|

市场调查报告书

商品编码

1690860

智慧型手机相机镜头:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Smartphone Camera Lens - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

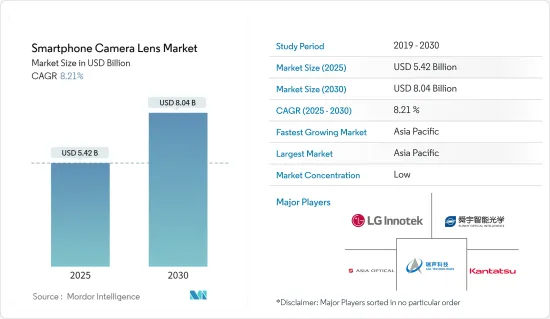

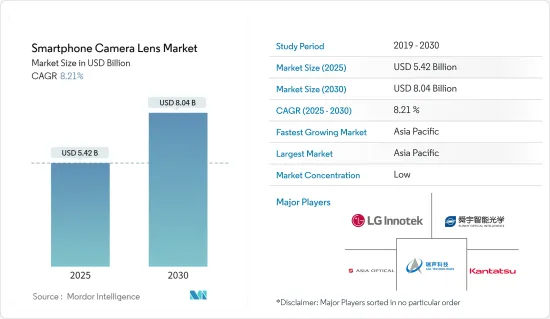

预计 2025 年智慧型手机相机镜头市场规模为 54.2 亿美元,到 2030 年将达到 80.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.21%。

市场正在见证与智慧型手机使用的不同类型镜头相关的各种进步。各大智慧型手机厂商都在开发搭载多镜头的智慧型手机,包括长焦镜头、微距镜头、超广角镜头以及其他类型的镜头。

关键亮点

- 智慧型手机相机镜头是内建于智慧型手机相机模组的光学元件。这些镜头与感测器和影像处理演算法相结合,用于捕捉照片和影片。镜头通常由多个玻璃或塑胶元件以特定方式排列组成,以实现所需的光学性能。透过组合具有不同焦距和功能的多个镜头,智慧型手机使用者无需使用外部附件即可捕捉各种影像。

- 随着智慧型手机技术的快速发展,相机镜头的采用率正在不断提高,促使市场参与企业透过产品创新、扩张活动、合併、收购、联盟和伙伴关係投资该技术。例如,2023年1月,三星电子发布了其最新的影像感测器ISOCELL HP2,解析度为2亿像素。三星表示,该镜头是其像素技术的改进,旨在提高其高阶智慧型手机的影像品质。

- 区域经济成长和新兴市场可支配收入的提高导致全球智慧型手机需求激增。随着每代智慧型手机的推出,相机性能都有新的进步。消费者在购买新手机时越来越重视手机相机的品质。这就是製造商投资提高行动电话相机镜头性能的原因。

- 过去几年,智慧型手机市场销售持续下滑。造成这一下降的因素有几个,包括客户需求减弱、经济不确定性和全球通货膨胀。

- 新冠疫情的爆发对市场造成了显着的打击,各国政府采取的封锁等各种防控措施对工业成长产生了显着的影响。结果,我们看到市场放缓,尤其是在疫情初期。新冠疫情影响了全球智慧型手机的销售。这种情况也给该行业带来了一些挑战。封锁和经济不确定性消费者削减非必要开支,进而导致智慧型手机需求下降。

智慧型手机相机镜头市场趋势

多摄像头智慧型手机的普及和先进相机技术的引入正在推动市场

- 随着最新技术的推出,智慧型手机也不断更新。新款智慧型手机的卖点通常是其全新升级的相机。这种能力对于硬体技术的持续改进产生了巨大的需求。如今,人们不再只注重使用传统相机,而是更注重用行动电话拍照。

- 随着人工智慧的进步,智慧型手机正在经历包括多相机出现在内的技术创新。随着智慧型手机的推出,多镜头智慧型手机在市场上获得了巨大的欢迎,许多品牌开始推出配备四镜头甚至五镜头的机型。智慧型手机中多个相机的加入使得新功能的发展成为可能,例如变焦、更好的 HDR(高动态范围)、肖像模式、3D 选项和低照度捕捉选项。

- 镜头市场也正在开拓一些先进的相机技术。例如,夜间模式功能允许使用者在低照度条件下拍摄高品质的照片。采用先进的演算法和影像处理技术,降低杂讯,增强细节,使影像更明亮、更清晰。

- 光学影像防手震、计算摄影和支援人工智慧的相机功能(例如,透过调整曝光、颜色和其他参数来优化相机设定和提高影像品质)也可能推动对更好镜头的需求。

亚太地区将迎来巨大成长

- 亚太地区是智慧型手机製造活动的重要中心,需要稳定的相机镜头供应。该地区的消费者越来越喜欢使用配备高解析度相机的智慧型手机来拍摄照片和影片。这种需求的成长推动了对智慧型手机先进相机镜头的需求。

- 亚太地区是智慧型手机最重要的市场之一,主要得益于其高度发展的通讯产业和庞大的基本客群。根据中国国家统计局的数据,2022年中国智慧型手机产量约16亿支。 2022年中国将成为全球最大的智慧型手机生产国。 2021年和2020年的智慧型手机产量分别为16.7亿支和14.7亿支。据IBEF称,印度是全球最大的行动电话出口国之一。该国的目标是到 2026 财年生产价值 3,000 亿美元的电子产品。智慧型手机製造被视为实现这一雄心勃勃目标的关键。

- 该地区对先进行动网路的投资正在不断增加。中国、印度、日本、澳洲、新加坡和韩国等国家正在增加对发展国内通讯市场的投资。预计此举将推动该地区市场的发展。原料的易得性、低廉的设置和人事费用也促使许多公司在亚太地区建立生产基地。

- 印度、中国、韩国和台湾等国家和地区对智慧型手机和其他电子产品的需求不断增长,也鼓励许多公司在亚太地区设立工厂。例如,全球智慧型手机设备品牌 OPPO 最近在印度设立了一个智慧型手机製造部门。

智慧型手机相机镜头产业概况

智慧型手机相机镜头市场细分化,存在众多大型和小型公司。主要参与企业包括 LG Innotek、舜宇光学科技(集团)有限公司、亚洲光学股份有限公司、瑞声科技和 Kantatsu(夏普公司)。这些公司不断创新新产品并与其他公司建立策略伙伴关係以维持市场占有率。

- 2023 年 6 月 - LG Innotek 宣布将向其位于越南海防的生产子公司投资 9.95 亿美元,以扩大相机模组生产线。此次投资的目的是扩大某些相机模组的生产能力,例如苹果 iPhone 的相机模组。越南新厂预计于2024年下半年完工,2025年开始量产。

- 2023 年 4 月 - 天才电子光学 (GSEO) 专注于开发创新产品和解决方案。公司将向需要改进的供应商提出建议并监督实施过程。业内人士称,该公司是定于 2023 年发布的 iPhone 系列的潜在供应商,包括潜望镜镜头。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 多摄像头智慧型手机的普及和先进相机技术的引入

引进先进的相机技术

- 市场限制

- 智慧型手机销售放缓,价格竞争加剧

第六章市场区隔

- 按地区

- 亚太地区

- 美洲

- 欧洲

- 其他的

第七章竞争格局

- 供应商排名分析

- 公司简介

- LG Innotek

- Sunny Optical Technology(Group)Company Limited

- Asia Optical Co. Inc.

- AAC Technologies

- Kantatsu Co. Ltd(Sharp Corporation)

- SEKONIX Co. Ltd

- Genius Electronic Optical(GSEO)

- Largan Precision Company Limited

- Kinko Optical Co. Ltd

- Haesung Optics Co. Ltd

- Ofilm Group Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

第八章投资分析与机会

The Smartphone Camera Lens Market size is estimated at USD 5.42 billion in 2025, and is expected to reach USD 8.04 billion by 2030, at a CAGR of 8.21% during the forecast period (2025-2030).

The market is witnessing various advancements related to the different types of lenses being used in smartphones. Various smartphone manufacturers are developing smartphones with multiple cameras that include other types of lenses, including telephoto lenses, macro lenses, and ultra-wide-angle lenses.

Key Highlights

- The lenses of smartphone cameras refer to the optical components integrated into the camera modules of smartphones. These lenses combine with sensors and image-processing algorithms to capture photos and videos. A single lens typically comprises multiple glass or plastic elements arranged in a specific configuration to achieve the desired optical performance. Combining multiple lenses with different focal lengths and functionalities helps smartphone users capture a wide range of images without using external attachments.

- With rapidly increasing technological developments in smartphones, the adoption of camera lenses has been continuously rising, thereby pushing the market players to invest in this technology through product innovations, expansion activities, mergers, acquisitions, collaborations, and partnerships. For instance, in January 2023, Samsung Electronics announced the launch of its latest image sensor, the ISOCELL HP2, which entails a 200-megapixel resolution. According to Samsung, the lens will offer improved pixel technology for better image quality in its premium smartphones.

- Growing regional economies and rising disposable incomes in emerging markets have led to a surge in the global demand for smartphones. With each new generation of smartphones, there are new advancements in the capabilities of the cameras. Consumers increasingly prioritize the quality of a phone's camera while purchasing a new one. Thus, manufacturers are investing in improving the performance of camera lenses in mobile phones.

- Over the recent years, the smartphone market has witnessed a decline in sales. Several factors have contributed to this decline, including reduced demand from customers, economic uncertainties, and global inflation.

- The outbreak of the COVID-19 pandemic has left a notable dent in the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdowns, significantly impacted the growth of the industry. As a result, a slowdown was witnessed in the market, especially during the initial phase of the pandemic. The COVID-19 pandemic impacted the global sales of smartphones. This situation also posed several challenges to the industry. Lockdowns and economic uncertainties led to consumers spending less on non-essential products, thereby resulting in a decrease in the demand for smartphones.

Smartphone Camera Lens Market Trends

Increasing Popularity of Multiple Camera Smartphones and the Introduction of Advanced Camera Technologies will Drive the Market

- Smartphones are being continuously updated with the incorporation of the latest technologies. A central selling point of new smartphones is often a new and improved camera. This feature generates heavy demand to improve this hardware technology on a continuous basis. Nowadays, people are more focused on clicking pictures on their phones instead of using conventional cameras for the same.

- As artificial intelligence continues to advance, smartphones are witnessing innovations, including the emergence of multiple cameras. With the introduction of smartphones, when multi-camera smartphones gained enormous market traction, many brands began to introduce quad-camera or five-camera models. Multiple cameras in smartphones have enabled the development of new features, such as zoom, better HDR (high dynamic range), portrait modes, 3D options, and low-light photography options.

- The lens market is also witnessing the development of several advanced camera technologies. For instance, the night mode feature enables users to capture high-quality photos in low-light conditions. It uses advanced algorithms and image processing techniques to reduce noise and enhance details, thereby resulting in brighter and clearer images.

- Optical image stabilization, computational photography, and AI-powered camera features, like optimizing camera settings and enhancing image quality by adjusting exposure, color, and other parameters, are also likely to drive the demand for better lenses.

Asia-Pacific will Witness Significant Growth

- The Asia-Pacific region is a significant hub for smartphone manufacturing activities, which require a steady supply of camera lenses. Consumers in the region are showing an increased preference for smartphones with high-resolution cameras for capturing photos and videos. This growth in demand is leading to an increased need for advanced camera lenses for smartphones.

- The Asia-Pacific region has been one of the most significant markets for smartphones, primarily due to the highly developing telecom sector and the large customer base. According to the National Bureau of Statistics of China, in 2022, the production volume of smartphones in China was almost 1.6 billion units. China was the world's largest smartphone producer in 2022. In 2021 and 2020, the recorded volumes of smartphone production were 1.67 units and 1.47 billion units, respectively. According to IBEF, India is one of the leading exporters of cell phones. The country aims to produce electronics worth USD 300 billion by FY 2026. Manufacturing smartphones would be the key to achieving this ambitious goal.

- The region is increasingly investing in advanced mobile networks. Countries like China, India, Japan, Australia, Singapore, and South Korea are increasingly investing in developing their domestic telecom markets. This move is expected to drive the market in the region. The availability of raw materials and the low costs of establishment and labor have also motivated many companies to establish their production centers in the Asia-Pacific region.

- The growing demand for smartphones and other electronic products in countries such as India, China, the Republic of Korea, and Taiwan is encouraging many companies to set up their factories in the Asia-Pacific region. For instance, OPPO, a global smartphone and device brand, recently established a smartphone manufacturing unit in India.

Smartphone Camera Lens Industry Overview

The smartphone camera lens market is fragmented due to the presence of many large and small players. Some of the major players are LG Innotek, Sunny Optical Technology (Group) Company Limited, Asia Optical Co. Inc., AAC Technologies, and Kantatsu Co. Ltd (Sharp Corporation). These companies keep innovating new products and entering strategic partnerships with other firms to retain their market shares.

- June 2023 - LG Innotek announced an investment worth USD 995 million in its Hai Phong production subsidiary in Vietnam to expand its camera module production line. The purpose of the investment is to expand the production capacity of specific camera modules, such as the camera module of Apple's iPhone. The construction of the new plant in Vietnam is expected to be completed in the second half of 2024, and it will start mass production in 2025.

- April 2023 - Genius Electronic Optical (GSEO) focuses on developing innovative products and solutions. The company recommends suppliers wherever improvements are needed and monitors their implementation processes. The company was named by industry sources as a potential supplier for the upcoming iPhone series in 2023, which included periscope lenses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of Multiple Camera Smartphones and the Introduction of

Advanced Camera Technologies

- 5.2 Market Restraints

- 5.2.1 Slow Down of Smartphone Sales and Increasing Pricing Competition

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 Asia-Pacific

- 6.1.2 Americas

- 6.1.3 Europe

- 6.1.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 VENDOR RANKING ANALYSIS

- 7.2 Company Profiles

- 7.2.1 LG Innotek

- 7.2.2 Sunny Optical Technology (Group) Company Limited

- 7.2.3 Asia Optical Co. Inc.

- 7.2.4 AAC Technologies

- 7.2.5 Kantatsu Co. Ltd (Sharp Corporation

- 7.2.6 SEKONIX Co. Ltd

- 7.2.7 Genius Electronic Optical (GSEO)

- 7.2.8 Largan Precision Company Limited

- 7.2.9 Kinko Optical Co. Ltd

- 7.2.10 Haesung Optics Co. Ltd

- 7.2.11 Ofilm Group Co. Ltd

- 7.2.12 Samsung Electro-Mechanics Co. Ltd