 2027 年,随着消费者履约中心需求的不断增长,英国的仓库数量将达到 214,000 个。

- 2024 年 5 月,杜拜环球港务集团在考文垂开设了迄今为止最大的仓库,占地 598,000 平方英尺(约 8,000平方公尺),这是 5000 万英镑(6092 万美元)投资的一部分,旨在增强客户竞争力。此前,英国政府于 2023 年 9 月在比斯特开设了一座占地 27 万平方英尺的音乐和视讯分销仓库,该仓库将处理英国70% 的实体音乐和 35% 的家庭娱乐产品。 DP World 先前已在特伦特河畔伯顿开设了一个 75,000 平方英尺的仓库,并在其伦敦门户物流中心开设了一个 230,000 平方英尺的多用户仓库。杜拜环球港务集团在南安普敦和伦敦门户设有枢纽,业务遍及 78 个国家,控制全球 10% 的贸易。预计这些倡议将提高该产业对 GDP 的贡献。

- 英国大型仓库的数量正在快速成长。到 2027 年,预计全球整体将有约 214,000 个面积超过 50,000 平方英尺的仓库。许多仓库将作为电子商务履约中心,到 2027 年,大约 18% 的仓库将用于消费者履约。这一增长表明,随着电子商务的扩张,作为贸易物流中心的仓库比例开始转向消费者履约中心。

英国政府对燃油价格有很大影响,燃油税和增值税(标准税率为 20%)构成了汽油和柴油价格的大部分。

- 2022年8月,原油价格跌破100美元,月末收在每桶90.63美元。 2023年油价进一步下跌,5月跌至每桶72.50美元的低点。 2024年3月,英国汽油价格平均为每公升150.1披索,为2023年11月以来的最高水准。这是由于油价上涨以及中东局势恶化导致英镑兑美元走弱。虽然整体通膨有所缓和,但 3 月汽油和柴油价格上涨。 2024 年 4 月以色列对伊朗发动报復性攻击后,油价飙升,随后开始下跌。

- 2024 年 6 月,英国政府确认计画在 2030 年强制要求喷射机燃料中至少含有 10% 的永续航空燃料 (SAF)。目前,SAF 比传统燃料稀缺且昂贵,因此很难在航空领域增加其使用。 SAF 占世界喷射机燃料的份额不到 0.1%。政府对 SAF 的授权将于 2025 年 1 月开始,但需获得立法核准。这是 2022 年「Jet Zero」策略的延续,该策略旨在 2050 年实现航空净零排放。

英国宅配、快捷邮件和小包裹(CEP)产业概况

英国宅配、快捷邮件和小包裹(CEP) 市场适度整合,主要有五家参与者(按字母顺序排列):DHL 集团、主要企业配送服务公司(包括皇家邮政)、法国邮政集团、奥托集团(包括爱马仕集团)和美国联合包裹服务公司 (UPS)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 英国

- 价值炼和通路分析

第五章市场区隔

- 销售目的地

- 国内的

- 国际的

- 送货速度

- 快捷邮件

- 非快捷邮件

- 模型

- 企业对企业(B2B)

- B2C

- 消费者对消费者(C2C)

- 运输重量

- 重型货物

- 轻型货物

- 中等重量货物

- 运输方式

- 航空邮件

- 路

- 其他的

- 最终用户

- 电子商务

- 金融服务(BFSI)

- 医疗保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- APC Overnight

- DHL Group

- FedEx

- GEODIS

- 国际配送服务(包括皇家邮政)

- La Poste Group

- Otto Group(including The Hermes Group)

- Rapid Parcel

- United Parcel Service of America, Inc.(UPS)

- Yodel

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

The United Kingdom Courier, Express, and Parcel (CEP) Market size is estimated at 17.77 billion USD in 2025, and is expected to reach 20.87 billion USD by 2030, growing at a CAGR of 3.27% during the forecast period (2025-2030).

Growing carbon footprint reduction initiatives owing to increasing e-commerce CEP orders are expected to positively impact CEP industry

- The e-commerce industry is a leading driver of growth in the domestic and international CEP segments. The most common goods purchased online by UK consumers in 2022 were fashion goods , with clothing accounting for a 63% share and shoes for a 47% share. These were followed by consumer electronics, with a 35% share, and books, movies, and games, with a 33% share in 2022. All these item deliveries collectively drove CEP demand in the United Kingdom.

- CEP companies with some of the biggest market shares are taking significant steps to reduce the carbon footprint generated by delivering huge volumes of parcels. For instance, Royal Mail has allowed 90,000 posties to make on-feet deliveries. Two-thirds of the deliveries are made purely by foot or through a 'park and loop' method, which is mostly on foot. The company is also aiming to have 5,500 electric vans by 2023 in a further effort to reduce carbon emissions. Amazon also started on-foot and electric cargo bike delivery in London in 2022. Initiatives by both companies are a part of their commitment toward all shipments having net-zero carbon emissions by 2040.

United Kingdom Courier, Express, and Parcel (CEP) Market Trends

The UK's warehouse count is expected to reach 214,000 by 2027 due to a rise in demand for consumer fulfillment centers

- In May 2024, DP World opened its largest warehouse yet, a 598,000 sq ft facility in Coventry, as part of a GBP 50 million (USD 60.92 million) investment to boost customer competitiveness. This follows the September 2023 opening of a 270,000 sq ft music and video distribution warehouse in Bicester, handling 70% of the UK's physical music and 35% of home entertainment products. Previously, DP World opened a 75,000 sq ft site in Burton upon Trent and a 230,000 sq ft multi-user warehouse at London Gateway's logistics hub. Alongside its hubs at Southampton and London Gateway, operating in 78 countries, DP World manages 10% of global trade. Such initiaves are expected to boost the GDP contribution from the sector.

- The number of large warehouses in the United Kingdom is rapidly increasing. By 2027, there are expected to be around 214,000 warehouses larger than 50,000 square feet globally. Many of these warehouses are to serve as e-commerce fulfillment centers, and approximately 18% of all warehouses will be for consumer fulfillment by 2027. This increase suggests the global expansion of e-commerce as the proportion of warehouses operating as trade distribution hubs begins to shift in favor of consumer fulfillment centers.

UK government has a major influence on fuel prices, and both fuel duty and VAT (standard 20% rate) make up majority of the petrol and diesel prices

- In August 2022, the oil price dropped under USD 100 and finished the month at USD 90.63 a barrel. Prices dropped further in 2023, and by May, a barrel of oil was down to USD 72.50. In March 2024, petrol prices in the UK averaged 150.1p per litre, the highest since November 2023. This is due to rising oil prices due to Middle East tensions and a weaker pound against the dollar. Although overall inflation has eased, petrol and diesel prices increased in March. Oil prices have since dropped after spiking following Israel's retaliatory attack on Iran in April 2024.

- In June 2024, the UK government confirmed it plans to require at least 10% sustainable aviation fuel (SAF) in jet fuel by 2030. Currently, SAF is scarce and more expensive than traditional fuels, making it challenging to increase its use in aviation. SAF represents less than 0.1% of jet fuel globally. The government's SAF mandate, pending legislative approval, is set to start in January 2025. This follows the 2022 "Jet Zero" strategy aiming for net-zero emissions in aviation by 2050.

United Kingdom Courier, Express, and Parcel (CEP) Industry Overview

The United Kingdom Courier, Express, and Parcel (CEP) Market is moderately consolidated, with the major five players in this market being DHL Group, International Distributions Services (including Royal Mail), La Poste Group, Otto Group (including The Hermes Group) and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 United Kingdom

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 APC Overnight

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 International Distributions Services (including Royal Mail)

- 6.4.6 La Poste Group

- 6.4.7 Otto Group (including The Hermes Group)

- 6.4.8 Rapid Parcel

- 6.4.9 United Parcel Service of America, Inc. (UPS)

- 6.4.10 Yodel

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms