|

市场调查报告书

商品编码

1690790

揭露管理 (DM):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Disclosure Management (DM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

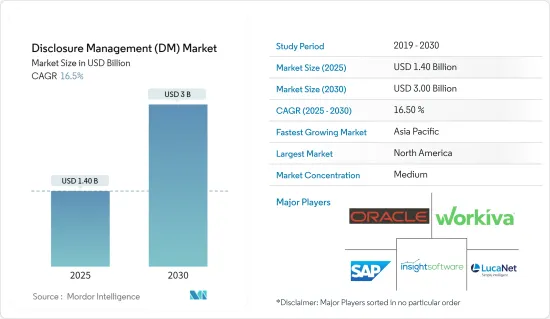

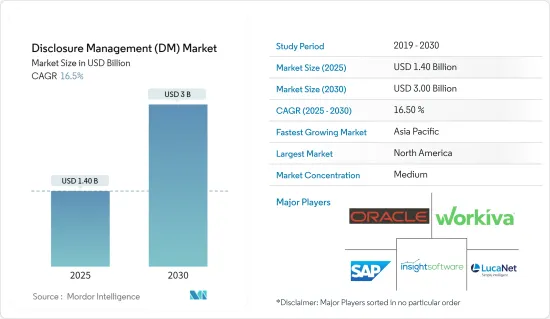

2025 年资讯揭露管理市场规模估计为 14 亿美元,预计到 2030 年将达到 30 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.5%。

主要亮点

- 彙报中的揭露管理可协助您建立和编辑带有视觉标记的可扩展商业报告语言 (XBRL) 文件(例如 10K 和 10Q)并向监管机构提交,以便向 SEC 和类似的政府机构提交文件。财务报表、评论和支援时间表可以在 Microsoft Excel 或 Word 中编制,然后以 PDF、XBRL、HTML 和 EDGAR 格式对应和交付。

- 数位科技的进步彻底改变了财务揭露的管理方式。人工智慧和自动化的日益广泛使用是该领域的主要趋势之一。自动化可以简化流程、减少错误并提高揭露管理的准确性。人工智慧主导的解决方案可以自动化文件审查、资料提取和分析任务。处理大量资料时,这可以减少处理时间并提高准确性。当谈到财务揭露管理时,资料管理和安全也是越来越重要的考虑因素。

- 康卡斯特、可口可乐、辉瑞和宝洁等多家跨国公司正在采用人工智慧主导的自动化工具来改善其财务报告流程。透过使用机器学习演算法、云端基础的平台和视觉化软体,这些公司正在缩短财务报告时间、提高财务资料的准确性、遵守法规并根据财务资料做出更明智的决策。

- 对监管要求和标准的日益关注导致对不遵守监管要求和标准的公司采取更严厉的执法措施,并加强对违法者的罚款和处罚。此外,基于区块链的解决方案的发展进一步加速了向更高透明度的转变。区块链允许各方之间安全、即时地共用敏感资料,而无需第三方中介,从而降低了传统方法的成本和复杂性。

- 永续性报告也越来越受到关注,公司被要求除了揭露收入成长和利润率等传统财务绩效指标外,还必须揭露其对环境的影响,以便让相关人员更好地了解其多方面的整体绩效,而不是只注重短期利润而牺牲长期生存能力。这些预计将推动揭露管理市场的需求。

- 然而,与监管揭露流程相关的限制预计将对市场成长构成挑战。近期,各类终端用户对云端的采用增加,而 COVID-19 疫情的影响进一步加速了 DAM 系统的交付。例如,MariaDB 的一项调查发现,全球 40% 的受访者已加快向云端的迁移,51% 的受访者计划将更多应用程式迁移到云端中,为未来的 COVID-19 停工做好准备。这些趋势增加了市场对云端基础的揭露管理解决方案的需求。

揭露管理 (DM) 市场趋势

BFSI 预计将成为成长最快的终端用户产业

- 在预计预测期内,银行、金融服务和保险 (BFSI) 行业将占据最大的市场占有率。 BFSI 产业的组织使用揭露管理解决方案来有效、有效率地管理其业务揭露流程。数位转型,加上对超个人化产品和服务日益增长的需求,促使许多企业重新思考如何管理揭露流程。此外,在复杂的法规环境中分发所需的揭露资讯可能占客户沟通的 60% 以上。

- 需要尽量减少人为介入带来的风险和诈欺也是越来越多采用风险管理解决方案的主要原因。透过标准化、集中化和自动化来协调全球揭露管理可以节省时间和金钱,并降低导致违规的人为错误的风险。随着全球报告要求变得越来越复杂和严格,组织正在以前所未有的精细度报告和呈现资料,这意味着更复杂的业务和流程以及更大的风险。这将进一步提升资讯揭露管理在银行和金融机构的应用。

- 由于东南亚等多个开发中国家的存在,亚太地区是成长最快的 BFSI 产业。印度和中国等主要经济体也在推动成长,小型银行也加入了数位化潮流。例如,2023 年 8 月,卡纳塔克邦银行宣布数位化。根据2023年8月发布的一项研究,约有250家全球数位银行正在重新设计即将到来的金融科技时代,其中20%的数位转型机构位于亚太地区。马来西亚在这一数位化发展趋势中也取得了显着的进展。

- 2024 年泰雷兹数位信任指数显示,在共用个人资料方面,银行、医疗保健和政府服务是最受信任的产业。同时,媒体和娱乐、社交媒体和物流公司处于行业排名的底部。此外,超过四分之一(26%)的客户在过去 12 个月内由于隐私问题离开了某个品牌。

- 采用云端基础的、内容主导的全球揭露管理软体的公司往往拥有更强大的监管合规框架和管治。根据共享服务和外包网路的报告,近六成的共享服务主管将自动化列为持续的优先事项。这表明该市场对揭露控制的采用正在增加。

预计北美将占据较大的市场占有率

- 由于美国和加拿大等技术先进的国家,北美揭露管理市场预计将大幅成长。公司正在处理日益复杂的报告流程,其中包含各种文件格式,从而带来越来越多的需求。更快的报告和财务报表揭露、报告比较、用户变化的追踪以及以前版本的完整恢復为用户提供了更大的控制权,并正在推动市场需求。

- 为了保持竞争力,越来越需要遵守行业法规,这也是推动该地区市场需求的主要因素之一。这促使企业选择云端部署模式,全天候存取资讯、低成本维护服务,并专注于改善客户体验,从而刺激大型企业的市场成长。

- 2023 年 6 月,分析、彙报和绩效管理解决方案 Insight Software 宣布将 Infor Financials 和 Supply Management (FSM) 与 Spreadsheet Server 整合。这使 Infor FSM 用户能够简化来自任何资料来源的报告,加快关闭速度,缩短规划週期并建立客製化报告。这使财务团队可以更好地控制他们的 Infor FSM彙报,最终使他们能够花费更少的时间准备资料,而花费更多时间发现新的见解。

- 该地区越来越关注永续性报告,公司被要求除了揭露利润成长和利润率等传统财务绩效指标外,还必须揭露其对环境的影响,以便利益相关人员更好地了解公司在多个行业的整体表现,而不是只注重短期利润而牺牲长期生存能力。预计这些将推动该地区对资讯揭露管理的需求。

揭露管理 (DM) 市场概览

资讯揭露管理市场主要集中在 SAP、IRIS Business Services、OCR Services 和 Oracle Corporation 等知名公司。还有许多中型供应商,例如 CoreFiling 和 Trintech,进一步加剧了市场竞争。此外,新参与企业有巨大的机会扩大其产品供应,从而加剧竞争格局。因此,市场适度整合,预计未来几年竞争将会加剧。

- 2023 年 5 月,Workiva Inc. 宣布与非营利组织 Code.org 建立多年伙伴关係。此次合作旨在提高电脑科学教育的机会并促进技术领域的多样性。

- 2023 年 2 月,Insight Software 收购了 PowerOn,透过整合 Microsoft Power BI 增强了其业务规划解决方案。此次策略性收购增强了公司的营运规划能力,尤其使利用 Power BI 简化和增强整个组织的规划和资料收集流程的企业客户受益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 多种文件格式导致彙报流程复杂

- 全球业务整合

- 市场限制

- 监理揭露流程受到多重限制

第六章 市场细分

- 按组件

- 软体

- 按服务

- 按部署

- 本地

- 云

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 卫生保健

- 零售

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- SAP SE

- Oracle Corporation

- Workiva Inc.

- insightsoftware

- LucaNet AG

- DataTracks

- Tagetik Software Srl(Wolters Kluwer NV)

- CoreFiling Limited

- Trintech Inc.

- IRIS Carbon(IRIS Business Services)

- Donnelley Financial Solutions(DFIN)

- OCR Services Inc.

第八章投资分析

第九章:市场的未来

The Disclosure Management Market size is estimated at USD 1.40 billion in 2025, and is expected to reach USD 3.00 billion by 2030, at a CAGR of 16.5% during the forecast period (2025-2030).

Key Highlights

- Disclosure management in reporting assists organizations in creating and editing visually labeled extensible business reporting language (XBRL) filings to a regulatory body, such as a 10K or 10Q filed to the SEC or comparable government agencies. Financial statements, comments, and supporting schedules can be compiled in Microsoft Excel or Word and then mapped and delivered in PDF, XBRL, HTML, or EDGAR formats.

- The evolution of digital technologies has revolutionized the way financial disclosures are managed. The rise in artificial intelligence and automation usage is one of the key trends in this space. Automation enables streamlining processes, reducing errors, and improving disclosure management accuracy. Artificial intelligence-driven solutions can automate document review, data extraction, and analysis tasks. This authorizes faster processing times and improved precision when dealing with large volumes of data. Data management and security have also become increasingly essential considerations regarding financial disclosure management.

- Several multinational companies, including Comcast, Coca-Cola, Pfizer, and Procter & Gamble, have implemented AI-led automation tools to improve their financial reporting processes. By using machine learning algorithms, cloud-based platforms, and visualization software, these companies have reduced the time taken for financial reporting, improved the accuracy of their financial data, complied with regulations, and made more informed decisions based on their financial data.

- The improved focus on regulatory requirements and standards has led to more stringent enforcement actions against those firms that fail to adhere to them, resulting in higher fines and fines imposed upon violators. Furthermore, the shift toward more significant transparency has been further accelerated by the evolution of blockchain-based solutions, which allow secure real-time sharing of confidential data between parties without requiring third-party intermediaries, thus decreasing costs and complexity associated with conventional methods.

- There is a rising focus on sustainability reporting, which mandates companies to disclose environmental effects along with conventional financial performance metrics such as income growth or profit margins to better notify stakeholders about their overall implementation across multiple dimensions rather than just focusing solely on short-term gains at the expense of long-term viability. These are expected to drive the demand in the disclosure management market.

- However, constraints related to regulatory disclosure processes are expected to challenge the growth of the market. With the recent uptick in the adoption of the cloud among different end users, the impact of the COVID-19 pandemic has further accelerated the offerings of DAM systems. For instance, according to a survey by MariaDB, 40% of global respondents accelerated their move to the cloud, and 51% planned to drive more applications to the cloud to prepare for future COVID-19 shutdowns. Such trends increased the demand for cloud-based disclosure management solutions in the market.

Disclosure Management (DM) Market Trends

BFSI is Expected to Be the Fastest-growing End-user Industry

- The banking, financial services, and insurance (BFSI) vertical is expected to have the largest market share during the forecast period. Organizations in the BFSI industry are using disclosure management solutions to effectively and efficiently manage business disclosure processes. Digital transformation, coupled with an increased need for hyper-personalized products and services, is pushing many companies to rethink how they manage their disclosure process. Moreover, the distribution of required disclosures in complex regulatory environments can comprise more than 60% of customer communications.

- The need to minimize the risks and frauds that occur through human interventions is another major reason for the rising adoption of risk management solutions. Harmonizing global disclosure management with standardizing, centralizing, and automating organizations saves time and money and reduces the risk of human error that can lead to non-compliance. With global reporting requirements becoming more complex and stringent, organizations are reporting on and presenting data at an unprecedented level of granularity, which means more operational and process complexity and increased risk. This further increases the application of disclosure management in banking and finance institutions.

- Asia-Pacific has the fastest-growing BFSI industry owing to its various developing countries, such as countries in Southeast Asia. Major economies such as India and China are also boosting growth, with even small banks getting on with the ongoing digitalization trend. For instance, in August 2023, Karnataka Bank announced the digitalization of its processes, aligning with the organization's plan to attract new customers while retaining the old ones. According to a study published in August 2023, roughly 250 global digital banks were redesigning the forthcoming days of fintech, and 20% of these digital transformative bodies were present in Asia-Pacific. Malaysia is also making noteworthy progress in this digital development trend.

- The 2024 Thales Digital Trust Index revealed that banking, healthcare, and government services are the most trusted sectors for sharing personal data. On the other hand, media and entertainment, social media, and logistics companies were at the bottom of the industry rankings. Additionally, over a quarter (26%) of customers left a brand in the previous 12 months due to privacy concerns.

- Organizations with purpose-built cloud-based and content-driven global disclosure management software tend to have strengthened regulatory compliance frameworks and governance. A Shared Services & Outsourcing Network report found that nearly six in ten shared services executives cite automation as a continuing priority. This suggests the increasing implementation of disclosure management in the market.

North America is Expected to Hold a Significant Market Share

- The North American disclosure management market is expected to grow significantly, owing to technologically advanced countries like the United States and Canada. Companies are dealing with increasing complexity in the reporting process characterized by different file formats, causing the demand to rise. The quicker report preparation and financial statement disclosure, report comparison, tracking changes made by any user, and complete restoration of earlier versions provide greater control to the users, propelling demand in the market.

- The rising need to comply with industry regulations to sustain market competition is one of the key factors driving market demand in the region. This encourages companies to opt for the cloud deployment model and 24/7 availability of accessible information with low-cost maintenance services, fueling the growth of the market in large enterprises, owing to their increasing focus on improving the customer experience.

- In June 2023, Insight Software, the player in analytics, reporting, and performance management solutions, announced the integration of a Spreadsheet Server with Infor Financials and Supply Management (FSM). Spreadsheet Server now empowers Infor FSM users to do more with less by streamlining reporting from all data sources to close books more quickly, shrink planning cycles, and accelerate the creation of customized reports. It grants finance teams more control over Infor FSM reporting and ultimately empowers them to spend less time preparing the data and more time deriving new insights.

- There is a rising focus on sustainability reporting in the region, which mandates companies to disclose environmental effects along with conventional financial performance metrics such as income growth or profit margins to better notify stakeholders about their overall implementation across numerous proportions rather than just focusing solely on short-term gains at the cost of long-term viability. These are expected to drive the demand for disclosure management in the region.

Disclosure Management (DM) Market Overview

The disclosure management market is semi-concentrated, featuring prominent players such as SAP, IRIS Business Services, OCR Services, and Oracle Corporation. The presence of numerous medium-scale vendors like CoreFiling and Trintech further fuels the market competition. Additionally, new entrants in the market have significant opportunities to expand their offerings, intensifying the competitive landscape. As a result, the market is moderately consolidated, and competition is projected to escalate in the coming years.

- May 2023: Workiva Inc. announced a multi-year partnership with the non-profit organization Code.org. This collaboration is dedicated to increasing access to computer science education and promoting diversity within the technology sector.

- February 2023: Insight Software acquired Power ON, enhancing its operational planning solutions by integrating Microsoft Power BI. This strategic acquisition bolstered the company's capabilities in operational planning, particularly benefiting enterprise clients utilizing Power BI to streamline and enhance their planning and data collection processes across their organizations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Complexity in the Reporting Process Characterized by Different File Formats

- 5.1.2 Worldwide Integration of Business

- 5.2 Market Restraints

- 5.2.1 Multiple Constraints Related to Regulatory Disclosure Processes

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premises

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Manufacturing

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Middle East and Africa

- 6.4.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 Workiva Inc.

- 7.1.4 insightsoftware

- 7.1.5 LucaNet AG

- 7.1.6 DataTracks

- 7.1.7 Tagetik Software Srl (Wolters Kluwer NV)

- 7.1.8 CoreFiling Limited

- 7.1.9 Trintech Inc.

- 7.1.10 IRIS Carbon (IRIS Business Services)

- 7.1.11 Donnelley Financial Solutions (DFIN)

- 7.1.12 OCR Services Inc.