|

市场调查报告书

商品编码

1940743

实心热塑性丙烯酸(珠状)树脂:市场份额分析、产业趋势与统计、成长预测(2026-2031)Solid-grade Thermoplastic Acrylic (Beads) Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

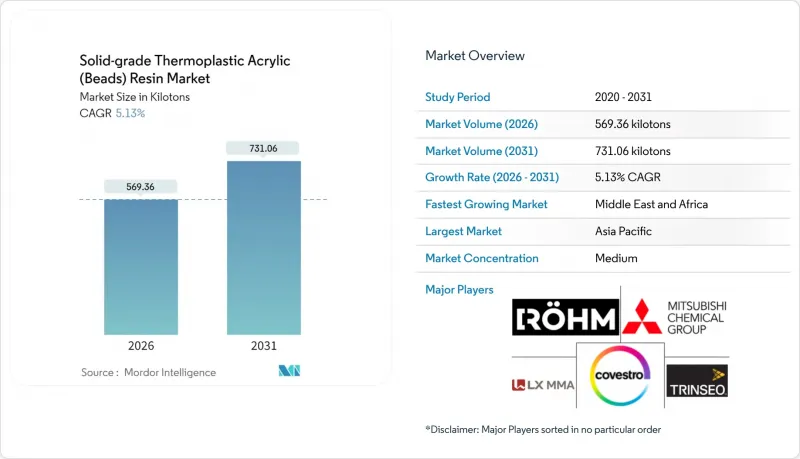

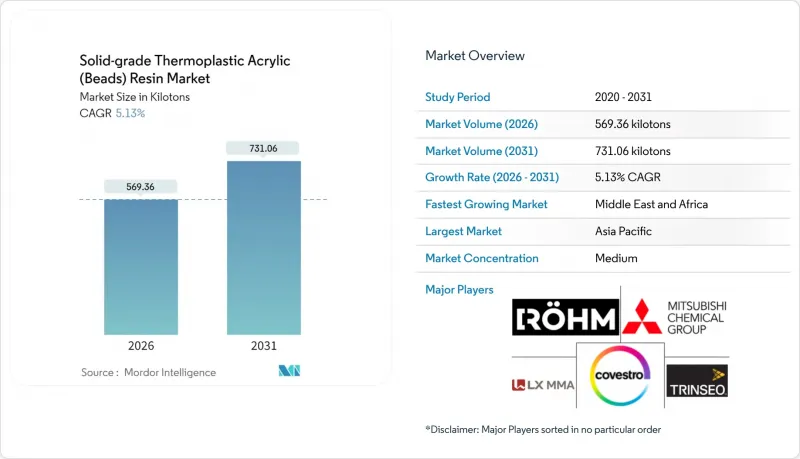

预计到 2026 年,固体级热塑性丙烯酸(珠状)树脂的市场规模将达到 569.36 千吨。

预计从 2025 年的 541.59 千吨成长到 2031 年的 731.06 千吨,2026 年至 2031 年的复合年增长率为 5.13%。

这一稳步增长反映了汽车行业轻量化策略的推进、粉末涂料的日益普及以及空气污染法规的日益严格,这些因素正在重塑涂料、复合材料和3D列印价值链的采购决策。一级汽车供应商正转向透明PMMA照明模组,这种模组既能减轻车辆重量,又能保持光学透明度。亚太和北美地区的基础设施投资对于可靠的终端应用至关重要。儘管MMA原料价格的持续波动正在考验生产商的利润率,但下游对再生和回收等级产品的需求正在加速住友化学等公司对解聚技术的投资。随着西方一体化製造商扩大产能、日本老牌企业退出市场以及中国企业在日益严格的溶剂排放和微珠法规的背景下提高产量,竞争格局正在发生变化,这也推动了差异化丙烯酸珠化学技术的价值提升。

全球固体级热塑性丙烯酸(珠粒)树脂市场趋势及洞察

亚洲和北美油漆和涂料消费量不断增长

亚太地区持续的基础设施投资推动了对高性能丙烯酸涂料的需求,这类涂料能够抵御恶劣天气和城市污染。中国快速的都市化凸显了涂料供应的紧张,而同时,涂料需求却十分强劲。在北美,美国《清洁空气法》的实施促使配方师转向水性或高固态体系,这些体係依赖轮胎边缘状丙烯酸树脂来控制黏度和保持光泽。两大洲的同步需求激增维持了多年的更新周期,并推动了固态含量热塑性丙烯酸(珠状)树脂市场的扩张。建筑化学品,例如密封剂和弹性涂料,是丙烯酸珠状树脂需求的另一个来源,但产能扩张未能跟上需求成长的步伐,导致2025年和2026年供应端价格得到支撑。

汽车产业向轻量化、透明的PMMA照明模组转型

电气化目标正迫使汽车製造商在不牺牲安全性和设计的前提下减轻车辆重量。住友化学的化学回收PMMA已被LG Display和日产汽车采用,这标誌着向闭合迴路永续性模式的转变。赢创的PMMA挡风玻璃原型相比玻璃更轻,预示着透明PMMA结构件的广泛应用。受ADAS感测器外壳、高阶导光板和发光标誌等应用的推动,汽车应用领域对固态热塑性丙烯酸树脂(珠粒)的需求持续超出基本案例。儘管2024年底欧洲市场需求的暂时下降缓解了MMA的价格,但轻量化的根本需求仍然促使材料科学预算转向丙烯酸解决方案。

MMA原物料价格波动

丙烯成本波动和裂解装置意外停产会直接导致甲基丙烯酸甲酯(MMA)价格飙升,挤压树脂生产商的利润空间。 2024年4月美国现货MMA价格大幅上涨后,因下游需求放缓,已进入回檔阶段。同时,中国出口量几乎翻了一番,给亚洲合约价格带来新的压力。这导致了结构性调整:住友化学关闭了位于新加坡的MMA工厂,三菱化学冻结了其在路易斯安那州的新计画。这些事态发展凸显了固体级热塑性丙烯酸树脂(珠粒)市场对原物料价格波动的脆弱性,而原物料价格波动会影响扩张的经济效益。

细分市场分析

预计到2025年,涂料产业将占据固体级热塑性丙烯酸(珠状)树脂市场52.74%的份额,这反映了该材料在建筑、工业和修补涂料应用领域的强势地位。珠状丙烯酸树脂可形成高光泽、耐刮擦的漆膜,并可作为符合VOC法规的粉末涂料的基础材料。亚太地区基础设施的同步发展、对高性能防水材料的旺盛需求以及粉末涂料在全球范围内的普及,都为该细分市场的发展提供了有利条件。在快速都市化的经济体中,节能建筑对线圈涂布的需求持续推动固态级热塑性丙烯酸(珠状)树脂市场稳定成长。

用于轻质结构件的丙烯酸复合树脂是成长引擎,预计到2031年将以5.62%的复合年增长率成长。汽车头灯透镜、尾灯外壳和家用电器均采用PMMA混合物,以增强其透明度和抗衝击性。紫外光固化涂料为电子产品和汽车内装提供快速固化解决方案,模糊了传统的细分市场界线。在黏合剂和密封剂领域,耐候耐化学腐蚀的珠状树脂正在创造稳定但成长速度较慢的收入来源。随着VOC和微塑胶法规日益严格,配方师正依靠创新的固体级热塑性丙烯酸树脂(珠状)市场解决方案,在不影响永续性的前提下实现耐久性。

固体级热塑性丙烯酸(珠状)树脂市场报告按应用领域(丙烯酸复合树脂、油漆和涂料、其他应用)、终端用户行业(建筑和施工、汽车和交通运输、其他)、配方(溶剂型、水性、高固态、紫外光固化型)和地区(亚太地区、其他)进行细分。市场预测以吨为单位。

区域分析

2025年,亚太地区占全球总量的44.90%,这主要得益于中国基础建设的蓬勃发展、日本电子产业的壮大以及韩国汽车出口的成长。国内MMA价格在供应紧张的情况下上涨,展现出市场即使在物流中断的情况下也具有韧性。多家中国製造商宣布计划在2027年前新建MMA/PMMA产能,以缓解供应瓶颈,但实际产量将取决于全球需求趋势。在印度,持续的高速公路建设和经济适用住宅政策正在创造对轮胎边缘级丙烯酸涂料的新需求,而东南亚国协则受益于工厂搬迁,从而刺激了建筑业和消费性电子产品的消费。

由于住宅的復苏和汽车製造商向电气化转型,北美市场仍然充满吸引力。加州严格的VOC(挥发性有机化合物)法规促使高固态、UV固化丙烯酸系统的早期应用,其他州也纷纷效仿,扩大了潜在需求群体。 ROHM公司扩建位于德克萨斯州的工厂,便是美国战略性生产布局的典范,旨在缩短供应链并规避原材料风险。加拿大涂料需求与节能维修奖励密切相关,而墨西哥的近岸外包浪潮则促使家电和汽车零件工厂指定使用丙烯酸树脂作为涂料和透明镜片。

欧洲市场前景喜忧参半。德国汽车产业的放缓将抑制2024年的需求,而日益严格的环保法规正在加速向再生和生物基丙烯酸酯的转型。欧盟2023/2055号法规强制要求化妆品和工业用户采用可生物降解的珠粒替代品,这为专业供应商创造了利基成长机会。北欧国家对永续建材的公共采购正在推动水性丙烯酸涂料的普及。同时,欧盟凝聚基金支持的东欧基础建设计划支撑着基准需求。中东和非洲地区预计将以5.42%的复合年增长率成为成长最快的地区,这主要得益于海湾合作委员会国家建筑业的多元化发展以及非洲的都市化。儘管固态热塑性丙烯酸(珠粒)树脂市场仍处于起步阶段,但这些因素正在推动该地区市场份额的成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲和北美油漆和涂料消费量不断增长

- 汽车产业向轻量化、透明的PMMA照明模组转型

- 全球转向高固态粉末涂料(为因应VOC法规)

- 3D列印光阻配方製造商采用以微珠为基础流变改性剂

- 生物功能化PMMA微珠作为化妆品中PE微塑胶的替代品

- 市场限制

- MMA原物料价格波动

- 欧盟和中国加强溶剂排放法规和微珠法规

- 具成本竞争力的苯乙烯替代品(ASA/ABS)

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过使用

- 丙烯酸树脂复合材料

- 油漆和涂料

- 线圈涂布

- 工业涂料

- 建筑涂料

- 运输涂料

- 其他用途

- 按最终用途行业划分

- 建筑/施工

- 汽车和运输设备

- 电气和电子设备

- 医疗保健

- 消费品

- 按产品形式

- 溶剂型

- 水溶液

- 高固态含量

- 紫外线固化型

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Allnex GMBH

- BASF

- Chansieh Enterprises Co. Ltd.

- CHIMEI

- Covestro AG

- Dow

- Heyo Enterprises Co. Ltd.

- Kolon Industries, Inc.

- LG MMA

- Lucite International Alpha BV

- Makevale Group

- Mitsubishi Chemical Corporation

- Pioneer Chemicals Co. Ltd.

- Polyols & Polymers Pvt. Ltd.

- Rohm GmbH

- Sumitomo Chemical Co., Ltd.

- Suzhou Direction Chemical Co. Ltd.

- Trinseo

第七章 市场机会与未来展望

Solid-grade Thermoplastic Acrylic (Beads) Resin Market size in 2026 is estimated at 569.36 kilotons, growing from 2025 value of 541.59 kilotons with 2031 projections showing 731.06 kilotons, growing at 5.13% CAGR over 2026-2031.

This steady growth reflects how lightweighting mandates in the automotive industry, rising powder-coating conversions, and clean-air regulations are reshaping procurement decisions across coatings, composites, and 3D printing value chains. Tier-one automotive suppliers are committing to transparent PMMA lighting modules that cut vehicle weight while maintaining optical clarity, and infrastructure spending across Asia-Pacific and North America remains a dependable end-use anchor. Persistent MMA feedstock volatility tests producer margins, yet downstream demand for circular, recycled grades is accelerating investment in depolymerization technologies by firms such as Sumitomo Chemical. Competitive dynamics are shifting as Western integrated majors add capacity, Japanese incumbents exit, and Chinese firms increase volume, all against a backdrop of tighter solvent-emission and micro-bead limits that reward differentiated acrylic bead chemistries.

Global Solid-grade Thermoplastic Acrylic (Beads) Resin Market Trends and Insights

Growing Paints and Coatings Consumption in Asia and North America

Continued infrastructure investment across the Asia-Pacific region elevates demand for high-performance acrylic coatings that can endure extreme weather and urban pollution. China's fast-paced urbanization highlights supply tightness amid robust demand for coatings. In North America, U.S. Clean Air Act enforcement is steering formulators toward waterborne or high-solids systems that rely on bead-grade acrylics for viscosity control and gloss retention. This parallel surge across two continents sustains a multi-year replacement cycle, favoring the expansion of the Solid-grade Thermoplastic Acrylic (Beads) Resin market. Construction chemicals, such as sealants and elastomeric coatings, form a secondary stream of acrylic bead demand, while capacity additions lag behind demand trajectories, preserving price discipline for suppliers in 2025 and 2026.

Automotive Shift to Lightweight, Transparent PMMA Lighting Modules

Electrification goals pressure OEMs to trim vehicle mass without compromising safety or styling. Chemically recycled PMMA from Sumitomo Chemical, already specified by LG Display and Nissan, highlights the pivot toward closed-loop sustainability models. Evonik's prototype PMMA windshield demonstrates savings over glass, foreshadowing the broader adoption of transparent PMMA structural parts. The convergence of ADAS sensor housings, premium light guides, and illuminated badges continues to drive the automotive demand for Solid-grade Thermoplastic Acrylic (Beads) Resin above base-case projections. Temporary demand dips in Europe during late 2024 eased MMA prices; yet, the fundamental lightweighting imperative continues to pull material science budgets toward acrylic solutions.

MMA Feedstock Price Volatility

Propylene cost swings and unplanned cracker outages translate rapidly into MMA price spikes, eroding resin producer margins. U.S. spot MMA surged during April 2024, then corrected as downstream demand cooled, while Chinese export volumes nearly doubled, exerting fresh pressure on Asian contract prices. Structural adjustments followed: Sumitomo Chemical idled Singapore MMA, and Mitsubishi Chemical shelved its Louisiana greenfield project. These moves underscore the vulnerability of expansion economics to feedstock instability in the Solid-grade Thermoplastic Acrylic (Beads) Resin market.

Other drivers and restraints analyzed in the detailed report include:

- Global Conversion to High-Solid Powder Coatings (VOC Compliance)

- 3-D Printing Photo-Resin Formulators Adopting Bead-Based Rheology Modifiers

- Tightening EU and China Solvent-Emission/Micro-Bead Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paints and coatings contributed 52.74% to the Solid-grade Thermoplastic Acrylic (Beads) Resin market in 2025, reflecting the material's entrenched position in architectural, industrial, and refinish applications. Bead-grade acrylic enables high-gloss, mar-resistant films and underpins powder coatings that meet VOC regulations. The segment benefits from simultaneous infrastructure buildouts in the Asia-Pacific region, high demand for waterproofing with high performance, and global adoption of powder coating. Coil-coating demand for energy-efficient buildings in rapidly urbanizing economies continues to drive the Solid-grade Thermoplastic Acrylic (Beads) Resin market size expansion at a stable rate.

Acrylic composite resins within lightweight structural parts represent the growth engine for applications, advancing at a 5.62% CAGR through 2031. Automotive headlamp lenses, tail light housings, and appliances exploit PMMA blends that offer clarity and impact resistance. UV-curable coatings blur traditional segment boundaries by providing rapid-cure solutions for electronics and automotive interiors. Adhesives and sealants add a predictable, though slower-growing, revenue stream by leveraging bead-grade resin for weatherability and chemical resistance. As regulatory focus intensifies on VOCs and microplastics, formulators rely on innovative Solid-grade Thermoplastic Acrylic (Beads) Resin market solutions to achieve durability without sacrificing sustainability credentials.

The Solid-Grade Thermoplastic Acrylic (Beads) Resin Market Report is Segmented by Application (Acrylic Composite Resins, Paints and Coatings, and Other Applications), End-Use Industry (Building and Construction, Automotive and Transportation, and More), Formulation (Solvent-Based, Water-Based, High-Solids, and UV-Curable), and Geography (Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific controlled 44.90% of global volume in 2025, powered by China's infrastructure boom, Japan's electronics sector, and South Korea's automotive exports. Domestic MMA prices climbed amid tight supply, validating market resilience even during logistic snarls. Multiple Chinese producers have announced plans to add new MMA/PMMA capacity, aiming to debottleneck the supply by 2027; however, actual output will depend on global demand. India's ongoing highway and affordable housing drives offer fresh outlets for bead-grade acrylic coatings, while ASEAN countries benefit from factory relocation trends that boost construction and appliance consumption.

North America stays attractive as residential construction rebounds and automakers shift to electric drivetrains. California's stringent VOC rules have catalyzed the early adoption of high-solid and UV-curable acrylic systems, and other states have referenced these limits, thereby expanding the establishment of addressable demand. Rohm's Bay City plant lift in Texas exemplifies strategic U.S. capacity placements that shorten supply lines and hedge feedstock risk. Canadian coatings demand tracks energy-efficiency retrofit incentives, whereas Mexico's near-shoring wave spurs appliance and auto-part factories that specify acrylic resins for finishes and transparent lenses.

Europe faces mixed prospects: German automotive weakness has tempered 2024 volumes, yet the continent's advanced environmental regulations are accelerating the pivot to recycled and bio-based acrylics. EU Regulation 2023/2055 requires cosmetic and industrial users to adopt biodegradable bead alternatives, creating niche growth opportunities for specialty suppliers. Nordic public procurement of sustainable building materials boosts the penetration of waterborne acrylic coatings, while Eastern European infrastructure projects supported by EU cohesion funds sustain baseline demand. The Middle East and Africa exhibit the fastest regional CAGR of 5.42%, driven by GCC construction diversification and African urbanization, which is fueling a nascent but rising share of the Solid-grade Thermoplastic Acrylic (Beads) Resin market.

- Allnex GMBH

- BASF

- Chansieh Enterprises Co. Ltd.

- CHIMEI

- Covestro AG

- Dow

- Heyo Enterprises Co. Ltd.

- Kolon Industries, Inc.

- LG MMA

- Lucite International Alpha B.V.

- Makevale Group

- Mitsubishi Chemical Corporation

- Pioneer Chemicals Co. Ltd.

- Polyols & Polymers Pvt. Ltd.

- Rohm GmbH

- Sumitomo Chemical Co., Ltd.

- Suzhou Direction Chemical Co. Ltd.

- Trinseo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing paints and coatings consumption in Asia and North America

- 4.2.2 Automotive shift to lightweight, transparent PMMA lighting modules

- 4.2.3 Global conversion to high-solid powder coatings (VOC compliance)

- 4.2.4 3-D printing photo-resin formulators adopting bead-based rheology modifiers

- 4.2.5 Bio-functional PMMA micro-beads replacing PE micro-plastics in cosmetics

- 4.3 Market Restraints

- 4.3.1 MMA feed-stock price volatility

- 4.3.2 Tightening EU and China solvent-emission/micro-bead regulations

- 4.3.3 Cost-competitive styrenic substitutes (ASA/ABS)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Acrylic Composite Resins

- 5.1.2 Paints and Coatings

- 5.1.2.1 Coil Coatings

- 5.1.2.2 Industrial Coatings

- 5.1.2.3 Architectural Coatings

- 5.1.2.4 Transportation Coatings

- 5.1.3 Other Applications

- 5.2 By End-use Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive and Transportation

- 5.2.3 Electrical and Electronics

- 5.2.4 Medical and Healthcare

- 5.2.5 Consumer Goods

- 5.3 By Formulation

- 5.3.1 Solvent-Based

- 5.3.2 Water-Based

- 5.3.3 High-Solids

- 5.3.4 UV-Curable

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Allnex GMBH

- 6.4.2 BASF

- 6.4.3 Chansieh Enterprises Co. Ltd.

- 6.4.4 CHIMEI

- 6.4.5 Covestro AG

- 6.4.6 Dow

- 6.4.7 Heyo Enterprises Co. Ltd.

- 6.4.8 Kolon Industries, Inc.

- 6.4.9 LG MMA

- 6.4.10 Lucite International Alpha B.V.

- 6.4.11 Makevale Group

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Pioneer Chemicals Co. Ltd.

- 6.4.14 Polyols & Polymers Pvt. Ltd.

- 6.4.15 Rohm GmbH

- 6.4.16 Sumitomo Chemical Co., Ltd.

- 6.4.17 Suzhou Direction Chemical Co. Ltd.

- 6.4.18 Trinseo

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment