|

市场调查报告书

商品编码

1690961

磷酸酯:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Phosphonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

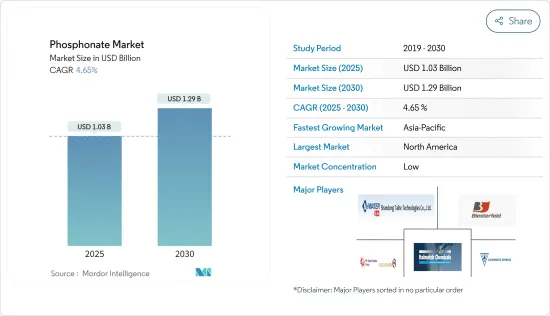

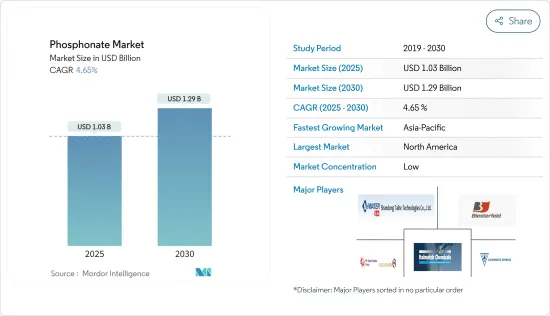

磷酸酯市场规模预计在 2025 年为 10.3 亿美元,预计到 2030 年将达到 12.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.65%。

水处理行业的积极前景以及清洁剂和清洗剂行业近期的稳步发展预计将在未来几年推动磷酸酯的需求。

关键亮点

- 磷酸酯在水处理产业有广泛的应用。预计清洗和清洁剂行业的快速成长也将推动磷酸酯的需求。

- 然而,由于磷酸酯的不可降解性和替代品的可用性而引起的环境问题预计会阻碍市场成长。

- 磷酸酯前驱药物和奈米多孔磷酸酯的新兴应用有望为研究市场带来新的机会。

- 预计亚太地区将主导市场,其中大部分需求来自中国和印度。

磷酸酯市场趋势

水处理产业需求不断成长

- 磷酸酯、正磷酸盐和多磷酸盐在水处理中起着至关重要的作用。其主要作用是抑制管道腐蚀和金属浸出,尤其是铅和铜。磷酸盐与这些金属发生反应,形成溶解性较差的化合物,从而最大限度地降低污染风险。此外,磷酸盐可以隔离铁和锰,防止水变色。

- 水处理是一种先进的技术,利用化学物质去除和防止水垢、减少腐蚀、杀死细菌和藻类以及净化水质。水处理化学品主要有三种:凝聚剂、除生物剂和阻垢剂。

- HEDP磷酸酯通常用作各种工业水处理过程中的化学添加剂。 HEDP 是一种能防止水垢和污垢的阻垢剂。

- 与其他阻垢剂相比,HEDP具有许多优点:抗污染性优异、污染性低、溶解性优异、协同效应优异。

- 温室气体扩散造成的气候变化,导緻美国、墨西哥等国干旱发生频率明显增加。

- 根据美国干旱监测报告,2023 年美国约有 28% 的地区将面临干旱,其中严重干旱程度在近几个月急剧上升。此类干旱将严重耗尽该国的淡水资源,包括地下水、水坝和运河水,导致清洁饮用水严重短缺。

- 有多种污水处理基础设施可用于处理地方政府污水。在美国,每天处理的污水约为 340 亿加仑。这些都市废水主要含有来自食物、人类排泄物、肥皂和清洁剂的氮和磷。

- 各国政府正投资推动北美各地的污水处理政策。例如,美国环保署于2024年2月宣布,将在清洁饮用水和污水基础设施上投资约60亿美元。

- 此外,印度正在实施先进的污水处理计划,以应对水资源短缺问题。在住宅和城市事务部的领导下,AMRUT(阿塔尔復兴与城市转型使命)、Swachh Bharat 使命(城市)2.0 和智慧城市使命等倡议正在推动这些努力。

- 2022 年 12 月,国家河流保护计画 (NRCP)累计约 754.78 亿美元(6,2481.60 亿印度卢比)用于 36 条河流的污染控制措施。这些处理项目将涵盖印度 16 个州的 80 个城镇,旨在建立每天 2,745.7 百万公升(MLD)的污水处理能力来污染防治。

- 近年来,工业部门对水的需求不断增加,加上政府为控制水污染而製定的法规不断出台,刺激了对水处理解决方案的需求增加。

- 工业新水处理厂的投资预计将推动受调查市场的需求。例如

- 2024 年 1 月,总部位于罗特根的 Membion 公司获得了 500 万欧元(约 550 万美元)的投资,用于突破性的 Membion MBR 模组。该取得专利的模组具有高度的空间利用率,与传统工厂相比,占地面积减少了 75%,并且能够将污水中的细菌负荷减少 1,000 倍。该模组专为处理都市废水和工业污水而设计。

- 2023 年 10 月,水务公司完成了其位于澳洲 Mowanjum污水处理厂价值 830 万美元的升级改造。该计划是新的原住民社区供水服务 (ACWS) 计画的一部分,并将成为原住民社区中第一家获得许可的工厂。

- 2023 年 6 月,美国环保署 (EPA) 宣布一项超过 2.78 亿美元的开创性投资,用于加强美国印第安人和阿拉斯加原住民部落的用水和污水基础设施。

- 由于水资源短缺和资源减少,全球对水处理的需求不断增加,预计在预测期内将为磷酸酯创造巨大的市场。

亚太地区可望主导磷酸酯市场

- 由于中国、印度和日本等国用水量增加导致磷酸酯消费量增加,亚太地区在磷酸酯市场处于领先地位。

- 由于清洁剂、水处理、油田化学品、化妆品和其他终端使用行业的需求量很大,预计中国和印度将推动磷酸酯市场的发展。

- 在中国,尤其是在新冠疫情之后,人们的卫生意识不断增强,瓷砖和硬木地板的使用也愈发普遍,这刺激了对高端地板清洁剂的需求。

- 印度是世界上最大的清洁剂製造商和供应商之一。印度对纺织清洁剂的需求主要受到洗衣机普及率不断提高的推动。

- 领先的清洁剂製造商正在创新其产品并建立新设施以促进市场成长。例如

- 2023 年 12 月,Godrej Consumer Products (GCPL) 推出了旨在改变洗衣体验的液体清洁剂「Godrej Fab」。

- 2022年5月,宝洁公司(P&G)在印度海得拉巴郊区运作了一家液体清洁剂生产部门,投资20亿印度卢比(2,683万美元)。

- 印度品牌资产基金会(IBEF)预测,受德里、孟买和班加罗尔等主要城市需求的推动,到2025-2026年,印度洗碗机市场规模将超过9,000万美元。

- 鑑于这些趋势,亚太膦磷酸酯市场预计将继续稳定成长。

磷酸酯产业概况

全球磷酸酯市场较为分散。主要参与企业(不分先后顺序)包括 Italmatch Chemicals、山东泰和水处理技术、Bisterfeld AG、Aquapharm Chemical Pvt。有限公司和 Zschimmer & Schwarz Chemie GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 磷酸酯在水处理产业的广泛应用

- 清洗和清洁剂行业的快速成长

- 其他驱动因素

- 市场限制

- 不可降解性对环境的影响

- 替代产品的可用性

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- ATMP

- HEDP

- DTPMP

- 其他的

- 按最终用户产业

- 清洁剂和清洗剂

- 水处理

- 油田化学品

- 化妆品

- 建筑材料

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Aquapharm Chemical Pvt. Ltd

- Biesterfeld AG

- Bozzetto Group

- Changzhou Kewei Fine Chemicals Co. Ltd

- Excel Industries

- Italmatch Chemicals

- Jiangsu Yuanquan Hongguang Environmental Protection Technology Co. Ltd

- Jiyuan Qingyuan Water Treatment Co. Ltd

- Mks DevO Chemicals

- Shandong IRO Water Treatment Co. Ltd

- Shandong Kairui Chemistry Co. Ltd

- Shandong Taihe Watre Treatment Technologies Co. Ltd

- ShanDong XinTai Water Treatment Technology Co. Ltd

- Uniphos Chemicals

- Zschimmer & Schwarz Chemie GmbH

第七章 市场机会与未来趋势

- 磷酸酯在前驱药物和奈米多孔磷酸酯中的新应用

- 其他机会

The Phosphonate Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 1.29 billion by 2030, at a CAGR of 4.65% during the forecast period (2025-2030).

The positive outlook of the water treatment industry and steady progress in the detergent and cleaning agent industry in recent times are likely to drive the demand for phosphonates in the coming years.

Key Highlights

- There are wide applications of phosphonates in the water treatment industry. The rapid growth of the cleaners and detergents industry is also expected to drive the demand for phosphonates.

- However, environmental concerns due to its non-degradable nature and availability of substitutes are expected to hinder the market's growth.

- Nevertheless, emerging applications of phosphonates in pro-drugs and nano-porous phosphonates are expected to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the market, with the majority of demand coming from China and India.

Phosphonate Market Trends

Increasing Demand in the Water Treatment Industry

- Orthophosphate and polyphosphates, types of phosphonates, play a pivotal role in water treatment. Their primary function is to curb corrosion and metal leaching from pipes, notably lead and copper. By reacting with these metals, phosphates form less soluble compounds, thereby minimizing contamination risks. Furthermore, phosphates sequester iron and manganese, averting water discoloration.

- Water treatment is an advanced technique that uses chemicals to eliminate and prevent scaling, reduce corrosion, kill bacteria and algae, and purify water. There are three main types of water treatment chemicals: flocculants, biocides, and scale inhibitors.

- HEDP phosphonate is commonly used as a chemical additive in various industrial water treatment processes. HEDP is a type of scale inhibitor that can prevent scale and dirt.

- Compared to other scale inhibitors, HEDP has many advantages. It provides excellent dirt resistance, low pollution, good dissolution, and good synergy.

- The changing climate due to the proliferation of greenhouse gases has greatly increased the frequency of droughts in countries like the United States and Mexico.

- As reported by the US Drought Monitor, in 2023, around 28% of the United States faced drought conditions, with severe categories spiking in recent months. These droughts severely deplete the country's freshwater resources, including groundwater, dams, and canal water, leading to a critical shortage of clean drinking water.

- Several sewerage infrastructures have been created to process municipal wastewater. In the United States, approximately 34 billion gallons of wastewater is being processed every day. This municipal wastewater mostly contains nitrogen and phosphorus from food, human waste, soaps, and detergents.

- Governments are investing in promoting wastewater treatment policies across North America. For instance, in February 2024, the US EPA announced an investment of nearly USD 6 billion for clean drinking water and wastewater infrastructure.

- Furthermore, in India, advanced sewerage programs are being implemented to combat water scarcity. Initiatives like the Atal Mission for Rejuvenation & Urban Transformation (AMRUT), Swachh Bharat Mission (Urban) 2.0, and the Smart Cities Mission are driving these efforts under the Ministry of Housing & Urban Affairs.

- In December 2022, the National River Conservation Plan (NRCP) earmarked approximately USD 75,478 million (INR 6,248,160 million) for pollution control efforts on 36 rivers. These efforts span 80 towns across 16 states and aim to establish a sewage treatment capacity of 2,745.7 million liters per day (MLD) to combat pollution.

- In recent years, rising water demand from the industrial sector, coupled with evolving government regulations aimed at curbing water pollution, have spurred a heightened demand for water treatment solutions.

- Investments in new water treatment facilities in industrial complexes are expected to boost the demand of the market studied. For instance,

- In January 2024, Membion, hailing from Roetgen, garnered an investment of EUR 5 million (~USD 5.5 million) for its groundbreaking Membion MBR modules. These patented modules are space-efficient, occupying 75% less area, and can diminish bacterial load in wastewater by 1,000 times, surpassing traditional plants. They are designed for both municipal and industrial wastewater treatment.

- In October 2023, Water Corporation completed an upgrade worth USD 8.3 million to the Mowanjum wastewater treatment plant in Australia. This initiative is part of a new Aboriginal Communities Water Services (ACWS) program, leading to the first licensed plant in an Aboriginal community.

- In June 2023, The US Environmental Protection Agency (EPA) unveiled a landmark investment exceeding USD 278 million to enhance water and wastewater infrastructure for American Indian and Alaska Native tribes, marking the largest annual funding allocation for such initiatives.

- With rising water scarcity and fewer resources, the demand for water treatment is increasing globally, which is expected to provide a huge market for phosphonates during the forecast period.

Asia-Pacific Expected to Dominate the Phosphonate Market

- Asia-Pacific leads the phosphonate market, driven by rising water usage in nations like China, India, and Japan, subsequently boosting phosphonate consumption.

- China and India are set to propel the phosphonate market due to high demand from detergents, water treatment, oil field chemicals, cosmetics, and other end-use industries.

- Heightened hygiene awareness in China, especially after the COVID-19 pandemic, has spurred demand for premium floor cleaners, especially with the country's common use of tile and wood flooring.

- India is one of the largest producers and suppliers of detergent globally. The demand for fabric detergents in India is mainly driven by the rising penetration of washing machines.

- Key detergent manufacturers are innovating products and establishing new facilities to bolster the market's growth. For instance,

- In December 2023, Godrej Consumer Products (GCPL) launched "Godrej Fab," a liquid detergent aimed at transforming the laundry experience.

- In May 2022, Proctor & Gamble (P&G) inaugurated its inaugural liquid detergent manufacturing unit on the outskirts of Hyderabad, India, with an investment of INR 200 crore (USD 26.83 million).

- The India Brand Equity Foundation (IBEF) projects India's dishwasher market to exceed USD 90 million by 2025-2026, spurred by demand in major cities like Delhi, Mumbai, and Bangalore.

- Due to these trends, the Asia-Pacific phosphonate market is set for consistent growth in the years ahead.

Phosphonate Industry Overview

The global phosphonate market is fragmented in nature. The major players (not in any particular order) include Italmatch Chemicals, Shandong Taihe Water Treatment Technologies Co. Ltd, Biesterfeld AG, Aquapharm Chemical Pvt. Ltd, and Zschimmer & Schwarz Chemie GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Wide Applications of Phosphonates in the Water Treatment Industry

- 4.1.2 Rapid Growth of the Cleaners and Detergents Industry

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Environmental Impact Due to Non-Degradable Nature

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Types

- 5.1.1 ATMP

- 5.1.2 HEDP

- 5.1.3 DTPMP

- 5.1.4 Other Types

- 5.2 By End-user Industry

- 5.2.1 Detergent and Cleaning Agent

- 5.2.2 Water Treatment

- 5.2.3 Oil field chemicals

- 5.2.4 Cosmetics

- 5.2.5 Building Materials

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aquapharm Chemical Pvt. Ltd

- 6.4.2 Biesterfeld AG

- 6.4.3 Bozzetto Group

- 6.4.4 Changzhou Kewei Fine Chemicals Co. Ltd

- 6.4.5 Excel Industries

- 6.4.6 Italmatch Chemicals

- 6.4.7 Jiangsu Yuanquan Hongguang Environmental Protection Technology Co. Ltd

- 6.4.8 Jiyuan Qingyuan Water Treatment Co. Ltd

- 6.4.9 Mks DevO Chemicals

- 6.4.10 Shandong IRO Water Treatment Co. Ltd

- 6.4.11 Shandong Kairui Chemistry Co. Ltd

- 6.4.12 Shandong Taihe Watre Treatment Technologies Co. Ltd

- 6.4.13 ShanDong XinTai Water Treatment Technology Co. Ltd

- 6.4.14 Uniphos Chemicals

- 6.4.15 Zschimmer & Schwarz Chemie GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Phosphonates in Pro-drugs and Nano-porous Phosphonates

- 7.2 Other Opportunities