|

市场调查报告书

商品编码

1690842

拉丁美洲低温运输物流:市场占有率分析、产业趋势与成长预测(2025-2030)Latin America Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

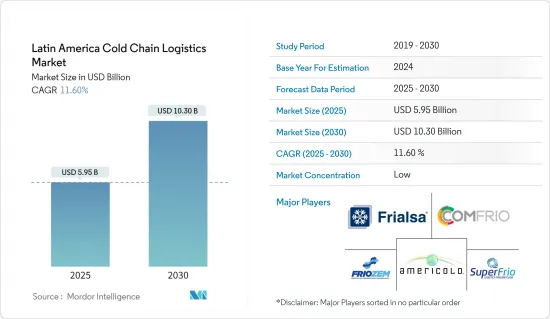

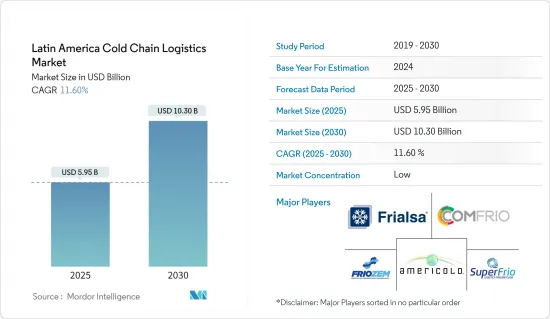

拉丁美洲低温运输物流市场规模预计在2025年为58.7亿美元,预计到2030年将达到101.5亿美元,预测期内(2025-2030年)的复合年增长率为11.60%。

拉丁美洲国家向全球出口各种各样的产品,其中许多产品以天然、优质的状态交付给消费者。这些产品包括肉类、鱼类、水果和乳製品,高度依赖不间断的低温运输。北美、欧洲甚至拉丁美洲本身都是主要的出口目的地,但某些产品也出口到非洲和南美,尤其是新冠疫苗等医药产品。

药品需求激增,尤其是辉瑞/Biontech 的新冠疫苗等需要超低温的药品需求,正在推动拉丁美洲低温运输产业的创新和扩张。但劳动力短缺和基础设施不足等挑战依然存在,需要采取统一的政治、社会和财政应对措施。

拉丁美洲的疫苗贸易,加上对冷冻食品和乳製品日益增长的需求,对于推动市场至关重要。巴西位居榜首,其次是墨西哥、阿根廷和哥伦比亚。预计到 2025 年,加工食品销售额将大幅成长,为低温运输物流和仓储公司创造丰厚的利润机会。预计秘鲁在 2020 年至 2026 年期间的成长率将达到 15.16%,参与企业将加入该地区其他领先的低温运输企业。

儘管面临劳动力短缺和仓库爆满等挑战,拉丁美洲的生鲜食品供应链仍保持弹性。这些障碍促使该地区现有参与企业加强其技术力,以缓解该地区的冷冻空间短缺问题。

2022 年 10 月,总部位于乌拉圭蒙得维的亚的 Frigorifico Modelo (Frimosa) 宣布将其冷藏业务出售给 Emergent Cold LatAm。 Emergent Cold LatAm 是该地区主要企业,将收购 Frimosa 位于 Polo Oeste 的旗舰设施。此外,Emergent Cold LatAm 计划在巴拉圭亚松森购买一个可容纳 8,400 个托盘的仓库。

总之,受药品和生鲜食品需求不断增长的推动,拉丁美洲的低温运输产业正在经历强劲成长。儘管面临劳动力短缺和基础设施差距等挑战,该行业仍准备透过技术进步和策略性投资实现进一步发展。 Emergent Cold LatAm 等主要企业持续的整合和扩张努力凸显了该地区克服这些障碍和满足不断增长的市场需求的潜力。

拉丁美洲低温运输物流市场趋势

增加对冷冻基础设施的投资

生鲜食品国际贸易的增加使得对可靠低温运输的需求日益增长。在这些市场中运作的公司必须确保其产品在国际贸易中的品质和安全。生鲜食品国际贸易的成长推动了对强大低温运输的需求。该领域的公司必须优先考虑有效的低温运输管理,以确保国际运输过程中的产品品质和安全。

为跨境客户提供无缝的端到端连接不仅是一项策略性倡议,而且也是一个巨大的经济优势。这种方法简化了供应链操作并提高了业务效率。从经济角度来看,成本节约意味着盈利的提高和市场占有率的增加,从而使公司成为更有价值的物流合作伙伴。

领先的温控仓储和物流供应商 Emergent Cold LatAm 在塔尔卡瓦诺开设了智利最大的冷冻食品仓库。这一里程碑标誌着 EmergentCold 在拉丁美洲迄今为止最重要的扩张。塔尔卡瓦诺因其水产品和水果出口而闻名于世,该仓库将在当地低温运输基础设施中发挥至关重要的作用。

该设施的储存容量为 294,000 立方米,可容纳 37,000 个托盘,将创造 150 个直接就业机会和约 500 个间接就业机会,从而增强当地经济。

在本地和国际投资者的支持下,该地区已经建立了专门的投资工具。从历史上看,拉丁美洲并没有统一的仓库网络,只有巴西和墨西哥有一些例外。主要目标是建立一个跨境、泛拉丁美洲网络,提供全面的食品供应链解决方案。

受不断增长的市场需求、技术进步以及对更高效、更广泛的低温运输物流网络的迫切需求的推动,巴西是拉丁美洲冷资料储存投资激增的领头羊。

总之,以 Emergent Cold LatAm 新工厂为代表的拉丁美洲低温运输基础设施的扩张凸显了该地区在全球生鲜食品市场中日益增长的重要性。随着投资的持续,该地区有望成为温控物流的重要枢纽,确保生鲜产品跨境安全且有效率地运输。

巴西在低温运输物流市场占据主导地位。

近年来,巴西低温运输物流市场大幅扩张,主要得益于生鲜产品购买力的增强和製药业的快速成长。值得注意的是,巴西的冷冻食品产业受到上层和中产阶级消费者的购买所推动。

这些消费者表现出明显的购买模式,其中25%的人每月购买冷冻食品4-5次,30%的人每月至少购买两次,40%的人每月至少购买一次冷冻食品。女性在这一市场占据主导地位,占冷冻食品购买量的 73%。在冷冻食品中,肉类(39%)、披萨(33%)和千层麵(10%)最受欢迎。

此市场主要由中上阶层(42%)和中下阶层(29%)所构成。巴西中产阶级的崛起,加上双收入家庭面临的时间限制,是支持冷冻食品市场成长的关键因素。

巴西冷冻食品产业由 700 多家冷冻食品公司组成,其中大多数(超过 90%)都是小型企业。巴西是冷冻肉类出口国中的重要角色,提供多种多样的产品,包括冷冻牛肚、牛里肌和各种牛肉切块。

儘管巴西在冷冻食品领域占据主导地位,但该国目前冷藏储存能力仅600万立方米,缺口约30%。此次短缺将对冷冻食品市场产生重大影响。冷藏和运输设施不足会造成大量产品浪费,并影响冷冻食品的供应和价格。

为了满足不断增长的需求,巴西必须优先投资扩大其低温运输基础设施。巴西的成长前景看好,尤其是在全球肉类市场,因为它是水果、肉类、糖和大豆的主要出口国。

巴西低温运输市场可望加速成长。这是由于多种因素造成的,包括该国冷藏产品出口的增加、现代技术和自动化的快速采用、对肉类、水产品、水果和蔬菜的需求不断增长以及基础设施的显着改善。此外,随着此类基础设施的发展,冷藏运输的市场占有率预计会增加。

总之,受生鲜产品需求增加和基础设施进步的推动,巴西低温运输物流市场呈现强劲成长动能。为了维持这种成长,重要的是解决当前冷资料储存容量短缺的问题并利用现代技术。随着巴西在全球市场,尤其是肉类出口领域的作用不断扩大,低温运输物流领域将在确保货物高效安全运输方面发挥至关重要的作用。

拉丁美洲低温运输物流产业概况

拉丁美洲低温运输物流产业高度分散,既有本地参与者,也有全球参与企业。这种多样性显示竞争环境非常激烈,没有一家公司能够独占鰲头。该领域的主要竞争对手包括Fralsa Frigorificos SA、Comfrio Solucoes Logisticas、Friozem Armazens Frigorificos、Superfrio Armazens Gerais 和 Americold Logistics。

这些公司正在转向物联网、RFID、云端储存和电子资料交换等最尖端科技,以提高低温运输物流的效率。为了巩固市场结构,企业间的併购也增加。例如,Emergent Cold Latin America 收购 Frigorifico Modelo 在乌拉圭的业务以及在巴拉圭的新仓库就凸显了这一趋势。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况(低温运输物流市场现况)

- 市场动态

- 驱动程式

- 电子商务的成长

- 医疗领域占市场主导地位

- 限制因素

- 供应链中断

- 缺乏温控仓库

- 机会

- 技术创新

- 驱动程式

- 政府法规(冷藏储存和运输)

- 冷媒和包装材料洞察

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 地缘政治与疫情将如何影响市场

第五章市场区隔

- 按服务

- 冷藏/冷冻仓库

- 冷藏运输

- 附加价值服务(订单管理、冷冻、贴标、库存管理等)

- 按温度

- 冷藏

- 《冷冻》

- 常温

- 按最终用户

- 水果和蔬菜

- 乳製品(牛奶、奶油、起司、冰淇淋等)

- 鱼、肉和水产品

- 加工食品

- 製药

- 烘焙和糖果零食

- 其他的

- 按国家

- 墨西哥

- 巴西

- 智利

- 哥伦比亚

- 其他拉丁美洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Frialsa Frigorificos SA

- Comfrio Solucoes Logisticas

- Friozem Armazens Frigorificos Ltda

- Superfrio Armazens Gerais Ltda

- Americold Logistics

- Brasfrigo

- Arfrio Armazens Gerais Frigorificos

- Ransa Comercial SA

- Localfrio

- Qualianz*

- 其他公司(关键资讯/概述)

第七章:市场的未来

第 8 章 附录

- 宏观经济因素

- 对外贸易统计

The Latin America Cold Chain Logistics Market size is estimated at USD 5.87 billion in 2025, and is expected to reach USD 10.15 billion by 2030, at a CAGR of 11.60% during the forecast period (2025-2030).

Latin American nations export a diverse range of products globally, with many reaching consumers in their natural state, emphasizing quality. These products, including meat, fish, fruits, and dairy, rely heavily on an uninterrupted cold chain. While North America, Europe, and even Latin America itself are primary destinations, certain products, notably pharmaceuticals like the Covid-19 vaccines, have found their way to Africa and South America.

The surge in demand for medicines, notably those requiring ultra-low temperatures like Pfizer/Biontech's Covid-19 vaccine, has propelled the cold chain sector in Latin America to innovate and expand. Yet, challenges persist, with labor shortages and inadequate infrastructure necessitating a unified political, social, and financial effort.

Latin America's vaccine trade, coupled with a rising appetite for frozen foods and dairy, has been pivotal in propelling the market. Brazil leads the pack, trailed by Mexico, Argentina, and Colombia. Projections suggest a significant uptick in processed food sales until 2025, presenting a lucrative opportunity for cold chain logistics and warehousing firms. Peru, poised for a 15.16% growth rate from 2020 to 2026, is set to join the region's leading cold chain players.

Despite challenges like workforce shortages and full-capacity warehouses, Latin America's perishable food supply chain remains resilient. These hurdles are prompting established regional players to bolster their technological prowess, aiming to combat the region's refrigerated space deficit.

In a notable move in October 2022, Uruguay's Montevideo-based Frigorifico Modelo (Frimosa) announced the sale of its cold storage operations to Emergent Cold Latin America (Emergent Cold LatAm). Emergent Cold LatAm, a key player in refrigerated storage and logistics in the region, will acquire Frimosa's primary facility in Polo Oeste, boasting 22,000 cold storage pallets, a bonded warehouse, and ample room for expansion. Additionally, Emergent Cold LatAm is set to purchase an 8,400-pallet warehouse in Asuncion, Paraguay.

In conclusion, the cold chain sector in Latin America is experiencing significant growth driven by increased demand for pharmaceuticals and perishable foods. Despite facing challenges such as labor shortages and infrastructure gaps, the sector is poised for further development through technological advancements and strategic investments. The ongoing consolidation and expansion efforts by key players like Emergent Cold LatAm highlight the region's potential to overcome these obstacles and meet the growing market demands.

Latin America Cold Chain Logistics Market Trends

Increasing investment in cold storage infrastructure

The increase in international trade in fresh food has led to an increase in the need for reliable cold chains. Companies operating in these markets must ensure the quality and safety of their products during internationaThe rise in global trade of fresh food has heightened the demand for robust cold chains. Companies in this space must prioritize effective cold chain management to guarantee product quality and safety during international transit.

Enabling seamless end-to-end connections for customers across nations is not just a strategic move but also a significant economic advantage. This approach streamlines supply chain operations, enhancing operational efficiency. Economically, it can lead to heightened profitability through cost savings and an expanded market share, positioning the company as a more valuable logistics partner.

Emergent Cold Latin America (Emergent Cold LatAm), the leading provider of temperature-controlled storage and logistics in the region, unveiled Chile's largest frozen food warehouse in Talcahuano. This milestone marks Emergent Cold's most substantial expansion in Latin America. Given Talcahuano's global reputation for seafood and fruit exports, this warehouse stands as a pivotal addition to the local cold chain infrastructure.

Boasting a storage capacity of 294,000 m3 and 37,000 pallets, this facility is set to create 150 direct jobs and an estimated 500 indirect job opportunities, bolstering the regional economy.

Backed by both local and international investors, a dedicated investment vehicle was established for the region. Historically, Latin America, barring a few exceptions in Brazil and Mexico, lacked a unified warehouse network. The primary aim was to create a pan-Latin American network, transcending individual borders, and offering a holistic food supply chain solution.

Brazil spearheads the surge in cold storage investments across Latin America, driven by rising market demands, technological progress, and the pressing need for more efficient and expansive cold chain logistics networks.

In conclusion, the expansion of cold chain infrastructure in Latin America, exemplified by Emergent Cold LatAm's new facility, highlights the region's growing importance in the global fresh food market. As investments continue to pour in, the region is poised to become a critical hub for temperature-controlled logistics, ensuring the safe and efficient transport of perishable goods across borders.

The cold chain logistics market is dominated by Brazil.

In recent years, the Brazil cold chain logistics market has seen notable expansion, primarily fueled by a rising appetite for perishable goods and the burgeoning pharmaceutical sector. Notably, Brazil's frozen food sector is buoyed by the purchases of its upper and middle-class consumers.

These consumers exhibit a noteworthy buying pattern: 25% purchase frozen food 4-5 times a month, 30% do so at least twice, and 40% make the purchase at least once monthly. Women, in particular, dominate this market, accounting for 73% of frozen food purchases. Among the frozen food offerings, meat (39%), pizzas (33%), and lasagnas (10%) stand out as the most favored.

The market is largely shaped by the high middle class (42%) and the low middle class (29%). The rise of Brazil's middle class, combined with the time constraints faced by working families, is a key driver behind the frozen food market's growth.

The industry boasts over 700 frozen food businesses in operation, with the majority (over 90%) classified as small enterprises. Brazil's role as a frozen meat exporter is substantial, offering a diverse range that includes frozen beef tripe, tenderloins, and various beef cuts.

Despite its prominence in the frozen food arena, Brazil's current cold storage capacity of 6 million cubic meters falls short by about 30%. This shortfall bears significant consequences for the frozen food market. Inadequate cold storage and transportation facilities can result in substantial product wastage, potentially affecting the supply and affordability of frozen foods.

To meet the escalating demand, Brazil must prioritize investments in expanding its cold chain infrastructure. Given its status as a leading exporter of fruits, meat, sugar, and soybeans, Brazil holds promising growth prospects, particularly in the global meat market.

The Brazil cold chain market is poised for accelerated growth. This is attributed to several factors, including the country's increased exports of refrigerated products, a surge in the adoption of modern technologies and automation, a rising appetite for meat, seafood, fruits, and vegetables, and notable improvements in infrastructure facilities. Furthermore, the market share of cold transport is expected to witness a rise, thanks to these enhanced infrastructure facilities.

In conclusion, the Brazil cold chain logistics market is on a robust growth trajectory, driven by the increasing demand for perishable goods and advancements in infrastructure. Addressing the current shortfall in cold storage capacity and leveraging modern technologies will be crucial for sustaining this growth. As Brazil continues to expand its role in the global market, particularly in meat exports, the cold chain logistics sector will play a pivotal role in ensuring the efficient and safe transportation of goods.

Latin America Cold Chain Logistics Industry Overview

In Latin America, the cold chain logistics sector stands out for its fragmentation, hosting a mix of local and global players. This diversity underlines a fiercely competitive landscape, where no single entity reigns supreme. Key contenders in this arena include Frialsa Frigorificos SA, Comfrio Solucoes Logisticas, Friozem Armazens Frigorificos, Superfrio Armazens Gerais, and Americold Logistics.

These companies are pivoting towards cutting-edge technologies like IoT, RFID, cloud storage, and electronic data interchange, amplifying the efficiency of their cold chain logistics. Mergers and acquisitions are on the rise, as firms seek to bolster their market foothold. For instance, Emergent Cold Latin America's acquisition of Frigorifico Modelo's operations in Uruguay and a new warehouse in Paraguay underscores this trend.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Scenario of the Cold Chain Logistics Market)

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growth in E-commerce

- 4.2.1.2 Healthcare Sector is the market

- 4.2.2 Restraints

- 4.2.2.1 Supply Chain Disruptions

- 4.2.2.2 Lack of Temperature- Controlled Warehouses

- 4.2.3 Opportunities

- 4.2.3.1 Technological Innovations

- 4.2.1 Drivers

- 4.3 Government Regulations (Related to Cold Storage and Transport)

- 4.4 Insights into Refrigerants and Packaging Materials

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Cold Storage/Refrigerated Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.3 Value-added Services (Order Management, Blast Freezing, Labeling, Inventory Management, etc.)

- 5.2 By Temperature

- 5.2.1 Chilled

- 5.2.2 Frozen

- 5.2.3 Ambient

- 5.3 By End User

- 5.3.1 Fruits and Vegetables

- 5.3.2 Dairy Products (Milk, Butter, Cheese, Ice Cream, etc.)

- 5.3.3 Fish, Meat, and Seafood

- 5.3.4 Processed Food

- 5.3.5 Pharmaceutical (Includes Biopharma)

- 5.3.6 Bakery and Confectionery

- 5.3.7 Other End Users

- 5.4 By Country

- 5.4.1 Mexico

- 5.4.2 Brazil

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Frialsa Frigorificos SA

- 6.2.2 Comfrio Solucoes Logisticas

- 6.2.3 Friozem Armazens Frigorificos Ltda

- 6.2.4 Superfrio Armazens Gerais Ltda

- 6.2.5 Americold Logistics

- 6.2.6 Brasfrigo

- 6.2.7 Arfrio Armazens Gerais Frigorificos

- 6.2.8 Ransa Comercial SA

- 6.2.9 Localfrio

- 6.2.10 Qualianz*

- 6.3 Other Companies (Key Information/Overview)

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Factors

- 8.2 External Trade Statistics