|

市场调查报告书

商品编码

1690778

中东和非洲造纸和纸浆产业:市场占有率分析、产业趋势和统计、成长预测(2025-2030 年)Middle East And Africa Pulp And Paper Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

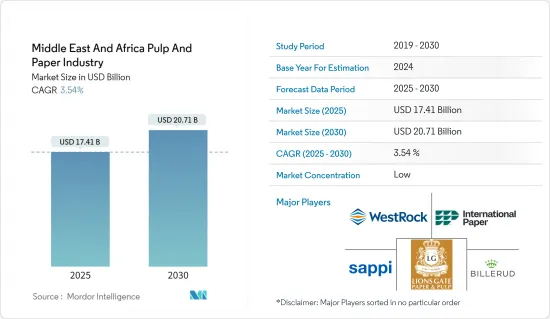

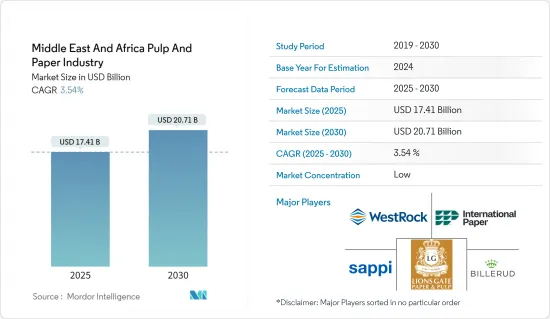

中东和非洲的造纸和纸浆产业预计将从 2025 年的 174.1 亿美元成长到 2030 年的 207.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.54%。

主要亮点

- 中东和非洲的纸和纸浆产品市场正在扩大,这主要是由于对纸製品的需求不断增长,以及人们对减少传统包装材料碳影响的必要性的认识不断提高。为了透过限制国内垃圾排放来减少不可再生资源的使用,卡达政府根据其「2030国家愿景」推出了多项绿色经济计画。

- 对环保包装材料,尤其是纸质包装解决方案的需求正在推动市场的发展。禁止食品和饮料行业使用一次性塑胶的严格法律的实施进一步加剧了这种情况。此外,不可持续的商业行为导致消费者要求更高的标准和更环保的产品。

- 电子商务销售额的成长以及对纸箱和箱板纸的需求的成长是推动市场发展的两个关键因素。消费者现在优先考虑可回收性和生物分解性,而不是再生性作为关键包装参数。这反映出消费者对包装废弃物未来对环境的影响日益担忧。由于这些因素,市场在预测期内可能会继续成长。

- 此外,根据沙乌地阿拉伯通讯(SPA) 报导,2023 年前三个月,沙乌地阿拉伯的旅游收入成长了两倍多,达到 370 亿沙特里亚尔(98.6 亿美元)。同期该国旅游收入成长了225%。快速成长的旅游业为沙乌地阿拉伯食品和饮料产业的发展提供了许多机会,加速了对一系列纸质包装的需求,包括纸箱、纸袋和瓦楞纸箱。

- 预计原物料价格上涨将对造纸和纸浆产业的成长构成挑战。然而,随着非洲生活水准的提高,非洲大陆对纸张和纸浆产品的需求可能会增加。由于都市化和可支配收入的增加,预计未来几年市场将会成长。此外,有理由承认,该地区纸张消费量的增加正在创造商机,并且在预测期内将不再影响对纸质产品的需求。

- 日益增强的环保意识也推动了纸製品的成长,该地区各国政府,特别是阿拉伯联合大公国政府,对一次性塑胶等不可再生产品的使用施加了限制。消费者的态度和偏好也在改变。近年来,注重健康和卫生的消费者推动了纸质包装和纸巾等一次性产品市场的发展,这些产品的人均消费量不断上升。中东和非洲市场对纸和纸浆产品的需求受到对环保包装解决方案的需求的推动。

中东和非洲纸张和纸浆市场的趋势

印刷和书写占据市场占有率主导地位

- 纸张在书写和印刷中的使用在阿联酋、以色列和沙乌地阿拉伯等国家已经取得了非凡的普及,而已开发国家的零售业也出现了商场和超级市场数量的增加。每个国家强大的分销网络,包括多品牌商店和线上零售商,正在为中东和非洲的书写和印刷纸创造商机。

- 中东印刷业越来越需要印刷服务供应商转变其宗旨和营运模式,并探索新途径来实现其服务产品的多样化。随着该地区环境法规的出台以及政府和企业遵循永续商业实践的压力越来越大,印刷服务提供者最终将不得不投资永续技术以保持竞争力。这项见解为印刷企业及其客户带来了短期机会。

- 教育体系的发展和政府对教育的重视,推高了该地区纸张的市场价值,从而导致对书写和印刷用纸的需求增加。例如,2023年2月印刷和书写等级的消费量大幅增加。南非造纸製造商协会(PAMSA)对纸张和印刷在现代社会中的地位进行了调查。从阅读习惯到标籤和包装的重要性,调查显示,82% 的南非人将纸张作为日常生活的一部分。

- 此外,中东地区不断成长的纸张、文具和印刷产品市场对全球製造商的吸引力也越来越大。阿联酋作为区域贸易枢纽的地位代表着其全部区域新兴市场的关键。根据沙乌地阿拉伯统计总局统计,沙乌地阿拉伯「出版活动」产业收入大幅成长。 2020 年为 1,119,290,000 美元,预计到 2024 年将增至 1,336,060,000 美元。这一显着的成长趋势表明该地区的印刷和书写潜力,从而产生了全部区域对纸张的需求。

- 沙乌地阿拉伯市场是世界上成长最快的经济体之一,为纸製品和相关产业带来了大量的投资机会。沙乌地阿拉伯也是将生产转移到国内市场的国家之一。例如,2024年1月,PIF宣布与中东和北非专门生产和回收纸本产品的製造商中东纸业公司完成投资协议。 PIF 的投资将使 MEPCO 能够透过纸製品等再生产品提高生产能力、提高业务效率并促进环境永续性,这符合沙乌地阿拉伯的永续目标。

沙乌地阿拉伯占主要市场份额

- 在沙乌地阿拉伯,对客户友善包装和增强产品保护的需求不断增长,使得纸和纸板包装成为可行且经济高效的解决方案。此外,沙乌地阿拉伯是中东包装产业的主要市场之一。该国拥有庞大的消费群和广泛的工业活动(石油和天然气行业除外),对纸质包装的需求快速增长。

- 沙乌地阿拉伯的大量投资、经济自由化和社会改革为国内外包装企业创造了巨大的机会。随着对食品和饮料的需求不断增长,沙乌地阿拉伯正在吸引 2.32 亿沙特里亚尔(6,180 万美元)对食品业的投资。沙乌地阿拉伯工业城市和技术区管理局签署了该协议。 MODON 已签署了七份合同,总面积达 99,400平方公尺,这将主要惠及沙乌地阿拉伯的食品和饮料行业。此外,在2023年沙乌地阿拉伯食品博览会开幕式上,MODON 还签署了另外两项协议,以促进资金筹措解决方案、支持业务发展并鼓励创业。

- 此外,2023 年 4 月,总部位于阿联酋的 Hot Pack Global 宣布在沙乌地阿拉伯开展一项预计投资 10 亿沙特里亚尔(2.66 亿美元)的食品包装专门计划,以提供环保产品。初始工厂每年将为快速消费品生产 7,000 万个包装单元。目的是将沙乌地阿拉伯打造为顶级国际投资目的地,吸引新资本,留住现有投资者,扩大投资,以促进长期、永续的国家经济成长。

- 此外,该国的2030愿景非常重视永续性。沙乌地阿拉伯王国的目标是到2060年实现净零排放。该宣言符合「2030愿景」的雄心勃勃的目标,其中包括加速能源转型、实现永续性目标和鼓励新的投资。可回收纸包装是一种永续的选择。由可再生资源木纤维製成。这是一种永续的选择,因为它是由可再生资源製成的,而且其生产有利于环境。因此,沙乌地阿拉伯各行业的一次性包装消费量预计会增加。

- 随着消费行为向环保包装的转变,永续和环保包装已成为各製造商的需求之一。瓦楞纸箱和折迭纸盒满足所有要求,因为它们是由廉价、可回收的资源製成的。随着人们不断尝试减少一次性塑胶的使用,以及消费者越来越注重永续性,纸板产品变得越来越受欢迎。瓦楞纸供应商正在引入永续性的创新,这项发展的主要特征之一是在个人护理和家居包装领域使用完全可回收材料生产包装。

- 根据沙乌地阿拉伯统计总局的数据,2023 年纸张和纸製品产业营业额为 54.8 亿美元。因此,受需求成长(特别是食品和饮料行业的需求)和消费者偏好变化的推动,沙乌地阿拉伯的纸和纸板市场预计将经历显着增长。随着电子商务市场的成长,线上食品配送应用程式和快餐店的兴起也受益于纸包装。

中东和非洲造纸和纸浆产业概况

中东和非洲的纸张和纸浆市场比较分散,主要参与者有国际纸业公司、Smurfit Kappa、Lions Gate Paper & Pulp 和 Billerud 等。主导这一市场的关键因素是透过创新、市场渗透、退出障碍、竞争策略的实力和企业集中度所获得的永续竞争优势。

2023年7月,欧洲最大的纸张和包装公司Smurfit Kappa计划在摩洛哥开设其第一个北非基地,为快速成长的新兴消费品市场的成长铺平道路。该公司已在该占地 25,000平方公尺的工厂投资超过 3,500 万欧元(3,849 万美元)。

2023 年 5 月,Bilour 推出了可再生、可回收和生物分解性的厕所用卫生纸和厨房纸包装解决方案。 Billow 推出了一种机上光牛皮纸,专门针对厕所用卫生纸和厨房用纸包装进行了改进和检验。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 消费者对包装食品和生鲜食品的需求不断增加

- 市场挑战

- 原料成本上涨

第六章 市场细分

- 按年级

- 漂白化学浆 (BCP)

- 溶解木浆 (DWP)

- 未漂白牛皮纸浆

- 机械浆

- 按应用

- 印刷与书写

- 报纸纸张

- 组织

- 箱板

- 瓦楞纸板

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 伊朗

- 以色列

- 约旦

- 巴林

- 科威特

- 埃及

- 突尼西亚

- 摩洛哥

- 阿尔及利亚

- 南非

第七章 竞争格局

- 公司简介

- WestRock Company

- International Paper Company

- Lions Gate Paper & Pulp

- Sappi

- Billerud

- Stora Enso OYJ

- Mondi PLC

- Oji Holdings Corporation

- Resolute Forest Products

- Svenska Cellulosa AB SCA

- Smurfit Kappa

第八章投资分析

第九章 市场机会与未来趋势

The Middle East And Africa Pulp And Paper Industry is expected to grow from USD 17.41 billion in 2025 to USD 20.71 billion by 2030, at a CAGR of 3.54% during the forecast period (2025-2030).

Key Highlights

- The market for pulp and paper products is expanding in the Middle East and Africa, mainly due to the growing demand for paper-based products and rising awareness of the need to lessen the carbon impact of traditional packaging materials. To reduce the use of non-renewable resources by limiting trash output in the nation, the Qatari government has launched several green economy programs under the National Vision 2030.

- The need for green packaging materials, particularly paper packaging solutions, is driving the market. This is further fueled by the enforcement of strict legislation regarding the ban on single-use plastic in the food and beverage sector. Also, unsustainable business practices have empowered consumers to demand a higher standard of product with a favorable ecological impact.

- The expansion of e-commerce sales and the rising demand for cartons and container boards are two significant factors driving the market under consideration. Consumers now prioritize recyclability and biodegradability over reusability as crucial packaging parameters. This reflects customers' increased concerns about the future environmental impact of packaging waste. Due to these factors, the market studied may continue to grow over the forecast period.

- Furthermore, according to the Saudi Press Agency (SPA), in the first three months of 2023, Saudi Arabia saw a more than three-fold increase in revenue from tourism, amounting to SAR 37 billion (USD 9.86 billion), as one of the largest oil exporters sought to draw in more foreign tourists and diversify away from oil-based revenues. The country's incoming tourism revenue increased by 225% over the same period. The rapidly growing tourism sector presents many opportunities for developing the food and beverage industry in Saudi Arabia, accelerating the necessity of different paper-based packaging like folding cartons, paper bags, corrugated boxes, and more.

- The increasing price of raw materials is expected to challenge the growth of the pulp and paper industry. However, as living standards in Africa improve, the continent's demand for pulp and paper products may also increase. The market is expected to grow in the coming years due to urbanization and rising disposable income. Moreover, there is reason to acknowledge that paper consumption in the region will increase, creating business opportunities and no longer affecting the demand for paper-based products during the forecast period.

- Increasing environmental awareness is also driving the growth of paper products, with governments in the region, particularly the United Arab Emirates, clamping restrictions on using non-renewable products like single-use plastics. Consumer attitudes and preferences have changed. Recently, health and hygiene-conscious consumers have fuelled the market for paper packaging and disposables like tissues, with per capita consumption of these products on the rise. The demand for paper and pulp products in the Middle East and Africa market is driven by the demand for green packaging solutions.

Middle East And Africa Pulp And Paper Market Trends

Printing and Writing to Hold Significant Market Share

- The use of paper in writing and printing has shown exceptional penetration in countries such as the United Arab Emirates, Israel, and Saudi Arabia, with an increasing number of shopping malls and supermarkets in the retail sector in developed countries. A strong distribution network in the countries, including multi-brand stores and online retailers, creates opportunities for writing and printing papers in the Middle East and Africa.

- The Middle East printing industry has accelerated the need for print service providers to transform their objectives and operational models and to look toward new avenues to diversify their offerings. With environmental regulations being adopted in the region, increasing the pressure on governments and businesses to follow sustainable business practices, print service providers will eventually have to invest in sustainable technology to remain competitive. This insight presents an opportunity for print businesses and their customers in the immediate future.

- The growing educational system and the focus of governments on it have boosted the market value of paper in the region, leading to increased demand for paper in writing and printing. For instance, in February 2023, the consumption of printing and writing grades was up fairly. The Paper Manufacturers Association of South Africa (PAMSA) surveyed the position of paper and print in modern society. From reading habits to the importance of labels and packaging, the survey recorded that 82% of South Africans acknowledged paper as a part of their daily lives.

- Furthermore, the Middle East's growing market for paper, stationery, and printing products is becoming increasingly attractive to global manufacturers. The regional trade hub status of the United Arab Emirates presents a key to emerging markets throughout the region. According to the General Authority for Statistics (Saudi Arabia), the industry revenue of "publishing activities" in Saudi Arabia has increased significantly. It was USD 1,119.29 million in 2020, expected to increase to USD 1,336.06 million by 2024. This significant growth trend shows the region has potential for printing and writing and creates demand for paper throughout the region.

- The Saudi market is one of the fastest-growing economies in the world, and with it comes many investment opportunities for paper products and related industries. Saudi Arabia is also one of the countries where production is increasingly shifting to the domestic market. For instance, in January 2024, the Public Investment Fund announced the completion of an investment agreement with Middle East Paper Company, a manufacturer specialized in producing and recycling paper-based products in the Middle East and North Africa. PIF's investment will allow MEPCO to increase its production capacity, improve operational efficiency, and promote environmental sustainability through recycled products, including paper goods, which are in line with Saudi Arabia's sustainable development targets.

Saudi Arabia to Hold Major Share in the Market

- The growing demand for customer-friendly packages and heightened product protection is expected to boost paper and paperboard packaging as a viable and cost-effective solution in Saudi Arabia. Furthermore, Saudi Arabia is one of the leading markets in the packaging industry in the Middle East. The country has a huge consumer base and a wide range of industrial activities (apart from the oil and gas sector), adding to the rapid demand for paper-based packaging.

- Substantial investment, economic liberalization, and social reforms are generating massive opportunities for international and domestic packaging players in Saudi Arabia. With the constantly growing demand for food and beverages, Saudi Arabia attracts SAR 232 million (USD 61.8 million) in investments in the food industry. The Saudi Industrial City and Technology Zone Authority signed these agreements. Seven contracts with a total area of 99,400 square meters, mainly to benefit the Kingdom's food and beverage sector, have been granted by MODON. Furthermore, to facilitate financing solutions, support business development, and encourage entrepreneurship during the opening ceremony of Saudi Food 2023, MODON also signed two additional agreements.

- Moreover, in April 2023, the UAE-based Hot Pack Global unveiled a project for specialized food packaging in Saudi Arabia for an estimated SAR 1 billion (USD 266 million) to provide environmentally friendly goods. The initial factory is anticipated to create 70 million packaging units annually for quickly moving consumer items. In order to foster long-term, sustainable national economic growth, the aim is to market Saudi Arabia as a top international investment location, draw in new capital, keep existing investors, and increase their investments.

- Moreover, the country's vision for 2030 has strongly emphasized sustainability. The Kingdom of Saudi Arabia strives to achieve Net Zero by 2060. This declaration is consistent with the larger goals of Vision 2030, which include accelerating the energy transition, achieving sustainability targets, and spurring new investment. Due to its recycling capabilities, paper packaging is a sustainable option. It is made using wood fiber, which is an entirely renewable resource. Being made from a renewable resource whose production benefits the environment makes it a sustainable option. Consequently, the consumption of disposable packaging in various industries in Saudi Arabia is expected to grow.

- Sustainable and eco-friendly packaging is on the list of requirements from different manufacturers after consumer behavior shifts toward environmentally friendly packaging. Corrugated boxes and folding cartons fulfill all requirements because they are inexpensive and made from recyclable resources. Corrugated items are increasingly popular as attempts to minimize the use of single-use plastics continue, and consumers show increased interest in sustainability. Suppliers of corrugated cardboard are introducing innovations in sustainability, and one of the primary features of this development is the production of packaging from entirely recyclable materials in the personal care and household packaging segments.

- According to the General Authority for Statistics (Saudi Arabia), the industry revenue of paper and paper products was USD 5.48 billion in 2023. Thus, the paper and paperboard market in Saudi Arabia is expected to witness significant growth owing to rising demand and changing consumer preferences, particularly in the food and beverage industry. A growing number of online food delivery apps and fast-food restaurants, along with the growth of the e-commerce market, are benefiting from paper-based packaging.

Middle East And Africa Pulp And Paper Industry Overview

The pulp and paper market in the Middle East and Africa is fragmented, with major players like International Paper Company, Smurfit Kappa, Lions Gate Paper & Pulp, and Billerud. The significant factors governing this market are a sustainable competitive advantage through innovation, levels of market penetration, barriers to exit, power of competitive strategy, and firm concentration ratio.

In July 2023, Smurfit Kappa, Europe's most extensive paper and packaging company, planned to open its first-ever North African site in Morocco, paving the way for growth in a rapidly developing market for consumer goods. The company invested over EUR 35 million (USD 38.49 million) in the 25,000 sq. m facility.

In May 2023, Billerud launched a renewable, recyclable, and biodegradable wrapping solution for toilet and kitchen rolls. Billerud presented a machine-glazed kraft paper, which was specially adapted and validated for wrapping toilet and kitchen paper rolls.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Consumer Demand for Packaged and Fresh Food

- 5.2 Market Challenges

- 5.2.1 Increasing Costs of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Grade

- 6.1.1 Bleached Chemical Pulp (BCP)

- 6.1.2 Dissolving Wood Pulp (DWP)

- 6.1.3 Unbleached Kraft Pulp

- 6.1.4 Mechanical Pulp

- 6.2 By Application

- 6.2.1 Printing and Writing

- 6.2.2 Newsprint

- 6.2.3 Tissue

- 6.2.4 Cartonboard

- 6.2.5 Containerboard

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Iran

- 6.3.4 Israel

- 6.3.5 Jordan

- 6.3.6 Bahrain

- 6.3.7 Kuwait

- 6.3.8 Egypt

- 6.3.9 Tunisia

- 6.3.10 Morocco

- 6.3.11 Algeria

- 6.3.12 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 WestRock Company

- 7.1.2 International Paper Company

- 7.1.3 Lions Gate Paper & Pulp

- 7.1.4 Sappi

- 7.1.5 Billerud

- 7.1.6 Stora Enso OYJ

- 7.1.7 Mondi PLC

- 7.1.8 Oji Holdings Corporation

- 7.1.9 Resolute Forest Products

- 7.1.10 Svenska Cellulosa AB SCA

- 7.1.11 Smurfit Kappa