|

市场调查报告书

商品编码

1690768

持续整合工具:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Continuous Integration Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

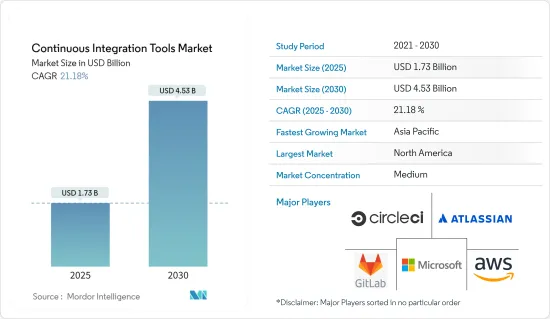

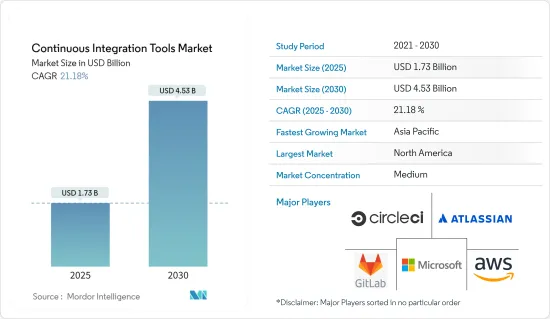

持续整合工具市场规模预计在 2025 年达到 17.3 亿美元,预计到 2030 年将达到 45.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.18%。

持续整合是一种用于开发软体的 DevOps 方法,其中开发人员定期将程式码变更合併到共用储存库中。然后对程式码运行自动建置和测试。

主要亮点

- 持续整合 (CI) 可协助开发人员提供即时报告,并在程式码中发现任何缺陷时立即采取纠正措施。它是 DevOps 的一个组成部分,整合了多个 DevOps 阶段。测试阶段也是自动化的,并立即向使用者报告。

- 透过持续集成,可以在提交程式码后立即建置和测试软体。在拥有许多开发人员的大型计划中,提交发生在一天中的不同时间。每次提交时,程式码都会被建置和测试。如果测试用例通过,则对建置进行部署测试。如果部署成功,则程式码推送到生产环境。这个提交、建置、测试和部署过程是持续的,因此称为「持续整合」。

- 市面上有许多不同的 CI 工具,每种工具都有自己独特的功能。它们有开放原始码和付费版本,可让您选择最适合您需求的版本。

- 儘管所有 CI 工具都具有相同的基本功能,但选择最适合您的长期目标的 CI 工具非常重要。此外,可以根据功能、易用性、成本等选择多种工具来满足不同的需求。

- 根据软体公司 JetBrains 的调查,到 2021 年,43% 的软体开发人员将采用持续整合工具。由于 CI 工具的便利性,预计未来几年市场将呈现正成长。

COVID-19 疫情迫使多家公司让员工在家工作,大大增加了开发人员采用 CI 工具的需求。越来越多的企业将其应用程式迁移至云端或云端基础的平台。此类事件需要及时使用 CI 工具。

持续整合解决方案的市场趋势

零售和电子商务行业预计将大幅成长

- 数位转型使零售商能够为消费者提供多通路、全通路体验。数位化呈现使客户可以根据自己的方便在不同的平台上购物。

- COVID-19 疫情影响了零售和电子商务产业的消费行为。零售商被迫调整其实体经营方式以与数位系统结合。零售商需要提供简单、无缝的电子商务体验,从浏览到研究、选择、购买、退货和换货。疫情过后,顾客对更好的数位购物体验的要求越来越高。零售商被要求使他们的网站适合行动设备,提供诸如「线上购买,店内取货」(BOPIS)等整合解决方案,并在跨设备和通路提供可靠、一致的数位体验。

- 消费行为的这些变化迫使零售商将数位管道和电子商务纳入业务,这种转变导致数位资料的大量增加,从而推动了对持续整合工具的需求。

- 随着新技术以更快的速度被采用以简化供应链,零售业变得越来越复杂。持续整合有望成为这些零售业务的接触点。持续整合可协助您满足下一代客户日益增长的需求。持续整合可以提高程式码品质、加快持续交付速度,并降低因不断增加的发布数量而产生的 IT 成本。

- 持续整合模型是一种催化剂,它允许零售终端用户测试尽可能多的程式码并将其整合到现有产品中,而不会出现重大效能问题。这为电子商务网站提供了一个绝佳的机会,透过比以往更快、更流畅地推出更新和新功能,即时回应用户的需求和愿望。

北美可望主导市场

- 北美是一个相当发达的市场,有几家新兴企业致力于增强机构的持续整合能力。目前正在最有效地部署大量资料整合技术和工具,以识别主要最终用户(如银行、金融服务和保险业以及政府主导)之间的资料同步模式。

- 总体趋势是倾向于采用 CI 基础设施来推动 DevOps 并简化流程。对于早期采用者来说,特别需要考虑的是,如果任务是由公共基础设施驱动的,那么程式码将公开可用,并且必须在整个开发和部署过程中定期部署,确保公众和其他相关第三方可以存取程式码以进行品质保证和安全审核,从而实现快速的开发和补救过程。

- 总的来说,API 是现代数位生态系统的基础。该地区的团队正在寻求采用由自动化工具和整合安全测试功能增强的持续整合实践,从而大大推动 DevOps 的采用。本地供应商也正在透过在其 CI 产品中应用 API 来逐步最大化其能力。此外,伙伴关係也吸引了市场上的一些关键供应商,这些供应商有能力获得更多客户。

- 去年 2 月,美国CI/CD 管线供应商 CircleCI 宣布与 AWS GovCloud 合作,协助美国政府利用 AWS 政府平台实现应用开发工作流程的现代化。该伙伴关係涉及与小型企业管理局 (SBA) 等独立联邦机构以及 AWS 等系统整合商的合作。

此外,该公司的成长势头持续增强,该公司宣布完成 F 轮资金筹措,筹得 1 亿美元,估值升至 17 亿美元。此举取代了最近计划收购荷兰发布编配平台 Vamp 的计划,并将使该公司能够最大限度地发挥其服务产品的潜力。

持续整合解决方案行业概览

由于新市场参与者的出现和现有市场参与者的扩张,预计在预测期内持续整合工具市场的竞争格局将保持分散。中小型解决方案提供者正在不断筹集资金,以更顺利地进入市场。

2022 年 11 月,Arista Networks 宣布推出全面的网路自动化解决方案 Arista 持续整合 (CI) 管道。 Arista CI Pipeline 基于 Arista 的 EOS 网路资料湖 (NetDL),协助企业客户采用现代网路营运模式。此策略减少了营运时间和成本,同时为网路提供了灵活的、资料驱动的变更管理流程,从而加快了部署速度并提高了可靠性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 越来越多地采用基于软体的业务流程

- 对降低软体开发复杂性和最佳化成本的需求日益增加

- 市场挑战

- 缺乏引入 CI 工具的专业知识,尤其是在中小型企业中

第六章 市场细分

- 部署形式

- 本地

- 云

- 最终用户产业

- 资讯科技/通讯

- 零售与电子商务

- 医疗保健和生命科学

- BFSI

- 媒体与娱乐

- 其他终端用户产业(教育、製造业)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Atlassian Corporation PLC

- Amazon Web Services Inc.

- Microsoft Corporation

- Circle Internet Services Inc.

- GitLab Inc.

- Buddy(BDY Sp zoo Sp K)

- Micro Focus International PLC

- JetBrains SRO

- CodeShip Inc.

- Thoughtworks Inc.

- IBM Corporation

- Travis CI GmbH

第八章投资分析

第九章:市场的未来

The Continuous Integration Tools Market size is estimated at USD 1.73 billion in 2025, and is expected to reach USD 4.53 billion by 2030, at a CAGR of 21.18% during the forecast period (2025-2030).

Continuous integration is a DevOps method for making software in which developers regularly merge their code changes into a shared repository. After that, automated builds and tests are run on the code.

Key Highlights

- Continuous integration (CI) helps developers provide immediate reporting whenever any defect is identified in the code, so immediate corrective action is taken. It is an essential part of DevOps that integrates numerous DevOps stages. The testing phase is also automated and is instantly reported to the user.

- In continuous integration, the software is built and tested immediately after the code commit. In a larger project with many developers, commits are made at various times during the day. With each commit, code is built and tested. If the test case is passed, the build is tested for deployment. If the deployment is a success, the code is pushed to production. This commit, build, test, and deploy is a continuous process, hence the name "continuous integration."

- Various CI tools are available on the market, offering access to unique features. These have open-source and paid versions, and depending on the user's needs, the most preferred can be selected.

- Although all the CI tools are designed to perform the same basic functions, choosing the best CI tool becomes vital in the long run. Multiple tools may also be chosen to meet different needs, depending on things like features, how easy they are to use, and cost, among other things.

- According to a survey by JetBrains (a software company), 43% of software developers will employ continuous integration tools in 2021. Because CI tools are useful, the market is expected to grow positively over the next few years.

Due to the COVID-19 pandemic, several businesses had employees working from home, and the need to adopt CI tools for developers increased substantially. Companies increasingly moved their apps to the cloud or cloud-based platforms. Such incidents necessitated the use of CI tools in a timely manner.

Continuous Integration Solutions Market Trends

Retail and E-commerce Industry Expected to Exhibit Significant Growth

- Digital transformation allows retailers to open up multi-channel and omnichannel experiences for their consumers. A digital presence allows customers to shop across various platforms according to their convenience.

- The COVID-19 pandemic impacted consumer behaviour in the retail and e-commerce industries. Retailers are required to adapt their brick-and-mortar operations to integrate with digital systems. Retailers need to deliver a simple and seamless e-commerce experience from browsing to researching, selecting, purchasing, returning and exchanging. Customers are inclined toward better digital shopping experiences after the pandemic. Retailers are required to ensure their sites are mobile-responsive, provide integrated solutions, such as "buy online, pick up in-store" (BOPIS), and deliver a reliable, consistent digital experience across devices and channels.

- This changed consumer behaviour is forcing retailers to incorporate digital channels and e-commerce into their operations, increasing the demand for continuous integration tools as digital data largely increases in this shift.

- Adopting new technologies at an increased rate with efficient supply chains becomes more complicated in the retail industry. Continuous integration is expected to become the touchpoint for these retail businesses. Continuous integration helps meet the requirements of increasing demands from next-generation customers. It offers improved code quality, continuous delivery speed, and IT cost reduction with the constant increase in releases.

- The continuous integration model is primed to ensure that retail sector end users can test as many types of codes as they want and integrate them within their existing product without any major performance issues. This gives e-commerce sites a great chance to respond to users' needs and wants in real time by pushing updates and new features more quickly and smoothly than ever before.

North America Expected to Dominate the Market

- North America is a considerably developed market, owing to the presence of several startups working toward easing the continuous integration capabilities of institutions. Bulk data integration techniques and tools are currently most efficiently implemented in critical end-users such as BFSI or government initiatives to identify data synchronization patterns.

- The general trend has been favourable toward the adoption of CI infrastructure to advance DevOps and streamline processes. A special consideration for early adopters has been that if a task is driven by public infrastructure, the code must consequently be publicly available and deployed periodically throughout the development and deployment process, ensuring access to the code for quality assurance and security audits by the public and other relevant third parties and allowing for rapid development and fixing processes.

- Generally, APIs are foundational for a modern digital ecosystem. The region's teams aim to adopt continuous integration practices buttressed by automation tools and integrated security testing capabilities, significantly boosting DevOps adoption. Local vendors have also been slowly maximizing capabilities by applying APIs to their CI offerings. Moreover, partnerships are engaging significant vendors in the market who are well-placed for further customer acquisition.

- In February last year, CircleCI, a CI/CD pipeline provider based in the USA, announced a collaboration with AWS GovCloud to assist in the augmentation of application development workflows for United States government platforms utilizing AWS's government platform to modernize their application development workflows. The partnership involves collaborating with an independent federal agency, such as the Small Business Administration (SBA), or systems integrators, such as AWS.

Moreover, the company's growth has been well placed with the announcement of a Series F funding round, raising USD 100 million and bringing the company's valuation to USD 1.7 billion. This was in lieu of their recently planned acquisition of Vamp, a Dutch release orchestration platform, allowing the company to maximize the potential of their offering.

Continuous Integration Solutions Industry Overview

Because of the emergence of new market players and the expansion of existing market players, the competitive landscape of the Continuous Integration Tools Market is expected to fragment over the forecast period. Small and medium-sized solution providers are increasingly raising capital and attempting to enter the market smoothly.

In November 2022, Arista Networks announced a comprehensive network automation solution with the Arista Continuous Integration (CI) Pipeline. The Arista CI Pipeline, based on Arista's EOS Network Data Lake (NetDL), aids enterprise customers in implementing a contemporary network operating paradigm. With less operational time and money, this strategy gives the network a flexible, data-driven process for managing changes that makes deployment faster and more reliable.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Software-based Business Processes

- 5.1.2 Increasing Demand for Reduced Complexities in Software Development and Cost Optimization

- 5.2 Market Challenges

- 5.2.1 Lack of Expertise in Deployment of CI Tools Especially in the Small and Medium Enterprises

6 MARKET SEGMENTATION

- 6.1 Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 End-User Industry

- 6.2.1 IT and Telecom

- 6.2.2 Retail and E-commerce

- 6.2.3 Healthcare and Life Sciences

- 6.2.4 BFSI

- 6.2.5 Media and Entertainment

- 6.2.6 Other End-User Industries (Education, Manufacturing)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlassian Corporation PLC

- 7.1.2 Amazon Web Services Inc.

- 7.1.3 Microsoft Corporation

- 7.1.4 Circle Internet Services Inc.

- 7.1.5 GitLab Inc.

- 7.1.6 Buddy (BDY Sp zoo Sp K)

- 7.1.7 Micro Focus International PLC

- 7.1.8 JetBrains SRO

- 7.1.9 CodeShip Inc.

- 7.1.10 Thoughtworks Inc.

- 7.1.11 IBM Corporation

- 7.1.12 Travis CI GmbH