|

市场调查报告书

商品编码

1690824

驱蚊剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mosquito Repellent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

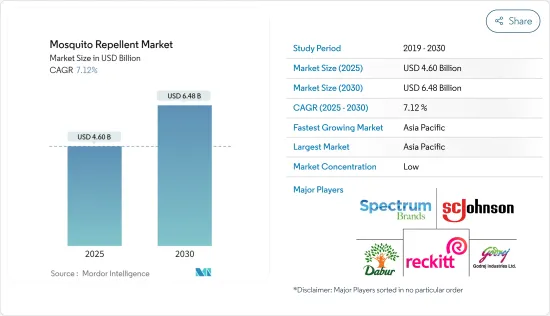

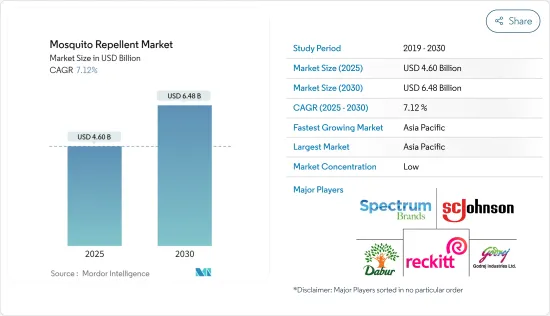

驱蚊剂市场规模预计在 2025 年为 46 亿美元,预计到 2030 年将达到 64.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.12%。

消费者对蚊媒疾病认识的不断提高以及对保持健康和卫生的需求不断增长,推动了全球驱蚊剂市场的成长。此外,登革热、疟疾、基孔肯雅病、日本脑炎和淋巴丝虫病等媒介传播疾病的发生率也有所增加。这些疾病在世界各地造成了严重的公共卫生问题,大多数疫情发生在季风季节。例如,2023年10月,孟加拉经历了有史以来最严重的登革热疫情。气候变迁导致的气温上升加剧了登革热在农村和都市区的蔓延。根据孟加拉卫生服务总局的官方统计,截至 2023 年 1 月,全国已有 1,017 人死亡,其中包括 100 多名儿童,感染人数已上升至 208,000 多人。这些蚊媒疾病不仅影响人类,还会将多种疾病和寄生虫传播给狗,包括犬心臟病、西尼罗河病毒 (WNV) 和东部马脑炎 (EEE)。

此外,驱蚊剂市场的公司正在与世界各地的地方政府和大学密切合作,进行各种宣传宣传活动,教育大众如何避免昆虫并最终预防疾病。此外,广告宣传在促进消费者意识和产品教育方面发挥着至关重要的作用。例如,2021 年 10 月,达伯印度有限公司发起了一项重大倡议—#MakingIndiaDengueFree宣传活动,以推广其驱蚊品牌 Odomos。这些宣传活动趋势,加上天然和植物来源驱虫剂以及具有持久功效的产品日益增长的趋势,正在推动全球市场的成长。此外,环保无毒配方在市场上越来越受欢迎。这促使製造商推出新产品。例如,2022 年,庄臣推出了喷雾和湿纸巾两种类型的驱蚊剂 STEM。根据该公司介绍,STEM 驱蚊剂采用柠檬草、薄荷和迷迭香油等植物活性成分配製而成,可提供有效的解决方案。

驱蚊剂市场趋势

喷雾/气雾剂市场需求旺盛

除家庭使用外,驱蚊喷雾也经常在户外活动中使用,如露营、远足、野餐、园艺等。它可以减少蚊虫叮咬带来的不适和潜在的健康风险,并带来愉快的体验。全球范围内此类活动的增加是推动该领域市场成长的主要因素之一。例如,根据户外基金会的数据,2023年美国有超过6,100万人至少参加过一次健行活动。这是自2010年以来北美地区记录的最高数字,比当年的数字增加了约89%。此外,驱蚊喷雾剂在大型室内空间和室外区域均有效,消费者可以在整个房间或室外环境中喷洒喷雾剂,以便在一段时间内创造无蚊区。这种广泛的覆盖范围使气雾剂成为家庭使用的理想选择。

此外,据观察,许多传统驱蚊剂由于使用了活性成分而具有独特的、有时令人不快的气味,因此製造商在其驱蚊剂中加入水果或花香,使其使用起来更加愉快。这对于对强烈化学气味敏感的人来说尤其有吸引力。大公司正在提供此类产品以及驱蚊剂来吸引更多的人。例如,2023年2月,Godrej Consumer Products推出了一款低成本液体驱蚊剂和一款无气体速效驱蚊喷雾。该公司表示,Goodknight Mini Liquid 和 HIT No-Gas Spray 将为低收入家庭提供安全、无烟的驱蚊剂。预计预测期内市场上出现的此类创新突破将进一步支持和促进市场成长。

亚太地区是一个快速成长的市场

亚太地区占有最大的市场份额,预计未来几年将出现显着增长,这主要是由于人们对驱蚊剂认识的提高,蚊媒疾病的流行率以及政府和非政府支持市场占有率的数量不断增加,以尽量减少蚊媒疾病的发生。例如,中国国土面积广阔,气候类型多样,属于亚热带气候,非常利于蚊子的传播。因此,他们面临疟疾、登革热和兹卡病毒等蚊媒疾病的挑战。这些疾病会对民众的健康构成重大风险,因此增加了对驱蚊剂作为预防措施的需求。例如,根据世界卫生组织(WHO)的数据,2023年8月中国全国报告了4,198例登革热病例。因此,全国对驱蚊剂的需求正在增加。此外,政府控制疾病的措施、人们日益增强的健康意识以及这些产品的价格实惠是支持该地区驱蚊剂需求的关键因素。例如,印度政府推出了“国家消除疟疾战略计划”,目标是到2027年使印度成为一个无疟疾国家,到2030年彻底消灭疟疾。此外,清洁印度运动等各种计划的推出,在人们心中建立了卫生和清洁的重要性,从而推动了该国驱蚊剂市场的成长。

此外,以天然成分为基础的驱蚊剂的采用也越来越多。由于消费者担心避免皮肤刺激和过敏等问题,此类驱蚊剂的采用越来越多。因此,製造商开始涉足提供使用天然成分的驱蚊剂。例如,Goodknight 提供一种驱蚊滚珠布,据称其 100% 天然,含有香茅油和尤加利油等成分。同样,Mamaearth、Mother Sparsh、Herbal Strategi 和 Softsens 等品牌也开始提供天然和草本驱蚊剂,以满足全部区域日益增长的需求。

驱蚊产业概况

驱蚊剂市场竞争激烈,市场主要企业正采取产品发布、业务扩展、伙伴关係等策略,以建立强大的消费群和受人尊敬的市场地位。主要企业正在透过增加产品系列的创新来增加市场占有率。为了在市场上取得竞争优势,企业利用各种因素进行竞争,以满足高端和低端经济细分市场的需求。公司正在推出使用植物来源成分的儿童产品和针对低收入消费者的产品。此外,主要企业正在采取必要措施,扩大其业务营运的地域和生产能力,增加销售额,并提升其全球品牌影响力。此外,公司也开展社群媒体宣传活动来促销他们的驱蚊产品。主要参与者包括 Godrej Consumer Products Ltd、SC Johnson &Son、Dabur India Ltd、Spectrum Brands Holdings Inc. 和 Reckitt Benckiser。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 媒介传播疾病的增加推动市场成长

- 广告和促销宣传活动以支援需求

- 限制因素

- 驱蚊剂:对环境和人类来说是一种无声的毒药

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 液体蒸发器

- 蚊香

- 喷雾剂/气雾剂

- 乳霜、乳液、滚珠

- 其他产品类型

- 成分类型

- 天然驱蚊剂

- 传统驱蚊

- 分销管道

- 超级市场/大卖场

- 便利商店/杂货店

- 网路零售商

- 其他分销管道

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 西班牙

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 主要企业策略

- 市场占有率分析

- 公司简介

- SC Johnson & Son Inc.

- Reckitt Benckiser Group PLC

- Spectrum Brands Holdings Inc.

- Godrej Consumer Products

- Dabur India Limited

- PIC Corporation

- Tiger Brands Ltd

- Pif Paf Alimentos

- Honasa Consumer Pvt. Ltd

- Henkel AG & Co. KGaA

第七章 市场机会与未来趋势

The Mosquito Repellent Market size is estimated at USD 4.60 billion in 2025, and is expected to reach USD 6.48 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

The increase in consumer awareness regarding mosquito-borne diseases and rising demand for maintenance of health and hygiene is propelling the growth of mosquito repellents in the global market. In addition to this, the incidences of vector-borne diseases such as dengue, malaria, chikungunya, Japanese encephalitis, and lymphatic filariasis are on the rise. These diseases pose significant public health concerns globally, with most of them being prevalent during the monsoon season. For instance, in October 2023, Bangladesh witnessed the worst dengue outbreak on record, with rising temperatures due to climate change driving the ongoing spread in both rural and urban areas. The official statistics from the Bangladesh Directorate General of Health Services claimed that as of January 2023, 1,017 people had died across the country, including more than 100 children, with infections rising to over 208,000. Such mosquito diseases not only affect humans, but they also transmit several diseases and parasites to dogs, such as dog heartworm, West Nile virus (WNV), and Eastern equine encephalitis (EEE).

Moreover, companies operating in the mosquito repellent market are working closely with regional governments and universities worldwide to run several awareness campaigns to educate the public about ways to avoid insects and, consequently, prevent diseases. Additionally, advertising campaigns play an important role in promoting consumer awareness and product education. For instance, in October 2021, Dabur India Ltd launched its mega initiative, the #MakingIndiaDengueFree campaign, to promote its mosquito repellent brand, Odomos. Such campaigns, coupled with the growing trend of natural and plant-based repellents and products with long-lasting effectiveness, are some factors supporting the market's growth across the globe. Moreover, eco-friendly and non-toxic formulations are gaining popularity in the market. This, in turn, encourages manufacturers to launch new products. For instance, in 2022, S.C. Johnson launched STEM, a new lineup of mosquito repellent in spray and wipe forms. As per the company's claim, the STEM mosquito repellent is formulated using plant-active ingredients such as lemongrass, mint, and rosemary oil to provide an effective solution.

Mosquito Repellent Market Trends

Spray/Aerosols Are Gaining High Demand In The Market

Mosquito sprays are commonly used during outdoor activities such as camping, hiking, picnics, or gardening, apart from household usage. These activities often take place in areas where mosquitoes are prevalent, and applying mosquito spray helps create a comfortable experience by reducing the annoyance and potential health risks associated with mosquito bites. The rise in such activities across the globe is one of the major factors driving the segment's growth in the market. For instance, according to the Outdoor Foundation, more than 61 million people in the United States participated in hiking activities at least once in 2023. This was the highest figure recorded in the North American country since 2010 and represented a growth of around 89% over the figure recorded in that year. Additionally, mosquito aerosols are also effective in treating larger indoor spaces or outdoor areas, and consumers can create a mosquito-free zone for a specific period by spraying the aerosol throughout a room or an outdoor environment. This wide coverage makes aerosols suitable for use in homes.

Moreover, as many traditional mosquito repellents have a distinct and sometimes unpleasant odor due to the active ingredients used, manufacturers are observed to be incorporating fruity and floral fragrances into mosquito sprays, making them more pleasant to use. This can be especially appealing for individuals who are sensitive to strong chemical smells. Major players are offering such products along with mosquito repellent devices to attract a wider audience. For example, in February 2023, Godrej Consumer Product launched a low-cost liquid mosquito repellent device and a no-gas instant mosquito-kill spray. The company claims that Goodknight Mini Liquid and HIT No-Gas Spray make safe and smoke-free mosquito protection accessible for lower-income consumers. Such innovative developments happening in the market are expected to further support and boost the market's growth during the forecast period.

Asia-Pacific is the Fastest-growing Regional Market

Asia-Pacific holds the largest market share with a significant growth potential over the coming years, majorly owing to the growing awareness about mosquito repellents, the high number of mosquito-borne diseases, and increased government and non-government-supported programs to minimize incidences of mosquito-borne diseases. For instance, China is a huge country with various climates, including sub-tropical climates, that are favorable for mosquito spread. Thus, the country faces the challenge of mosquito-borne diseases such as malaria, dengue fever, and Zika virus. These diseases can pose significant health risks to the population, leading to an increased demand for mosquito repellents as a preventive measure. For example, according to the World Health Organization, in August 2023, there were 4,198 dengue cases reported across China. Owing to this, there has been a strong demand for mosquito repellents across the country. Additionally, the disease control initiatives undertaken by the government, rising health awareness among people, and the affordable costs of these products are some of the major factors supporting the demand for mosquito repellents in the region. For instance, the Indian government launched the National Strategic Plan for Malaria Elimination, aiming to make India a malaria-free country by 2027 and eliminate the disease completely by 2030. In addition, the launch of various programs like the Swacch Bharat Abhiyaan has created a sense of the importance of hygiene and cleanliness in people's minds, improving the market growth of mosquito repellents in the country.

Furthermore, there has been a rise in the adoption of mosquito repellents based on natural ingredients. The adoption of such mosquito repellents has been increasing due to consumers' interest in avoiding problems such as skin rashes and allergies. Thus, manufacturers have started to be involved in offerings of mosquito repellent made with natural ingredients. For instance, Goodknight offers mosquito repellent fabric roll-on, which it claims to be 100% natural, consisting of ingredients like citronella and eucalyptus oil. Similarly, brands like Mamaearth, Mother Sparsh, Herbal Strategi, and Softsens, have started to provide natural and herbal mosquito repellents to cater to the growing demand across regional countries.

Mosquito Repellent Industry Overview

The mosquito repellent market is competitive, with the major players of the market indulging in strategies like product launches, expansions, and partnerships to establish a strong consumer base and esteemed position in the market. The major companies are increasing their market share through increased innovation in their product portfolio. To gain a competitive advantage in the market, companies compete on different factors addressing both high-end and low-end economic groups. Companies are launching products for children with plant-based ingredients and other products for low-income groups. The leading companies are also taking necessary measures to increase their business operations in terms of geography and production capacity to boost sales and enhance brand presence worldwide. Moreover, players are launching social media campaigns to promote mosquito-repellent products. A few major players include Godrej Consumer Products Ltd, S.C. Johnson & Son, Dabur India Ltd, Spectrum Brands Holdings Inc., and Reckitt Benckiser.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Incidences of Vector-borne Disease Fueling Market Growth

- 4.1.2 Advertisements and Promotional Campaigns Supporting Demand

- 4.2 Restraints

- 4.2.1 Mosquito Repellents: Silent Toxicant to the Environment and Humans

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Liquid Vaporizers

- 5.1.2 Coils

- 5.1.3 Sprays/Aerosols

- 5.1.4 Creams, Lotions, and Roll-ons

- 5.1.5 Other Product Types

- 5.2 Ingredient Type

- 5.2.1 Natural Mosquito Repellent

- 5.2.2 Conventional Mosquito Repellent

- 5.3 Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience/Grocery Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 S. C. Johnson & Son Inc.

- 6.3.2 Reckitt Benckiser Group PLC

- 6.3.3 Spectrum Brands Holdings Inc.

- 6.3.4 Godrej Consumer Products

- 6.3.5 Dabur India Limited

- 6.3.6 PIC Corporation

- 6.3.7 Tiger Brands Ltd

- 6.3.8 Pif Paf Alimentos

- 6.3.9 Honasa Consumer Pvt. Ltd

- 6.3.10 Henkel AG & Co. KGaA