|

市场调查报告书

商品编码

1690757

义大利 CEP(快递包裹):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Italy Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

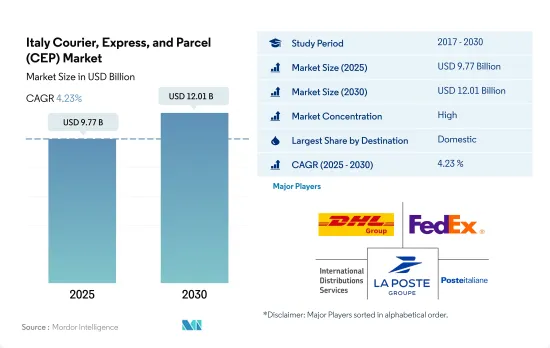

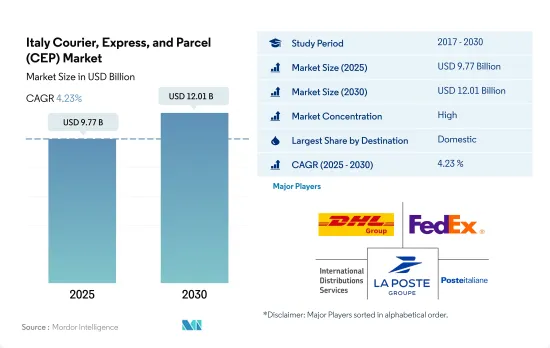

义大利快递包裹 (CEP) 市场规模预计在 2025 年为 97.7 亿美元,预计到 2030 年将达到 120.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.23%。

消费者由于选择多样、便利性和可获得性而转向电子商务,这是 CEP 配送成长的主要驱动力。

- 义大利 CEP 市场的国内和国际部分受到该国强劲的电子商务成长和采用的推动。 2022 年电子商务产业价值为 419 亿美元。 Laposte、Post Italiane、FedEx、DHL 和 UPS 是义大利 CEP 市场的主要企业。 Post Italiane 是义大利人最常使用的小包裹递送公司。亚马逊物流也是义大利重要的CEP公司,2021年运送了2.09亿个包裹。预计到2025年,电子商务产业的价值将达到648亿美元。大大小小的CEP公司都在寻找未来趋势和需求机会,形成策略联盟并进行投资,推动市场显着成长。

- 预计到 2027 年,义大利的电子商务用户将达到 4,210 万,该国的用户渗透率将达到 72.4%,这得益于本地和国际电子零售商对网路购物的偏好增加,这将为宅配行业提供巨大的推动力。由于选择多样、方便、快速且成本低廉,义大利消费者正迅速转向透过电子商务购买商品。

义大利 CEP(快递包裹)市场趋势

义大利计画2026年彻底改造超重型货运车辆,未来前景看好

- 2024年7月,义大利运输部核准在米兰和波隆那之间战略位置的皮亚琴察建立铁路货运站的计划。新车站将位于皮亚琴察东部,具体位于勒莫斯区。此外,勒莫斯已经是皮亚琴察多式联运码头的所在地,由 Hupac监督。现有的终点站目前正在进行大规模扩建,计划于 2024年终或 2025 年初完工。随着这些发展,皮亚琴察的铁路货运未来前景光明。

- 义大利计划在2024年升级其超重型货运车辆,理由是车辆状况不佳且未达欧盟标准。面对俄罗斯和乌克兰之间的衝突以及欧盟监管趋严等挑战,托运人和运输公司正在敦促政府实施公共奖励计画。该计画要求2026年投资7.4724亿美元,三年内逐步淘汰25-30%最老、污染最严重、最不安全的车辆。义大利对货运业的支持落后于法国和德国,但预计最早在 2024 年底就会改变。

年终燃料相关消费税折扣结束后,义大利的燃料价格飙升。

- 过去三年来,义大利一直是欧洲主要市场中平均批发电价最高的地方。这主要是因为其严重依赖天然气发电,这项策略使其有别于其他欧洲市场。 2023年,义大利的批发电价平均为每兆瓦时137.80美元,比德国和法国的平均价格高出三分之一,比西班牙高出50%以上。预计到 2024 年,义大利的电力成本将继续上涨,最近的批发价格比法国高出近 40%,比西班牙高出 60%。

- 截至 2024 年 3 月,义大利电力和天然气监管机构 Arela 已将 2025 年至 2027 年新容量竞标的支付上限提高至 86,466.7 美元/兆瓦。上一届竞标于 2022 年至 2024 年举行,新增产能拍卖价格最高为 74,724.3 美元/兆瓦,现有产能拍卖价格最高为 35,227.2 美元/兆瓦,分 15 年支付。未来几年,随着电动车、热泵和电解槽的电气化程度不断提高,义大利的电力需求将会成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 义大利

- 价值链与通路分析

第五章 市场区隔

- 目的地

- 国内的

- 国际的

- 送货速度

- 表达

- 非快递

- 模型

- 企业对企业 (B2B)

- 企业对消费者 (B2C)

- 消费者对消费者(C2C)

- 运输重量

- 重型货物

- 轻型货物

- 中等重量货物

- 运输方式

- 航空邮件

- 路

- 其他的

- 最终用户

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- Asendia

- DHL Group

- FedEx

- GEODIS

- International Distributions Services(including GLS)

- La Poste Group(including BRT)

- Poste Italiane

- Sailpost SpA

- Speedy SRL

- United Parcel Service of America, Inc.(UPS)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 71429

The Italy Courier, Express, and Parcel (CEP) Market size is estimated at 9.77 billion USD in 2025, and is expected to reach 12.01 billion USD by 2030, growing at a CAGR of 4.23% during the forecast period (2025-2030).

Robust consumer shift to e-commerce owing to availability of several choices, convenience, and accessibility majorly driving CEP delivery growth

- The domestic and international segments of the Italian CEP market are being driven by robust e-commerce growth and adoption in the country. The e-commerce industry was valued at USD 41.9 billion in 2022. Laposte, Post Italiane, FedEx, DHL, and UPS are the key players in the Italian CEP market. Post Italiane is the most used by Italians for parcel deliveries. Amazon Logistics is another significant CEP company in Italy, which delivered 209 million packages in 2021. The e-commerce industry is projected to be valued at USD 64.8 billion by 2025. CEP companies, both big and small scale, are capitalizing on the upcoming trends and demand opportunities and making strategic partnerships and investments, leading to significant market growth.

- E-commerce users in Italy are projected to reach 42.1 million by 2027, with the country reaching a 72.4% user penetration by 2027 due to increasing preference for shopping online from domestic and international e-retailers, thereby majorly boosting the courier industry. Consumers in Italy are rapidly shifting toward purchasing products through e-commerce, owing to the availability of several choices, higher convenience, easy accessibility, and lower costs.

Italy Courier, Express, and Parcel (CEP) Market Trends

Growing future prospects due to planned overhaul of superheavy cargo transport fleet by 2026 in Italy

- In July 2024, the Italian Ministry of Transport greenlit a project to establish a rail freight station in Piacenza, strategically placed between Milan and Bologna. The upcoming station will be situated in the eastern part of Piacenza, specifically in the Le Mose area. Moreover, Le Mose already hosts the Piacenza Intermodal Terminal, overseen by Hupac. This existing terminal is currently undergoing significant enhancements, with completion slated for late 2024 or early 2025. These developments paint a promising future for Piacenza's rail freight prospects.

- In 2024, Italy plans to upgrade its superheavy cargo transport fleet due to poor conditions and failure to meet EU standards. Shippers and carriers are urging the government to implement a public incentive plan amid challenges from the Russian-Ukrainian conflict and stricter EU regulations. The plan requires a USD 747.24 million investment by 2026 to phase out 25-30% of the oldest, most polluting, and least safe vehicles over three years. Italy's support for the freight sector has lagged behind France and Germany, but changes are expected as early as late 2024.

Fuel prices surged in Italy after the discount on fuel-related excise duties expired at the end of 2022

- For the last three years, Italy has consistently held the record for the highest average wholesale power prices among major European markets. This is primarily due to its heavy reliance on natural gas for electricity generation, a strategy that sets it apart from its European counterparts. In 2023, Italy's wholesale power prices stood at an average of USD 137.80 per megawatt hour, a figure that was a third higher than both Germany's and France's averages, and over 50% more than Spain's. Moving into 2024, Italy's power costs have continued to surge, with recent wholesale prices sitting nearly 40% above France's and a striking 60% higher than Spain's.

- As of March 2024, Italy's power and gas regulator, Arera, has increased the maximum payments in capacity auctions for 2025-2027 to USD 86,466.7/MW for new capacity. Previous auctions for 2022-2024 offered maximum payments of USD 74,724.3/MW for new capacity and USD 35,227.2/MW for existing capacity, payable over 15 years. In coming years, Italian power demand will rise due to increased electrification from electric vehicles, heat pumps, and electrolyzers.

Italy Courier, Express, and Parcel (CEP) Industry Overview

The Italy Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being DHL Group, FedEx, International Distributions Services (including GLS), La Poste Group (including BRT) and Poste Italiane (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Italy

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Asendia

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 International Distributions Services (including GLS)

- 6.4.6 La Poste Group (including BRT)

- 6.4.7 Poste Italiane

- 6.4.8 Sailpost SpA

- 6.4.9 Speedy SRL

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219