|

市场调查报告书

商品编码

1690796

拣选机器人:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Piece Picking Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

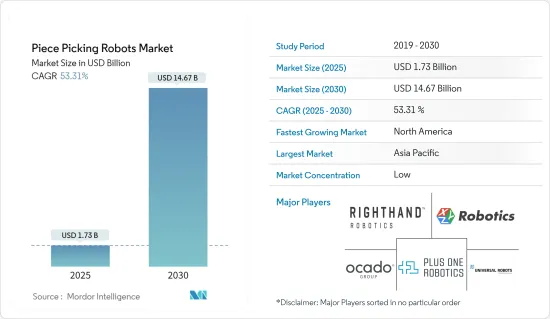

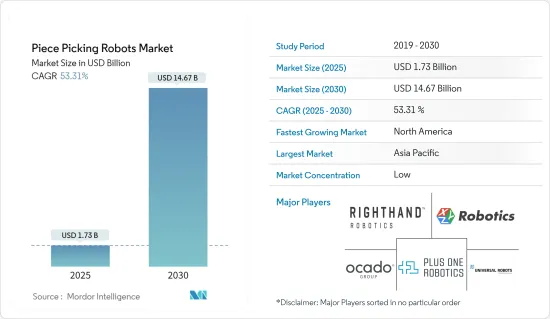

预计 2025 年拣选机器人市场规模将达到 17.3 亿美元,到 2030 年预计将达到 146.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 53.31%。

关键亮点

- 自动化投资正在推动拣选机器人的成长,尤其是在电子商务、物流和製造等领域。提高效率、精度、可扩展性和成本效益正在推动这一自动化趋势。由于新冠疫情和电子商务需求激增,仓储和物流领域的劳动力短缺问题加剧,刺激了对自动化的投资增加。因此,拣选机器人越来越承担订单拣选等劳力密集角色,减少对大量劳动力的依赖。

- 2024年9月,总部位于以色列梅塔尔的Pickommerce获得340万美元融资。该公司表示,将利用这笔资金加速其旗舰产品拾料机器人PickoBot的开发、生产和市场扩张。 Pickomerce 进一步强调了当今物流中心自动化程度不断提高的趋势,并指出机器人现在主要负责检索板条箱和装卸包裹等业务。

- 随着各个地区工资上涨,企业越来越多地转向使用机器人来降低营运成本。虽然对拣选机器人和自动化技术的前期投资可能很高,但长期节省劳动力的前景和连续工作而不疲劳的好处使其具有吸引力。此外,美国银行预测,到 2025 年,45% 的製造业将由机器人主导。按照这一发展轨迹,印度着名纺织公司雷蒙德有限公司和三星等科技巨头的主要中国供应商富士康科技集团等工业巨头,准备分别利用生产设施的自动化取代 10,000 名和 60,000 名工人。

- 拣选机器人需要大量的前期投资,这对市场成长造成了重大障碍。对支持性基础设施的需求进一步扩大了这项投资。此外,这些机器人的技术限制,例如速度慢、难以抓取非传统物品以及可靠性问题,限制了市场扩张。

- 与任何先进技术一样,拣选机器人需要定期维护,这可能会导致运作。最大限度地减少此类干扰对于这些机器人无缝融入高通量行业至关重要。此外,不同行业有独特的工作流程和产品类型,这产生了很高的客製化需求。这种需求使得拣选解决方案的部署变得复杂,增加了时间和成本。

- 乌克兰持续不断的衝突正在扰乱製造拣选机器人所必需的原材料和零件的供应链。这种中断可能导致缺货、前置作业时间延长和成本上升,所有这些都会对市场产生直接影响。作为回应,公司可能会转向其他供应商或增加本地产量,这可能会重塑市场动态和定价。俄罗斯和乌克兰之间持续的紧张局势,加上中国的“零容忍政策”,导致全球通膨大幅上升。这种高通膨正在蔓延至各个领域,包括电子元件和工业自动化产业,推高了元件价格并抑制了研究市场的成长。此外,通货膨胀和利率上升抑制了消费者支出,进一步限制了市场扩张。

选择机器人市场趋势

零售、仓库、配销中心和物流中心是最大的最终用户

- 随着市场需求的快速变化,机器人技术正成为零售企业的重要资产。亚马逊、Bossa Nova Robotics 和 Braincorp 等大公司正在引领这一潮流,帮助推动需求激增。世界各地的公司都在将机器人自动化引入仓库,主要是为了降低人事费用。

- 亚马逊和沃尔玛等零售巨头正在将行动机器人无缝融入其仓库和零售店。随着消费者期望转向按需零售,库存策略正在发生显着转变。考虑到这一点,零售商正在投资电子商务基础设施、全通路履约和小型商店,以更贴近消费者。

- 不仅在仓库管理领域,零售业也正在经历机器人浪潮。店内机器人不仅可以协助顾客,还可以处理库存管理和清洁业务。这些技术创新不仅提高了业务效率,还使零售商能够为客户提供更个人化的服务。在技术进步和竞争差异化的推动下,机器人技术的采用没有放缓的迹象。随着零售业的不断发展,充分利用机器人技术的公司将能够在市场上获得优势。

- 传统商业模式的转变,尤其是零售业从实体店转向线上平台,正在刺激测试市场的成长。例如,美国人口普查局的资料突显了美国零售业电子商务的稳定成长。 2024 年第二季度,电子商务占美国零售总额的 16%,高于上一季。此外,2024年4月至6月,美国零售电子商务销售额超过2,910亿美元,创下季度销售额历史新高。

- 随着企业努力适应不断增长的电子商务需求、劳动力短缺以及快速且准确的订单履行需求,拣选机器人在零售、仓库、配送中心和物流中心的应用正在显着上升。由于采用人工智慧 (AI)、机器学习、3D 视觉和自主移动机器人 (AMR) 等技术的进步,拣选机器人正在巩固其作为现代零售和物流基础设施重要组成部分的地位。

- 亚马逊、沃尔玛、DHL和阿里巴巴等产业巨头正在不断投资这些技术,显着影响全球物流和零售履约的发展轨迹,预示着该市场机器人系统的快速成长。

北美占据主要市场占有率

- 北美地区包括美国和加拿大等国家,占据全球拾取机器人市场的很大份额。这一优势归功于该地区先进的技术基础设施、强劲的自动化需求以及製造、物流、零售和仓储等蓬勃发展的行业。北美采用拣选机器人的关键驱动因素包括提高业务效率、降低成本、电子商务的激增以及紧张的劳动力市场。

- 劳动力短缺,特别是依赖重复性手动任务的配送和仓储行业,正在刺激美国和加拿大采用自动化技术。随着薪资上涨和劳动力短缺,企业正在转向机器人解决方案来维持生产并降低营运成本。

- 据美国商会称,製造业受到疫情的严重打击,约有 140 万个工作岗位流失。根据美国劳工统计局2023年2月的资料,製造业约有75万人失业。预测显示,到 2030 年,美国可能会有超过 200 万个製造业职缺。这些动态正在推动製造业和非製造业加速采用自动化和机器人技术。此外,许多市场参与企业正在积极加强其在该地区的存在。

- 例如,以协作机器人(Rapyuta PA-AMR)和仓库解决方案而闻名的Rapyuta Robotics于2023年2月在美国成立了子公司。此举是Rapyuta在印度成立后的第二家国际子公司。 Rapyuta 旨在利用其先进的技术和硬体为美国市场带来巨大的价值。芝加哥办事处预计将加强 Rapyuta 的全国销售和运营,彰显该公司致力于确保为美国客户带来丰厚投资收益的承诺。

- 电子商务激增、技术进步、劳动力问题以及自动化投资增加等因素正在推动北美拣选机器人市场的快速成长。製造、物流、零售、电子商务等领域的公司正在使用机器人来提高效率、降低成本和提高精度。随着人工智慧 (AI)、机器学习和机器人系统的不断进步,北美不仅有望在未来几年经历显着增长,而且还将在全球拣选机器人领域保持关键作用。

拣选机器人产业概况

零件拣选机器人市场有主要企业,例如 SSI Schaefer、Swisslog、Dematic 和 RightHand Robotics。他们的存在和持续的创新正在重塑市场格局。

例如,2023 年 9 月,建造和部署先进仓库自动化解决方案的重要参与企业MOVU Robotics 推出了其最新创新产品「Movu Eligo」机器人拣选臂。鑑于其市场渗透率和先进的产品供应,预测期内竞争对手之间的竞争可能会加剧。

由于进入门槛较低,一些创业投资(VC) 支持的新参与企业正在取得进展,有可能加剧市场竞争。为了获得竞争优势,参与企业正在增强其机器人功能,以获得更好的投资收益(ROI) 和更快的挑选率。我们也投资人工智慧(AI)、深度学习和视觉技术等尖端技术。此外,持续使用高品质组件可提高效能。如上所述,该市场的特征是企业之间的竞争激烈且敌意程度高。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 对自动化产业的影响评估

- 拣选机器人的软体技术及演进

第五章市场动态

- 市场驱动因素

- 从整箱或託盘拣选转向单件流并改进技术投资

- 增加自动化投资

- 市场问题

- 速度慢,夹持器无法处理特殊物品,可靠性问题

第六章市场区隔

- 按机器人类型

- 协作

- 移动及其他

- 按最终用户应用程式

- 製药

- 零售/仓储/配送中心/物流中心

- 其他最终用户应用程式

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Plus One Robotics Inc.

- Ocado Group Plc

- Universal Robots A/S(TERADYNE, INC.)

- XYZ Robotics Inc.

- Righthand Robotics Inc.

- Berkshire Grey Inc.

- Robomotive BV

- Lyro Robotics Pty Ltd.

- Knapp AG

- Grey Orange Pte. Ltd.

- Hand Plus Robotics Pte Ltd

- Dematic Group(KION Group AG)

- Nomagic Inc.

- Fizyr BV

- Mujin Inc.

- Nimble Robotics Inc.

- Swisslog Holding AG

- Daifuku Co., Ltd.

- Osaro Inc.

- Covariant

- SSI Schaefer Group

第八章投资分析

第九章:市场的未来

The Piece Picking Robots Market size is estimated at USD 1.73 billion in 2025, and is expected to reach USD 14.67 billion by 2030, at a CAGR of 53.31% during the forecast period (2025-2030).

Key Highlights

- Investment in automation is propelling the growth of piece-picking robots, particularly in sectors like e-commerce, logistics, and manufacturing. The push for enhanced efficiency, precision, scalability, and cost-effectiveness is driving this automation trend. Labor shortages in warehousing and logistics, exacerbated by the COVID-19 pandemic and surging e-commerce demands, have spurred heightened investments in automation. As a result, piece-picking robots are increasingly taking on labor-intensive roles, such as order picking, thereby diminishing the reliance on a vast workforce.

- In September 2024, Pickommerce, hailing from Meitar, Israel, clinched funding of USD 3.4 million. The company announced that this capital infusion would accelerate the development, production, and marketing of its flagship, the PickoBot piece-picking robot. Furthermore, Pickommerce underscored the escalating trend of automation in today's logistics hubs, noting that robots are now chiefly tasked with duties like crate collection and package unloading.

- As wages climb in various regions, businesses are increasingly leaning on robots to trim operational expenses. While the upfront investment in piece-picking robots and automation tech can be steep, the promise of long-term labor savings and the benefit of continuous, fatigue-free operation make it enticing. Moreover, Bank of America projects that by 2025, a significant 45% of all manufacturing will be dominated by robotics. In alignment with this trajectory, industry giants such as Raymond Limited, a prominent Indian textile firm, and Foxconn Technology Group, a key Chinese supplier for tech behemoths like Samsung, are poised to substitute 10,000 and 60,000 workers, respectively, with automation in their production facilities.

- Piece-picking robots demand a hefty upfront investment, presenting a notable hurdle to market growth. This investment is further magnified by the necessity for supportive infrastructure. Moreover, technical constraints of these robots-such as their slower speeds, difficulties gripping unconventional items, and concerns about reliability-hinder market expansion.

- Like other advanced technologies, piece-picking robots need regular maintenance, which can lead to operational downtime. To ensure these robots fit seamlessly into high-throughput industries, it's crucial to minimize such interruptions. Additionally, given the unique workflows and product types across various industries, there's a strong demand for customization. This need complicates the deployment of piece-picking solutions, increasing both time and costs.

- The ongoing Ukraine conflict has disrupted the supply chain for raw materials and components vital to manufacturing piece picking robots. Such disruptions can result in shortages, longer lead times, and increased costs, all of which directly influence the market. In response, companies might turn to alternative suppliers or bolster local production, potentially reshaping market dynamics and pricing. The persistent Russia-Ukraine tensions, coupled with China's "Zero Tolerance Policy," have spurred a notable rise in global inflation. This inflation surge has reverberated across various sectors, notably the electronic components and industrial automation industries, driving up component prices and stunting the studied market's growth. Furthermore, elevated inflation and interest rates have curtailed consumer spending, further constraining market expansion.

Piece Picking Robots Market Trends

Retail, Warehousing, Distribution Centers, and Logistics Centers to be the Largest End Users

- As market demands shift swiftly, robotics is emerging as a vital asset for retail companies. Leading the charge are major players such as Amazon, Bossa Nova Robotics, and Brain Corp, propelling this surge in demand. Across the globe, organizations are adopting robotic automation in their warehouses, primarily to cut down on labor costs.

- Retail behemoths, including Amazon.com and Walmart, have seamlessly integrated mobile robots into their warehouses and retail outlets. With consumer expectations leaning towards on-demand retail, there's a noticeable shift in inventory strategies. In light of this, retailers are pouring investments into e-commerce infrastructure, omnichannel fulfillment, and setting up smaller stores in closer proximity to consumers.

- Beyond warehousing, robotics is making waves in retail. In-store robots are not just assisting customers; they're managing inventory and even taking on cleaning duties. Such innovations are not only boosting operational efficiency but also allowing retailers to provide tailored services. With technological strides and a push for competitive differentiation, the adoption of robotics shows no signs of slowing down. As the retail landscape continues to evolve, those companies that harness robotics adeptly stand to gain a pronounced advantage in the market.

- The shifting paradigms of traditional businesses, notably the retail sector's pivot from physical stores to online platforms, are fueling growth in the examined market. For instance, data from the US Census Bureau underscores the steady ascent of e-commerce's prominence in the US retail arena. In Q2 2024, e-commerce constituted 16% of the total retail sales in the US, a rise from the previous quarter. Additionally, from April to June 2024, US retail e-commerce sales eclipsed USD 291 billion, marking a historic high for quarterly revenue.

- As businesses strive to adapt to surging e-commerce demands, labor shortages, and the necessity for swift and accurate order fulfillment, the adoption of piece-picking robots is witnessing a notable uptick across Retail, Warehousing, Distribution Centers, and Logistics Centers. Thanks to technological advancements such as artificial intelligence (AI), machine learning, 3D vision, and Autonomous Mobile Robots (AMRs), piece-picking robots are cementing their status as integral components of modern retail and logistics infrastructure.

- With industry giants like Amazon, Walmart, DHL, and Alibaba continuously investing in these technologies, the trajectory of global logistics and retail fulfillment is set to be significantly influenced, heralding rapid growth for robotic systems in this market.

North America Holds Significant Market Share

- The North American segment, encompassing countries like the US and Canada, holds a significant share of the global piece-picking robots market. This dominance is attributed to the region's advanced technological infrastructure, a robust demand for automation, and evolving sectors such as manufacturing, logistics, retail, and warehousing. Key drivers for the adoption of piece-picking robots in North America include the push for operational efficiency, cost reduction, the surge of e-commerce, and a tightening labor market.

- Labor shortages, particularly in distribution and warehousing sectors reliant on repetitive manual tasks, have notably spurred the adoption of automation in the US and Canada. With wages on the rise and labor becoming scarce, companies are turning to robotic solutions to sustain production and curtail operating costs.

- According to the US Chamber of Commerce, the manufacturing sector faced a major blow, shedding around 1.4 million jobs at the pandemic's onset. Data from February 2023 by the US Bureau of Labor & Statistics highlighted about 750,000 unfilled positions in manufacturing. Projections suggest over 2 million manufacturing roles could remain vacant in the US by 2030. Such dynamics have driven both manufacturing and non-manufacturing entities to increasingly adopt automation and robotic technologies. Furthermore, numerous market players are actively bolstering their presence in the region.

- For example, in February 2023, Rapyuta Robotics, known for its collaborative pick-assist robots (Rapyuta PA-AMR) and warehouse solutions, inaugurated its US subsidiary. This move marks Rapyuta's second international venture following its establishment in India. With its advanced technology and hardware, Rapyuta aims to deliver substantial value to the US market. The Chicago office is poised to boost Rapyuta's sales and operations nationwide, underscoring the company's commitment to ensuring a solid return on investment for its American customers.

- Factors like the e-commerce surge, technological advancements, labor challenges, and heightened investment in automation are propelling the swift growth of North America's piece-picking robots market. Businesses spanning manufacturing, logistics, retail, and e-commerce are leveraging these robots to enhance efficiency, cut costs, and boost accuracy. Given the ongoing advancements in artificial intelligence (AI), machine learning, and robotic systems, North America is not only poised for significant growth in the coming years but is also set to maintain its pivotal role in the global piece-picking robot arena.

Piece Picking Robots Industry Overview

The piece-picking robot market includes several key players, including SSI Schaefer, Swisslog, Dematic, and RightHand Robotics. Their presence and ongoing innovations are reshaping the market landscape.

For instance, in September 2023, MOVU Robotics, a significant player in crafting and deploying advanced warehouse automation solutions, announced its latest innovation, the 'Movu Eligo' robot picking arm. Given their market penetration and advanced product offerings, competitive rivalry is set to escalate during the forecast period.

With moderate entry barriers, several Venture Capital (VC)-)-backed newcomers have gained traction, potentially heightening market competition. To secure a competitive advantage, players enhance bot capabilities for better Return on Investment (ROI) and quicker pick rates. They also invest in advanced technologies like Artificial Intelligence (AI), deep learning, and vision tech. Moreover, consistent access to quality components boosts performance. In summary, the market is characterized by intense competition and high rivalry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Automation Industry

- 4.5 Piece-picking Robot Software Technology and Evolution

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 A Shift from Full-case or Pallet Picking to Piece Flow and Improved Technology Investments

- 5.1.2 Increasing Investments in Automation

- 5.2 Market Challenges

- 5.2.1 Slower Speeds, Inability of the Grippers to Deal with Unusual Items, and Reliability Issues

6 MARKET SEGMENTATION

- 6.1 By Type of Robot

- 6.1.1 Collaborative

- 6.1.2 Mobile and others

- 6.2 By End User Application

- 6.2.1 Pharmaceutical

- 6.2.2 Retail/Warehousing/Distribution Centers/Logistics Centers

- 6.2.3 Other End User Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Plus One Robotics Inc.

- 7.1.2 Ocado Group Plc

- 7.1.3 Universal Robots A/S (TERADYNE, INC.)

- 7.1.4 XYZ Robotics Inc.

- 7.1.5 Righthand Robotics Inc.

- 7.1.6 Berkshire Grey Inc.

- 7.1.7 Robomotive BV

- 7.1.8 Lyro Robotics Pty Ltd.

- 7.1.9 Knapp AG

- 7.1.10 Grey Orange Pte. Ltd.

- 7.1.11 Hand Plus Robotics Pte Ltd

- 7.1.12 Dematic Group (KION Group AG)

- 7.1.13 Nomagic Inc.

- 7.1.14 Fizyr B.V.

- 7.1.15 Mujin Inc.

- 7.1.16 Nimble Robotics Inc.

- 7.1.17 Swisslog Holding AG

- 7.1.18 Daifuku Co., Ltd.

- 7.1.19 Osaro Inc.

- 7.1.20 Covariant

- 7.1.21 SSI Schaefer Group