|

市场调查报告书

商品编码

1690786

欧洲楼宇自动化系统:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Building Automation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

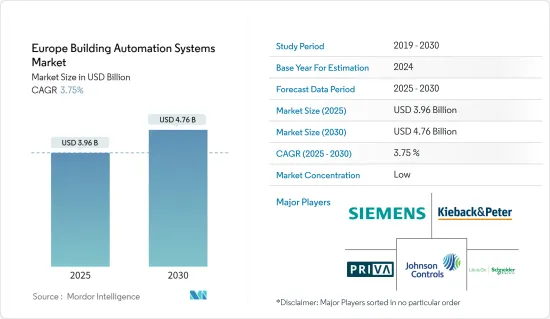

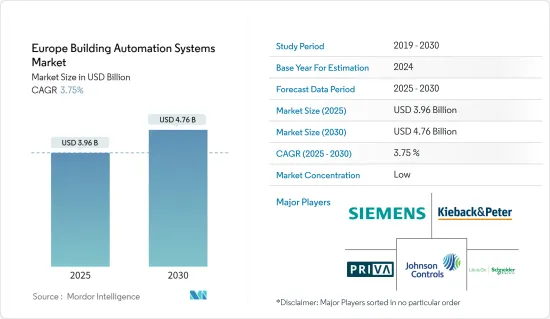

欧洲楼宇自动化系统市场规模预计在 2025 年为 39.6 亿美元,预计到 2030 年将达到 47.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.75%。

关键亮点

- 大楼自动化系统(BAS),又称楼宇控制系统或楼宇管理系统,控制建筑物内的各种电气、电子和机械系统。这包括楼宇管理系统、暖通空调控制、照明控制、火灾侦测、安全系统等。系统范围涵盖商业和住宅终端用户。建筑业对于帮助欧盟实现其能源和环境目标至关重要。建造更多节能建筑可以提高居民的生活水准,减少能源贫困,并透过创造环保就业机会为经济和社会做出贡献。此外,它还能改善室内空气质量,从而带来更好的整体健康益处。

- 欧洲对物联网产品的需求正在成长。德国、英国和荷兰在该地区引领物联网应用,紧随其后的是东欧和北欧。製造业、住宅、医疗保健和金融业处于物联网应用的前沿,而零售业和农业也正在取得长足进展。由于合格专业人员的短缺和外包需求的不断增长,外包需求持续存在。楼宇自动化系统 (BAS) 技术已取得显着进步,并持续改进新功能。然而,由于对大楼自动化系统缺乏信任,许多楼宇管理人员仍然手动操作 HVAC 系统。不幸的是,在许多配备了功能齐全的大楼自动化系统的建筑物中,由于缺乏了解或安装人员没有设置大楼自动化系统,建筑物管理人员仍然手动操作设备。

- 法国、英国和德国等国家对大楼自动化系统的需求庞大,这主要是由于城市人口的增加,这对市场成长做出了重大贡献。在法国,2023年总人口将超过6,800万人。自 21 世纪初以来,该国人口一直在增加。同年,法国法兰西岛区成为法国人口最多的地区。根据法国国家统计局 (INSEE) 的数据,超过 1,200 万法国公民居住在法国法兰西岛地区。紧接在法兰西岛之后的是奥弗涅-罗纳-阿尔卑斯大区和新阿基坦南部区。

- 此外,欧洲各地的住宅正在兴起,为未来几年的大楼自动化系统创造了新的市场机会。根据荷兰中央统计局的数据,自 2000 年以来,荷兰每年新建住宅数量在 44,000 至 86,000 套之间,与 20 世纪 70 年代相比,总体建设活动有所下降,当时荷兰每年新建住宅数量在 77,000 至 143,000 套之间。预计2023年竣工的住宅数量约为79,000套。

欧洲大楼自动化系统市场趋势

商业领域预计将成为最大的终端用户

- 商业部门包括办公室、医院、零售和基础设施。各种技术的进步、物联网 (IoT)、机器学习 (ML)、人工智慧 (AI) 的快速应用、智慧感测器和技术与商业建筑中的各种终端应用、电器、设备、产品和设备的整合是预计将支援未来市场收益成长的关键因素。

- 根据欧洲建筑性能研究所 (BPIE) 的说法,如果安装、试运行和操作正确,楼宇自动化在所有商业建筑中都是具有成本效益的,无论能源价格、使用或气候因素如何。据该组织称,每个装置的平均净节能效果约为暖气、热水、冷气和通风的 37%,照明方面的 25%。

- 此外,欧洲已法规要求所有大型非住宅建筑到2025年必须配备核心建筑自动化功能。这些法规也对该领域的市场需求产生了正面影响。此外,人们对商业建筑安全日益增长的担忧也是市场的一个驱动因素。大楼自动化系统透过控制特定区域的存取和监控活动来帮助提高商业建筑的安全性。这些系统还可以透过侦测火灾和其他紧急情况来帮助提高安全性。

- 商用房地产市场的价值正在成长,进一步推动了这个领域和市场的发展。例如,根据EPRA的预测,到2023年,德国、英国和法国将成为欧洲最大的商用房地产市场,占欧洲市场总量的近一半。在德国,商用房地产市场价值约为1.9兆美元。

- 此外,新兴欧洲国家零售店数量的增加预计将推动市场成长。例如,根据 Retail-Index 的数据,截至 2023 年 2 月,时尚和服饰在捷克共和国的零售连锁店数量方面处于领先地位,拥有 38 家连锁店,其次是体育和休閒,拥有 29 家连锁店。个人护理、鞋类和皮革均位居第三,共有 20 家连锁店,而婴儿用品连锁店数量最少,仅有 4 家。

德国占很大份额

- 政府加大对节能产品的投入预计将推动该国市场的发展。例如,2020年8月13日,《建筑能源法》修正案在《联邦公报》上公布。联邦内政部和社区部以及联邦经济和能源部提案了《建筑能源法》,该法案已由联邦政府提交。 2020年6月18日,德国联邦议院核准了《建筑能源法》。联盟协议中概述的措施、2018 年住宅高峰会上做出的决定以及 2030 年气候行动计画都将透过规范建筑物能源效率的《建筑能源法》来实施。

- 根据德国联邦统计局统计,截至2023年3月,德国获准建造24,500住宅。此类建筑许可证允许国内外建筑自动化公司根据客户需求开发新产品并占领市场占有率。

- 此外,由于基础设施的改善和对环保建筑的需求增加,德国市场正在大幅成长。据经合组织称,德国的目标是到2050年将再生能源的比例从17%提高到80%以上,同时逐步淘汰核能发电厂的发电。温室气体排放已减少40%,预计2050年将减少至少80%。

- 据报道,这些系统的优势正在推动对智慧建筑控制的需求。值得注意的是,疫情导致建筑管理方法和解决方案发生重大变化,新方法正在迅速被采用。

- 此外,建设活动的增加和可支配收入的提高导致全国广大消费者越来越多地采用大楼自动化系统。根据德国联邦统计局的数据,到 2025 年,德国住宅和非住宅建筑收益预计将达到约 890.1 亿美元。

- 政府也致力于投资建筑业以促进国家的发展。例如,2023年9月,联邦政府宣布在房地产危机期间向建筑业投资450亿欧元(约481.3亿美元)。为了解决住宅短缺问题,柏林承诺在 2027 年将投入 180 亿欧元(192.5 亿美元)用于经济适用住宅开发,同时也将从州和联邦政府获得额外资金。

欧洲大楼自动化系统产业概况

由于有许多主要供应商,欧洲大楼自动化系统市场呈现细分化。主要供应商包括西门子股份公司、江森自控国际有限公司、Kieback&Peter GmbH & Co.KG、Priva Holding BV 和施耐德电气 SE。市场参与企业正在采取伙伴关係和收购等策略来加强其产品供应并获得可持续的竞争优势。

2024 年 3 月:海康威视宣布与欧洲商业建筑和住宅自动化解决方案提供商 Can'nX 建立技术合作伙伴关係。此次合作将使海康威视的技术融入家庭和建筑自动化的全球标准 KNX通讯协定中。透过将海康威视的人工智慧设备(例如摄影机)整合到建筑系统中,整合商可以增强其建筑自动化解决方案,提高楼宇管理效率并改善整体安全性。

2022年1月:霍尼韦尔宣布推出楼宇先进控制。该建筑管理系统利用建筑物现有的电线,使建筑管理人员能够更好地控制性能,有助于改善用户体验,同时推动能源管理目标。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章市场动态

- 市场驱动因素

- 加强能源和业务效率的措施和要求

- 物联网在欧洲国家快速发展

- 市场限制

- 缺乏技术一致性,采购实施成本高

第六章市场区隔

- 按组件

- 硬体

- 控制器

- 现场设备

- 软体即服务

- 硬体

- 按最终用户

- 住宅

- 商业的

- 工业的

- 按国家

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 比利时

- 瑞典

- 芬兰

- 丹麦

第七章竞争格局

- 公司简介

- Siemens AG

- Johnson Controls International PLC

- Kieback& Peter GmbH & Co. KG

- Priva Holding BV

- Schneider Electric SE

- Robert Bosch GmbH

- Trane Technologies PLC

- Lynxspring Inc.

- Belimo Holding AG

- Sauter AG

8.供应商市场占有率分析

第九章投资分析

第十章:投资分析市场的未来

The Europe Building Automation Systems Market size is estimated at USD 3.96 billion in 2025, and is expected to reach USD 4.76 billion by 2030, at a CAGR of 3.75% during the forecast period (2025-2030).

Key Highlights

- A building automation system (BAS), also known as a building control or building management system, controls various electric, electronic, and mechanical systems within a building. This includes building management systems, HVAC controls, lighting controls, fire detection, and security systems. The scope of the system encompasses end users in both commercial and residential settings. The construction industry is crucial in helping the EU achieve its energy and environmental goals. Constructing more energy-efficient buildings will improve residents' living standards, reduce energy poverty, and contribute to the economy and society by creating green jobs. Additionally, it will lead to better indoor air quality and overall health benefits.

- The demand for IoT products is increasing in Europe. Germany, the United Kingdom, and the Netherlands lead the region's IoT adoption, followed closely by Eastern Europe and the Nordics. While the manufacturing, housing, health, and finance industries are at the forefront of IoT adoption, the retail and agricultural industries are also making significant progress. The demand for outsourcing continues due to a shortage of qualified specialists and a growing willingness to outsource. The technology for building automation systems (BAS) has advanced significantly and is constantly improving with new capabilities. However, many building managers still manually operate HVAC systems because they lack confidence in the building automation system. Unfortunately, many buildings with fully functional building automation systems run their equipment manually by building operators due to a lack of understanding or the installation contractors not configuring the building automation system.

- Countries such as France, the United Kingdom, and Germany contribute considerably to the market growth, primarily due to the increase in urban population, which generates significant demand for building automation systems. In France, in 2023, the total population was over 68 million. The population in the nation increased since the mid-2000s. The Ile-de-France was the most populous region in France in the same year. INSEE said more than 12 million French citizens lived in the Ile-de-France region. Ile-de-France was followed by Auvergne-Rhone-Alpes and Nouvelle-Aquitaine region in the Southern part of the country.

- Moreover, the growing residential construction across Europe will create new market opportunities for the building automation system in the coming years. According to Centraal Bureau voor de Statistiek, since 2000, the Netherlands has added between 44,000 and 86,000 new houses per year to the housing stock, showing an overall slower construction activity than in the 1970s, when the annual number of new homes added ranged between 77,000 and 143,000. In 2023, the number of home completions amounted to approximately 79,000.

Europe Building Automation Systems Market Trends

The Commercial Segment is Expected to be the Largest End User

- The commercial segment includes offices, hospitals, retail space, and infrastructure. Advancements in various technologies and the rapid increase in traction of the Internet of Things (IoT), the integration of machine learning (ML), artificial intelligence (AI), and smart sensors and technologies in various end uses and appliances, devices, and products and appliances in commercial buildings are key factors expected to continue to support revenue growth in the market.

- As per the Buildings Performance Institute Europe (BPIE), building automation is cost-effective for all commercial buildings, regardless of energy prices, usage, and climatic factors, provided it is correctly installed, commissioned, and operated. According to the organization, the average net energy savings per installation are about 37% for space heating, water heating, cooling, and ventilation, and 25% for lighting.

- Further, a regulatory decree in Europe requires all large non-residential buildings to be equipped with the main building automation functions by 2025. Such regulations also positively impact the market demand for this segment. In addition, the rising security concerns in commercial buildings act as a driver for the market. Building automation systems can help improve security in a commercial building by controlling access to certain areas and monitoring activity. These systems can also help improve safety by detecting fires and other emergencies.

- The value of the commercial real estate market is increasing, further driving the segment and market. For instance, according to EPRA, Germany, the United Kingdom, and France had Europe's largest commercial real estate markets in 2023, amounting to almost half of the total European market. In Germany, the market size of commercial real estate was approximately USD 1.9 trillion.

- Also, the rising number of retail outlets in the emerging European countries will drive the market growth. For instance, according to Retail-Index, as of February 2023, fashion and clothing was the leading industry in terms of retail chains in Czechia, with 38 chains, followed by sports and leisure with 29 retail chains. Personal care, footwear, and leather shared third place, both standing at 20 chains, while the baby wear industry showed the smallest amount, with four retail chains.

Germany to Hold Significant Market Share

- The rise in government policies toward energy-efficient products in the country is anticipated to drive the market. For instance, the revised Building Energy Act was published in the Federal Law Gazette on August 13, 2020. The Federal Ministry of the Interior and Community and The Federal Ministry for Economic Affairs and Energy proposed the Buildings Energy Act, which was presented by the Federal Government. On June 18, 2020, the German Bundestag approved the Building Energy Act. The coalition agreement, the decisions made at the 2018 housing summit, and the measures outlined in the Climate Action Programme 2030 are all enforced through the Structures Energy Act, which regulates energy efficiency laws for buildings.

- According to the Federal Statistical Office of Germany, in March 2023, the construction of 24,500 dwellings was permitted in Germany. Such construction permits will enable local and international building automation firms to develop new products according to customers' requirements and capture market share.

- Also, the market in Germany has witnessed substantial growth due to a rise in infrastructure development and growing demand for green buildings. According to the OECD, Germany aims to raise the share of renewables from 17% to more than 80% in 2050 while phasing out electricity production from nuclear power plants. Greenhouse gas emissions have been shortened by 40% and are estimated to be cut by at least 80% by 2050.

- The demand for smart building control has increased due to the reported benefits of these systems. Notably, the pandemic has significantly changed the approach to building management and solutions, and new methods have quickly been accepted.

- Moreover, increasing construction activities and the rise in disposable income increased the adoption of building automation systems among a broader consumer base in the country. According to the Statistisches Bundesamt, it is expected that revenue from the construction of residential and non-residential buildings in Germany is projected to be approximately USD 89.01 billion by 2025.

- In addition, the country's government is focusing on investing in the construction industry to boost the country's growth. For instance, in September 2023, the federal government announced a EUR 45 billion (USD 48.13 billion) investment in the construction industry amid the real estate crisis. To address the housing shortage, Berlin has pledged to spend EUR 18 billion (USD 19.25 billion) on developing affordable housing by 2027, with additional funding coming from the state and federal governments.

Europe Building Automation Systems Industry Overview

The European building automation systems market is fragmented due to the presence of many key vendors. Some significant players include Siemens AG, Johnson Controls International PLC, Kieback&Peter GmbH & Co. KG, Priva Holding BV, and Schneider Electric SE. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

March 2024: Hikvision announced a technology partnership with Can'nX, which provides automation solutions for European commercial and residential buildings. This partnership enables Hikvision technologies to be integrated into the KNX protocol, the global standard for home and building automation. Integrators can enhance their building automation solutions by integrating Hikvision AI-enabled devices, such as cameras, into building systems, thereby increasing building management efficiency and improving overall security.

January 202: Honeywell announced the launch of Advanced Control for Buildings. This building management system can use a building's existing electrical wiring to give building managers more control over performance and help to improve the user experience while advancing energy management goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Initiatives and Directives for Energy and Operational Efficiency

- 5.1.2 Rapid Growth of IoT in European Countries

- 5.2 Market Restraint

- 5.2.1 Absence of Technology Alignment and High Acquisition and Implementation Costs

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Controllers

- 6.1.1.2 Field Devices

- 6.1.2 Software-as-a Service

- 6.1.1 Hardware

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Country

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Netherlands

- 6.3.7 Belgium

- 6.3.8 Sweden

- 6.3.9 Finland

- 6.3.10 Denmark

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Johnson Controls International PLC

- 7.1.3 Kieback&Peter GmbH & Co. KG

- 7.1.4 Priva Holding BV

- 7.1.5 Schneider Electric SE

- 7.1.6 Robert Bosch GmbH

- 7.1.7 Trane Technologies PLC

- 7.1.8 Lynxspring Inc.

- 7.1.9 Belimo Holding AG

- 7.1.10 Sauter AG