|

市场调查报告书

商品编码

1690766

中东石油和天然气管道:市场占有率分析、产业趋势和成长预测(2025-2030年)Middle-East Oil And Gas Line Pipe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

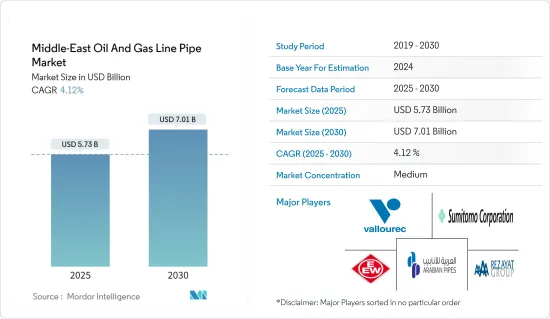

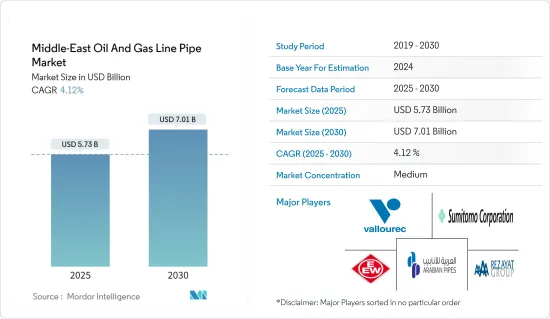

中东石油和天然气管道市场规模预计在 2025 年为 57.3 亿美元,预计到 2030 年将达到 70.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.12%。

2020 年第一季的 COVID-19 疫情导致封锁限制和管道计划延误。此外,电力消耗下降导致天然气需求下降,而旅游限制也对石油消耗产生了负面影响。预计在预测期内,天然气基础设施的发展、投资的增加以及海水淡化厂产能的扩张等因素将推动市场发展。然而,预计原油价格上涨将阻碍市场成长。

关键亮点

- 无缝类型预计在预测期内将出现显着增长,因为它比其他类型具有许多优势。

- 预计未来几年海上探勘和生产计划数量的增加将为市场参与企业提供令人兴奋的机会,为管线管行业的进一步增长铺平道路。

- 预计预测期内沙乌地阿拉伯将主导中东石油和天然气管道市场。

中东石油天然气管道市场趋势

无缝类型市场正在经历显着成长

- 无缝管线管是一种长管道,透过加热和重塑称为钢坯的实心棒材为圆形而製成。这些钢坯进一步加热,并用子弹形穿孔机穿孔,钢材在穿孔机上拉伸,形成表面无缝隙的中空管。

- 这种类型的管线管通常用于中游石油和天然气、炼油厂和化学工业的高压应用。此外,这种管线管的一般用途取决于其厚度。因此,高压应用需要更高的厚度。

- 使用这些管线管的优点包括能够提高管道的承压能力、在两根管线管之间安装其他设备所需的形状一致性以及增强的抗负载强度。然而,儘管这些管线管具有多种优点,但也存在製造过程中常见的许多缺点。这些缺点包括高成本、冷却不稳定引起残余应力导致的变形以及冷却后壁厚和管宽不均匀。

- 此外,中东地区2021年原油产量为13.158亿吨,占全球整体的31.2%,超过2020年的12.949亿吨,成为最大的原油生产国。近年来,该地区石油和天然气需求及产量的不断增长,催生了多个无缝管道计划。

- 例如,2022年9月,国家石油建设公司(NPCC)获得阿布达比国家石油公司(ADNOC)一份价值5.48亿美元的合同,用于建设一条通往阿布达比近海下扎库姆气田的新天然气管道。新的海底管线将连接扎库姆西超级综合体和达斯岛,预计2025年完工。预计此类用于石油和天然气行业运输腐蚀性流体和气体的计划将在预测期内推动无缝管线管市场的成长。

- 因此,基于上述因素,无缝管线管市场预计将显着成长,从而导致预测期内石油和天然气管线管的需求增加。

沙乌地阿拉伯主导市场

- 截至 2021 年,沙乌地阿拉伯是世界第二大原油生产国,日产量为 1,095 万桶,是全球第八大天然气生产国,日产量为 113.5 亿立方英尺。

- 此外,沙乌地阿拉伯的页岩气蕴藏量位居世界第五。因此,沙乌地阿拉伯具有巨大的潜力来复製北美传统型蕴藏量开发的成长。传统型蕴藏量的不断开发预计将推动多个集输设施和处理站对管线管道的需求。

- 到 2028 年,沙乌地阿美计画从北阿拉伯、南加瓦尔和东加瓦尔贾富拉盆地的传统天然气蕴藏量中每天生产 6.5 亿立方公尺天然气。

- 沙特阿美公司和沙乌地基础工业公司(SABIC)计划建立一个联合油製化学品计划,每年从2000万吨原油中直接生产化学品和基油。该设施预计将于 2028 年完工,并将确定管线管道的重要应用。

- 由于 SASREF、Petro Rabigh 和 Jubail 等炼油厂升级和扩建计划以及 Jizan 炼油厂的推出,沙乌地阿拉伯的管线管道部署预计将大幅增加。

- 据该工程公司称,预计 2022 年 11 月,沙特阿美将对 Master Gas III计划所需的 160 万吨 56 英寸非酸性地面管道发出重大竞标。新管道将帮助沙乌地阿美公司将天然气从沙乌地阿拉伯东部输送到西部。因此,预计此类计划将增加该国对石油和天然气管道的需求。

- 随着2021年天然气产量增加1,173亿标准立方米,管线管需求大幅增加。此外,新的精製计划预计将有助于沙乌地阿拉伯主导中东地区的石油和天然气管道市场。

- 因此,由于上述因素,预计沙乌地阿拉伯将在预测期内主导石油和天然气管道市场。

中东油气管线产业概况

中东石油和天然气管道市场中等细分。市场的主要企业(不分先后顺序)包括 Arabian Pipes Company、Rezayat Group、EEW Group、Sumitomo Corporation 和 Vallourec SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2028 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 无缝的

- 焊接

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Arabian Pipes Company

- Rezayat Group

- EEW Group

- Sumitomo Corporation

- Vallourec SA

- Abu Dhabi Metal Pipes & Profiles Industries Complex LLC

- Jindal SAW Ltd

- ArcelorMittal SA

第七章 市场机会与未来趋势

The Middle-East Oil And Gas Line Pipe Market size is estimated at USD 5.73 billion in 2025, and is expected to reach USD 7.01 billion by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

The COVID-19 outbreak in Q1 of 2020 had delayed pipeline projects due to imposed lockdown restrictions. Also, it led to a decrease in gas demand due to the decline in electricity consumption, and travel restrictions also negatively affected oil consumption. Factors such as increasing development of gas infrastructure, growing investments, and increasing capacity of desalination plants are expected to drive the market during the forecast period. However, the high volatility of crude oil prices is expected to hinder market growth.

Key Highlights

- The seamless type segment is expected to witness significant growth during the forecast period, owing to the number of advantages when compared to other types.

- The rise in offshore exploration and production projects is expected to create an excellent opportunity for the market players in the years to come, as these projects are paving the way for the line pipe industry to grow more.

- Saudi Arabia is expected to dominate the Middle East oil and gas line pipe market during the forecast period.

Middle-East Oil and Gas Line Pipe Market Trends

Seamless Type Segment to Witness a Significant Growth

- Seamless line pipes are small pieces of a long pipeline that are made by heating and reshaping solid rods of steel, called billets, into round shapes.These billets are further heated and then pierced by a bullet-shaped piercer, over which the steel gets stretched and takes the shape of a hollow pipe without having any seams on its surface.

- These types of line pipes are usually suitable for high-pressure applications such as in the oil and gas midstream sector, refineries, the chemical industry, etc. Moreover, the general application of such line pipes depends on their thickness. Thus, high-pressure applications are required to have higher thicknesses.

- Several advantages of using these line pipes include their ability to improve the pipeline's ability to withstand pressure, the uniformity of shape required to install other equipment between two-line pipes, and their greater strength under load. However, despite having several advantages, these line pipes also have an equal number of disadvantages that generally occur in them during production. These disadvantages include high cost, residual stresses caused by unstable cooling that create deformation, and uneven thickness and pipe width after cooling.

- Moreover, in 2021, the Middle Eastern region was the largest producer of crude oil, producing 1315.8 million tons, which accounted for 31.2% of the global crude oil production and was greater than the production in 2020, which was 1294.9 million tons. The increasing demand and production of oil and gas in the region in recent years gave rise to several seamless pipeline projects.

- For instance, in September 2022, the National Petroleum Construction Company (NPCC) was granted a USD 548 million contract by the Abu Dhabi National Oil Company (ADNOC) to build a new gas pipeline at its Lower Zakum field offshore Abu Dhabi. The new undersea pipeline will connect Zakum West Super Complex to Das Island and be finished in 2025. Such projects transporting corrosive fluids or gas in the oil and gas industry are expected to propel the market growth for seamless line pipes during the forecast period.

- Therefore, based on the above-mentioned factors, the market for seamless line pipes is expected to witness significant growth, which, in turn, increases the demand for the oil and gas line pipe market during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia was the world's second-largest crude oil producer at 10.95 million barrels per day and the world's eighth-largest natural gas producer at 11.35 billion cubic feet per day as of 2021.

- Additionally, Saudi Arabia also has the world's fifth-largest estimated shale gas reserve. Thus, it has great potential for the country to replicate North America's unconventional reserve development growth. The increasing exploitation of unconventional reserves is expected to drive the demand for line pipes at multiple gatherings and treatment stations.

- By 2028, Saudi Aramco plans to produce 0.65 bcm of natural gas per day and is expected to target unconventional gas reserves in North Arabia, South Ghawar, and the Jafurah Basin, east of Ghawar.

- Saudi Aramco and Saudi Basic Industries Corp. (SABIC) plan to set up a joint oil-to-chemicals project that produces chemicals and base oils directly from 20 million tons of crude oil per annum. It is expected that the facility is likely to be completed by 2028, thus witnessing the significant application of line pipes.

- With upgrades and expansion projects in refineries like SASREF, Petro Rabigh, and Jubail, as well as the launch of the Jizan refinery, the deployment of line pipes in Saudi Arabia is expected to increase considerably.

- In November 2022, according to engineering firms, Aramco was expected to issue a large tender for 1.6 million metric tons of 56-inch non-sour surface pipelines required for the Master Gas III project. The new pipes will assist Aramco in transporting gas from the east to the west of Saudi Arabia. Thus, with this kind of project, demand for oil and gas line pipes is expected to increase in the country.

- With increasing gas production-117.3 billion standard cubic meters in 2021-the demand for line pipes grew considerably. Additionally, with new refining projects, Saudi Arabia is expected to dominate the oil and gas pipeline market in the Middle Eastern region.

- Therefore, based on the above-mentioned factors, Saudi Arabia is expected to dominate the oil and gas line pipe market over the forecast period.

Middle-East Oil and Gas Line Pipe Industry Overview

The Middle Eastern oil and gas pipeline market is moderately fragmented. The key players in the market (not in any particular order) include Arabian Pipes Company, Rezayat Group, EEW Group, Sumitomo Corporation, and Vallourec SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Seamless

- 5.1.2 Welded

- 5.2 Geography

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Arabian Pipes Company

- 6.3.2 Rezayat Group

- 6.3.3 EEW Group

- 6.3.4 Sumitomo Corporation

- 6.3.5 Vallourec SA

- 6.3.6 Abu Dhabi Metal Pipes & Profiles Industries Complex LLC

- 6.3.7 Jindal SAW Ltd

- 6.3.8 ArcelorMittal SA