|

市场调查报告书

商品编码

1690856

咨询服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Consulting Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

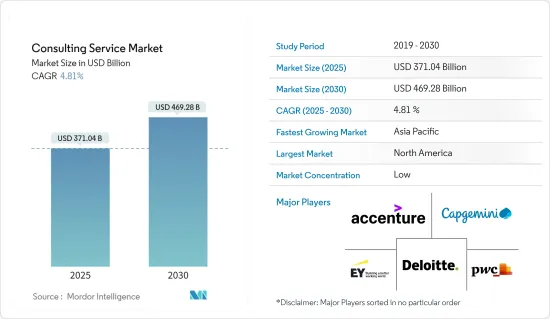

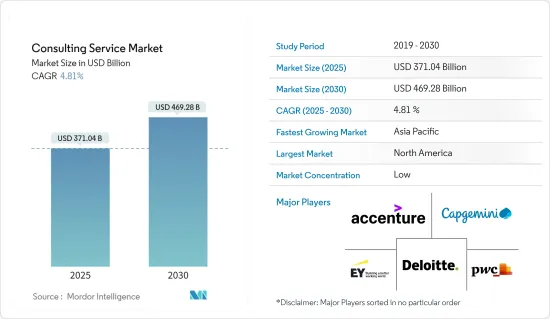

咨询服务市场规模预计在 2025 年为 3,710.4 亿美元,预计到 2030 年将达到 4,692.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.81%。

关键亮点

- 咨询服务市场的成长受到多种因素的影响。需求是由业务营运日益复杂、技术环境不断发展以及对策略决策日益关注所驱动的。企业正在寻求外部专业知识来解决挑战、实施数位转型并提高整体效率。全球化、监管变化以及对创新解决方案的需求也促进了市场的扩张。此外,中小企业对咨询服务益处的认识不断提高也推动了市场的成长。

- 随着科技对商业的影响越来越大,顾问公司正在寻求将技术和资料分析融入他们的服务中,以帮助他们的客户保持领先地位。技术主导的咨询利用人工智慧、机器学习和资料分析等先进技术来帮助解决复杂的业务问题。这种类型的咨询可以帮助您做出资料主导的决策、自动化手动流程并提高整体绩效。咨询公司也在利用科技以更具创新性的方式提供服务。例如,您可以使用虚拟实境和扩增实境技术来视觉化复杂的概念,并利用云端基础的平台与客户即时协作。

- 此外,技术进步的快速步伐也推动了对人工智慧、网路安全和创新管理等领域专业咨询的需求。为了保持竞争力,公司向顾问寻求尖端解决方案和行业最佳实践。

- 全球咨询市场依靠适应性和创新而蓬勃发展。抵制变革会阻碍新方法和新技术的采用,从而损害这种活力。在数位转型至关重要的时代,抵制变革的组织将不得不跟上更容易接受创新的竞争对手,这可能会进一步影响对咨询服务的需求。

- COVID-19 疫情的爆发促使全国各地的组织采取一切必要措施,确保员工和社区的安全。由于远距办公的增加和企业数位转型的扩展,COVID-19 疫情使市场受益。企业希望业务流程无缝、高效并且可以从任何地方存取。

咨询服务市场趋势

业务咨询服务类型占据大部分市场占有率

- 业务咨询服务主要用于提高业务效率。该领域的咨询活动涵盖咨询服务以及对主要职能(销售、行销、生产等)和次要职能(财务、人力资源、供应链、资讯通信技术、法律等)的实际实施支援。业务咨询是咨询行业中最大的部分。

- 製造、供应链管理、流程管理和业务废弃物减少等应用的成长主要推动了对业务咨询服务的需求。供应链管理、流程管理、采购和外包是一些最常用的业务咨询服务。

- 为了提高业务效率并降低业务成本,预计业务咨询需求将会成长。业务效率低下可能会使公司损失很大一部分年收益。 Acuity Knowledge Partners 等顾问公司提供 SCM 咨询服务,自疫情爆发以来,该公司的需求大幅增加。在过去的十年中,供应链管理软体和采购市场成长了一倍以上。

- 随着企业大力投资增加其营运的生态足迹,永续性供应链管理咨询服务正在兴起。该地区的企业意识到过去几年出现的供应链中断问题,并致力于建立有弹性的供应链以维持未来的发展。

- 此外,在已开发地区,利用管理顾问来实施公共部门业务管理创新的趋势日益增长。不同的文化、结构、管理知识和投资模式往往会阻碍公共服务的发展。业务咨询服务通常与策略和技术咨询服务相关,因此一种服务的成长将推动对另一种服务的需求。

预计北美将占据较大的市场占有率

- 新冠疫情加速了各行各业公司的广泛转型,以便在组织和财务上更好地摆脱疫情带来的挑战,从而导緻美国对咨询服务的需求增加。企业为未来几年制定的计划需要咨询服务来做出改变并推动业务运营,从而促进市场成长。

- 终端用户的气候控制和净零战略趋势正在为美国市场的供应商创造机会。越来越多的公司寻求咨询协助,将环境、社会和管治(ESG) 考量纳入其策略和业务中。

- 例如,2023年1月,波士顿顾问集团(BCG)与美国船级社(ABS)签署了一份谅解备忘录,为海洋和近海价值链中的客户提供联合脱碳咨询服务。新的联合服务将支援船东进行技术和营运改进,以实现其净零目标,并将包括有关碳捕获技术和采用替代低碳燃料的建议。

- 加拿大的技术咨询业务成长缓慢。根据加拿大製造商和出口商协会 (CME) 和加拿大统计局的 CME 2023 技术采用调查,企业不愿意为其营运投资技术。加拿大的製造业由小型企业组成,其中 93% 的企业僱用的员工不足几百人,技术采用率较低。此外,调查发现,28%的製造商处于数位转型的早期阶段,而12%的製造商尚未开始。

- 加拿大数位化采用计画(CDAP)的最新倡议将支持中小企业的数位转型,并加速加拿大联邦政府在全国范围内的数位化采用。这些可能为加拿大技术咨询服务需求的增加铺平道路。

咨询服务业概况

咨询服务市场高度分散,国内外参与企业都拥有数十年的产业经验。透过利用他们的专业知识,供应商正在采取强有力的竞争策略。由于市场参与企业障碍相对较低,新参与企业很容易进入市场,现有企业在利润较低时也容易退出。麦肯锡公司、贝恩公司、波士顿顾问集团(BCG)和德勤等产业巨头正专注于提供全面解决方案来吸引客户。

- 2024 年 1 月:德勤收购了总部位于纽约的数位产品公司 Giant Machines 的全部资产。 Giant Machines 专注于开发和设计创新数位产品,而 Deloitte Digital 和 Deloitte Engineering 正在加强其能力,为客户提供全套工程服务,以提供具有策略性和规模的解决方案。

- 2023 年 11 月:埃森哲收购了专门从事 Salesforce 解决方案的数位转型顾问公司 Incapsulate。身为 Salesforce 白金顾问合作伙伴,埃森哲增强了其 Salesforce 能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

- 产业生态系统分析

- 主要区域热点

- 工业4.0和数位转型对咨询服务市场的影响

- 数位化在咨询服务市场中的作用分析

- 管理顾问领域的典型经营模式

第五章市场动态

- 市场驱动因素

- 对组织效率的需求日益增加

- 市场问题

- 客户的成本削减措施和客户组织内部的变革阻力

第六章市场区隔

- 按服务类型

- 业务咨询

- 策略咨询

- 财务咨询

- 技术咨询

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Deloitte Touche Tohmatsu Limited

- Accenture PLC

- Pricewaterhousecoopers LLP

- Ernst & Young Global Limited

- Capgemini SE

- KPMG International

- Boston Consulting Group Inc.

- AT Kearney Inc.

- Mckinsey & Company

- Bain & Company Inc.

- Roland Berger Holding Gmbh & Co. KGAA

- Simon-Kucher & Partners

- OC& C Strategy Consultants LLP

- Gartner Inc.

- Tata Consultancy Services

第八章投资分析

第九章 市场机会与未来趋势

The Consulting Service Market size is estimated at USD 371.04 billion in 2025, and is expected to reach USD 469.28 billion by 2030, at a CAGR of 4.81% during the forecast period (2025-2030).

Key Highlights

- The growth of the consulting services market is influenced by several factors. Increased complexity in business operations, evolving technology landscapes, and a growing focus on strategic decision-making drive demand. Companies seek external expertise to navigate challenges, implement digital transformations, and enhance overall efficiency. Globalization, regulatory changes, and the need for innovative solutions also contribute to the expanding market. Additionally, the surge in awareness of the benefits of consulting services among small and medium-sized enterprises further fuels the market's growth.

- With the growing impact of technology on business, consulting firms anticipate incorporating technology and data analytics into their services to assist clients in staying ahead of the curve. Technology-driven consulting comprises the leverage of advanced technologies, like AI, machine learning, and data analytics, to assist clients in solving complex business problems. This type of consulting assists organizations in making data-driven decisions, automating manual processes, and increasing overall performance. Consulting firms are also leveraging the technology to offer their services in more innovative ways. For instance, they may leverage virtual and augmented reality technologies to assist the clients in visualizing complex concepts or leverage cloud-based platforms to collaborate with clients in real time.

- Furthermore, the rapid pace of technological advancement fuels the need for specialized consulting in areas such as artificial intelligence, cybersecurity, and innovation management. As organizations strive to stay competitive, they turn to consultants for cutting-edge solutions and industry best practices.

- The global consulting market thrives on adaptability and innovation. Resistance to change hinders this dynamic by impeding the adoption of new methodologies and technologies. In an age where digital transformation is necessary, organizations that resist transformation may need to catch up to competitors who embrace innovation more readily, further impacting the demand for consulting services.

- The outbreak of COVID-19 prompted organizations across the country to undertake all the necessary steps to ensure the safety of their employees and the community. The COVID-19 pandemic benefited the market, owing to the rise in remote working and the expanding digital transformation of enterprises. Businesses are looking for business processes that are seamless, efficient, and accessible from any location.

Consulting Service Market Trends

Operations Consulting Service Type to Hold Major Market Share

- Operations consulting services are mainly used to enhance operational efficiency. Consultancy activities in this segment differ from advisory services to hands-on implementation support for primary functions (e.g., sales, marketing, production, etc.) and secondary functions (e.g., finance, HR, supply chain, ICT, legal, etc.). Operations consultancy forms the largest segment within the advisory branch.

- Growth in applications such as manufacturing, supply chain management, process management, and operation waste reduction, among others, mainly drives the demand for operation consulting services. Supply chain management, process management, procurement, and outsourcing are some of the most adopted operations consulting services.

- Demand for operation consulting is expected to grow to enhance operational efficiency and reduce operations costs. Operation inefficiency can cost a business a considerable share of its revenue annually. Consultancies such as Acuity Knowledge Partners offer SCM consulting services, and the company has witnessed a significant surge in demand after the pandemic. Over the last decade, the supply chain management software and procurement market expanded more than twice.

- Supply chain management consulting services concerning sustainability practices are increasing as companies invest significantly in boosting the ecological footprint of their operations. Businesses in the region have acknowledged the supply chain disruption witnessed in the past years and focused on resilient supply chains to sustain the future.

- The developed regions also witnessed the growing trend of engaging management consultancies in implementing operations management innovations in the public sector. Different cultures, structures, managerial knowledge, and investment patterns often hamper public services. Operations consulting services are often associated with strategy and technology consulting services; therefore, growth in one eventually fuels the demand for others.

North America is Expected to Hold Significant Market Share

- The COVID-19 pandemic accelerated broader transformation initiatives by businesses across industries to come out of pandemic challenges in the best possible organizational and financial shape, leading to the demand for consulting services in the United States. The plan that had been planned for the coming years by the business has necessitated the need for consulting services to make changes and drive business operations, adding growth to the market.

- The trend of climate control and net zero strategy in end users is creating an opportunity for market vendors in the United States. Companies increasingly seek consulting support to integrate environmental, social, and governance (ESG) considerations into their strategies and operations.

- For instance, in January 2023, Boston Consulting Group (BCG) and the American Bureau of Shipping (ABS) signed a MoU to offer joint services in decarbonization consulting to marine and offshore value chain clients. The new joint offering can support shipping asset owners in making technical and operational improvements to reach net-zero goals and provide advice on carbon capture technology and the uptake of alternative and low-carbon fuels, among other areas.

- Technology consulting in Canada is growing slowly as technology adoption among businesses in the country needs to catch up. According to the CME 2023 Technology Adoption Survey by Canadian Manufacturers & Exporters (CME) and Statistics Canada, businesses were reluctant to invest in technology for their operations. The manufacturing sector in Canada was composed of small businesses, with 93% of businesses having fewer than 100 workers and a slower technology adoption rate. Further, the survey stated that 28% of manufacturing businesses were at the beginning of digital transformation, and 12% said they were yet to start.

- Recent Canadian Digital Adoption Program (CDAP) initiatives support small and medium-sized enterprises (SMEs) to digitally transform their businesses and accelerate digital adoption across the country by the Canadian Federal Government. These are likely to create their way ahead by increasing the demand for technology consulting services in Canada.

Consulting Service Industry Overview

The consulting service market is highly fragmented, with local and international players having decades of industry experience. The vendors are incorporating a powerful competitive strategy by leveraging their expertise. The market has relatively low exit barriers, which encourages new enterprises to participate and established firms to withdraw when profits are low. Major industry players, like McKinsey & Company, Bain & Company, Boston Consulting Group (BCG), and Deloitte, emphasize providing integrated solutions to attract customers.

- January 2024: Deloitte acquired all assets of Giant Machines, a digital product company based in New York City. Giant Machines focuses on developing and designing innovative digital products, helping Deloitte Digital and Deloitte Engineering to strengthen their ability to provide clients with a full suite of engineering services to deliver strategy and scale solutions.

- November 2023: Accenture acquired Incapsulate, a digital transformation consulting firm specializing in Salesforce solutions. As a Salesforce Platinum Consulting partner, Incapsulate strengthens Accenture's Salesforce capabilities, which mainly focus on assisting clients to utilize data and AI-driven insights to transform how they connect with customers and meet their ever-evolving needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Ecosystem Analysis

- 4.5 Key Regional Hotspots

- 4.6 Impact of Industry 4.0 and Digital transformation -Related Practices on the Consulting Services Market

- 4.7 Analysis of the Role of Digitization in the Consulting Services Market

- 4.8 Prevalent Business Models in the Management Consulting Domain

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Organizational Efficiency

- 5.2 Market Challenges

- 5.2.1 Client Cost-cutting Measures and Resistance to Change Within Client Organization

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Operations Consulting

- 6.1.2 Strategy Consulting

- 6.1.3 Financial Advisory

- 6.1.4 Technology Advisory

- 6.1.5 Other Service Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.6 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deloitte Touche Tohmatsu Limited

- 7.1.2 Accenture PLC

- 7.1.3 Pricewaterhousecoopers LLP

- 7.1.4 Ernst & Young Global Limited

- 7.1.5 Capgemini SE

- 7.1.6 KPMG International

- 7.1.7 Boston Consulting Group Inc.

- 7.1.8 A T Kearney Inc.

- 7.1.9 Mckinsey & Company

- 7.1.10 Bain & Company Inc.

- 7.1.11 Roland Berger Holding Gmbh & Co. KGAA

- 7.1.12 Simon-Kucher & Partners

- 7.1.13 OC&C Strategy Consultants LLP

- 7.1.14 Gartner Inc.

- 7.1.15 Tata Consultancy Services