|

市场调查报告书

商品编码

1690782

许可证管理:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)License Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

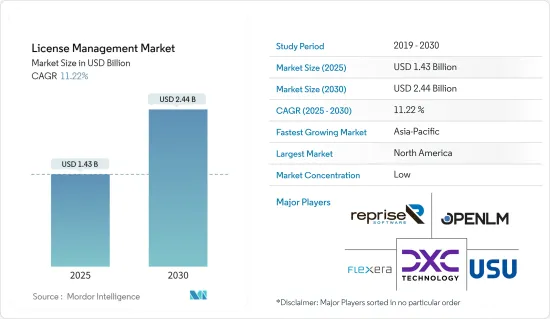

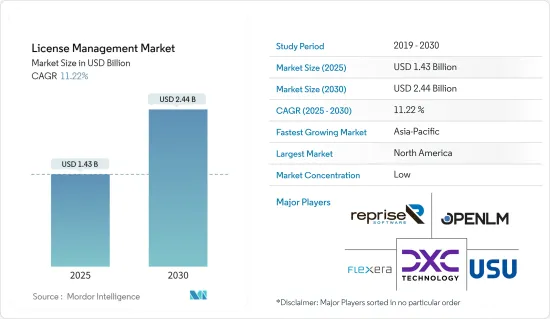

许可证管理市场规模预计在 2025 年为 14.3 亿美元,预计到 2030 年将达到 24.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.22%。

推动市场成长的关键因素包括增加对IT基础设施的投资以及企业快速采用数位化。此外,云端技术的进步,加上对管理单一授权的工具日益增长的需求,有望帮助优化软体投资。这些工具旨在降低成本、提高整个企业的软体采用率并确保开发人员遵守授权条款。

市场正在显着增长,其推动因素包括数位工具和平台的采用日益增多、有效满足跨行业合规性的需求日益增长、以及最大化软体支出的需求日益增长。

此外,公司正在重新平衡其技术投资。这项调整将包括优化软体投资、合理化技术平台、进行全面的软体供应商合约审查以及确定最有利的软体授权模式等行动。在这些情况下,许可证管理解决方案和服务至关重要,它们提供关键的见解和建议以缓解过渡。

无论规模大小,组织都越来越重视其 IT 服务和应用程式的管理。因此,企业正在大力投资升级其IT基础设施基础设施,并基于增强的功能和性能放弃旧有系统。

随着新技术的日益涌现,企业了解软体使用情况至关重要。管理软体许可证一直是一个挑战,但在当今技术主导的环境中,它变得更加复杂。因此,组织必须优先透过消除重复许可、避免过度许可和确保平衡支出来降低成本。这些发展对许可证管理解决方案的需求也更大。

监管不确定性是市场成长研究的一个主要限制因素。缺乏统一的全球标准和不同地区不断变化的法规对试图在不同市场部署有效许可证管理解决方案的公司构成了挑战。

自疫情爆发以来,各行各业的企业都加大了对数位转型的关注,大量采用数位化平台和工具。随着企业踏上数位转型之旅,它们正在不断扩大和多样化其软体产品组合。不断扩大的数位足迹推动了对强大的许可证管理解决方案的需求,从而推动企业更有效率、更经济地业务。

许可证管理市场趋势

预计软体组件部分将占据相当大的市场占有率。

- 由于企业对有效管理软体资产的需求不断增加,预计软体元件领域将显着成长。该部门专注于帮助公司遵守许可协议、控製成本、优化软体使用以及避免因不遵守许可而受到处罚的解决方案。云端服务、基于订阅的授权以及软体使用日益复杂等新兴趋势正在推动以软体为中心的授权管理解决方案的需求。

- 各行各业的组织都在不断实现业务自动化并采用先进的软体工具。例如,商业服务公司创新集团 (The Innovation Group) 2023 年的一项调查发现,近 50% 的经理人表示他们的公司正处于数位转型之中。此外,约有27%的受访者表示他们已经完成转型。值得注意的是,只有 5% 的公司表示尚未开始数位转型且没有计划这样做。

- 随着自动化变得越来越普遍,对软体授权的需求正在激增,管理也变得越来越复杂。自动化许可证管理工具可有效追踪软体资产并确保最佳利用率。随着公司扩大其软体组合,手动许可证管理成为一项挑战。实施自动化可以帮助您简化软体使用、优化成本并消除浪费。

- 由于软体供应商频繁进行许可证审核,公司受到越来越严格的审查。这种合规驱动正在刺激对强大许可证管理系统的需求,以避免因不当使用软体而受到处罚。公司正在积极寻求解决方案,以确保做好审核准备并避免意外的财务处罚。

- 随着违规的增加和审核的日益频繁,简化这些流程、降低财务风险和营运负担的软体的价值变得显而易见。

- 云端运算彻底改变了软体许可。例如,Flexera Software 报告称,到 2024 年,80% 的企业将依赖 Microsoft Azure 满足其公共云端需求。 AWS、Microsoft Azure 和 Google Cloud 等超大规模公司引领云端运算领域。

亚太地区可望实现显着成长

- 实施软体许可证优化最佳实践可以显着减少可能导致利用率不足、过度利用、许可证违规或昂贵的供应商处罚的搁置软体,从而为您的组织节省大约 25% 的软体开支。同时,企业软体供应商和智慧型装置製造商因未能实施灵活的许可方式而损失了利润。亚太地区的企业和应用程式製造商越来越意识到应用程式使用管理可以提供的巨大竞争优势。

- 中国政府依据《中华人民共和国对外贸易法》、《中华人民共和国技术进出口管理条例》等相关法律法规,对限制出口和禁止出口的技术实施全面的管制措施。对商业企业从事对外技术贸易的管制技术目录和管理方法也由商务部製定,并实施许可管理。

- 在印度,《2023-24年经济调查》强调需要放宽微型、小型和中型企业(MSMEs)的授权、检查和合规要求。城市发展管理和监管合规改革可以显着改善商业环境并释放经济成长。

- 在新加坡,2024年7月,新加坡金融管理局(MAS)发布了《付款服务提供者许可指南》[PS-G01](《指南》)的更新版本,该指南于2024年8月生效。修订后的指南旨在澄清、简化和加强新加坡2019年《付款服务法》(PS法)下付款服务供应商的许可流程。预计这将促进 BFSI 领域的市场需求。

- 许多全球公司正逐步投资亚太地区作为其研发基地。例如,总部位于美国的 Flexera Software 继续在亚太地区实施其多年扩张计划,为其提供成长空间。 Flexera 向亚太地区云端的扩张将使在澳新银行和亚太地区有供应商关係的企业能够充分利用 Flexera 提供的所有服务,同时满足其特定的管治和主权要求。

- 此外,根据 Flexera Software 的数据,价值 164 亿美元的受威胁非正版软体大部分位于亚太地区。根据多项研究,亚太地区(特别是印度、越南、印尼和中国等国家)在使用非正版软体方面处于领先地位。非正版软体的商业性价值不断上升。

许可证管理行业概览

许可证管理市场由许多提供许可证管理软体和服务的国内外公司主导,包括 USU Software AG、DXC Technology Co.、Flexera Software LLC、Oracle Corporation、Thales Group 和 ServiceNow Inc. 各公司都与其他公司伙伴关係开发和推出该市场的领先解决方案。这导致了大量投资并加剧了市场竞争。

企业正在开发先进技术以获得竞争优势、保持市场竞争力并留住客户,这加剧了市场竞争。软体产品和功能的不断创新为供应商提供了差异化优势,并加剧了竞争对手之间的竞争。

总体而言,在所研究的市场中,竞争公司之间的竞争强度很高,预计在预测期内将保持不变。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 软体投资优化需求日益增加

- 组织内部审核准备要求不断提高

- 市场限制

- 监管标准和框架不明确

- 市场机会

第六章 市场细分

- 按组件

- 软体

- 按服务

- 按部署

- 本地

- 云

- 按用途(定性趋势分析)

- 审核服务

- 咨询服务

- 合规管理

- 许可证授权和优化

- 操作与分析

- 其他应用

- 按最终用户

- BFSI

- 医疗保健和生命科学

- 资讯科技/通讯

- 媒体与娱乐

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- USU Software AG

- OpenLM Ltd

- DXC Technology Co.

- Flexera Software LLC

- Reprise Software Inc.

- License Dashboard

- Oracle Corporation

- Quest Software Inc.

- Thales Group

- ServiceNow Inc.

第八章投资分析

第九章:市场的未来

The License Management Market size is estimated at USD 1.43 billion in 2025, and is expected to reach USD 2.44 billion by 2030, at a CAGR of 11.22% during the forecast period (2025-2030).

Key drivers fueling market growth include heightened investments in IT infrastructure and rapid digitalization adoption across businesses. Furthermore, advancements in cloud technology, coupled with surging demand for tools that manage single licenses, promise to optimize software investments. These tools aim to cut costs, boost software usage across the company, and ensure compliance with the developer's licensing terms.

The market is registering significant growth, led by several factors, including the rising adoption of digital tools and platforms, the growing need to meet compliance across industry verticals efficiently, and the rising need to maximize software expenditures.

Furthermore, businesses are recalibrating their technological investments. This realignment includes actions like optimizing software investments, streamlining technology platforms, conducting comprehensive software vendor contract reviews, and pinpointing the most beneficial software licensing models. In this context, license management solutions and services are crucial, offering vital insights and recommendations to ease the transition.

Organizations, both large and small, are increasingly prioritizing the management of IT services and applications for both immediate and future strategic decisions. As a result, enterprises heavily invest in upgrading their IT infrastructure, moving away from legacy systems based on enhanced features and capabilities.

In a landscape where new technologies emerge almost daily, it's crucial for organizations to stay informed about their software usage. While managing software licenses has always posed challenges, the complexities have intensified in today's tech-driven environment. Therefore, organizations must prioritize cost savings by eliminating duplicate licenses, avoiding over-licensing, and ensuring balanced spending. Such developments are further driving the demand for license management solutions.

Regulatory uncertainty is a significant constraint on the market's growth studied. The absence of uniform global standards and shifting regional regulations pose challenges for companies striving to deploy effective license management solutions in diverse markets.

Post-pandemic, businesses across industries increased focus on digital transformation, resulting in substantial adoption of digital platforms and tools. As enterprises embark on digital transformation journeys, they increasingly expand and diversify their software portfolios. With this growing digital footprint, the need for robust license management solutions intensifies, steering organizations toward more efficient and cost-effective operations.

License Management Market Trends

Software Component Segment is Expected to Hold Significant Market Share

- The software component segment is expected to record significant growth, driven by the rising need for companies to manage their software assets efficiently. This segment centers on solutions that assist businesses in adhering to licensing agreements, controlling costs, optimizing software utilization, and steering clear of penalties for license violations. The growing trend towards cloud services, subscription-based licensing, and the escalating complexity of software usage have further fueled the demand for software-centric license management solutions.

- Across diverse industries, organizations are increasingly automating operations and embracing advanced software tools. For example, a 2023 survey by The Innovation Group, a business services company, revealed that nearly 50% of managers reported that their companies were in the midst of a digital transformation. In addition, about 27% stated that they had already completed the transformation. Notably, only 5% of companies indicated that they neither started nor planned to pursue digital transformation.

- As automation becomes more prevalent, the demand for software licenses surges, complicating their management. Automated license management tools empower businesses to efficiently track software assets efficiently, ensuring optimal utilization. With enterprises broadening their software portfolios, manual license management becomes a challenge. Embracing automation streamlines software usage optimizes costs, and curbs wastage.

- Frequent license audits by software vendors have heightened scrutiny on companies. This push for compliance, to sidestep penalties from improper software use, has spurred demand for robust license management systems. Enterprises are actively pursuing solutions that guarantee audit readiness, helping them dodge unforeseen financial penalties.

- As the costs of non-compliance escalate and audits grow more frequent, the value of software that streamlines these processes becomes evident, alleviating both financial risks and operational burdens.

- Cloud computing has revolutionized software licensing. For example, Flexera Software reports that in 2024, 80% of enterprises are turning to Microsoft Azure for their public cloud needs. Hyperscalers, such as AWS, Microsoft Azure, and Google Cloud, are leading the charge in global cloud computing.

Asia Pacific Expected to Witness Significant Growth

- Implementing software license optimization best practices saves enterprises around 25% of their software spend by drastically reducing the license under-use, over-use-license non-compliance, or shelfware, resulting in costly vendor penalties. At the same time, enterprise software vendors and intelligent device manufacturers are leaving money on the table by failing to implement flexible licensing. APAC enterprises and application producers increasingly understand the major competitive advantages that application usage management can deliver.

- The Chinese government implements comprehensive control measures for technologies restricted or prohibited from export, following the relevant statutes of the Foreign Trade Law of the People's Republic of China and the Regulations on Administration of Technology Import and Export of the People's Republic of China. It employs licensing management for commercial enterprises engaged in technology trade with foreign parties by formulating corresponding controlled technology catalogs and control measures.

- In India, the 2023-24 Economic Survey underscored the need for easing licensing, inspection, and compliance requirements for micro, small and medium enterprises (MSMEs). Urban development management and regulatory compliance reforms can significantly improve the business environment and unleash economic growth.

- In Singapore, in July 2024, the Monetary Authority of Singapore (MAS) published updates to its Guidelines on Licensing for Payment Service Providers [PS-G01] (the Guidelines), which took effect in August 2024. The revisions to the Guidelines are intended to improve clarity, streamline application reviews, and enhance the licensing process for payment service providers under the Payment Services Act 2019 of Singapore (the PS Act). This is expected to increase the market demand in the BFSI sector.

- Many global companies are gradually investing in Asia-Pacific as an R&D hub. For instance, US-based Flexera Software continued expansion in APAC, providing room to grow as it continues its multi-year expansion plan in the APAC region. Flexera's presence in the APAC cloud will allow organizations with vendor relationships in ANZ (Australia and New Zealand) and APAC to take full advantage of all the Flexera offers while satisfying specific governance and sovereignty requirements.

- Furthermore, as per Flexera Software, most unlicensed software, with a stunning economic worth of USD 16.4 billion, is based in Asia-Pacific. As per various studies, the Asian-Pacific region (especially countries such as India, Vietnam, Indonesia, and China) is at the top in unlicensed software use. The commercial value of unlicensed software has been rising continuously.

License Management Industry Overview

The license management market comprises many local and international players like USU Software AG, DXC Technology Co., Flexera Software LLC, Oracle Corporation, Thales Group, and ServiceNow Inc., which offer license management software and services. Companies are forming partnerships with others to develop and launch advanced solutions in the market. As such, considerable investments are being recorded in the market, increasing competition.

Companies are developing advanced technologies to gain a competitive edge, remain competitive in the market, and retain their clients, thereby intensifying the rivalry in the market. Continuous innovation in software offerings and functionalities creates a differentiating advantage for the vendors and increases competitive rivalry.

Overall, the intensity of the competitive rivalry is high in the market studied and is expected to be the same over the forecasted period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand to Optimize Software Investments

- 5.1.2 Growing Requirement for Audit-readiness among Organizations

- 5.2 Market Restraints

- 5.2.1 Uncertain Regulatory Standards and Frameworks

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Application (Qualitative Trend Analysis)

- 6.3.1 Audit Services

- 6.3.2 Advisory Services

- 6.3.3 Compliance Management

- 6.3.4 License Entitlement and Optimization

- 6.3.5 Operations and Analytics

- 6.3.6 Other Applications

- 6.4 By End User

- 6.4.1 BFSI

- 6.4.2 Healthcare and Life Sciences

- 6.4.3 IT and Telecommunication

- 6.4.4 Media and Entertainment

- 6.4.5 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 USU Software AG

- 7.1.2 OpenLM Ltd

- 7.1.3 DXC Technology Co.

- 7.1.4 Flexera Software LLC

- 7.1.5 Reprise Software Inc.

- 7.1.6 License Dashboard

- 7.1.7 Oracle Corporation

- 7.1.8 Quest Software Inc.

- 7.1.9 Thales Group

- 7.1.10 ServiceNow Inc.