|

市场调查报告书

商品编码

1690878

流体动力设备-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Fluid Power Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

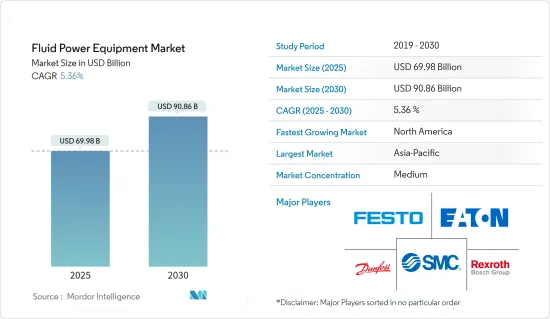

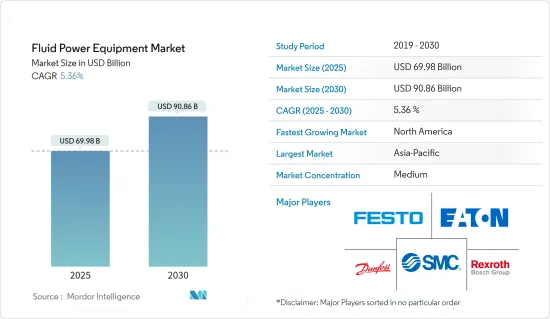

流体动力设备市场规模预计在 2025 年为 699.8 亿美元,预计到 2030 年将达到 908.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.36%。

流体动力设备市场对许多行业至关重要,包括建筑、农业、航太、物料输送以及石油和天然气。流体动力系统利用液压和气压技术透过加压流体管理能量,从而广泛使用泵浦、马达、汽缸和阀门等设备。这些部件对于需要高精度、高可靠性和高效率的领域至关重要。

油压设备领先市场

关键亮点

- 油压设备占据市场主导地位,提供强大而可靠的解决方案,特别适合重型机械和工业应用。油压缸和阀门等产品广泛应用于建筑和製造等领域,这些领域对高强度和精确控制至关重要。气动设备的功率较小,但在速度、简单性和安全性至关重要的行业中更受青睐,例如食品加工和汽车组装。

技术进步推动需求

关键亮点

- 液压和气压系统的技术发展、能源效率法规以及日益增长的自动化趋势推动了流体动力元件的需求。流体动力技术与工业控制系统的整合正在推动创新,特别是在航太和石油天然气等领域,因为液压机械和流体动力控制系统正在改进,以提高效率并减少对环境的影响。

工业自动化的进步刺激了流体动力系统的需求

关键亮点

- 提高自动化程度:各行各业正在向自动化转变,对流体动力设备市场产生了重大影响。液压和气压系统越来越多地被整合到自动化工业机械中,以提供更高的精度和控制力。这种需求在工厂自动化中尤其强烈,因为高效率的製造流程和降低人事费用是首要任务。

- 液压马达和泵浦的扩展:工业泵浦和液压马达在物料输送和航太等领域的应用越来越广泛。自动化使操作更快、更精确,进一步增加了对提高可靠性和运作效率的流体动力设备创新的需求。

- 工业 4.0 整合:作为工业 4.0 转型的一部分,流体动力技术正在发展,包括智慧感测器和先进的控制机制。这些可以实现即时监控和调整,从而最大限度地减少停机时间并提高工业油压设备的性能。

- 汽车和半导体製造中的气动技术:随着生产过程变得越来越复杂,汽车和半导体製造等产业越来越依赖流体动力应用。气动系统因其速度、灵活性和安全性而变得在组装和机器人技术中不可或缺。

能源效率和环境考量塑造市场格局

关键亮点

- 关注能源效率:随着环境法规变得越来越严格,能源效率越来越成为液压和气压系统製造商的重点。这些系统经过重新设计,以最大限度地减少能源消耗和减少排放,并符合全球永续性目标。

- 重新设计的液压阀和气缸:液压阀和气缸经过大量重新设计,更加节能。流体动力传动系统采用节能马达和泵,有助于降低各行业的营业成本和环境影响。

- 建筑业和农业领域的应用日益广泛:节能液压解决方案在建筑业和农业等领域越来越受欢迎,在这些领域,挖土机和拖拉机等设备都在恶劣的条件下运作。采用先进的控制系统来优化能源使用而不牺牲性能。

- 优化的气动阀门:气动阀门和致动器经常用于包装和食品加工等行业,它们经过优化以实现节能。这些系统在较低的压力水平下运行,降低了消费量,同时保持了工业应用的高速和高精度。

流体动力设备市场趋势

阀门占据很大市场份额

- 阀门占据了很大的市场。阀门是流体动力系统中必不可少的部件,用于管理各种应用中的流体流动。气动阀,包括电磁先导阀和空气先导阀,广泛应用于汽车和电动工具等行业。 Warren Controls 的 ILEA 2900E 系列电动截止控制阀等创新产品凸显了阀门耐用性和精度的进步,巩固了其在流体动力设备市场中的核心地位。

- 智慧阀门技术:智慧阀门技术的出现正在彻底改变工业运营,实现即时监控和控制。新型博世力士乐阀门平台使液压控制更容易整合到多功能係统中,从而提高效率和客製化。

- 压力保险阀保险阀透过调节气动系统中的过压,对于维护高压环境中的安全性非常重要。它在建筑和汽车等领域的使用凸显了系统完整性的重要性。林德液压的模组化阀块等可客製化解决方案体现了提高流体动力系统适应性和操作灵活性的创新。

- 气动阀门和工业 4.0:工业 4.0 的影响力日益增强,推动了对气动阀门的需求,尤其是在智慧製造领域。这些阀门为自动化生产线提供精确的控制。人口成长和水资源管理技术进步等因素也导致流体动力设备市场对流体控制阀的需求不断增加。

北美强劲成长

- 工业扩张和自动化:由于工业化的快速发展和各个领域的自动化程度提高,北美流体动力设备市场有望显着成长。汽车、航太和建筑等行业都依赖液压和气压系统来实现生产流程的现代化并提高生产效率。日立和沃尔沃北美公司在将液压系统整合到机器以提高操作能力方面处于领导企业。

- 石油和天然气产业:北美油压设备市场在很大程度上受到石油和天然气产业的推动,高压系统为流体泵送等任务提供动力。液压升降机和其他设备对于高效的石油采集过程至关重要。美国天然气消费量的增加意味着能源生产对液压系统的需求增加。

- 建筑业:在建筑业,正在进行的基础设施计划正在推动对液压机械的需求增加。依赖液压系统的挖土机和起重机等重型机械的需求正在增加。神钢和洋马等公司之间的合作正在推动液压挖土机生产的技术创新,进一步推动北美流体动力设备市场的发展。

- 节能解决方案:永续性是塑造北美流体动力市场的关键趋势。降低成本和减少环境影响的节能係统越来越受欢迎。美国能源局强调了压缩空气系统在製造业为动力来源工具和物料输送的重要性。最近的 FDA 指南也推动了食品加工中采用更清洁、节能的气动系统,标誌着流体动力创新的持续成长。

流体动力设备产业概况

市场领导:流体动力设备市场呈现半整合状态,由博世力士乐股份公司、丹佛斯公司和伊顿公司等知名全球参与企业组成。

技术创新:派克汉尼汾公司和 SMC 公司等领先公司依靠液压和气压技术的进步来提高系统效率、永续性和精度。这些公司在全球范围内运营,提供标准化和自订的流体动力解决方案,以满足各种各样的工业需求。

永续性和数位化整合:未来市场成功的关键驱动因素包括物联网和自动化技术的集成,以及对开发永续和节能係统的关注。主要企业需要继续投资创新和伙伴关係,以在不断发展的流体动力市场中保持竞争力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章全球油压设备市场展望

- 当前市场状况

- 主要市场驱动因素与挑战

第五章 市场洞察

- 市场驱动因素

- 能源效率和环境考量塑造市场格局

- 工业自动化的进步推动了对流体动力系统的需求

- 技术进步推动需求

- 市场问题

第六章市场区隔:全球油压设备市场

- 依产品类型

- 泵浦

- 马达

- 阀门

- 圆柱

- 蓄能器和过滤器

- 其他产品类型(变速箱、流体连接器等)

- 按最终用户产业

- 建造

- 农业

- 物料输送

- 石油和天然气

- 航太与国防

- 工具机

- 油压工具

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

- 供应商市场占有率分析-油压设备市场

第七章全球气动设备市场展望

- 当前市场状况

- 主要市场驱动因素与挑战

第 8 章市场区隔:全球气动设备市场

- 依产品类型

- 阀门

- 致动器

- 纤维连接环

- 配件

- 其他的

- 按最终用户产业

- 食品加工和包装

- 车

- 物料输送和组装

- 化工/塑胶/石油

- 半导体电子

- 金工

- 纸张和印刷

- 生命科学

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

- 供应商市场占有率分析-气动设备市场

第九章竞争格局

- 公司简介

- Bosch-Rexroth AG

- Danfoss AS

- Eaton Corporation

- Hydac

- Parker-Hannifin Corporation

- HydraForce Inc.

- Kawasaki Heavy Industries Limited

- Nachi-Fujikoshi Corp.

- Festo AG

- SMC Corporation

- Emerson Electric Co.

- Schlumberger Limited

- IMI Precision Engineering

- Parker Hannifin Corporation

- Ingersoll Rand Inc.

- Flowserve BV(Flowserve Corporation)

- Neles Oyj

- 市场展望 - 气动设备市场

- 市场展望 -油压设备市场

The Fluid Power Equipment Market size is estimated at USD 69.98 billion in 2025, and is expected to reach USD 90.86 billion by 2030, at a CAGR of 5.36% during the forecast period (2025-2030).

The fluid power equipment market is pivotal to numerous industries, including construction, agriculture, aerospace, material handling, and oil and gas. Fluid power systems utilize hydraulic and pneumatic technologies to manage energy via pressurized fluids, leading to the widespread use of equipment like pumps, motors, cylinders, and valves. These components are essential for sectors that require high precision, reliability, and efficiency in their operations.

Hydraulic Equipment Leads the Market

Key Highlights

- Hydraulic equipment plays a dominant role in the market, offering powerful and reliable solutions, particularly suited for heavy machinery and industrial applications. Products like hydraulic cylinders and valves are extensively used across sectors such as construction and manufacturing, where high force and precise control are critical. While pneumatic equipment is less powerful, it is preferred in industries such as food processing and automotive assembly, where speed, simplicity, and safety are key considerations.

Technological Advancements Drive Demand

Key Highlights

- Demand for fluid power components is fueled by technological developments in hydraulic and pneumatic systems, energy efficiency regulations, and growing automation trends. Integrating fluid power technology into industrial control systems has led to innovations, particularly in sectors like aerospace and oil and gas, where hydraulic machinery and fluid power control systems are being refined for enhanced efficiency and reduced environmental impact.

Advances in Industrial Automation Fuel Demand for Fluid Power Systems

Key Highlights

- Incased Automationre: The ongoing shift toward automation in various industries is significantly impacting the fluid power equipment market. Hydraulic and pneumatic systems are increasingly integrated into automated industrial machinery, offering superior precision and control. This demand is particularly strong in factory automation, where efficient manufacturing processes and reduced labor costs are prioritized.

- Hydraulic Motors and Pumps Expansion: Industrial pumps and hydraulic motors are gaining wider use in sectors such as material handling and aerospace. Automation enables faster, more precise operations, driving further demand for fluid power equipment innovations that improve reliability and operational efficiency.

- Industry 4.0 Integration: As part of the Industry 4.0 transformation, fluid power technology is evolving to include smart sensors and advanced control mechanisms. These allow real-time monitoring and adjustments, minimizing downtime and enhancing performance in industrial hydraulic machinery.

- Pneumatic Equipment in Automotive and Semiconductor Manufacturing: Industries like automotive and semiconductor manufacturing are increasing their reliance on fluid power applications due to the growing complexity of production processes. Pneumatic systems are becoming essential for assembly lines and robotics, valued for their speed, flexibility, and safety.

Energy Efficiency and Environmental Considerations Shape Market Outlook

Key Highlights

- Energy Efficiency Focus: As environmental regulations become stricter, energy efficiency is a growing concern for manufacturers of hydraulic and pneumatic systems. These systems are being re-engineered to minimize energy consumption and reduce emissions, in line with global sustainability goals.

- Redesign of Hydraulic Valves and Cylinders: Hydraulic valves and cylinders are undergoing significant redesigns to enhance energy efficiency. Fluid power transmission systems are being equipped with energy-efficient motors and pumps, which help to reduce operational costs and environmental impacts across industries.

- Increased Adoption in Construction and Agriculture: Energy-efficient hydraulic solutions are gaining traction in sectors like construction and agriculture, where equipment such as excavators and tractors operate under challenging conditions. Advanced control systems are being introduced to optimize energy use without sacrificing performance.

- Optimized Pneumatic Valves: Pneumatic valves and actuators, frequently used in industries such as packaging and food processing, are being optimized for energy savings. By operating at lower pressure levels, these systems reduce energy consumption while maintaining high-speed and precision in industrial applications.

Fluid Power Equipment Market Trends

Valves Holds a Significant Share in the Market

- Valves Hold a Significant Share in the Market: Valves are essential components in fluid power systems, managing fluid flow in various applications. Pneumatic valves, including solenoid-piloted and air-piloted types, are heavily used in industries such as automotive and power tools. Innovations such as Warren Controls' ILEA 2900E series of electrically actuated globe-control valves highlight advancements in valve durability and precision, reinforcing their central role in the fluid power equipment market.

- Smart Valve Technology: The emergence of smart valve technology is revolutionizing industrial operations, enabling real-time monitoring and control. This is critical in industries like mining and agriculture, where Bosch Rexroth's new valve platform facilitates the integration of hydraulic control into multifunctional systems, improving both efficiency and customization.

- Pressure Relief Valves: Pressure relief valves are critical in maintaining safety in high-pressure environments by regulating excess pressure in pneumatic systems. Their use in sectors like construction and automotive underscores the importance of system integrity. Customizable solutions such as Linde Hydraulics' modular valve block demonstrate innovations that improve adaptability and operational flexibility in fluid power systems.

- Pneumatic Valves and Industry 4.0: The growing influence of Industry 4.0 is driving the demand for pneumatic valves, particularly in smart manufacturing. These valves offer precise control in automated production lines. Factors such as increasing population and advancements in water management technologies are also contributing to the rising demand for fluid control valves in the fluid power equipment market.

North America to Witness Considerable Growth

- Industrial Expansion and Automation: The fluid power equipment market in North America is poised for substantial growth, spurred by rapid industrialization and increased automation across various sectors. Industries like automotive, aerospace, and construction are adopting hydraulic and pneumatic systems to modernize production processes and improve efficiency. Hitachi and Volvo North America are among the leaders in incorporating hydraulic systems into machinery, enhancing operational capabilities.

- Oil and Gas Sector: The hydraulic equipment market in North America is heavily driven by the oil and gas sector, where high-pressure systems power operations like fluid pumping. Hydraulic lifts and other equipment are vital for efficient oil extraction processes. Rising natural gas consumption in the US further signals the growing demand for hydraulic systems in energy production.

- Construction Sector: The construction industry's need for hydraulic machinery is expanding due to ongoing infrastructure projects. Heavy machinery such as excavators and cranes, which rely on hydraulic systems, are seeing increased demand. Partnerships between companies like Kobelco and Yanmar are driving innovations in hydraulic excavator production, further boosting the North American fluid power equipment market.

- Energy-Efficient Solutions: Sustainability is a key trend shaping the fluid power market in North America. Energy-efficient systems that reduce costs and environmental impacts are gaining traction. The US Department of Energy highlights compressed air systems' importance in manufacturing, where they power tools and handle materials. Recent FDA guidelines also drive the adoption of cleaner, energy-efficient pneumatic systems in food processing, indicating continued growth in fluid power innovations.

Fluid Power Equipment Industry Overview

Market Leaders: The fluid power equipment market is semi consolidated, with prominent global players such as Bosch-Rexroth AG, Danfoss AS, and Eaton Corporation commanding significant market share. These companies leverage economies of scale and R&D expertise to maintain their leadership positions.

Technological Innovation: Leading players like Parker-Hannifin Corporation and SMC Corporation emphasize technological advancements in hydraulics and pneumatics to enhance system efficiency, sustainability, and precision. These companies operate globally, offering both standardized and custom fluid power solutions to meet diverse industrial needs.

Sustainability and Digital Integration: Key factors driving future market success include the integration of IoT and automation technologies, as well as a focus on developing sustainable and energy-efficient systems. Leading companies must continue to invest in innovation and partnerships to remain competitive in the evolving fluid power market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 GLOBAL HYDRAULIC EQUIPMENT MARKET OUTLOOK

- 4.1 Current Market Scenario

- 4.2 Key Market Influencers - Market Drivers and Challenges

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Energy Efficiency and Environmental Considerations Shape Market Outlook

- 5.1.2 Advances in Industrial Automation Fuel Demand for Fluid Power Systems

- 5.1.3 Technological Advancements Drive Demand

- 5.2 Market Challenges

6 MARKET SEGMENTATION - GLOBAL HYDRAULIC EQUIPMENT MARKET

- 6.1 By Product Type

- 6.1.1 Pumps

- 6.1.2 Motors

- 6.1.3 Valves

- 6.1.4 Cylinders

- 6.1.5 Accumulators and Filters

- 6.1.6 Other Product Types (Transmission, Fluid Connectors, etc.)

- 6.2 By End-user Vertical

- 6.2.1 Construction

- 6.2.2 Agriculture

- 6.2.3 Material Handling

- 6.2.4 Oil and Gas

- 6.2.5 Aerospace and Defense

- 6.2.6 Machine Tools

- 6.2.7 Hydraulic Tools

- 6.2.8 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

- 6.4 Vendor Market Share Analysis - Hydraulic Equipment Market

7 GLOBAL PNEUMATIC EQUIPMENT MARKET OUTLOOK

- 7.1 Current Market Scenario

- 7.2 Key Market Influencers - Market Drivers and Challenges

8 MARKET SEGMENTATION - GLOBAL PNEUMATIC EQUIPMENT MARKET

- 8.1 By Product Type

- 8.1.1 Valves

- 8.1.2 Actuators

- 8.1.3 FRLs

- 8.1.4 Fittings

- 8.1.5 Other Product Types

- 8.2 By End-user Vertical

- 8.2.1 Food Processing and Packaging

- 8.2.2 Automotive

- 8.2.3 Material Handling and Assembly

- 8.2.4 Chemicals/Plastics/Oil

- 8.2.5 Semiconductor and Electronics

- 8.2.6 Metalworking

- 8.2.7 Paper and Printing

- 8.2.8 Life Sciences

- 8.2.9 Other End-user Verticals

- 8.3 By Geography

- 8.3.1 North America

- 8.3.2 Europe

- 8.3.3 Asia-Pacific

- 8.3.4 Rest of the World

- 8.4 Vendor Market Share Analysis - Pneumatic Equipment Market

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Bosch-Rexroth AG

- 9.1.2 Danfoss AS

- 9.1.3 Eaton Corporation

- 9.1.4 Hydac

- 9.1.5 Parker-Hannifin Corporation

- 9.1.6 HydraForce Inc.

- 9.1.7 Kawasaki Heavy Industries Limited

- 9.1.8 Nachi-Fujikoshi Corp.

- 9.1.9 Festo AG

- 9.1.10 SMC Corporation

- 9.1.11 Emerson Electric Co.

- 9.1.12 Schlumberger Limited

- 9.1.13 IMI Precision Engineering

- 9.1.14 Parker Hannifin Corporation

- 9.1.15 Ingersoll Rand Inc.

- 9.1.16 Flowserve BV (Flowserve Corporation)

- 9.1.17 Neles Oyj

- 9.2 Market Outlook - Pneumatic Equipment Market

- 9.3 Market Outlook - Hydraulic Equipment Market