|

市场调查报告书

商品编码

1690916

生物辨识卡:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Biometric Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

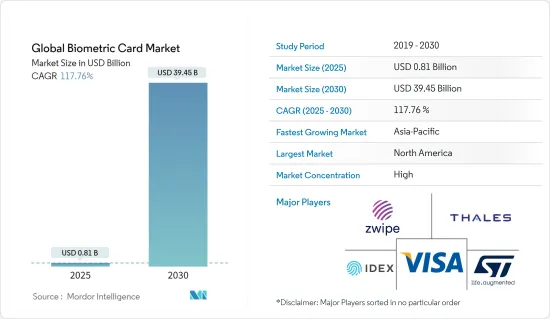

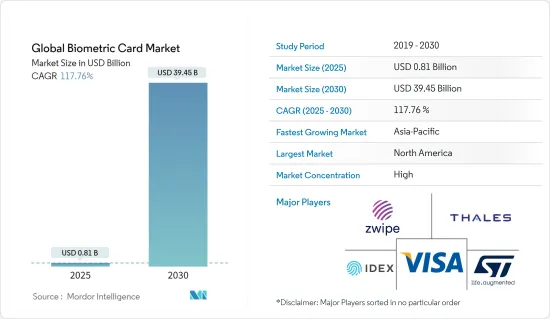

预计 2025 年全球生物辨识卡市场规模为 8.1 亿美元,到 2030 年将达到 394.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 117.76%。

主要亮点

- 生物辨识认证彻底改变了付款安全:随着对安全、便利付款方式的需求不断增加,生物辨识卡市场正在经历强劲成长。生物辨识卡结合了指纹感应器和其他生物辨识技术,透过解决付款诈骗问题并改善用户体验,正在彻底改变金融业。

- 安全交易:生物辨识卡将指纹认证与智慧卡技术结合,实现安全付款。

- 生态系统伙伴关係:生态系统参与者之间的合作关係激增正在推动市场的发展。

- 主要认证万事达卡、Visa 和中国银联在生物辨识卡解决方案认证方面处于领先地位。

- 金融包容性推动市场扩张生物辨识卡市场的关键驱动力是金融包容性倡议的需求,尤其是在新兴市场。政府和金融机构正在采用生物识别技术将银行帐户纳入金融体系,创造新的成长机会。

- 非洲倡议万事达卡和 Paycode 的目标是让 3,000 万非洲人参与生物辨识智慧卡金融包容计画。

- 巴西的潜力:巴西展现出巨大的潜力,Desti 等数位银行专注于服务不足的族群。

- 全球试验:波兰、伊拉克、印度、墨西哥、黎巴嫩和埃及等国家正在进行生物辨识卡试验。

- 多因素身份验证推动市场成长:多因素身份验证 (MFA) 的日益普及正在推动生物识别卡市场的发展。随着网路安全威胁的不断发展,企业和消费者正在转向采用生物识别的 MFA 解决方案来增强安全性。

- 整合到 MFA:生物特征认证正在成为 MFA 系统的关键要素。

- 医疗保健采用:医疗保健产业正在采用 MFA 来保护病患资料。

- 电子商务的爆炸式增长:行动银行和电子商务的兴起正在推动强身份验证的需求。

- 竞争格局和策略倡议:生物辨识卡市场竞争激烈,策略联盟和创新决定了市场动态。领先的公司正专注于技术进步和认证以巩固其市场地位。

- 泰雷兹集团领导层:泰雷兹在 20 多个生物辨识付款卡计划中处于领先地位。

- 伙伴关係扩张:Zwipe、Idemia Group 和 Fingerprint Cards AB 等公司正在透过与地区参与者合作来扩大其全球影响力。

- 推动创新:领先的金融平台正在推动安全和创新技术的采用。

- 未来展望与市场潜力:生物识别卡市场未来前景光明,新兴趋势显示将持续成长。生物辨识技术与物联网和智慧城市计画的融合正在释放超越传统付款的新机会。

- 多模态生物识别:市场正在朝向结合指纹、脸部辨识和手部多模态解决方案发展。

- 非接触式付款:非接触式生物辨识付款卡因其安全性和便利性而越来越受欢迎。

- 加密货币整合:在加密货币交易中使用生物辨识卡是一种新兴趋势。

生物识别卡市场趋势

BFSI 领域:生物辨识卡风靡一时

- 细分市场成长和市场占有率:BFSI(银行、金融服务和保险)细分市场引领生物辨识卡市场,预计将从 2022 年的 3,676 万美元成长到 2029 年的 12.82 亿美元。该细分市场 2021 年的市场占有率为 66.10%,凸显了其在市场扩张中的主导地位。

- 打击诈欺:金融机构正致力于加强安全措施,以减轻日益严重的卡片诈骗问题。

- 非接触式付款正在兴起:全球向非接触式付款的转变为生物识别卡的采用创造了肥沃的土壤。

- MFA 一致性:金融交易中对 MFA 的日益重视与生物辨识卡完全一致。

- 微趋势和产业倡议:金融机构和技术提供者之间的合作正在推动生物辨识卡的创新。例如,万事达卡与约旦-科威特银行合作推出了一种生物识别付款卡,该卡配有指纹读取器,可实现免密码付款。

- 伙伴关係推动创新这些合作强调了对更安全、更用户友好的付款方式的追求。

- 数位人民币试验中国建设银行与IDEX Biometrics合作进行数位人民币概念验证试验,展示生物辨识卡在新数位货币生态系统中的作用。

- 市场动态与未来展望:由于消费者对安全、无缝支付方式的需求不断增长,BFSI 产业预计将继续占据主导地位。随着生物辨识技术的成熟和生产成本的下降,其在银行服务的广泛应用预计将进一步巩固该产业的地位。

- 无缝升级路径:生物辨识卡为金融机构提供了安全、扩充性的解决方案,而不会破坏其现有的基础设施。

- 成本降低和成熟:随着生产成本的下降,预计 BFSI 领域对生物识别卡的采用将激增。

亚太地区:成长最快的区域

- 市场成长轨迹:亚太地区预计将成为生物辨识卡市场成长最快的地区,从 2022 年的 1,402 万美元扩大到 2027 年的 7.3796 亿美元,复合年增长率为 120.92%。

- 人口趋势:不断增长的中阶和不断加快的都市化化为生物识别卡解决方案创造了巨大的潜在市场。

- 政府措施:印度和中国的金融包容性计画为引入生物辨识卡创造了理想的环境。

- 微趋势和区域倡议:亚太地区正在实施多项倡议,旨在加速生物辨识卡的普及。例如,Fingerprint Cards AB 已与 Transcorp 合作在印度推出生物辨识卡,日本的 MoriX 已与 Fingerprint Cards 合作开发安全的支付方式。

- 印度推动非接触式付款印度推动非接触式付款正在加速生物识别卡的采用。

- 日本的安全付款:日本消费者正在寻求安全、无摩擦的付款方式,并且越来越多地转向生物识别卡。

- 市场动态与未来展望:亚太生物辨识卡市场的成长具有多样化的市场动态特点,涵盖日本等高科技已开发国家到印度和印尼等新兴市场。

- 多样化的机会:该地区的多样性为生物识别卡参与者提供了独特的挑战,但也带来了巨大的商机。

- 广泛采用:除了 BFSI 之外,医疗保健和政府身分证计画等领域预计将推动进一步成长。

生物辨识卡产业概况

全球科技集团主导市场

全球生物辨识卡市场由领先的技术集团和专业的生物辨识解决方案提供者主导。泰雷兹集团、IDEMIA集团和万事达卡等主要企业以其技术力和全球影响力主导市场。

整合市场:这些公司凭藉其技术专长获得了较大的市场占有率。

全球影响力:我们遍布多个地区的业务增强了我们的市场地位。

创新和伙伴关係推动市场主导:

创新和策略伙伴关係对于维持市场领导地位至关重要。 Fingerprint Cards AB 和 IDEX Biometrics ASA 等公司正在引进进生物辨识感测器和软体解决方案的开发。与主要付款网络合作对于获得市场认可至关重要。

技术领先地位:这些公司正在大力投资研发下一代生物辨识解决方案。

策略伙伴关係:与金融机构的合作关係可以实现更深入的市场渗透和认证合规性。

未来市场的成功因素:有几个因素对于生物辨识卡市场的未来成功至关重要。降低生产成本、确保遵守 GDPR 等法规以及扩展到新兴市场对于成长至关重要。

成本效益:将每张卡的製造成本从 20 美元降低到 5 美元是一个关键目标。

安全与合规:加强安全功能和法规合规性对于市场成功至关重要。

新兴市场机会:与新兴市场的当地机构伙伴关係提供了新的成长途径。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 产业生态系统分析

- 生物识别卡的演变

第五章 市场动态

- 市场驱动因素

- 新兴国家对金融包容性倡议的需求日益增长

- 转向多因素身份验证有利于市场成长

- 金融包容性推动市场扩张

- 生物辨识认证彻底改变了付款安全,推动了市场成长

- 市场挑战

- 来自非卡片式生物辨识设备的激烈竞争

- 实施成本高

第六章 市场细分

- 按应用

- 付款

- 存取控制

- 政府身分证与金融包容性

- 其他用途

- 按行业

- BFSI

- 零售

- 政府

- 卫生保健

- 商业组织

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Zwipe AS

- Thales Group

- IDEX Biometrics ASA

- ST Microelectronics NV

- Visa Inc.

- Seshaasai Business Forms(P)Ltd

- IDEMIA Group

- Goldpac Fintech

- Mastercard Incorporated

- Fingerprint Cards AB

- Ethernom Inc.

- Samsung's System LSI Business

- Shanghai Fudan Microelectronics Group Co. Ltd

第八章投资分析

第九章:未来展望

第十章市场机会分析

The Global Biometric Card Market size is estimated at USD 0.81 billion in 2025, and is expected to reach USD 39.45 billion by 2030, at a CAGR of 117.76% during the forecast period (2025-2030).

Key Highlights

- Biometric Authentication Revolutionizing Payment Security: The Biometric Card Market is witnessing significant growth as demand for secure and convenient payment methods rises. Biometric cards, incorporating fingerprint sensors or other biometric technologies, are revolutionizing the financial industry by addressing payment fraud concerns while improving user experience.

- Secure transactions: Biometric cards integrate fingerprint recognition with smart card technology to ensure secure payments.

- Ecosystem partnerships: A surge in collaborations among players in the ecosystem is driving the market forward.

- Major certifications: Mastercard, Visa, and China UnionPay are leading the way in certifying biometric card solutions.

- Financial Inclusion Driving Market Expansion: A key driver of the biometric card market is the demand from financial inclusion initiatives, particularly in emerging markets. Governments and financial institutions are adopting biometric technologies to integrate unbanked populations into the financial system, creating new growth opportunities.

- African initiatives: Mastercard and Paycode aim to enroll 30 million Africans in a biometric smart card financial inclusion program.

- Brazilian potential: Brazil shows high potential, with digital banks like Desty focusing on underserved populations.

- Global trials: Biometric card trials are ongoing in countries like Poland, Iraq, India, Mexico, Lebanon, and Egypt.

- Multi-Factor Authentication Boosting Market Growth: The growing adoption of multi-factor authentication (MFA) is a major factor fueling the biometric card market. As cybersecurity threats evolve, businesses and consumers are integrating MFA solutions that incorporate biometrics for enhanced security.

- Integration in MFA: Biometric authentication is becoming a key element of MFA systems.

- Healthcare adoption: The healthcare sector is embracing MFA to protect patient data.

- Ecommerce surge: The rise of mobile banking and ecommerce is increasing the demand for strong authentication.

- Competitive Landscape and Strategic Initiatives: The biometric card market is highly competitive, with strategic collaborations and innovations defining market dynamics. Leading players are focusing on technological advancements and certifications to strengthen their market positions.

- Thales Group leadership: Thales is at the forefront with over 20 biometric payment card projects.

- Partnerships for expansion: Companies like Zwipe, Idemia Group, and Fingerprint Cards AB are expanding their global reach by partnering with regional players.

- Innovation push: Major financial platforms are driving the adoption of secure, innovative technologies.

- Future Outlook and Market Potential: The future of the biometric card market looks promising, with emerging trends indicating sustained growth. The integration of biometrics with IoT and smart city initiatives is unlocking new opportunities beyond traditional payments.

- Multimodal biometrics: The market is evolving towards multimodal solutions, combining fingerprint, facial recognition, and hand geometry.

- Contactless payments: Contactless biometric payment cards are gaining popularity due to their security and convenience.

- Cryptocurrency integration: The use of biometric cards in cryptocurrency transactions is an emerging trend.

Biometric Card Market Trends

BFSI Segment: Dominating the Biometric Card Landscape

- Segment Growth and Market Share: The BFSI (Banking, Financial Services, and Insurance) sector is leading the biometric card market, with projected growth from USD 36.76 million in 2022 to USD 1.282 billion by 2029. The sector held a 66.10% market share in 2021, underscoring its dominance in driving market expansion.

- Combatting fraud: Financial institutions are focusing on enhanced security to mitigate rising card fraud.

- Pandemic-driven contactless payments: The global shift towards contactless payments has created fertile ground for biometric card adoption.

- MFA alignment: The increasing emphasis on MFA in financial transactions aligns perfectly with biometric cards.

- Micro Trends and Industry Initiatives: Collaborations between financial institutions and technology providers are driving innovations in the biometric card space. For example, Mastercard partnered with Jordan Kuwait Bank to launch a biometric payment card featuring an on-card fingerprint reader for PIN-free payments.

- Partnerships driving innovation: These collaborations highlight the push towards more secure and user-friendly payment methods.

- Digital renminbi trials: China Construction Bank's partnership with IDEX Biometrics for digital renminbi experiments showcases the role of biometric cards in emerging digital currency ecosystems.

- Market Dynamics and Future Outlook: The BFSI sector's dominance is expected to continue, driven by increasing consumer demand for secure, seamless payment methods. As biometric technology matures and production costs decrease, widespread adoption is anticipated across banking services, further solidifying the sector's role.

- Seamless upgrade path: Biometric cards provide financial institutions with a secure, scalable solution without disrupting existing infrastructure.

- Cost reduction and maturity: As production costs fall, widespread biometric card adoption across the BFSI sector is expected to surge.

Asia-Pacific: The Fastest-Growing Regional Segment

- Market Growth Trajectory: The Asia-Pacific region is expected to experience the fastest growth in the biometric card market, expanding from USD 14.02 million in 2022 to USD 737.96 million by 2027, with a CAGR of 120.92%.

- Demographic trends: A growing middle class and increasing urbanization create a large addressable market for biometric card solutions.

- Government initiatives: Financial inclusion programs in India and China are creating an ideal environment for biometric card adoption.

- Micro Trends and Regional Initiatives: Asia-Pacific is witnessing numerous initiatives aimed at accelerating biometric card adoption. For instance, Fingerprint Cards AB has partnered with Transcorp to launch biometric cards in India, while MoriX in Japan is collaborating with Fingerprint Cards to develop secure payment methods.

- India's contactless push: India's drive for contactless payments is accelerating biometric card adoption.

- Japan's secure payment landscape: Japanese consumers are demanding secure, frictionless payment methods, boosting biometric card interest.

- Market Dynamics and Future Prospects: Asia-Pacific's growth in the biometric card market is characterized by diverse market dynamics, ranging from tech-savvy economies like Japan to emerging markets like India and Indonesia.

- Diverse opportunities: The region's diversity offers unique challenges but also substantial opportunities for biometric card players.

- Broader sectoral adoption: Beyond BFSI, sectors such as healthcare and government ID programs are expected to drive further growth.

Biometric Card Industry Overview

Market Dominated by Global Technology Conglomerates

The Global Biometric Card Market is led by major technology conglomerates and specialized biometric solution providers. Key players, including Thales Group, IDEMIA Group, and Mastercard, dominate the market with their technological prowess and global reach.

Consolidated market: These companies command significant market share due to their technological expertise.

Global reach: Their presence in multiple regions strengthens their market positions.

Innovation and Partnerships Drive Market Leadership:

Innovation and strategic partnerships are critical for maintaining market leadership. Companies like Fingerprint Cards AB and IDEX Biometrics ASA lead in the development of advanced biometric sensors and software solutions. Collaborations with major payment networks are essential for gaining market certification.

Technological leadership: These companies invest heavily in R&D to develop next-generation biometric solutions.

Strategic alliances: Partnerships with financial institutions enable deep market penetration and certification compliance.

Factors for Future Success in the Market: Several factors are crucial for future success in the biometric card market. Reducing production costs, ensuring compliance with regulations like GDPR, and expanding into emerging markets are vital for growth.

Cost efficiency: Lowering production costs from USD 20 to USD 5 per card is a key goal.

Security and compliance: Enhanced security features and regulatory compliance are essential for market success.

Emerging market opportunities: Partnerships with local institutions in emerging markets provide new growth avenues.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Industry Ecosystem Analysis

- 4.5 Evolution of Biometric Cards

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Financial Inclusion-based Initiatives in Emerging Countries

- 5.1.2 Move Toward Multi-factor Authentication Bodes Well for Market Growth

- 5.1.3 Financial Inclusion Driving Market Expansion

- 5.1.4 Biometric Authentication Revolutionizing Payment Security is Driving The Market Growth

- 5.2 Market Challenges

- 5.2.1 Strong Competition from Non-card Biometric Devices

- 5.2.2 Higher Implementation Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Payments

- 6.1.2 Access Control

- 6.1.3 Government ID and Financial Inclusion

- 6.1.4 Other Applications

- 6.2 By End-User Vertical

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Government

- 6.2.4 Healthcare

- 6.2.5 Commercial Entities

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zwipe AS

- 7.1.2 Thales Group

- 7.1.3 IDEX Biometrics ASA

- 7.1.4 ST Microelectronics NV

- 7.1.5 Visa Inc.

- 7.1.6 Seshaasai Business Forms (P) Ltd

- 7.1.7 IDEMIA Group

- 7.1.8 Goldpac Fintech

- 7.1.9 Mastercard Incorporated

- 7.1.10 Fingerprint Cards AB

- 7.1.11 Ethernom Inc.

- 7.1.12 Samsung's System LSI Business

- 7.1.13 Shanghai Fudan Microelectronics Group Co. Ltd