|

市场调查报告书

商品编码

1690792

洞察引擎:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Insight Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

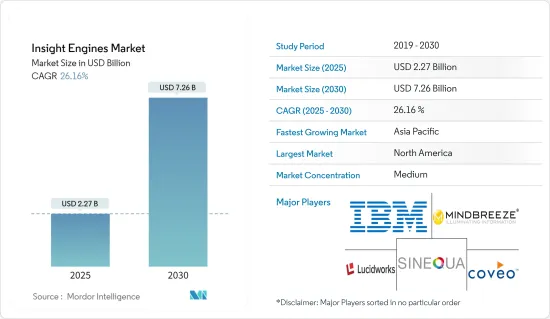

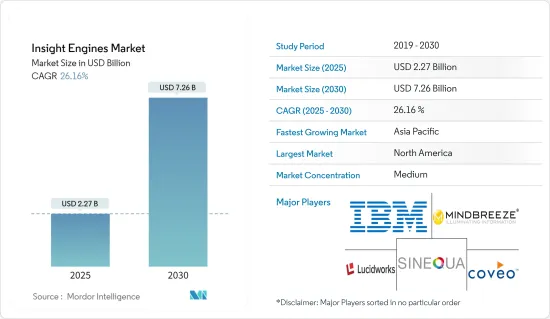

洞察引擎市场规模预计在 2025 年为 22.7 亿美元,预计到 2030 年将达到 72.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 26.16%。

主要亮点

- 洞察引擎与传统搜寻引擎的不同之处在于,它们不仅提供来源资料的链接,还提供有关特定事实和实体的上下文资讯。 Insight Engine的主要用途是内部和外部搜寻以及资料分析撷取。

- 即使资料和分析解决方案被广泛采用,许多公司仍难以实现其业务目标。作为一种解决方案,人们已经明显转向洞察引擎。这些引擎整合来自各种来源的资料并提供关键的业务洞察。Accenture强调,资料可用性已大幅增加 44 Zetta位元组。这些资料中的 80% 是非结构化的——涵盖从文字文件和音讯到视讯、电子邮件和社交媒体贴文的所有内容——剩下的 20% 是资料的。

- 为了从这个庞大的资料中获得见解并确定使用者和组织的需求,必须能够从文件中提取事实并轻鬆存取储存的事实。包括谷歌和必应在内的主流搜寻引擎透过使用「知识图谱」来储存事实来实现这一点。

- 对于许多企业来说,从资料中获得有价值的见解所需的投资可能是巨大的,需要独特的基础设施和资源。这项挑战使得许多企业将认知搜寻视为正确的解决方案。领先的资讯科技和服务公司 KD Nuggets 预测,企业将把约 15% 的 IT 预算分配给认知搜寻、分析和相关的云端基础的服务。

- 零售、金融、保险和保险业、媒体和通讯等多个行业都计划在不久的将来推出洞察计划。以 BFSI 领域为例,公司正在寻求改善客户的银行体验。透过利用高级分析技术,我们旨在深入了解流程和客户行为,从而根据过去的表现做出明智的业务决策。

- 此外,企业、消费者和设备产生的资料激增正在推动洞察引擎市场的发展。组织面临来自社群媒体、客户互动和物联网设备等来源的大量资料。洞察引擎擅长从这些资料中辨别有意义的模式和趋势,而传统处理方法往往无法实现这项功能。这项功能正在推动洞察引擎在世界各地的广泛采用。

洞察引擎市场趋势

BFSI 部门占主要份额

- 在快速变化的消费趋势和不断发展的业务预期中,银行面临着独特的挑战。在这种背景下,搜寻技术已成为驾驭复杂的现代金融世界的重要工具。资料来源曾经局限于传统管道,现在涵盖了广泛的选择。金融机构员工希望能够不间断地存取资料,无论数据储存在云端、SaaS 平台或其他数据孤岛中。先进的洞察引擎目前能够处理各种格式的数十亿份文檔,确保即时资料的可用性。

- 同时,保险公司面临日益严格的监管环境,同时也面临网路威胁和破坏环境的挑战。在这种动态的环境中,搜寻技术成为帮助组织快速适应并维持发展轨道的重要盟友。

- 在机器学习和人工智慧的支援下,洞察引擎利用各种资料来源为银行家提供客户的整体情况。其中包括来自年度报告、风险分析、社交媒体和行业部落格的见解。这种全面的洞察不仅可以为投资决策提供信息,而且还有助于更有效地识别投资机会和建立交易。透过利用大量资料和数位客户资料,银行可以利用洞察引擎并获取真实的信用报告。这种主动方法使银行能够及早发现诈欺活动,识别支付差异并强调异常行为。

- 此外,银行和其他金融机构也越来越多地使用洞察引擎来筛选社群媒体。透过使用自然语言处理,您可以评估客户情绪并分析围绕您的服务和策略的讨论。此功能使财务分析师能够创建更准确的报告并存取关键的分段资料,以增强向客户和内部相关人员提供的建议。利用资料来个人化银行服务不仅可以提高客户参与,还可以推动收益成长。 2023 年 6 月,Envestnet Data and Analytics 宣布其银行洞察引擎 (IEB) 解决方案荣获「最佳基于 AI 的金融服务解决方案」称号。

- 此外,BFSI 机构在遵守严格的监管方面面临重大障碍。 《一般资料保护规范》(GDPR)、《多德-弗兰克法案》和《反洗钱》(AML)法律等合规要求对金融业务进行更严格的审查。 Insight Engine 为组织提供即时资料分析和彙报工具,有助于快速识别可疑活动和合规性报告。透过采取这种积极主动的方式,金融机构不仅可以降低违规的风险,还可以保护自己免受潜在的处罚。这些优势正在推动 BFSI 领域采用洞察引擎。

亚太地区:预计大幅成长

- 日本、中国、印度、澳洲和韩国等国家正在引领亚太地区洞察引擎市场的快速成长。中国是亚太地区的技术领导者,拥有世界上最快的网路速度,也是阿里巴巴等巨头的所在地。

- 根据国家统计局数据,2023年上半年,受直播电商兴起的带动,中国网路零售额持续成长。同时,泰国《商业新闻》预测,今明两年网路购物年增率将达 6%,市场规模将达 178 亿美元至 195 亿美元。主要类别包括个人护理、家居用品、食品和饮料。线上销售的成长可能会刺激对零售洞察引擎软体的需求。

- 在爱奇艺、腾讯和优酷等主要企业的支持下,中国的法规结构有效地阻止了包括 FAANG 集团(Facebook、亚马逊、苹果、Netflix 和谷歌)在内的国际巨头进入市场。这些 FAANG 公司对各行业的广告业具有重大影响力,尤其是它们利用先进的洞察引擎进行大规模建议。因此,这种限制性措施既保护了国内市场,也为当地企业提供了蓬勃发展的机会,儘管成长率落后于美国更强劲的步伐。

- 展望未来,洞察引擎市场提供了广大的商机,尤其是在印度等新兴市场。

- 2023 年 3 月,Insight Software 宣布了 Angles Professional for Oracle 的升级计划,并在 2023 年 Gartner 资料与分析高峰会上展示了增强功能。为了满足对高阶营运分析日益增长的需求,Insight Software 与 Logi Analytics 建立了合作伙伴关係。此次合作旨在为 Oracle ERP Cloud 使用者提供建立可轻鬆跨部门共用的互动式仪表板和报告的工具。

Insight Engine 产业概览

洞察引擎市场较分散,有 IBM Corporation、Mindbreeze GmbH、LucidWorks Inc. 和 Sinequa SAS 等参与者。市场上的供应商也在透过使用机器学习功能(例如电脑视觉、语音转文字功能等),以本地方式或透过合作方式将其内容索引功能的范围扩展到富媒体。

例如,2024 年 4 月,Litera 推出了一款新的 GenAI主导的KM 工具,帮助公司加强谈判地位并增强交易计画。该工具将使公司能够精确定位“相关先例、贸易点和市场洞察”,以更好地支持其客户。 Litera 旨在透过深入挖掘过去交易的「所有交易、交易和谈判资料」为用户提供全面的解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 资料量不断增加,对结构化资料的需求不断增加

- 透过搜寻和自然语言处理增加分析查询

- 市场限制

- 对资料品质和资料来源检验的担忧

第六章 市场细分

- 按组件

- 软体

- 按服务

- 依部署类型

- 本地

- 云

- 按公司规模

- 中小型企业

- 大型企业

- 按最终用户产业

- BFSI

- 零售

- 资讯科技/通讯

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Mindbreeze GmbH

- Coveo Solutions Inc.

- Sinequa SAS

- LucidWorks Inc.

- ServiceNow Inc.(Attivio Cognitive Search Platform)

- Micro Focus International PLC

- Google LLC

- Microsoft Corporation

- Funnelback Pty Ltd

- IntraFind Inc.

- Dassault Systems SA

- EPAM Systems Inc.(Infongen)

- Expert System SpA

- IHS Markit Ltd

- Insight Engines Inc.

第八章投资分析

第九章:市场的未来

The Insight Engines Market size is estimated at USD 2.27 billion in 2025, and is expected to reach USD 7.26 billion by 2030, at a CAGR of 26.16% during the forecast period (2025-2030).

Key Highlights

- Insight engines differ from traditional search engines by offering contextual information about a given fact or entity rather than just providing links to source materials. Their primary applications encompass internal and external searches and data analytics extraction.

- Even with the widespread adoption of data and analytics solutions, many companies still find it challenging to achieve their business objectives. As a solution, there's a noticeable shift towards insight engines. These engines consolidate data from various sources, delivering vital business insights. Accenture highlights a monumental surge in data availability, now at 44 zettabytes. A significant 80% of this data is unstructured, covering everything from text documents and audio to videos, emails, and social media posts, with the remaining 20% being structured.

- To harness insights from this vast data pool and determine user or organizational needs, it's essential to extract facts from documents and ensure easy access to these stored facts. Major search engines, including Google and Bing, achieve this by utilizing a 'knowledge graph' for fact storage, a method they've employed for years.

- For numerous organizations, the investment required to extract valuable insights from data can be substantial, necessitating their own infrastructure and resources. This challenge drives many companies to view cognitive search as a fitting solution. KDNuggets, a prominent information technology and services firm, forecasts that organizations will allocate around 15% of their IT budgets to cognitive search, analytics, and related cloud-based services.

- Several industries, including retail, BFSI, media, and telecommunications, are set to adopt insight programs in the near future. Take the BFSI sector: companies are on a quest to enhance banking experiences for their customers. By leveraging advanced analytics, they aim to gain insights into processes and customer behaviors, leading to informed business decisions based on historical performance.

- Moreover, the surge in data generation by businesses, consumers, and devices propels the insight engine market. Organizations face a deluge of data from sources like social media, customer interactions, and IoT devices. Insight engines excel at discerning meaningful patterns and trends from this data, a feat often missed by traditional processing methods. This capability has fueled the global adoption of insight engines.

Insight Engines Market Trends

BFSI Segment Holds a Significant Share

- Banks grapple with unique challenges amidst a rapidly changing consumer landscape and evolving business expectations. In this context, search technology has emerged as a crucial tool for navigating the complexities of the modern financial world. Data sources, once confined to traditional channels, now encompass a wide array of options. Employees in financial institutions demand uninterrupted access to data, whether it's stored in the cloud, on SaaS platforms, or in other silos. Advanced insight engines are now adept at processing billions of documents across various formats, guaranteeing real-time data availability.

- Concurrently, insurers are contending with a tightening regulatory landscape while also facing challenges from cyber threats and disruptive innovations. In this dynamic environment, search technologies stand out as vital allies, empowering organizations to adapt swiftly and maintain their growth trajectory.

- Insight engines, driven by machine learning and artificial intelligence, tap into varied data sources to furnish bankers with a holistic view of their clients. This encompasses insights from annual reports, risk analytics, social media, and industry blogs. Such comprehensive insights not only inform investment decisions but also help in spotting opportunities and streamlining deal origination. Leveraging their extensive transactional and digital customer data, banks can utilize insight engines to access genuine credit reports. This proactive approach enables banks to detect fraud early, recognize payment discrepancies, and highlight any atypical activities.

- Furthermore, financial institutions, notably banks, are increasingly deploying insight engines to sift through social media. By harnessing Natural Language Processing, they can assess client sentiment and analyze discussions surrounding their services and strategies. This capability allows financial analysts to produce more precise reports, enhancing the advice given to both clients and internal stakeholders through access to vital, segmented data. Tailoring banking services using data not only heightens customer engagement but also propels revenue growth. A testament to this trend, in June 2023, Envestnet Data and Analytics unveiled that their Insights Engine for Banking (IEB) solution clinched the title of Best AI-based Solution for Financial Services.

- Additionally, BFSI institutions face significant hurdles in navigating stringent regulations. Compliance mandates, such as the General Data Protection Regulation (GDPR), the Dodd-Frank Act, and Anti-Money Laundering (AML) laws, necessitate meticulous oversight of financial operations. Insight engines equip organizations with tools for real-time data analysis and reporting, facilitating the prompt identification of suspicious activities and the effortless generation of compliance reports. By taking this proactive approach, institutions not only reduce the risk of non-compliance but also shield themselves from potential penalties. Such advantages are propelling the adoption of insight engines in the BFSI sector.

Asia-Pacific Expected to Witness Major Growth

- Countries like Japan, China, India, Australia, and South Korea are spearheading the rapid growth of the insight engine market in the Asia-Pacific region. China, a technological frontrunner in Asia-Pacific, boasts one of the world's fastest internet speeds and is home to major enterprises, including Alibaba.

- According to the National Bureau of Statistics, China's online retail sales saw consistent growth in the first half of 2023, driven by the rising trend of livestreaming e-commerce. Simultaneously, Thailand's Business News forecasts a 6% annual growth in online shopping for both this year and the next, targeting a market value between USD 17.8-19.5 billion. Leading categories include personal and household care products, beverages, and food. This uptick in online sales is poised to boost demand for insight engine software among retail players.

- China's regulatory framework, supported by key players like iQiyi, Tencent, and Youku, effectively prevents international giants, including the FAANG group (Facebook, Amazon, Apple, Netflix, and Google), from penetrating its market. These FAANG companies utilize advanced insight engines, especially for large-scale recommendations, and wield significant influence in advertising across various industries. Thus, while this regulatory approach safeguards the domestic market, it simultaneously offers local players an opportunity to thrive, even if their growth rate lags behind the more vigorous pace observed in the U.S.

- Looking ahead, the forecast period highlights promising opportunities for the insight engine market, particularly in emerging markets like India, driven by a surge of local entrants eager to make their mark.

- In March 2023, Insightsoftware unveiled its plans to upgrade Angles Professional for Oracle, showcasing the enhancement at the Gartner Data & Analytics Summit 2023. Responding to a rising demand for advanced operational analytics, Insightsoftware partnered with Logi Analytics. This collaboration aims to equip Oracle ERP Cloud users with tools to create interactive dashboards and reports, ensuring smooth sharing across departments.

Insight Engines Industry Overview

The insight engine market is fragmented due to the significant presence of players such as IBM Corporation, Mindbreeze GmbH, LucidWorks Inc., and Sinequa SAS. Vendors in the market are also extending the reach of their content indexing capabilities to rich media either natively or via partnership by using machine learning capabilities such as computer vision, speech-to-text functions, etc.

For instance, in April 2024, Litera unveiled a new GenAI-driven KM tool to help companies enhance their negotiation positions and bolster transaction planning. This tool enables firms to pinpoint 'relevant precedents, deal points, and market insights,' empowering them to better support their clients. By delving into 'all matter, deal, and negotiating data' from past transactions, Litera aims to provide a comprehensive solution for its users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Data and the Requirement of Structured Data

- 5.1.2 Rising Generation of Analytical Queries Via Search and Natural Language Processing

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Data Quality and Data Sources Validation

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Size of the Enterprise

- 6.3.1 Small- and Medium-Sized Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Retail

- 6.4.3 IT and Telecom

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Mindbreeze GmbH

- 7.1.3 Coveo Solutions Inc.

- 7.1.4 Sinequa SAS

- 7.1.5 LucidWorks Inc.

- 7.1.6 ServiceNow Inc. (Attivio Cognitive Search Platform)

- 7.1.7 Micro Focus International PLC

- 7.1.8 Google LLC

- 7.1.9 Microsoft Corporation

- 7.1.10 Funnelback Pty Ltd

- 7.1.11 IntraFind Inc.

- 7.1.12 Dassault Systems SA

- 7.1.13 EPAM Systems Inc. (Infongen)

- 7.1.14 Expert System SpA

- 7.1.15 IHS Markit Ltd

- 7.1.16 Insight Engines Inc.