|

市场调查报告书

商品编码

1692095

北美分析仪器:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)North America Analytical Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

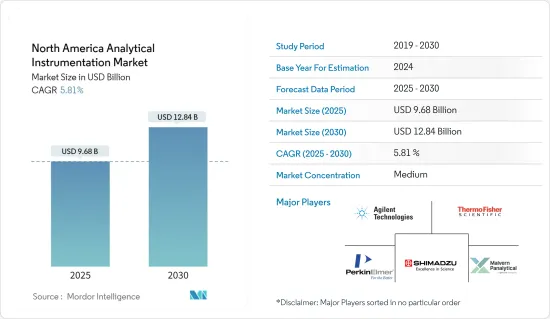

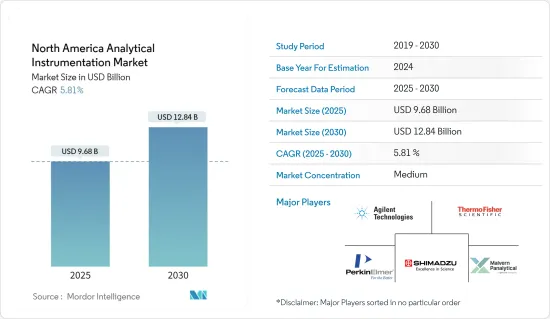

北美分析仪器市场规模预计在 2025 年为 96.8 亿美元,预计到 2030 年将达到 128.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.81%。

对产品品质的日益关注、研发投入的增加以及严格的政府监管是推动北美分析仪器市场成长的主要因素。在预计预测期内,客户意识的提高(尤其是在新兴地区)和对多功能分析仪器的需求将进一步促进市场成长。

主要亮点

- 过去几年中,政府(尤其是新兴国家)对环境检测和污染防治的倡议、北美对医药研发的投资增加、药品安全方面的严格规定、原油和页岩气产量的扩大、对食品质量的日益关注以及质谱仪的技术进步等因素是推动研究市场增长的主要因素。

- 此外,开发行动电话、电动车、能源系统和其他系统和设备电池的公司依靠分析仪器来提高测试、储存容量和生产产量,以创造更有效率、清洁和安全的能源来源。公司正在使用电子显微镜技术来了解原子尺度的结构,并结合光谱工具来发现材料中导致缺陷或低效率的关键变化。

- 然而,分析设备的高成本正在抑制市场的成长。此外,除了设备成本外,还涉及人力、维护、实验室费用等各种成本,抑制了市场的成长。此外,功能和性能的日益复杂化、技术进步和创新系统也推高了分析仪器的成本。

- 市场上的供应商越来越多地将分析作为支持全球主要受监管行业运营的行业的目标。协同工作越来越多地被应用于製药等行业,这对于业务成长至关重要。

- 最近爆发的新冠肺炎疫情为被调查市场带来了巨大的需求。在新冠疫情期间,加速研究的必要性变得更加迫切,大众期待科学界取得前所未有的进展。

北美分析设备市场趋势

生命科学领域预计将占据主要市场占有率

- 生命科学是分析仪器产业中占比最大的领域,占整个产业的四分之一。生命科学涵盖 13 个不同的技术领域,并涵盖使用光谱、原子光谱和分子光谱等分析工具的广泛应用。这为通用仪器应用和利基研究系统的发展提供了巨大的机会。

- 对次世代定序(NGS)的需求持续强劲,影响定序领域并推动核酸样品製备领域的强劲需求。随着基因组技术超越基础研究进入生物医学领域,这种成长在公共和私营部门都很明显。这种惊人的成长预计将对分析仪器解决方案产生巨大的需求,因为它可以帮助製药公司遵守有关药品安全的严格规定。

- 从地区来看,中国对生命科学设备的需求最高,主要受该国精准医疗计画的推动。美国是第二大生命科学市场。由于COVID-19的经济影响,对分析仪器的需求正在迅速转向临床和製药领域。

- 此外,对药物生物相似药、植物药和再生药物的需求大幅增加预计将推动业界采用分析仪器解决方案。

- 安捷伦科技等公司是美国领先的医疗保健和实验室分析仪器製造商之一,透过提供分析仪器和消耗品来进行研究、实验和做出准确的诊断,为该市场提供服务。

- 市场正在经历多项策略发展,例如新产品开发、合併和合作,这表明该领域对分析仪器的采用有所增加。例如,2021 年 11 月,赛默飞世尔科技宣布推出新的质谱 (MS) 仪器、工作流程和软体。 Thermo Scientific Orbitrap Exploris MX 质谱检测器器使生物製药实验室能够执行多属性方法 (MAM)、进行完整单株抗体分析、进行寡核苷酸品质测定以及进行胜肽图分析。

精准医疗发展推动市场发展

- 精准医疗的出现,开发个人化药物和治疗方法,是推动实验室分析设备市场成长的最重要因素之一。

- 扩大精准医疗的可近性需要更广泛地参与临床试验,以加速获得新的标靶治疗。这需要在临床试验期间执行多种功能的分析设备。

- 临床研究领域的这种需求促使 FDA核准了一系列针对个人特定特征的药物,例如 Lynparza 和 Blincyto。这些发展预计将刺激分析仪器市场的需求。

- 该市场的供应商正专注于扩大其在精准医疗产业的产品供应,主要透过合作伙伴关係和协作。例如,2021 年 7 月,Sciex 推出了 ZenoTOF 7600 系统,这是一款质谱液相层析质谱/质谱 (LC-MS/MS) 仪器,同时包含 Xenotrap 和电子活化解离 (EAD) 碎裂技术。

北美分析仪器行业概况

预计在整个预测期内,北美分析仪器市场的竞争程度将保持中等偏高。虽然市场上的大型供应商已经获得了更详细的产品系列併满足了各种客户的需求,但较小的供应商则处于利基市场,提供客製化和客户特定的订单。主要公司包括安捷伦科技公司、马尔文帕纳科有限公司(思百吉公司)、珀金埃尔默公司、赛默飞世尔科技公司和岛津製作所公司。

- 2021 年 11 月-安捷伦科技宣布推出用于奈米颗粒溶解测试的 NanoDisSystem。安捷伦仪器和软体组合使您能够透过专用、自动化且审核的工作流程满足 21 CFR Part 11 和其他法规的要求。

- 2021 年 10 月-布鲁克公司宣布推出大样本 Dimension IconIR红外线光谱和化学成像系统。该平台将 Dimension Icon AFM 与 nanoIR热感AFM-IR 技术相结合,为化学和材料特性映射树立了亚 10nm 化学成像分辨率的新标准。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 市场驱动因素

- 精准医疗的发展

- 市场限制

- 初始成本高

- COVID-19 产业影响评估

第五章市场区隔

- 依产品类型

- 层析法

- 分子分析光谱学

- 元素分析光谱

- 质谱仪

- 分析显微镜

- 其他产品类型

- 按最终用户产业

- 生命科学

- 化工和石化

- 材料科学

- 食品检验

- 石油和天然气

- 研究与研究机构

- 其他最终用户

第六章竞争格局

- 公司简介

- Agilent Technologies Inc.

- Bruker Corporation

- Perkinelmer Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- Malvern Panalytical Ltd(Spectris Plc)

- Mettler Toledo International

- Waters Corporation

- Bio-Rad Laboratories Inc.

第七章投资分析及未来展望

- 投资分析

- 未来展望

The North America Analytical Instrumentation Market size is estimated at USD 9.68 billion in 2025, and is expected to reach USD 12.84 billion by 2030, at a CAGR of 5.81% during the forecast period (2025-2030).

The rising concerns regarding product quality, increasing investments in R&D, and stringent government regulations are some major factors driving the growth of the North American analytical instrumentation market. The rising customer awareness, especially in emerging regions, and the need for analytical instruments across multiple sectors, are further expected to augment the market's growth over the forecast period.

Key Highlights

- In the past few years, the growth in the market studied was primarily driven by factors such as government initiatives for environmental testing and pollution control and especially in developing countries, increasing investments in North America's pharmaceutical R&D, stringent regulations on drug safety, expansion of crude and shale gas production, increasing focus on the quality of food products, and technological advancements in mass spectrometers.

- Further, companies developing batteries for mobile phones, electric vehicles, energy systems, and other systems/devices depend on analytical instruments to enhance testing, storage potential, and output to create more efficient, cleaner, and safer energy sources. Companies use electron microscopy technologies to understand structures that level down at the atomic scale, along with spectroscopy tools to discover critical changes in materials that cause defects and inefficiency.

- However, the high cost of analytical instruments restrains the growth of the studied market. Furthermore, along with the cost of instruments, various other costs are associated, such as staffing, maintenance, and laboratory expenses, thereby restraining the market's growth. Moreover, the advancement in features and functionalities, technological advancements, and innovative systems are adding to the cost of analytical instruments.

- The market vendors are increasingly targeting analytics, mainly to support industries operating in regulated sectors across the world. To target applications in industries such as pharmaceuticals, collaborative work is increasingly witnessing adoption, which is critical for business growth.

- The recent COVID-19 outbreak resulted in significant demand in the market studied. The need for accelerated research has significantly increased during the COVID-19 outbreak, and the public expects unprecedented progress from the scientific community.

North America Analytical Instrumentation Market Trends

Life Sciences Segment Expected to Hold Significant Market Share

- Life sciences account for the largest share in the analytical instrument industry, representing a quarter of the entire industry. Life sciences comprise more than 13 individual technology segments, encompassing a wide range of applications using analytical tools such as spectrometry, atomic spectroscopy, and molecular spectroscopy. This provides significant opportunities to grow both general instrument applications and niche research systems.

- Demand for Next Generation Sequencing (NGS) continues to flourish, impacting the sequencing segment and driving strong demand in the nucleic acid sample preparation segment. This growth was evident in the public and private sectors, as genomics technology went beyond basic research to reach the biomedical domain. Such tremendous growth is expected to create a significant demand for analytical instrumentation solutions, as it helps pharmaceutical companies comply with stringent regulations on drug safety.

- Geographically, China has the highest demand for life science instruments, majorly propelled by the country's precision medicine initiative. It is followed by the United States, which is the largest life science market. Owing to the impact of COVID-19 on the economy, the demand for analytical tools is rapidly shifting to the clinical and pharmaceutical segments.

- Also, a significant rise in demand for pharmaceutical biosimilars, phytopharmaceuticals, and regenerative medicine, is expected to aid in the adoption of analytical instrumentation solutions in the industry.

- The companies such as Agilent Technologies are just one of the leading manufacturers of analytical instruments for healthcare and research laboratories in the United States that contributes to this market by offering analytical instruments and supplies to conduct research and experiments and make accurate diagnoses.

- The market is witnessing several strategic developments such as new product developments, mergers, and collaboration that suggest the increase in the adoption of analytical tools in the segment. For instance, in November 2021, Thermo Fisher Scientific launched its new mass spectrometry (MS) instruments, workflows, and software. The Thermo Scientific Orbitrap Exploris MX mass detector allows biopharmaceutical laboratories to implement the multi-attribute method (MAM), perform intact monoclonal antibody analysis, conduct oligonucleotide mass determination, and carry out peptide mapping.

Development of Precision Medicines to Drive the Market Growth

- The emergence of precision medicine to develop personalized medicines and therapies is one of the most important factors driving the laboratory analytical instruments market's growth.

- Increased access to precision medicine requires more widespread participation in clinical trials to accelerate the availability of new targeted therapies. This requires the analytical instrument to perform various functions in clinical trials.

- Owing to such needs in the clinical research domain, the FDA approved various drugs, such as Lynparza and Blincyto, that are tailored to specific characteristics of an individual. Such developments are expected to boost the demand for the analytical instruments market.

- Vendors in the market are focusing on expanding their offerings in the precision medicine industry, primarily through partnerships and collaborations. For instance, in July 2021, Sciex launched the ZenoTOF 7600 System, a mass liquid chromatography-mass spectrometry/mass spectrometry (LC-MS/MS) instrument that includes both Zeno trap and electron activated dissociation (EAD) fragmentation.

North America Analytical Instrumentation Industry Overview

The degree of competition in the North America Analytical Instrumentation Market is anticipated to be moderately high over the forecast period. The major vendors in the market garner more in-depth product portfolios, catering to different customer requirements, whereas smaller vendors operate in niche segments providing customizations and customer-specific orders. Key players include Agilent Technologies Inc., Malvern Panalytical Ltd (Spectris Company), PerkinElmer Inc., Thermo Fisher Scientific, and Shimadzu Corporation.

- November 2021 - Agilent Technologies announced the introduction of the NanoDisSystem for nanoparticle dissolution testing. Combining Agilent instrumentation and software to enable customers to meet 21 CFR Part 11 and other regulations through its application, the new NanoDisSystem delivers a dedicated workflow that is automatable and auditable.

- October 2021 - Bruker Corporation announced the launch of its large sample Dimension IconIRnanoscale infrared spectroscopy and chemical imaging systems. The platform combines Dimension Icon AFM and nanoIR photothermal AFM-IR technology to establish new chemical and material property mapping standards with sub-10nm chemical imaging resolution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Market Drivers

- 4.4.1 Development of Precision Medicines

- 4.5 Market Restraints

- 4.5.1 High Initial Cost

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Chromatography

- 5.1.2 Molecular Analysis Spectroscopy

- 5.1.3 Elemental Analysis Spectroscopy

- 5.1.4 Mass Spectroscopy

- 5.1.5 Analytical Microscopes

- 5.1.6 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Life Sciences

- 5.2.2 Chemical and Petrochemical

- 5.2.3 Material Sciences

- 5.2.4 Food Testing

- 5.2.5 Oil and Gas

- 5.2.6 Research and Academia

- 5.2.7 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agilent Technologies Inc.

- 6.1.2 Bruker Corporation

- 6.1.3 Perkinelmer Inc.

- 6.1.4 Thermo Fisher Scientific Inc.

- 6.1.5 Shimadzu Corporation

- 6.1.6 Malvern Panalytical Ltd (Spectris Plc)

- 6.1.7 Mettler Toledo International

- 6.1.8 Waters Corporation

- 6.1.9 Bio-Rad Laboratories Inc.

7 INVESTMENT ANALYSIS AND FUTURE OUTLOOK

- 7.1 Investment Analysis

- 7.2 Future Outlook