|

市场调查报告书

商品编码

1690805

采矿业传送带:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Conveyor Belt In Mining Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

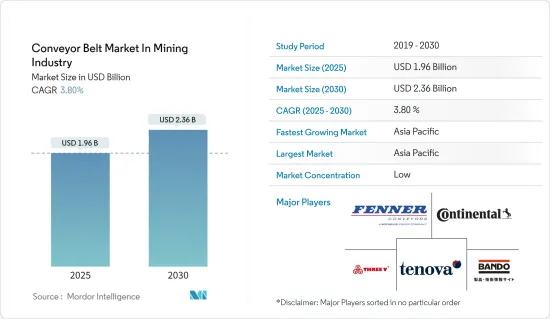

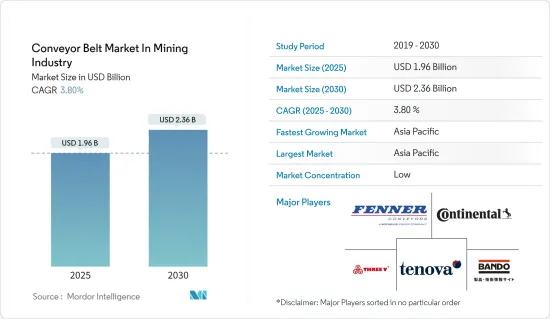

采矿市场传送带预计将从 2025 年的 19.6 亿美元成长到 2030 年的 23.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.8%。

在印度等国家,由于政府措施和煤矿数量的增加,需求正在增加。例如,根据该公司发布的技术路线图文件,在第二波疫情期间,印度煤炭公司计划采用能够每小时处理高达 4,500 吨煤炭的输送机。传统传送带的倾斜角度限制在 16 至 18 度左右。采用先进传送带升级矿山的重点正在推动市场成长。

主要亮点

- 在挖矿实务中,所需的功率输出是确定的,矿工指定旋转速度作为设计参数,这决定了要消散的热量。这会对尺寸标註过程产生很大影响。因此,在某些运转条件下,需要使用输出功率大于实际所需的齿轮组。如果在异常温暖的气候或容易出现极热或极冷的气候中使用输送机,则必须特别注意冷却。为此,西门子针对三个齿轮组系列、46种规格的输送机驱动装置开发了高效率的冷却解决方案。因此,在许多情况下,较小的齿轮组就足够了。

- 印度能否在2047年成为已开发国家取决于基础建设的改善。这是培育宜居、气候适应性和包容性城市并推动经济成长的基石。政府的承诺也体现在2024财年将把GDP的3.3%分配给基础建设领域,重点是建构高端工业部门。

- 确保职业安全和健康是采矿业的首要任务。采矿工作本身就很困难,为工人带来各种危险和风险。透过优先考虑安全并实施有效的安全措施,公司可以保护工人,防止事故和伤害,并为其营运的整体永续性做出贡献。

- 采矿业必须遵守重要的法规和标准,以确保安全、环境保护和负责任的做法。这包括矿山安全和健康法规,例如美国矿山安全和健康管理局 (MSHA) 的法规。

- 高昂的初始成本是限制只有较大的组织才能使用自动化物料输送系统(包括输送机和系统)的主要原因。同时也考虑长期利益。中小企业可能无法从这笔交易中获益。这些系统需要高水准的维护。

- 预计全球疫情将对各市场产生直接和长期影响。例如,疫情发生以来,一些受到影响的国家经济尚未如预期復苏,尤其是北美和欧洲笼罩在景气衰退的阴影之下。

- 例如,国际货币基金组织(IMF)估计,美国实际GDP成长率预计将在2024年放缓,然后恢復势头。这种趋势可能会减少对新金属和采矿厂的投资,从而减缓市场发展。

- 根据国际货币基金组织(IMF)2023年7月的最新预测,由于各国央行提高利率以对抗通膨且经济活动放缓,预计2023年和2024年全球经济成长将从2022年的3.5%放缓至3%左右。

采矿传送带的市场趋势

纺织增强传送带成长强劲。

- 纺织增强传送带通常用于输送磨料或重负载。对于较短的运输距离和较小的运输量,纺织增强传送带比钢丝传送带价格更实惠。纺织增强传送带是采矿、矿物加工和采石产业的理想选择。它们具有多种特性,包括耐油性、耐热性、耐磨性、耐衝击性和耐火性。高强度输送带的加强结构有四种基本结构:帘线织物、直经织物、实心织物和缆绳织物。

- 织物带的汽车胎体或编织内部结构由夹在橡胶基减震层之间的一系列单层或多层合成纤维层组成。上下皮带皆采用橡胶覆盖层构造,耐用、耐磨、防切割。此盖可保护皮带免受损坏,尤其是在传送带的装载点处。它为采矿业使用的传送带提供抗拉强度。

- 技术纺织品中使用的合成纤维比以前使用的天然纤维具有更高的强度、伸长率和柔韧性。主要纤维有棉、黏胶纤维、尼龙、聚酯纤维、玻璃和芳香聚酰胺。芳香聚酰胺的韧性是钢的七倍,但重量却比芳香聚酰胺轻。它可耐受 400-500°C 的温度、潮湿、化学品,并且还具有很强的耐磨性。这就是它们被用于采矿传送带的原因。其强度对采矿业输送带的承载能力和生产安全有重要的影响。因此,预计纺织增强传送带等材料将变得更加受欢迎,以增加传送带的强度。

- 皮带製造商提供编织皮带表,该表反映了根据皮带上所承载的各种材料类型和等级提案的皮带层数。在传送带中,编织织物优于钢筋,因为它们更灵活、强度更高、节能、耐腐蚀且重量更轻。

- 由于多个地区采矿活动的增加以及对采矿业的投资增加,预计预测期内对纺织增强输送带的需求将会上升。

亚太地区成长强劲

- 中国政府雄心勃勃的「中国製造2025」倡议在某种程度上受到德国的启发,该计画面向工业4.0,旨在提高中国在工业领域的竞争力。该十年规划于2015年5月推出,是政府竞标推动製造业向全球产业价值链的中高端迈进并培育若干先进製造业丛集做出的努力。工业化程度的提高可能会推动采矿业传送带解决方案市场的成长。

- 据国家发展和改革委员会称,2024年4月,中国宣布将建造更多煤矿,以帮助增加国内供应并抑制价格上涨。中国是世界上最大的煤炭生产国和消费国,已设定目标,到2030年新增约3亿吨/年的开采能力,作为「应急储备」。

- 政府对基础设施的投资和来自产业的投资增加,再加上「印度製造」计划,预计将推动市场研究。印度政府已将工业部门在国内生产总值(GDP)中的份额从2018年的17%提高到2022年的25%。

- 2024年2月,印度国有印度煤炭公司宣布将在5个新煤矿投入运营,并扩大至少16个现有煤矿的产能,以满足日益增长的石化燃料需求。该矿计划在下一财年启动五座新矿,总合年产量达 1,430 万吨。印度采矿业的这些发展可能会推动该地区的市场探索。

矿用输送带产业概况

由于存在小型、中型和大型企业以及全球性公司,采矿输送带市场高度分散。市场的主要企业包括三维控股集团、芬纳邓禄普澳洲有限公司(米其林集团)、阪东化学工业有限公司、康迪泰克德国有限公司(大陆集团)和 Tenova SPA(Techint 集团)。市场参与者正在采取收购和伙伴关係等策略来加强其产品供应并获得永续的竞争优势。

- 2024 年 1 月 - Fenner Dunlop BV 和 Fenner Dunlop Americas 宣布,将于 2024 年 1 月 1 日起合併为 Fenner Dunlop Conveyor Belting 品牌。此举旨在统一各地区和部门的品牌,以增强全球影响力。两个部门都将以芬纳邓禄普输送带公司的名义进行经营,并协调一致的品牌策略。这项变化凸显了芬纳集团对加强合作和市场影响力的承诺。

- 2023 年 11 月 - Gebr.Kufferath AG 宣布 Durensite 获得 IATF 16949 认证。此项认证证实了 GKD 对各行业最高品质标准的承诺。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠肺炎疫情和其他宏观经济趋势对市场的影响

- 在采矿业中,针对不同负载容量采用不同类型的输送机解决方案

- 采矿设施中传送系统的平均成本

第五章 市场动态

- 市场驱动因素

- 基础建设和建筑业的成长

- 更重视职场的安全

- 市场限制

- 资本要求高,技术纯熟劳工短缺

- 评估新冠肺炎对产业的影响

第六章 市场细分

- 按类型

- 钢丝

- 纺织加固

- 其他类型

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Sanwei Holding Group Co. Ltd

- Fenner Dunlop Australia Pty Ltd(Michelin group)

- Bando Chemical Industries Ltd

- ContiTech Deutschland GmbH(Continental AG)

- Tenova SpA(Techint Group)

- Dynamic Rubbers Pvt. Ltd

- Oriental Rubber Industries Pvt. Ltd

- Zhejiang Double Arrow Rubber Co. Ltd

- Bridgestone Corporation

- GKD Gebr. Kufferath AG

第八章投资分析

第九章 市场机会与未来趋势

The Conveyor Belt Market In Mining Industry is expected to grow from USD 1.96 billion in 2025 to USD 2.36 billion by 2030, at a CAGR of 3.8% during the forecast period (2025-2030).

The demand is boosted owing to increasing government initiatives and the number of coal mines in countries such as India. For instance, during the second pandemic wave, the Technology Roadmap document released by Coal India outlines that conveyors that may handle coal up to 4,500 tph/hr have been planned in Coal India. Conventional conveyors are limited to inclined angles around 16 to 18 degrees. The focus on upgrading the mines with advanced conveyor belts is aiding the market's growth.

Key Highlights

- In mining industry practices, the required output is desired, and the mining operator specifies rotary speed as a design parameter, determining the heat to be dissipated. This may strongly influence the dimensioning processes. This resulted in operating conditions that make a gear unit advisable larger than the output originally necessitates. If the conveyor belts operate in climatic zones that are unusually warm or even prone to extreme heat-cold fluctuations, much attention must be paid to cooling. For this reason, Siemens developed correspondingly efficient cooling solutions for its three gear-unit series, comprising 46 conveyor belt drive sizes. Therefore, in various cases, a smaller gear unit may be sufficient.

- India's journey toward becoming a developed nation by 2047 depends on improving its infrastructure. This is a cornerstone for fostering liveable, climate-resilient, and inclusive cities that drive economic growth. The government's commitment is evident through its allocation of 3.3% of GDP to the infrastructure sector in the fiscal year 2024, focusing on building high-end industrial segments.

- Ensuring occupational health and safety is a top priority in the mining industry. Mining operations are inherently challenging and pose various hazards and risks to workers. By prioritizing safety and implementing effective safety measures, companies may protect their workers, prevent accidents and injuries, and contribute to the overall sustainability of their operations.

- The mining industry operates under critical regulations and standards to ensure safety, environmental protection, and responsible practices. These include mine safety and health regulations, such as the Mine Safety and Health Administration (MSHA) in the United States.

- High initial costs have been the primary reason for restricting the use of automated material-handling systems, including conveyor belts and systems, to only large-scale organizations. At the same time, their long-term benefits are also considered. Small-and medium-scale enterprises may not benefit from this bargain. These systems require high levels of maintenance.

- Besides the direct impact on various market verticals, the global pandemic is also anticipated to have a long-term effect. For instance, since the pandemic, economies of multiple countries, which feel significant, are still unable to recover as anticipated, bringing a shadow of economic recession, especially in North American and European regions.

- For instance, according to the International Monetary Fund (IMF) estimates, the US real GDP growth is anticipated to remain slowed until 2024 before regaining momentum. Such trends may slow down the market by reducing investments in new metal and mining plants.

- According to the International Monitory Fund's (IMF's) July 2023 update, global economic growth was anticipated to fall from 3.5% in 2022 to about 3% in both 2023 and 2024 owing to the rising central bank policy rates to fight inflation, which is slowing down economic activities.

Mining Conveyor Belt Market Trends

Textile-reinforced Conveyor Belts to Witness Significant Growth

- Conveyor belts with textile reinforcement are typically used for abrasive and heavy-duty goods. They are a more affordable alternative to steel cord belts for shorter transporting distances and lesser capacities. The textile-reinforced conveyor belt is ideal for mining, mineral processing, and quarrying sectors. It may be blended with many different qualities, such as covers that are grease, heat, abrasion, impact, and fire-resistant quality. There are four basic types of construction for reinforcing high-strength belts: cord fabrics, straight warp fabrics, solid woven fabric, and cabled cords.

- The internal structure of a fabric belt carcass or textile consists of a single or multi-layered series of synthetic fabric layers interlaced between rubber-based shock-absorbent layers. The top and bottom sides of the belt consist of hard-wearing, abrasion, and cut-resistant rubber covers. The covers protect the belt from damage, especially at the loading points of the conveyor. This provides the tensile strength to the conveyor belt used in the mining industry.

- The strength, extension, and flexibility of synthetic fibers used in technical woven fabrics are higher than natural fibers used earlier. The primary fibers are cotton, viscose rayon, nylon, polyester, glass, and aramid. The aramid tenacity is seven times that of steel, and aramid is lighter than steel. It resists temperatures of 400-500 0C, dampness, and chemicals and has high abrasion resistance. Thus, it is used in mining conveyor belts. Its strength significantly influences the mining industry's carrying capacity and operating safety of conveyor belts. Therefore, materials like textile-reinforced conveyor belts are anticipated to become more prevalent to boost the conveyor belt's strength.

- The belting manufacturers supply tables for fabric belting, reflecting the number of plies proposed for a belt based on the different types and grades of materials to be transported on the belt. The fabric is better than steel reinforcement in conveyor belts as textiles make it much more flexible, high-strength, energy-efficient, corrosion-resistant, and lightweight.

- With rising mining activities across several regions and increased investments in the mining industry, the need for textile-reinforced conveyor belts is expected to rise in the forecast period.

Asia-P acific to Register Major Growth

- The government's ambitious 'Made in China 2025' initiative, partially inspired by Germany, for Industry 4.0 aims to boost the country's competitiveness in the industrial sector. The ten-year plan, introduced in May 2015, is the government's bid to shift the industries up to the medium-high end of the global industry value chain and foster several advanced manufacturing clusters. The increase in industrialization will grow the market for conveyor belt solutions for the mining sector.

- In April 2024, according to the National Development and Reform Commission, China announced it would build more coal mines to push for higher domestic supply and tame price increases. The world's biggest coal producer and consumer set targets to add about 300 million tons of annual mining capacity for "emergency storage reserves" by 2030.

- The increased government's infrastructure investments and investments from industries, coupled with the 'Make in India' initiative, are expected to drive the market studied. The Government of India increased the industrial sector's share of the gross domestic product (GDP) to 25% by 2022, from 17% in 2018.

- In February 2024, Indian state-run company Coal India announced it would begin operations at five new coal mines and expand the capacity of at least 16 existing mines to help meet the growing demand for fossil fuel. The miner plans to start operations at five new mines in the next fiscal year, with a combined annual capacity of 14.3 mt. These developments in the mining sector in India are likely to drive the market studied in the region.

Mining Conveyor Belt Industry Overview

The mining conveyor belt market is highly fragmented due to the presence of small and medium-sized enterprises and global players. Some of the major players in the market are Sanwei Holding Group Co. Ltd, Fenner Dunlop Australia Pty Ltd (Michelin Group), Bando Chemical Industries Ltd, Contitech Deutschland GMBH (continental AG), and Tenova SPA (Techint Group). Players in the market are adopting strategies such as acquisitions and partnerships to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Fenner Dunlop BV and Fenner Dunlop Americas announced they would merge under the Fenner Dunlop Conveyor Belting brand starting January 1, 2024. The move aims to unify the brand across regions and divisions for a more robust global presence. Both divisions will trade under the Fenner Dunlop Conveyor Belting name, aligning their strategies for consistent branding. This change underscores the Fenner Group's commitment to enhanced coordination and market impact.

- November 2023 - Gebr. Kufferath AG announced the successful certification from IATF 16949 for the Durensite. The certification confirms GKD's commitment to the highest quality standards in various industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Trends on the Market

- 4.5 Various Types of Conveyor Solutions for Various Payloads Handled in the Mining Industry

- 4.6 Average Cost for Conveyor Systems in a Mining Setup

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Infrastructure Development and the Building Industry

- 5.1.2 Increased Emphasis on Workplace Safety

- 5.2 Market Restraints

- 5.2.1 High Capital Requirements and Unavailability for Skilled Workforce

- 5.3 Assessment of the Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Steel Cord

- 6.1.2 Textile Reinforced

- 6.1.3 Other Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sanwei Holding Group Co. Ltd

- 7.1.2 Fenner Dunlop Australia Pty Ltd (Michelin group)

- 7.1.3 Bando Chemical Industries Ltd

- 7.1.4 ContiTech Deutschland GmbH (Continental AG)

- 7.1.5 Tenova SpA (Techint Group)

- 7.1.6 Dynamic Rubbers Pvt. Ltd

- 7.1.7 Oriental Rubber Industries Pvt. Ltd

- 7.1.8 Zhejiang Double Arrow Rubber Co. Ltd

- 7.1.9 Bridgestone Corporation

- 7.1.10 GKD Gebr. Kufferath AG