|

市场调查报告书

商品编码

1690785

中国资料中心:市场占有率分析、产业趋势与统计、成长预测(2025-2030)China Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

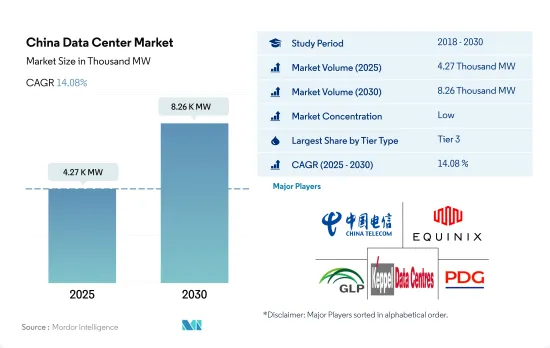

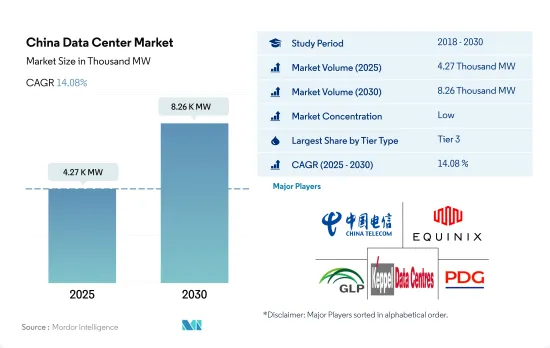

预计2025年中国资料中心市场规模将达到4,270kW,2030年将达到8,260kW,复合年增长率为14.08%。

预计主机託管收益在 2025 年将达到 40.117 亿美元,在 2030 年将达到 97.066 亿美元,预测期内(2025-2030 年)的复合年增长率为 19.33%。

到 2023 年, 层级 3资料中心将占据大部分市场份额,而层级 4 资料中心将成为成长最快的细分市场

- 3层级资料中心因具有现场协助、电力和冷却冗余等特点而最受欢迎。预计该部分将从 2022 年的 1,115.1 兆瓦成长到 2029 年的 1,874 兆瓦,复合年增长率为 5.7%。这些资料中心主要用于储存和处理关键业务资料,以满足不断增长的业务和可扩展性需求。全国约有 110 个层级 3资料中心,另有 37 个层级 3 规格资料中心正在建置中。

- 层级 4资料中心因其效能、较少的停机时间和 99.99% 的执行时间而成为大型企业的下一个选择。虽然这些资料中心的成本相对较高,但它们提供的效能超出了其价格,并支援大型企业的竞争和成长需求。 2022 年,普林斯顿数位集团和 SpaceDC Pte Ltd. 拥有 7 个层级 4资料中心。

- 由于停机时间长、电力和冷却冗余、现场远端援助等原因,第 1层级和第 2 层资料中心最不受欢迎。这些资料中心比第 3层级和层级4 层资料中心相对便宜,因此受到中小型企业和新兴企业的青睐。层级和层级资料中心最不受青睐,因此在预测期内可能会经历缓慢的成长。

中国资料中心市场趋势

华为、苹果、小米、Oppo 和 Vivo 正在推出价格实惠且具有高端功能的智慧型手机,吸引消费者购买。

- 2022年中国智慧型手机用户数将达到9.5亿,预计预测期末(2023-2029年)将达到18亿,复合年增长率为10.2%。 4G和5G在全国范围内的推广改善了行动通讯,使智慧型手机成为人们的基本必需品。

- 中国智慧型手机公司正在提供具有高端功能且价格实惠的智慧型手机,这导致该国智慧型手机用户数量增加。大约有50%的用户每12到18个月更换行动电话,因此各公司也常行动电话进行创新。目前,市场的主要企业是华为、苹果、小米、Oppo 和 Vivo。

- 智慧型手机用户的成长对国内资料中心市场的成长产生了正面影响。在研究期间,智慧型手机用户数量增加了五倍,资料中心机架数量从 2017 年的约 7 万个增加到 2021 年的 28 万个。预计这一趋势将在预测期内持续下去。

中国政府的「宽频中国」策略和日益增长的光纤连接将推动国内资料中心的发展

- 中国政府的「宽频中国战略」于2013年制定,并于2015年正式实施。根据该策略,到2021年,都市区住宅宽频网速将达到100Mbps,农村地区宽频网速将达到20Mbps。同时,商业和工业宽频网速将从2015年的平均100Mbps提升至2021年的1Gbps。随着光纤连接的进一步扩展,预计未来几年平均网路速度将大幅提升。

- 为了实现高速资料通讯,中国市场光纤电缆安装的长度正在逐年增加。 2017年至2022年期间,该国光纤电缆网路部署的复合年增长率为8.5%。光纤电缆的部署促进了该国最后一英里互联网的连接。这些电缆提供更好的连接性和更高的频宽,因此大多数企业已用传统的铜缆取代它们,以提供更好和升级的服务。

- 稳定的宽频速度(主要透过光纤电缆)对于资料中心的扩展和与其他资料中心和互联网交换中心(IX)的通讯至关重要。公司将关键业务资料储存在云端、主机託管或本地的情况变得越来越普遍。在这些储存库中,不同的伺服器为客户提供不同的服务。随着通讯点数量的不断增加,保持尽可能快的通讯非常重要。因此,预计中国各地强大的宽频连线将有助于资料中心在预测期内保持 100% 的执行时间。

中国资料中心产业概况

中国资料中心市场较为分散,前五大企业占比为17.92%。该市场的主要企业包括中国电信股份有限公司、Equinix Inc.、GLP Pte Limited 和 Keppel DC REIT Management Pte。 Ltd 和普林斯顿数位集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装的机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的资料流量

- 行动资料速度

- 宽频资料速度

- 光纤连接网路

- 法律规范

- 中国

- 价值炼和通路分析

第六章市场区隔

- 热点

- 北京

- 粤

- 河北省

- 江苏

- 上海

- 其他中东和非洲地区

- 资料中心规模

- 大规模

- 超大规模

- 中等规模

- 超大规模

- 小规模

- 层级类型

- 1层级和2级

- 层级

- 层级

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他的

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介.

- BDx Data Center Pte. Ltd

- Chayora Ltd

- China Telecom Corporation Ltd

- Chindata Group Holdings Ltd

- Equinix Inc.

- GDS Service Co. Ltd

- GLP Pte Limited

- Keppel DC REIT Management Pte. Ltd

- Princeton Digital Group

- Space DC Pte Ltd

- Telehouse(KDDI Corporation)

- Zenlayer Inc.

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模与DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

The China Data Center Market size is estimated at 4.27 thousand MW in 2025, and is expected to reach 8.26 thousand MW by 2030, growing at a CAGR of 14.08%. Further, the market is expected to generate colocation revenue of USD 4,011.7 Million in 2025 and is projected to reach USD 9,706.6 Million by 2030, growing at a CAGR of 19.33% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, Tier 4 is fastest growing segment

- Tier 3 data centers are the most preferred due to features such as on-site assistance, power, and cooling redundancy. The segment is expected to grow from 1,115.1 MW in 2022 to 1,874 MW by 2029 at a CAGR of 5.7%. These data centers are mainly chosen by companies for storing and processing business-critical data to cater to their growing business and scalability needs. There are around 110 Tier 3 data centers in the country, and around 37 upcoming data centers are under construction with Tier 3 specifications.

- Tier 4 data centers are the next most preferred by large businesses due to their performance, lower downtime, and 99.99% uptime. These data centers are relatively costly; however, the performance offered by them outweighs the price and supports the competitive and growing needs of large businesses. In 2022, the country had seven Tier 4 data centers owned by Princeton Digital Group and SpaceDC Pte Ltd.

- Tier 1 & 2 data centers are the least preferred due to their higher downtime durations, power and cooling redundancies, and on-site remote assistance. Since these data centers are relatively cheap compared to Tier 3 and Tier 4, small businesses and startup companies prefer them. Since Tier 1 & 2 data centers are the least preferred, stagnant growth could be seen during the forecast period.

China Data Center Market Trends

Huawei, Apple, Xiaomi, Oppo, and Vivo offer cheap smartphones with high end features which attracts consumers to spend more these products creating a hige demand in smartphones in the country

- The number of Chinese smartphone users was 950 million in 2022, and the figure is expected to reach 1.8 billion by the end of the forecast period (2023-2029), registering a CAGR of 10.2%. The spread of 4G and 5G connectivity across the country has improved mobile communication, making smartphones a basic necessity for people.

- Chinese smartphone companies are offering affordable smartphones with high-end features, leading to an increase in smartphone users in the country. Around 50% of users replace their phones every 12-18 months, making companies innovate their phones frequently. Currently, the major market players are Huawei, Apple, Xiaomi, Oppo, and Vivo.

- This increase in smartphone users has positively impacted the growth of the data center market in the country. During the study period, when the number of smartphone users increased fivefold, the number of racks in data centers increased from around 70k in 2017 to 280k in 2021. This trend is expected to be witnessed during the forecast period as well.

Chinese government's "Broadband China Strategy coupled with increased fiber connectivity, boost the data centers in the country

- The Chinese government's "Broadband China Strategy," drafted in 2013 and implemented in 2015, is accredited for spreading broadband connectivity across the country, primarily in remote locations. In 2021, under this strategy, the broadband speed reached 100 Mbps for residential use in cities and 20 Mbps in rural regions. On the other hand, the broadband speed for commercial/industrial use increased from an average speed of 100 Mbps in 2015 to 1 Gbps in 2021. With further expansion of the fiber connectivity network, average speeds are estimated to rise significantly in the coming years.

- In order to provide high data speeds, the Chinese market increased the distance of laying fiber optic cables over the years. The deployment of optic fiber cable networks in the country registered a CAGR of 8.5% during 2017-2022. The deployment of fiber optic cables spurred last-mile internet connectivity in the country. As these cables offer better connectivity and higher bandwidths, most companies replaced them with traditional copper cables to offer better and upgraded services.

- Stable broadband speed, predominantly via fiber cables, is crucial for the expansion of data centers and their communication with other data centers and internet exchanges (IX). It has become common for companies to store their business's critical data in the cloud, colocation, and in-house. Within these storage locations, various services are provided to their customers across different servers. With the increase in the number of points of communication, it becomes critical to keep communication as fast as possible. Therefore, strong broadband connectivity across the country is expected to support the data centers to maintain 100% uptime during the forecast period.

China Data Center Industry Overview

The China Data Center Market is fragmented, with the top five companies occupying 17.92%. The major players in this market are China Telecom Corporation Ltd, Equinix Inc., GLP Pte Limited, Keppel DC REIT Management Pte. Ltd and Princeton Digital Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 China

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Beijing

- 6.1.2 Guangdong

- 6.1.3 Hebei

- 6.1.4 Jiangsu

- 6.1.5 Shanghai

- 6.1.6 Rest of China

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 BDx Data Center Pte. Ltd

- 7.3.2 Chayora Ltd

- 7.3.3 China Telecom Corporation Ltd

- 7.3.4 Chindata Group Holdings Ltd

- 7.3.5 Equinix Inc.

- 7.3.6 GDS Service Co. Ltd

- 7.3.7 GLP Pte Limited

- 7.3.8 Keppel DC REIT Management Pte. Ltd

- 7.3.9 Princeton Digital Group

- 7.3.10 Space DC Pte Ltd

- 7.3.11 Telehouse (KDDI Corporation)

- 7.3.12 Zenlayer Inc.

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms