|

市场调查报告书

商品编码

1690924

印度导热流体:市场占有率分析、产业趋势和成长预测(2025-2030 年)India Thermic Fluid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

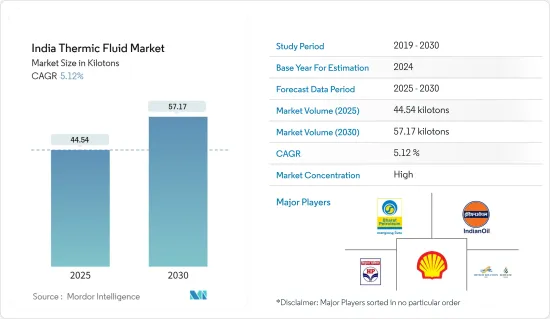

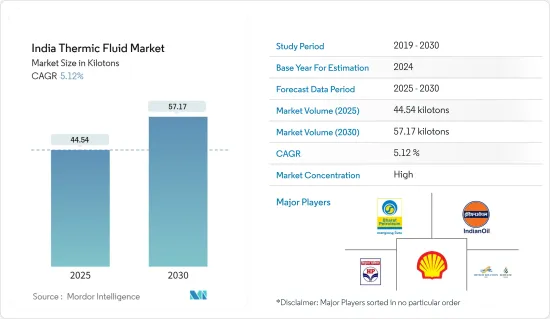

印度导热油市场规模预计在 2025 年为 44,540 公吨,预计在 2030 年达到 57,170 公吨,预测期内(2025-2030 年)的复合年增长率为 5.12%。

2020 年,因新冠疫情导致全国封锁,市场遭受重创。它影响了多个终端用户产业,包括化学品、石油和天然气。不过,对医药业务的需求激增,主要是因为疫情期间对各种药物的需求增加。儘管如此,该产业在后疫情时代正在恢復速度,预计在预测期内也将如此。

关键亮点

- 短期内,石油和天然气行业的广泛需求以及聚光型太阳光电的不断增加的使用预计将推动市场成长。

- 相反,传热流体(HTF)带来的爆炸风险可能会阻碍市场成长。

- 生物基传热介质的巨大开发潜力预计将为所研究的市场提供巨大的成长机会。

印度传热介质市场趋势

矿物油领域的需求不断成长

- 用作传热流体的矿物油是从原油蒸馏尾矿获得的石油基流体。矿物油是石蜡或环烷基本烃的异构混合物,分为石蜡油或环烷油。选择这些油是因为它们对黏度、传热能力和稳定性的影响。

- 石蜡矿物油具有较高的闪点和沸点。另一方面,环烷矿物油具有优异的低温性能和倾点。

- 矿物油在高温下具有优异的热稳定性,所需的处理和维护较少,对环境的影响较小。它还具有蒸气压和粘度低的特性。

- 根据印度经济顾问办公室统计,22财年末印度矿物油批发物价指数约126,较前一年的79.2上涨近40%。

- 由于矿物油在汽车、纺织、建筑、工业、医疗、製药、电子和消费品等各领域的广泛应用,对矿物油的需求不断增加。在製药业,它通常用于婴儿乳液、冷霜、药膏和化妆品中,以治疗和预防皮肤干燥、皲裂、鳞状、瘙痒和轻微刺激。此外,它还可以用作动物或人类的温和泻药。

- 印度製药业预计很快将实现22.4%的复合年增长率。根据印度品牌资产基金会的报告,预计到 2030 年将达到 1,300 亿美元。印度22财年和21财年的药品和医药出口总额分别为246亿美元和244.4亿美元。这将导致对该行业至关重要的矿物油的需求增加。

- 因此,预计上述策略将在未来几年对传热介质市场产生重大影响。

石油和天然气领域占市场主导地位

- 传热流体广泛应用于石油和天然气加工产业。传热流体和系统用于燃料提取、运输、精製和回收的各个阶段。

- 由于石油和天然气作业主要在偏远和难以进入的地方进行,因此使用具有高闪点和热稳定性的传热流体对于降低爆炸风险至关重要。传热流体用于海上平台加热设备、再生葡萄糖和分子筛,并有助于去除水分。在炼油厂,它们用于加热蒸馏石油和石油基产品的塔式再沸器。

- 传热流体用于天然气处理的液相中,进行脱水、萃取、脱硫、分馏,以及控制温度、维持相态和加热再沸器。

- 传热流体也用于石油管线和泵站,以调节流经管道的石油的黏度。因此,石油和天然气领域的所有这些应用在推动传热介质需求方面发挥着至关重要的作用。

- 印度品牌资产基金会的数据显示,到 2021 年,印度仍是世界第三大石油消费国。考虑到这一点,原油吞吐量将从 2020-2021 年的 2.2177 亿吨增加 9% 至 2021-22 年的 2.417 亿吨。印度也计划在2030年将精製能力提高两倍,从4.5亿吨增加到5亿吨。

- 据印度投资局称,2021-22 年石油产品产量为 2.543 亿吨。此外,2023年1月石油精製产量与2022年1月相比成长了4.5%。 2023年1月天然气产量与2022年1月相比增加了5.3%。

- 印度多家石油和天然气生产公司已采取重大措施,减少印度对其他国家进口的依赖。例如,印度石油天然气公司(ONGC)宣布,2023 年 1 月的产量与 2022 年 1 月相比下降了 5.3%,并于 2021 年 11 月宣布打算向其石化业务 ONGC Petro Additions Ltd.(OPaL)投资高达 600 亿印度卢比(8 亿美元),以帮助该公司满足其股本。

- 2021 年 9 月,印度石油有限公司 (BPCL) 宣布计划在未来五年内投资 40.5 亿美元,以提高其石化能力和精製效率。

- 此外,2022年8月,BPCL宣布计划在未来五年内向其石化、城市燃气和清洁能源业务投资1.4兆印度卢比(176.5亿美元)。

- 因此,预计在预测期内,石油和天然气行业的所有这些趋势将在推动该国热流体市场的成长方面发挥关键作用。

印度导热油产业概况

印度导热油市场已部分整合。市场的主要企业包括印度石油有限公司、壳牌公司、印度石油有限公司、印度斯坦石油有限公司和 Hitech Solution(Generation Four Engitech Ltd)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 石油和天然气产业的广泛需求

- 聚光型太阳热能发电的应用日益广泛

- 限制因素

- HTF(导热流体)引起的爆炸危险

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 矿物油

- 硅和芳烃

- 乙二醇

- 其他的

- 按最终用户产业

- 饮食

- 化学品

- 製药

- 石油和天然气

- 太阳热能发电

- 其他的

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Bharat Petroleum Corporation Limited

- Bozzler Energy Pvt Ltd.

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- GS Caltex India

- Hitech Solution(Generation Four Engitech Ltd)

- HP Lubricants

- Indian Oil Corporation Ltd.

- Paras Lubricants Ltd.

- Shell plc

- Savita Oil Technologies Limited

- Tide Water Oil Co. (India) Ltd.

第七章 市场机会与未来趋势

- 生物基传热介质开发潜力大

The India Thermic Fluid Market size is estimated at 44.54 kilotons in 2025, and is expected to reach 57.17 kilotons by 2030, at a CAGR of 5.12% during the forecast period (2025-2030).

Due to the nationwide lockdown caused by COVID-19, the market suffered in 2020. It influenced several end-user industries, including chemicals, oil, gas, etc. However, the pharmaceutical business saw a surge in demand, primarily due to the increased need for various medications during the epidemic. Nonetheless, the industry picked up speed in the post-pandemic era and is anticipated to keep doing so during the forecast period.

Key Highlights

- Over the short term, extensive demand from the oil and gas sector and increasing concentrated solar power usage are expected to drive the market's growth.

- Conversely, the explosion hazards posed by heat thermic fluids (HTFs) will likely hinder the market's growth.

- The high potential for developing bio-based thermic fluids will likely provide a significant growth opportunity for the market studied.

India Thermic Fluid Market Trends

Rising Demand for Mineral Oil Segment

- Mineral oils, employed as a thermic fluid, are petroleum-based fluids derived from crude oil distillation cuttings. Mineral oils are isomeric mixes of paraffin or naphthene-basic hydrocarbons classified as paraffinic or naphthenic. These oils are chosen for their viscosity, influencing heat transfer capabilities and stability.

- Paraffinic mineral oils hold a higher flash point and boiling point. On the other hand, naphthenic mineral oils include better lower temperature characteristics and pour points.

- Mineral oils provide superior thermal stability at high temperatures, need less disposal and maintenance, and include a lower environmental impact. They include features such as low vapor pressure and viscosity as well.

- According to the Office of Economic Adviser of India, the wholesale price index of mineral oil in India at the end of Fiscal Year 2022 was around 126, representing a nearly 40% increase over the previous year's WPI of 79.2.

- The mineral oil demand continues to increase due to its numerous applications in various sectors, including automotive, textile, construction, industrial, medical, pharmaceutical, electronics, and consumer products. In the pharmaceutical industry, it is commonly used in infant lotions, cold creams, ointments, and cosmetics to treat and prevent dry, rough, scaly, itchy skin and mild skin irritations. Additionally, it can be used as a mild laxative for veterinary or human purposes.

- The Indian pharmaceutical industry is predicted to register at a CAGR of 22.4% shortly. According to a report by the India Brand Equity Foundation, it is expected to reach USD 130 billion by 2030. In FY22 and FY21, Indian medication and pharmaceutical exports totaled USD 24.60 billion and USD 24.44 billion, respectively. As a result, the mineral oil demand, which is crucial to the sector, will increase.

- Therefore, the abovementioned tactics are expected to impact the thermic fluid market in the coming years significantly.

Oil and Gas Segment to Dominate the Market

- Heat transfer fluids are widely employed in the oil and gas processing industry. Heat transfer fluids and systems are used in all stages of fuel extraction, transportation, refining, and recycling.

- As the oil and gas business is primarily seen in remote and difficult-to-access locations, employing heat transfer fluids with a high flash point and thermal stability is critical to reducing the explosion risk. Thermic fluids are utilized on offshore platforms for facility heating and regeneration of glycols and molecular sieves, which aids in the water removal from the natural gas generated. These fluids are used in refineries to heat column reboilers, which are used to distill oil and oil-based products.

- Thermic fluids are employed in the liquid phase of natural gas processing for dehydration, extraction, sweetening, and fractionation, which helps control temperature, maintain phase, and heat reboilers.

- Thermic fluids are also used in oil pipelines and pumping stations to adjust the oil's viscosity as it moves through the line. As a result, all of these applications in oil and gas play an essential role in boosting the need for thermic fluids.

- According to the India Brand Equity Foundation, India remained the world's third-largest oil user in 2021. Keeping this in mind, crude oil processing grew by 9% from 221.77 million tons in 2020-21 to 241.7 million tons in 2021-22. India also intends to treble its refining capacity to 450-500 million tons by 2030.

- According to Invest India, the petroleum products production in FY 2021-22 was 254.3 MMT. In addition, petroleum refinery output grew by 4.5% in January 2023 compared to January 2022. Natural gas production increased by 5.3% in January 2023 compared to January 2022.

- Several Indian-based oil and gas-generating enterprises took significant steps to reduce India's reliance on imports from other countries. For example, Oil and Natural Gas Corp. Ltd (ONGC) announced intentions in November 2021 to invest up to INR 6,000 crore (USD 800 million) in its petrochemicals business, ONGC Petro Additions Ltd (OPaL), to assist in meeting its equity requirements.

- In September 2021, Bharat Petroleum Corporation Limited (BPCL) announced plans to invest USD 4.05 billion in improving the petrochemical capacity and refining efficiency over the next five years.

- Moreover, in August 2022, BPCL announced plans to invest INR 1.4 trillion (USD 17.65 billion) in the petrochemical, city gas, and clean energy business over the next five years.

- Hence, all such trends in the oil and gas industry are expected to play an instrumental role in driving the thermic fluid market growth in the country over the forecast period.

India Thermic Fluid Industry Overview

The thermic fluid market in India is partially consolidated in nature. Some of the key players in the market include Bharat Petroleum Corporation Limited, Shell plc, Indian Oil Corporation Ltd, Hindustan Petroleum Corporation Limited, and Hitech Solution (Generation Four Engitech Ltd), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Extensive Demand from the Oil and Gas Sector

- 4.1.2 Increasing Use in Concentrated Solar Power

- 4.2 Restraints

- 4.2.1 Explosion Hazards Posed By HTFs (Heat Thermic Fluids)

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 By Type

- 5.1.1 Mineral Oil

- 5.1.2 Silicon And Aromatics

- 5.1.3 Glycols

- 5.1.4 Other Types

- 5.2 By End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Chemicals

- 5.2.3 Pharmaceuticals

- 5.2.4 Oil and Gas

- 5.2.5 Concentrated Solar Power

- 5.2.6 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Bharat Petroleum Corporation Limited

- 6.4.2 Bozzler Energy Pvt Ltd.

- 6.4.3 Dow

- 6.4.4 Eastman Chemical Company

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 GS Caltex India

- 6.4.7 Hitech Solution (Generation Four Engitech Ltd)

- 6.4.8 HP Lubricants

- 6.4.9 Indian Oil Corporation Ltd.

- 6.4.10 Paras Lubricants Ltd.

- 6.4.11 Shell plc

- 6.4.12 Savita Oil Technologies Limited

- 6.4.13 Tide Water Oil Co. (India) Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 High Potential for the Development of Bio-based Thermic Fluids