|

市场调查报告书

商品编码

1690910

泰国 IT 与安全:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Thailand IT And Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

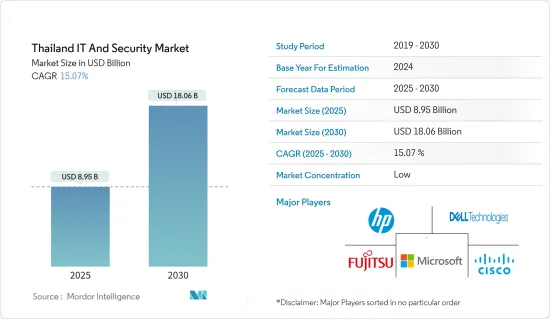

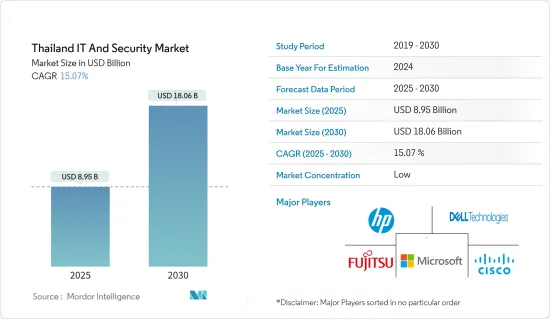

泰国 IT 和安全市场规模预计在 2025 年为 89.5 亿美元,预计到 2030 年将达到 180.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.07%。

主要亮点

- 随着网路的兴起,泰国正在数位经济转型,为通讯服务供应商、数位娱乐、游戏和家用电器等多个行业带来新的收益来源。

- 数位转型使企业更加依赖应用程式和扩展,从而使 IT 成为大多数企业的关键竞争优势。此外,IT外包已不仅是一种削减成本的技术,还提供云端迁移和云端服务选项。这种新形式是由围绕业务成长、客户体验和竞争颠覆的组织倡议所推动的。

- 政府推动数位技术发展和应用的措施也进一步推动了市场成长。例如,2023年11月,泰国政府与Google达成策略合作,以增强该国的数位竞争力并加速人工智慧创新。透过该协议,双方有望共同实施人工智慧经济蓬勃发展所需的四大基础支柱。该协议包括增加数位基础设施投资、促进安全负责任地采用人工智慧来转变公共服务提供方式、嵌入云端优先政策以及使该国更容易获得数位技能等措施。

- 政府国防机构和企业正在将更多资料转移到云端,设计新的数位系统,并增加其网路基础设施中的端点数量。对第三方和服务提供者的依赖性增加为攻击者提供了渗透供应链的新机会。

- 推动该国网路安全解决方案和服务成长的因素包括该国网路攻击的增加、对数位化和可扩展IT基础设施的需求不断增长、解决第三方供应商风险的需要不断增加、MSSP 的发展以及云端优先策略的采用。然而,缺乏满足需求的熟练 IT 专业人员正在阻碍企业的业务并对泰国市场的成长构成挑战。

- 新冠疫情加速了泰国各个终端用户产业对数位技术的采用和数位化转型力度。为了确保业务连通性,对云端运算、协作工具和IT基础设施相关解决方案的投资增加,导致对数位技术和远端工作的依赖增加,从而引发了安全担忧,导致市场对安全解决方案的需求增加。

泰国 IT 与安全市场趋势

云端安全推动市场成长

- 近年来,云端运算服务在泰国经历了显着成长。此次转型是政府推动数位化和云端技术的倡议的一部分。泰国的许多行业正在采用云端运算来实现业务流程的现代化并在各自的市场中获得竞争优势。

- 由于泰国拥有强大的网路基础设施和高速网路连接,云端运算在泰国越来越受欢迎。此外,本地和国际云端服务供应商的不断增长意味着泰国企业现在可以利用一系列云端基础的解决方案和服务。因此,预计预测期内最终用户对云端安全的需求将会增加,以保护云端环境并打击日益增长的网路威胁。

- 2023年7月,云端运算服务供应商云端运算解决方案(CCS)与全球科技公司腾讯的云端业务腾讯云端签署了一份谅解备忘录,向泰国的商业企业提供腾讯云端领先的云端AI解决方案,包括IaaS、PaaS和SaaS。此次伙伴关係旨在透过售后服务提高客户信任度和满意度,促进正处于数位转型阶段的泰国各种规模和行业的企业业务成长。

- 泰国处于亚洲云端运算采用趋势的前沿。根据阿里云「亚洲下一代云端策略」调查,泰国的云端运算采用正在迅速推进。大多数泰国企业(95%)计画大幅增加云端运算投资,领先印尼(94%)、菲律宾(91%)、香港特别行政区(83%)和新加坡(83%)等国家。调查结果显示,许多企业基于可靠的本地支援和良好的安全声誉而选择公共云端。这些以及其他与云端技术及相关趋势相关的发展预计将在未来几年推动对云端安全的需求。

IT硬体和设备预计将占据较大的市场占有率

- 泰国正在积极推行政府、医疗保健、教育和商业等多个领域的数位转型。这个数位化进程需要对 IT 硬体和设备进行投资,以支援现代化工作、简化业务并提高效率。

- 疫情期间,泰国政府鼓励学校和大学进行线上活动,导致对桌上型电脑、平板电脑和笔记型电脑等 IT 硬体和设备的需求激增。更具包容性的数位世界的到来使得平板电脑等设备成为必需品而非奢侈品,从而推动了泰国的需求。

- 泰国是东南亚国家联盟(ASEAN)地区最具活力的经济体之一。该国的 IT 产业正在不断扩大,对外国投资者的吸引力也越来越大。企业和政府机构的数位化不断提高,加上精通科技的消费者数量不断增加,推动了对 IT 硬体和设备的需求。

- 由于科技的应用日益广泛,泰国的 IT 产业正在经历强劲成长,为企业满足高端用户的需求提供了巨大的商业潜力。 2023 年 7 月,惠普宣布将把消费和商务用笔记型电脑的生产转移到泰国和墨西哥,以实现中国以外的供应链多元化。

泰国 IT 和安全产业概况

泰国的 IT 和安全市场比较分散,一些全球性公司专注于扩大在基本客群,并采用有机和无机成长策略。

- 2024年3月,领先的云端运算和网路安全解决方案供应商深信服科技与 VST ECS(泰国)建立策略合作伙伴关係,透过将 VST ECS 在 IT 解决方案分销方面的专业知识和经验与深信服的技术相结合,扩大深信服在泰国的基本客群。

- 2023 年 9 月富士通有限公司和富士通泰国有限公司收购了泰国 SAP 顾问公司创新咨询服务 (ICS),增强了其在亚太地区的 SAP 咨询和託管服务能力。这是富士通有限公司自 2021 年以来进行的第七次收购,也是其成为数位转型全球领导者的程序化併购策略的一部分。

- 2023 年 7 月,惠普宣布计划将数百万台消费和商务用笔记型电脑的生产转移到泰国和墨西哥,以实现其在中国以外的 PC 供应链多元化。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

- 泰国主要 IT 进出口调查结果

- 泰国主要市场指数

第五章 市场动态

- 市场驱动因素

- 数位化和对可扩展IT基础设施日益增长的需求

- 网路安全事件和报告法规的快速增加

- 市场限制

- 市场分散、资料外洩增多以及缺乏支援基础设施

- 网路安全专家短缺

第 6 章 泰国 IT 市场细分

- IT硬体和设备

- 桌面

- 笔记型电脑

- 药片

- 资讯科技软体

- 企业软体

- 生产力软体

- 应用开发软体

- 系统基础设施软体

- IT 服务

- 业务流程外包

- IT咨询与实施

- IT外包

- 其他IT服务

7. 泰国网路安全市场细分

- 人均网路安全支出

- 按类型

- 云端安全

- 资料安全

- 身分和存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他类型

第八章 竞争格局

- 公司简介 - 主要 IT 硬体供应商列表

- Simat Technologies Public Company Limited

- Movaci Co. Ltd

- Acer Inc.

- Advice IT Infinite Company Ltd

- HP Development Company LP

- Samsung Electronics Co. Ltd

- Intel Corporation

- Dell Technologies Inc.

- 公司简介 - 主要 IT 软体供应商列表

- Outsourcify

- Hire Quality Software Co. Ltd

- Tech Curve AI and Innovations

- Fujitsu Thailand Co. Ltd(Fujitsu Limited)

- Movaci Co. Ltd

- AppSquadz Software Pvt. Ltd

- G-Able Co. Ltd

- Microsoft Corporation

- 公司简介 - 主要 IT 网路安全供应商列表

- IBM Corporation

- Cisco Systems Inc.

- Fujitsu Thailand Co. Ltd

- Red Sky Digital Ventures Ltd

- Info Security Consultant Co. Ltd

- Dell Technologies Inc.

- Fortinet Inc.

- CGA Group Co. Ltd

- Intel Security(Intel Corporation)

第九章投资分析

第十章:市场的未来

简介目录

Product Code: 72436

The Thailand IT And Security Market size is estimated at USD 8.95 billion in 2025, and is expected to reach USD 18.06 billion by 2030, at a CAGR of 15.07% during the forecast period (2025-2030).

Key Highlights

- Following the widespread proliferation of the Internet, Thailand is transitioning into a digital economy, opening up new revenue sources for several industries, including telecommunications service providers, digital entertainment and gaming, and consumer electronics.

- With digital transformation, organizations have become increasingly dependent on applications and extensions that make IT a critical competitive advantage for most organizations. Moreover, IT outsourcing has become more than a simple cost-reduction technique with cloud migrations and cloud service options. This new form is driven by organizational initiatives regarding business growth, customer experience, and competitive disruption.

- Several government initiatives to propel digital technology development and adoption are further supporting market growth. For instance, in November 2023, the Thai government and Google strategically collaborated to boost the country's digital competitiveness and accelerate artificial intelligence innovation. Through this agreement, both parties are expected to work jointly to implement four foundational pillars that are essential for the country to thrive in the AI economy. The agreement includes advancing digital infrastructure investments, promoting secure and responsible AI adoption to transform public service delivery, anchoring on cloud-first policies, and making digital skills more accessible to the country.

- Various governmental defense agencies and companies are moving more data to the cloud, designing new digital systems, and increasing the number of endpoints in their network infrastructure. As a result of their increasing reliance on third parties and service providers, attackers have new opportunities to penetrate supply chains.

- The increasing number of cyberattacks in the country, the increasing demand for digitalization and scalable IT Infrastructure, the rising need to tackle risks from third-party vendor risks, the evolution of MSSPs, and the adoption of a cloud-first strategy are driving the growth of cybersecurity solutions and services in the country. However, the shortage of skilled IT professionals to meet the demand leads to businesses having difficulty in their operations, challenging the market's growth in Thailand.

- The COVID-19 pandemic has accelerated the adoption of digital technologies and digital transformation initiatives across various end-user industries in the country. The rising investment in cloud computing, collaborative tools, and IT infrastructure-related solutions to ensure business connectivity resulted in increased reliance on digital technologies and remote work, which has heightened security concerns, resulting in increased demand for security solutions in the market.

Thailand IT And Security Market Trends

Cloud Security is Expected to Drive Market Growth

- Cloud computing services in Thailand have seen remarkable growth in recent years. The transformation is part of the government's attribution initiatives to promote digitalization and cloud technologies. Many industries in Thailand have adopted cloud computing to modernize their business processes and gain a competitive advantage in their respective markets.

- Cloud computing has become increasingly popular in Thailand due to the country's strong internet infrastructure and high-speed internet connections. Additionally, the expanding presence of local and international cloud service providers has given Thai businesses access to a diverse range of cloud-based solutions and services. As a result, the demand for cloud security across end-users is expected to increase over the forecast period to secure cloud environments and respond to rising cyber threats.

- In July 2023, Cloud Computing Solutions Co. Ltd (CCS), a cloud computing services provider, and Tencent Cloud, the cloud business of global technology company Tencent, signed an MoU to offer leading Cloud-AI solutions from Tencent Cloud for business enterprises, including IaaS, PaaS, and SaaS in Thailand. This partnership aims to boost customer trust and satisfaction with an after-sales service, driving business growth for companies of all sizes and industries in Thailand in the midst of digital transformation.

- Thailand is at the forefront of Asia's cloud adoption trend. According to a "The Next-Generation Cloud Strategy in Asia" survey from Alibaba Cloud, the adoption of cloud is rapidly increasing in Thailand. A vast majority of Thai businesses (95%) are expected to significantly increase investment in the cloud across countries like Indonesia (94%), the Philippines (91%), Hong Kong Special Administration (83%), and Singapore (83%). The survey results indicated that many businesses chose the public cloud based on reliable local support and a strong reputation for security. Such developments related to cloud technology and related trends are anticipated to create demand for cloud security over the coming years.

IT Hardware and Devices Are Expected to Hold a Significant Market Share

- Thailand has been actively promoting digital transformation across various sectors, including government, healthcare, education, and businesses. This push toward digitalization requires IT hardware and device investments to support modernization efforts and improve efficiency by streamlining business operations.

- During the pandemic, the Thai government recommended schools and universities conduct activities online, which resulted in tremendous demand for IT hardware and devices like desktops, tablets, and laptops. With the advent of a more inclusive digital world, devices such as tablets became necessity rather than a luxury, driving demand in the country.

- Thailand has been one of the most vibrant economies in the Association of Southeast Asian Nations (ASEAN) region. The country's IT sector has expanded; it is becoming increasingly attractive to foreign investors. Businesses and government agencies are increasingly going digital, and more consumers are becoming tech-savvy, increasing the demand for IT hardware and devices.

- The IT sector has been growing significantly in Thailand, driven by the increasing usage of technology, offering vast business potential to companies to meet the demands of sophisticated users. In July 2023, HP announced the shifting of production of consumer and commercial laptops to Thailand and Mexico to diversify the supply chain beyond China.

Thailand IT And Security Industry Overview

The Thai IT and security market is fragmented owing to several global players focusing on expanding their client base across the country and adopting both organic and inorganic growth strategies.

- March 2024: Sangfor Technologies, a key provider of Cloud Computing and Cybersecurity solutions, strategically partnered with VST ECS (Thailand) Co. Ltd to expand Sangfor's customer base in Thailand by leveraging VST ECS's expertise and experience in IT solution distribution, combined with Sangfor's technology.

- September 2023: Fujitsu Limited and Fujitsu Thailand Limited acquired Thailand-based SAP consultancy Innovation Consulting Services (ICS) and strengthened its capabilities in SAP consulting and managed services across the Asia-Pacific region. This was the seventh acquisition by Fujitsu Limited since 2021 as part of its programmatic merger and acquisition strategy to become a global leader in digital transformation.

- July 2023: HP announced its plan to shift production of millions of consumer and commercial laptops to Thailand and Mexico to diversify its PC supply chain beyond China.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Coverage on major IT Imports and Exports - Thailand

- 4.5 Key Market Indicators in Thailand

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Rapidly Increasing Cybersecurity Incidents and Regulations Requiring their Reporting

- 5.2 Market Restraints

- 5.2.1 Fragmented Nature of the Market and Growing Incidence of Data Breaches and Lack of Supporting Infrastructure

- 5.2.2 Lack of Cybersecurity Professionals

6 THAILAND IT MARKET SEGMENTATION

- 6.1 IT Hardware & Devices

- 6.1.1 Desktop

- 6.1.2 Laptop

- 6.1.3 Tablet

- 6.2 IT Software

- 6.2.1 Enterprise Software

- 6.2.2 Productivity Software

- 6.2.3 Application Development Software

- 6.2.4 System Infrastructure Software

- 6.3 IT Services

- 6.3.1 Business Process Outsourcing

- 6.3.2 IT Consulting and Implementation

- 6.3.3 IT Outsourcing

- 6.3.4 Other IT Services

7 THAILAND CYBER SECURITY MARKET SEGMENTATION

- 7.1 Cybersecurity Per-capita Spending

- 7.2 By Type

- 7.2.1 Cloud Security

- 7.2.2 Data Security

- 7.2.3 Identity Access Management

- 7.2.4 Network Security

- 7.2.5 Consumer Security

- 7.2.6 Infrastructure Protection

- 7.2.7 Other Types

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - List of Major IT Hardware Vendors

- 8.1.1 Simat Technologies Public Company Limited

- 8.1.2 Movaci Co. Ltd

- 8.1.3 Acer Inc.

- 8.1.4 Advice IT Infinite Company Ltd

- 8.1.5 HP Development Company LP

- 8.1.6 Samsung Electronics Co. Ltd

- 8.1.7 Intel Corporation

- 8.1.8 Dell Technologies Inc.

- 8.2 Company Profiles - List of Major IT Software Vendors

- 8.2.1 Outsourcify

- 8.2.2 Hire Quality Software Co. Ltd

- 8.2.3 Tech Curve AI and Innovations

- 8.2.4 Fujitsu Thailand Co. Ltd (Fujitsu Limited)

- 8.2.5 Movaci Co. Ltd

- 8.2.6 AppSquadz Software Pvt. Ltd

- 8.2.7 G-Able Co. Ltd

- 8.2.8 Microsoft Corporation

- 8.3 Company Profiles - List of Major IT Cybersecurity Vendors

- 8.3.1 IBM Corporation

- 8.3.2 Cisco Systems Inc.

- 8.3.3 Fujitsu Thailand Co. Ltd

- 8.3.4 Red Sky Digital Ventures Ltd

- 8.3.5 Info Security Consultant Co. Ltd

- 8.3.6 Dell Technologies Inc.

- 8.3.7 Fortinet Inc.

- 8.3.8 CGA Group Co. Ltd

- 8.3.9 Intel Security (Intel Corporation)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219