|

市场调查报告书

商品编码

1690800

汽车智慧玻璃:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Smart Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

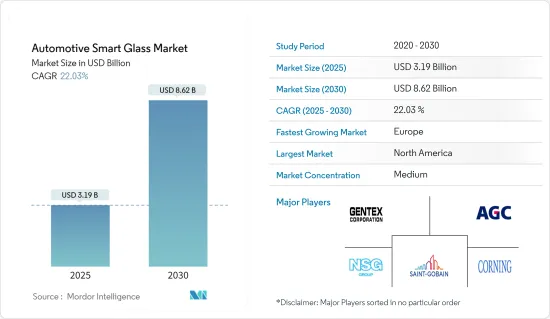

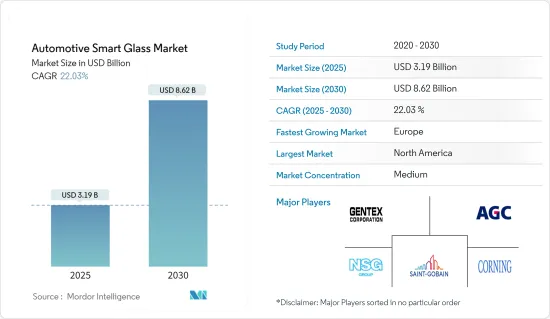

预计 2025 年汽车智慧玻璃市场规模为 31.9 亿美元,到 2030 年将达到 86.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.03%。

由于技术进步和消费者对先进汽车功能的需求不断增加,汽车智慧玻璃市场正在经历显着增长。智慧玻璃,也称为可切换玻璃,具有色调调节、透明度控制和减少热量等功能,可提高车辆的舒适度和能源效率。

开发人员不断开发新材料和新技术,以提高智慧玻璃解决方案的性能和可靠性。例如,电致变色和悬浮颗粒装置(SPD)技术的进步使得智慧玻璃产品具有更快的反应时间、更高的能源效率和更强的耐用性。

汽车製造商、玻璃製造商和技术供应商之间的合作也在推动市场扩张。利用玻璃製造商和汽车製造商的专业知识,我们将智慧玻璃解决方案整合到新车型中,满足消费者对高级功能和舒适性的需求。

此外,随着汽车製造商寻求透过改善用户体验、能源效率和环境永续性的创新功能来实现其产品的差异化,汽车智慧玻璃市场预计将继续成长。这一演变凸显了智慧玻璃技术在塑造未来汽车设计和功能方面日益增长的重要性。

汽车智慧玻璃市场的趋势

车辆中悬浮颗粒装置 (SPD) 的普及率日益提高

乘用车正在推动汽车智慧玻璃市场的主导地位,这从多个行业因素和趋势中可见一斑。预计到 2023 年全球汽车销量将从 2022 年的约 5,860 万辆飙升至约 6,520 万辆。汽车销售的这一上升趋势反映了对包括智慧玻璃解决方案在内的先进汽车技术的需求日益增长。

悬浮颗粒装置(SPD)正成为汽车领域的重要创新。这些设备将汽车玻璃和塑胶转变为动态可调的灯光管理系统,从而增强了驾驶体验。这项技术对天窗、车窗和遮阳帽特别有益,显着提高了使用者的舒适度和车辆的美观度。

SPD智慧眼镜因其高效性而脱颖而出,其每平方公尺仅消耗1.5瓦电能,而PDLC智慧眼镜每平方公尺消耗3瓦电能。低能耗意味着提高燃料效率并减少对环境的影响。例如,大陆集团报告称,SPD智慧玻璃可以每公里减少4克二氧化碳排放,并将行驶里程提高5.5%。

此外,SPD智慧玻璃可大幅降低车内的热量,带来更舒适、更豪华的驾驶体验。梅赛德斯-奔驰在其 S-Class 轿车和 SL 跑车等高端车型中采用了 SPD 玻璃,可将车内温度降低多达 10 摄氏度(18 华氏度)。这种减少不仅提高了乘客的舒适度,而且还保护了内部装潢建材免受红外线和紫外线辐射引起的过早老化。

随着智慧玻璃技术的进步和主要汽车製造商的采用,预计乘用车将在汽车智慧玻璃市场保持主导地位。随着大陆集团等公司和梅赛德斯·奔驰等高端品牌对研发的持续投资以及其实际优势的展示,智慧玻璃将继续成为汽车行业竞争格局中的关键特征。

这种融合不仅满足了消费者对舒适性和效率的需求,也满足了更广泛的环境和永续性目标,进一步巩固了乘用车的市场领先地位。

欧洲可望成为成长最快的市场

近年来,尤其是在疫情之后,全部区域对豪华汽车的需求飙升。这种成长的推动因素是从传统功能转向天窗和自动着色玻璃等先进便利功能的巨大转变。这一趋势与消费者对汽车舒适性和豪华性的日益偏好相吻合。

推动市场成长的关键因素有几个,包括主要欧洲市场的乘用车销售量增加、豪华车销售上升以及汽车天窗的偏好日益提升。几十年来,德国汽车业一直是欧洲工业的支柱,并发展成为高科技汽车生产和创新的领导者。尤其是德国,汽车研发支出净成长超过60%,凸显了其作为推动汽车智慧玻璃需求的关键创新地点的作用。例如

- 韩国大型化学公司 LG 化学在赢得向德国汽车零件供应商 Webasto SE 供应可调嵌装玻璃膜的合约后,已进入汽车智慧玻璃膜市场。

- 根据 2024 年 4 月宣布的协议,LG 化学将向 Webasto 供应用于生产汽车天窗系统的先进可切换玻璃薄膜。这些配备 LG Chem 技术的系统将供应给欧洲各地的汽车製造商。

微软和大众于 2022 年 5 月联手将扩增实境眼镜融入汽车。此次合作旨在使扩增实境(未来移动概念的关键元素)更接近现实。大众汽车正在与微软合作,将 HoloLens 2混合实境眼镜引入行驶中的车辆,展示移动出行的未来。

搭载智慧眼镜的新车陆续发布,厂商们也正在寻求拓展该领域的业务。奥迪、宝马、日产和探测车等知名汽车製造商分别在其 Q 系列、X 系列、逍客和 Evoque 等热销车型上提供天窗选项。这一趋势凸显了先进的便利功能在汽车产业,特别是高端汽车领域日益增长的重要性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 配备智慧玻璃技术的豪华和高级汽车越来越受欢迎

- 市场限制

- 预计较高的初始成本将抑制市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依技术类型

- 电致变色

- 聚合物分散液晶元件(PDLC)

- 悬浮颗粒物检测装置 (SPD)

- 按应用程式类型

- 后侧窗

- 天窗玻璃

- 前后玻璃

- 按车型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 南非

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Corning Inc.

- Guardian Industries

- Saint-Gobain SA

- AGP Glass

- Hitachi Chemical Co. Ltd

- Research Frontiers Inc.

- Nippon Sheet Glass Co. Ltd

- AGC Inc.

- Gentex Corporation

- Gauzy Ltd.

第七章 市场机会与未来趋势

- 与车辆连接和电子设备集成

The Automotive Smart Glass Market size is estimated at USD 3.19 billion in 2025, and is expected to reach USD 8.62 billion by 2030, at a CAGR of 22.03% during the forecast period (2025-2030).

The Automotive Smart Glass Market is witnessing significant growth, driven by technological advancements and increasing consumer demand for advanced vehicle features. Smart glass, also known as switchable glass, offers functionalities such as tinting, transparency control, and heat reduction, enhancing both comfort and energy efficiency in automobiles.

Manufacturers are continually developing new materials and technologies to improve the performance and reliability of smart glass solutions. For instance, advancements in electrochromic and SPD (Suspended Particle Device) technologies have enabled faster response times, better energy efficiency, and enhanced durability of smart glass products.

Collaborations between automotive manufacturers, glass suppliers, and technology providers are also driving market expansion. Partnerships enable the integration of smart glass solutions into new vehicle models, leveraging the expertise of both glass manufacturers and automotive OEMs to meet consumer demands for advanced functionality and comfort.

Furthremore, the Automotive Smart Glass Market is poised for continued growth as automakers seek to differentiate their products with innovative features that enhance user experience, energy efficiency, and environmental sustainability. This evolution underscores the increasing importance of smart glass technologies in shaping the future of automotive design and functionality.

Automotive Smart Glass Market Trends

Rise in penetration of suspended particle devices (SPD) in vehicles

Passenger cars are driving the dominance of the Automotive Smart Glass Market, as evidenced by multiple factors and trends in the industry. In 2023, global car sales surged to approximately 65.2 million units, a significant increase from around 58.6 million in 2022. This upward trend in car sales reflects the growing demand for advanced automotive technologies, including smart glass solutions.

Suspended particle devices (SPD) are emerging as a critical innovation within the automotive sector. These devices enhance the driving experience by transforming car glass or plastic into a dynamically adjustable light-management system. This technology is particularly beneficial for sunroofs, windows, and visors, significantly improving user comfort and vehicle aesthetics.

SPD smart glasses stand out for their efficiency, consuming only 1.5 watts per square meter, compared to the 3 watts per square meter required by PDLC smart glass. This lower energy consumption translates into better fuel efficiency and reduced environmental impact. For example, Continental reports that SPD smart glass can reduce carbon dioxide emissions by 4 grams per kilometer and extend the driving range by 5.5%.

Moreover, SPD smart glass contributes to a more comfortable and luxurious driving experience by significantly reducing heat inside the vehicle. Mercedes-Benz has implemented SPD glass in high-end models like the S-class sedan and SL roadster, which has shown a reduction in interior temperature by up to 10 degrees Celsius (18 degrees Fahrenheit). This reduction not only enhances passenger comfort but also protects interior materials from premature aging caused by infrared and ultraviolet radiation.

Given the advancements in smart glass technology and its adoption by leading automotive manufacturers, passenger cars are positioned to continue their dominance in the Automotive Smart Glass Market. The ongoing investment in research and development by companies like Continental and the practical benefits demonstrated by luxury brands such as Mercedes-Benz ensure that smart glass will remain a key feature in the competitive landscape of the automotive industry.

This integration not only caters to consumer demand for comfort and efficiency but also aligns with broader environmental and sustainability goals, further solidifying the role of passenger cars in driving the market forward.

Europe is Expected to Grow at the Fastest Rate in the Market

The demand for luxury cars has surged across the region in recent years, particularly post-pandemic. This growth is driven by a significant shift from traditional features towards advanced convenience features, such as sunroofs and automatic tinted glass. This trend aligns with the increasing consumer preference for enhanced comfort and luxury in vehicles.

Several key factors are propelling the market's growth, including a rise in passenger car sales in major European markets, increasing sales of luxury cars, and a growing preference for vehicle sunroofs. The German automotive sector has been the backbone of the European industry for decades, evolving into a leader in high-tech automotive production and innovation. Notably, Germany has seen a net growth of over 60% in automotive R&D, highlighting its role as a critical innovation hub driving the demand for automotive smart glass. For instance,

- LG Chem Ltd., a leading South Korean chemical company, has entered the automotive smart glass film market by securing a contract to supply switchable glazing films to German auto parts supplier Webasto SE.

- Under the agreement announced in April 2024, LG Chem will provide its advanced switchable glass films to Webasto for use in manufacturing automotive sunroof systems. These systems, equipped with LG Chem's technology, will be supplied to car manufacturers across Europe.

Microsoft and Volkswagen collaborated to integrate augmented reality glasses into vehicles in May 2022. This partnership aims to bring augmented reality, a key element of future mobility concepts, closer to reality. Volkswagen has worked with Microsoft to make the HoloLens 2 mixed-reality glasses available in mobile vehicles, showcasing the future of mobility.

The market is further encouraged by several new car launches featuring smart glass, prompting manufacturers to expand their operations in this segment. Prominent car manufacturers like Audi, BMW, Nissan, and Range Rover are offering sunroof options in popular models such as the Q-series, X-series, Qashqai, and Evoque, respectively. This trend underscores the growing importance of advanced convenience features in the automotive industry, particularly within the luxury car segment.

Automotive Smart Glass Industry Overview

The automotive smart glass market is moderately consolidated, with a few major players such as Saint Gobin, AGC Inc., Nippon Sheet Glass Co. Ltd., Gentex Corporation, and Cornering Inc. having significant shares in the market due to their well-established and developed products among various automakers. The companies are focusing on innovative technologies and following strategies, like acquisition, licensing the technology, and partnership, to expand, sustain, and capture the potential demand for rapid adoption of technological trends in the automotive industry. For instance,

- In January 2023, Asahi India Glass partnered with Enormous Brands to create impactful brand films for AIS Windows, its doors and windows solutions brand. This move comes as the Indian system windows and doors market evolves, driven by changing lifestyles, urbanization, and smart city construction. AIS Windows caters to customer preferences with a range of aluminum and uPVC framing materials and diverse glass solutions, positioning itself to significantly impact the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption Of Luxury And Premium Vehicles Equipped With Smart Glass Technologies

- 4.2 Market Restraints

- 4.2.1 High Initial Cost Is Anticipated To Restrain The Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 By Technology Type

- 5.1.1 Electrochromic

- 5.1.2 Polymer Dispersed Liquid Device (PDLC)

- 5.1.3 Suspended Particle Device (SPD)

- 5.2 By Application Type

- 5.2.1 Rear and Side Windows

- 5.2.2 Sunroof Glass

- 5.2.3 Front and Rear Windshield

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 South Africa

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Corning Inc.

- 6.2.2 Guardian Industries

- 6.2.3 Saint-Gobain SA

- 6.2.4 AGP Glass

- 6.2.5 Hitachi Chemical Co. Ltd

- 6.2.6 Research Frontiers Inc.

- 6.2.7 Nippon Sheet Glass Co. Ltd

- 6.2.8 AGC Inc.

- 6.2.9 Gentex Corporation

- 6.2.10 Gauzy Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration with Vehicle Connectivity and Electronics