|

市场调查报告书

商品编码

1692118

新加坡设施管理:市场占有率分析、产业趋势与成长预测(2025-2030 年)Singapore Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

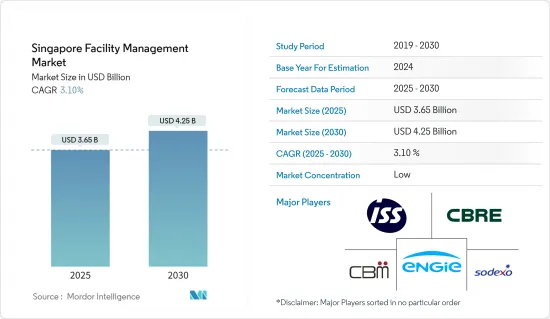

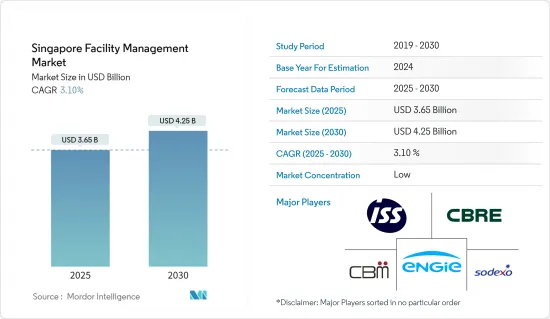

新加坡设施管理市场规模预计在 2025 年为 36.5 亿美元,预计到 2030 年将达到 42.5 亿美元,在市场估计和预测期(2025-2030 年)内的复合年增长率为 3.1%。

新加坡作为全球交通和物流枢纽的地位凸显了其对一流基础设施和设施管理的承诺。作为东南亚的重要门户,新加坡投入巨资升级和维护其设施。新加坡政府透过建设局 (BCA) 和住宅发展局 (HDB) 等机构,在推动设施管理的突破方面发挥了重要作用。他们正在製定严格的法规并提供指导以支持永续和高效的实践。

主要亮点

- 智慧建筑代表着科技与房地产的融合,将人类经验放在首位。这些建筑正在使用数位系统来提高效率、永续性和居住者的满意度。在智慧建筑中,管理系统整合到单一的数位平台上。这种统一的方法使资产所有者能够监督建筑性能、延长建筑寿命并促进租户之间的互动。蓬勃发展的智慧建筑的核心是人工智慧的预测能力。

- 过去十年来,许多在新加坡营运的服务供应商都将扩大业务作为优先事项,以利用日益增长的设施管理需求,特别是考虑到现有的有利于外包非核心业务的趋势。

- 新加坡的设施管理市场由于其分散性而面临重大挑战,其特点是存在大量中小型本地供应商。这些供应商通常专注于某些领域或服务,例如清洁、安全或维护,但提供全面、全方位解决方案的能力有限。与大型跨国公司不同,这些本地供应商缺乏现代设施管理实践所需的资源和专业知识。结果,业务效率和服务品质仍然不够理想,扩充性也受到限制。

- 除此之外,考虑到机会,该国正在经历以创新方式利用设施管理和企业房地产的可能性激增。此外,对 IFM 的需求不断增长、新兴产业非核心业务的外包以及对工作场所优化和生产力的重新关注进一步推动了市场成长。

- 基础设施开发投资的激增可能会对新加坡的设施管理服务市场产生正面影响。随着新的基础设施计划的建设,对有效的设施管理的需求日益增加,以便有效地维护、服务和运营这些设施。随着越来越多的组织和政府机构寻求设施管理服务以确保其资产的适当维护和功能正常运转,这可能会导致设施管理服务的成长。

新加坡设施管理市场趋势

资产管理可望快速成长

- 该市场的资产管理是指对建筑结构、电气系统和管道等实体资产进行系统性维护、营运和最佳化,以确保其在整个生命週期内的功能性、安全性和效率。我们的重点是延长资产的使用寿命,确保营运效率并透过预防性维护、检查和及时维修来管理其生命週期。

- 资产管理正在推动新加坡设施管理市场的成长,这得益于建筑开发的不断增长以及对先进基础设施管理的需求。

- 新加坡致力于建立智慧城市,并专注于永续性和能源效率,这为硬体设施服务(尤其是资产管理)创造了机会。根据世界人口评论,新加坡在 2024 年的行动指数得分为 79.52,被评为顶级智慧城市之一。

- 2024年8月,工程服务与核能公司AtkinsRealis Group Inc.取得新加坡GP Pte的订单。有限公司(SGP)为新加坡一级方程式赛车大奖赛订单计划管理服务,该赛事是国际汽车联合会(FIA)一级方程式世界锦标赛系列赛的一部分,是一项重要的马达赛事。作为为期两年的协议的一部分,AtkinsRealis 将提供成本管理和施工管理服务,以支援该设施的建设、营运和拆除,其中包括 50 多个合约和 4,000 多名人员。这还包括健康和安全、永续性咨询、数位和设施管理支持,以确保计划按照最高的品质和效率标准交付。

- 新加坡大型建筑计划的兴起使得对设施管理服务的需求日益增长。例如,榜鹅数码区的开发是一项重要的智慧和永续倡议。该地区也将设立新加坡科技大学的校园,作为网路安全和其他数位产业的中心。另一个重大计划是樟宜机场的扩建,建设工期从 2024 年到 2025 年加快,第 5 航站楼预计将于 2030 年代中期完工。

商业、零售和食品服务领域占主要份额

- 新加坡作为全球商业中心,是跨国公司的所在地,对商业空间专业设施管理服务的需求日益增长。随着企业注重职场效率,设施管理提供者正在提供全面服务。这些服务涵盖空间优化和能源管理以及先进的智慧建筑技术,其目标都是确保您的业务顺利运作。

- 随着电子商务和全通路的普及,传统零售商正在重新构想他们的实体店。由于这些零售商优先考虑独特的店内体验,他们需要先进的设施管理来优化环境控制、提高顾客舒适度并无缝整合技术。

- 此外,根据新加坡市区重建局的报告,截至 2023 年第三季度,共有 950.5 万平方公尺的饭店客房正在准备兴建中,其次是单一使用者工业空间、办公空间等。这代表新加坡新兴商业和住宅领域的成长,推动了对设施管理服务的需求。这些服务包括维护、安全、清洁、能源管理等,以确保您的设施顺利运作。这种需求正在推动公司增强其服务产品、进行创新并采用技术主导的解决方案。

- 此外,新加坡2030绿色计画等倡议凸显了政府对永续性的承诺。因此,越来越多的企业开始采取环保做法。这种转变扩大了设施管理公司对节能、绿建筑解决方案的需求,有助于推动更广泛的设施管理市场中这些领域的成长。

- 2024年5月,美国零嘴零食和饮料公司亿滋国际在新加坡开设了区域饼干和烘焙点心实验室和创新厨房。该实验室定位为“战略区域中心”,是对该公司已建立的新加坡技术中心的补充。

新加坡设施管理产业概况

新加坡的设施管理市场较为分散,参与者规模各异。随着各组织继续进行策略性投资以抵消当前的经济放缓,预计该市场将出现大量的合作、合併和收购。该地区的客户正在采用 FM 服务来促进他们的业务运作。市场由主要解决方案和服务提供者组成,例如 ISS A/S、CBRE Group Inc.、CBM Pte Ltd、ENGIE Services Singapore (Engie SA) 和 Sodexo Singapore Pte.Ltd。

FM 供应商正在采取强有力的竞争策略来利用他们的专业知识。我们也在广告上投入了大量资金。

市场上的领先供应商越来越注重提供能够吸引消费者的整合解决方案。 FM 供应商正在将技术融入他们的服务中,以增强他们的服务组合。

预计较小的供应商和市场新进入者将专注于保持与较大供应商相比的成本效益,进一步加剧该国的竞争。在国内,与公共部门相比,私营部门可能会受到更大的重视。

品质认证、服务内容、成本、技术力和技术是赢得新契约的重要因素。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 商业房地产行业的成长

- 办公室入住率上升

- FM 产业观察到的主要永续发展趋势

- 绿色实践和安全意识

- 智慧建筑的日益流行

- 新加坡绿建筑委员会《绿建筑的兴起与实践》

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 宏观经济指标对产业的影响

第五章市场动态

- 市场驱动因素

- 更重视外包非核心业务

- 增加基础建设投资

- 市场限制

- 市场分散,多家本地供应商

- 法规和法律变更

- PESTEL分析

- 市场准入的监管环境与法律体制

第六章市场区隔

- 按服务类型

- 硬体服务

- 资产管理

- MEP 和 HVAC 服务

- 消防和安全

- 其他硬体维修服务

- 软体服务

- 办公室支援与安全

- 清洁服务

- 餐饮服务

- 其他软体 FM 服务

- 硬体服务

- 按服务类型

- 内部

- 外包

- 单调频

- 捆绑调频

- 整合调频

- 按最终用户产业

- 商业、零售和餐饮

- 製造业和工业

- 政府、基础设施和公共部门

- 设施

- 其他最终用户产业

第七章竞争格局

- 公司简介

- ISS A/S

- CBRE Group Inc.

- CBM Pte. Ltd

- ENGIE Services Singapore(ENGIE SA)

- Sodexo Singapore Pte. Ltd(Sodexo Group)

- Abacus Property Management Pte. Ltd

- ACMS Facilities Management Pte. Ltd

- Certis CISCO Security Pte. Ltd(Temasek Holdings(Private)Limited)

- Compass Group PLC

- Cushman & Wakefield PLC

- Exceltec Property Management Pte. Ltd

- Jones Lang LaSalle Incorporated(JLL Incorporated)

- OCS Group International Limited

- Savills Singapore(Savills)

- Serco Group PLC

- United Tech Engineering Pte. Ltd

- UTiZ Facilities Management Services(UTiZ Global Ventures Pvt Ltd)

- Vinci Facilities Limited

第 8 章供应商定位分析

第九章投资分析

第十章:投资分析市场的未来

The Singapore Facility Management Market size is estimated at USD 3.65 billion in 2025, and is expected to reach USD 4.25 billion by 2030, at a CAGR of 3.1% during the forecast period (2025-2030).

Singapore's prime position as a global transportation and logistics hub underscores its commitment to top-notch infrastructure and facilities management. As a pivotal gateway to Southeast Asia, Singapore has seen substantial investments in upgrading and maintaining its facilities. The Singaporean government has been instrumental in pushing the envelope on facilities management through agencies like the Building and Construction Authority (BCA) and the Housing and Development Board (HDB). They've rolled out stringent regulations and offered guidance to champion sustainable and efficient practices.

Key Highlights

- Smart buildings epitomize the convergence of technology and real estate, prioritizing human experience. These structures leverage digital systems to boost efficiency, sustainability, and user satisfaction. In a smart building, management systems integrate into a single digital platform. This unified approach empowers asset owners to oversee building performance, prolong the structure's lifespan, and foster enhanced interactions among tenants. At the heart of a thriving smart building are its predictive capabilities, driven by artificial intelligence.

- Many service providers operating in Singapore have prioritized expanding their presence over the last decade in order to profit from the increasing need for facility management, particularly with the existing trend favoring the outsourcing of non-core activities.

- The Singaporean facility management market faces significant challenges due to its fragmented nature, characterized by the presence of numerous small to mid-sized local vendors. These vendors often specialize in specific sectors or services such as cleaning, security, or maintenance, which limits their ability to offer integrated, full-scale solutions. Unlike larger multinational players, these local vendors lack the resources and expertise that are critical for modern facility management practices. As a result, their operational efficiency and service offerings remain suboptimal, leading to limited scalability.

- In addition to this, considering the opportunities, the country has seen a surge in the number of possibilities to utilize facility management and corporate real estate in innovative ways. Also, the rising demand for IFM and outsourcing of non-core operations from emerging verticals and renewed emphasis on workplace optimization and productivity are further augmenting the growth of the market.

- The surge in infrastructure development investments can positively impact the Singaporean facility management services market. As new infrastructure projects are built, there is a rising demand for effective facility management to maintain, handle, and operate these facilities efficiently. This, in turn, can lead to the growth of facility management services as more organizations and government entities seek these services to ensure their assets' proper upkeep and functionality.

Singapore Facility Management Market Trends

Asset Management is Expected to be the Fastest Growing Segment

- Asset management within the market involves systematically maintaining, operating, and optimizing physical assets such as building structures, electrical systems, and plumbing to ensure their functionality, safety, and efficiency throughout their life cycle. It focuses on extending asset lifespan, ensuring operational efficiency, and managing the life cycle of these assets through preventive maintenance, inspections, and timely repairs.

- Asset management is driving the growth of the Singaporean facility management market, which is supported by increasing building development and the demand for advanced infrastructure management.

- Singapore's push toward becoming a smart city and its focus on sustainability and energy efficiency create opportunities for hard facility services, particularly in asset management. According to the World Population Review, Singapore ranked as one of the top smart cities with a motion index score of 79.52 in 2024.

- In August 2024, AtkinsRealis Group Inc., an engineering services and nuclear company, was awarded the project management services contract by Singapore GP Pte. Ltd (SGP) for the Formula 1 Singapore Grand Prix, a key motor racing event, which is part of the International Automobile Federation's (FIA) series of the Formula One World Championship. AtkinsRealis will provide cost management and construction management services involving over 50 contracts and 4,000 personnel to support the facilities' building, operation, and dismantling as part of its two-year contract. The mandate also includes health and safety, sustainability advisory, and digital and facilities management support to ensure the project is delivered to the highest quality and efficiency standards.

- Singapore is witnessing an uptick in large-scale construction projects, boosting the demand for facility management services. For instance, the development of the Punggol Digital District represents a major smart and sustainable initiative. It will feature a campus for the Singapore Institute of Technology and serve as a hub for cybersecurity and other digital industries. Another significant project is the expansion of Changi Airport, with the upcoming Terminal 5 expected to be completed by the mid-2030s, with construction ramping up in the 2024-2025 period.

The Commercial, Retail, and Restaurants Segment Holds Major Share

- As a global business hub, Singapore draws in multinational corporations, driving the demand for professional facility management services in its commercial spaces. With companies emphasizing boosting workplace efficiency more, facility management providers offer integrated services. These range from space optimization and energy management to advanced smart building technologies, all aimed at ensuring smooth operations.

- As e-commerce and omnichannel shopping gain traction, traditional retailers reimagine their physical stores. These retailers prioritize distinctive in-store experiences, necessitating sophisticated facility management to optimize environmental control, enhance customer comfort, and seamlessly integrate technology.

- Further, according to the report by Urban Redevelopment Authority Singapore, as of the third quarter of 2023, 9,505 thousand square meters of hotel rooms were in the pipeline, followed by single-user factory space, office space, and others. This represents the growth in the country's new commercial and residential sector, which has increased the demand for facility management services. These services encompass maintenance, security, cleaning, and energy management, ensuring that facilities operate smoothly. This demand encourages companies to enhance their service offerings, innovate, and adopt technology-driven solutions.

- Moreover, initiatives like the Singapore Green Plan 2030 underscore the government's commitment to sustainability. As a result, businesses are increasingly adopting eco-friendly practices. This shift amplifies the demand for energy-efficient and green building solutions from facility management companies, bolstering the growth of these sectors within the broader facility management market.

- In May 2024, Mondelez International, a US snacks and drinks company, inaugurated its Regional Biscuit and Baked Snacks Lab and Innovation Kitchen in Singapore. Positioned as a "strategic regional hub," this lab will complement the company's established Singapore Technical Centre.

Singapore Facility Management Industry Overview

The Singapore facility management market is fragmented, with the presence of diverse firms of different sizes. This market is anticipated to encounter a number of partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns that they are experiencing. Clients in this region are employing FM services to increase the ease of their business operations. The market comprises key solutions and service providers, such as ISS A/S, CBRE Group Inc., CBM Pte Ltd, ENGIE Services Singapore (Engie SA), and Sodexo Singapore Pte. Ltd. (Sodexo Group).

The FM vendors are incorporating a powerful competitive strategy by leveraging their expertise. In addition, they are spending a significant amount on advertising.

Major vendors in the market are further focusing on offering integrated solutions to attract consumers. FM vendors are incorporating technologies into their services, adding strength to their service portfolio.

Smaller and new vendors in the market are expected to focus on maintaining cost-benefit over major vendors, further intensifying the competition in the country. A significant share of the focus will be directed toward the private sector compared to the public sector in the country.

Quality certification, service offerings, costs, technical capabilities, and technology are important factors for attracting new contracts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.1.1 Growth in the Commercial Real Estate Sector

- 4.1.2 Rise in Occupancy of Offices

- 4.1.3 Key Sustainability Trends Observed within the FM industry

- 4.1.4 Strong Emphasis on Green Practices and Safety Awareness

- 4.1.5 Growing Trend of Smart Buildings

- 4.1.6 Rise of Green Buildings and Practices Outlined by the Singapore Green Building Council

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Indicators on The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Outsourcing of Non-core Operations

- 5.1.2 Increasing Investments in Infrastructure Development

- 5.2 Market Restraints

- 5.2.1 Fragmented Market with Several Local Vendors

- 5.2.2 Regulatory & Legal Changes

- 5.3 PESTEL Analysis

- 5.4 Regulatory Landscape and Legislative Framework for a Market Entrant

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Hard Services

- 6.1.1.1 Asset Management

- 6.1.1.2 MEP and HVAC Services

- 6.1.1.3 Fire Systems and Safety

- 6.1.1.4 Other Hard FM Services

- 6.1.2 Soft Services

- 6.1.2.1 Office Support and Security

- 6.1.2.2 Cleaning Services

- 6.1.2.3 Catering Services

- 6.1.2.4 Other Soft FM Services

- 6.1.1 Hard Services

- 6.2 By Offering Type

- 6.2.1 In-house

- 6.2.2 Outsourced

- 6.2.2.1 Single FM

- 6.2.2.2 Bundled FM

- 6.2.2.3 Integrated FM

- 6.3 By End-user Industry

- 6.3.1 Commercial, Retail and Restaurants

- 6.3.2 Manufacturing and Industrial

- 6.3.3 Government, Infrastructure, and Public Entities

- 6.3.4 Institutional

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ISS A/S

- 7.1.2 CBRE Group Inc.

- 7.1.3 CBM Pte. Ltd

- 7.1.4 ENGIE Services Singapore (ENGIE SA)

- 7.1.5 Sodexo Singapore Pte. Ltd (Sodexo Group)

- 7.1.6 Abacus Property Management Pte. Ltd

- 7.1.7 ACMS Facilities Management Pte. Ltd

- 7.1.8 Certis CISCO Security Pte. Ltd (Temasek Holdings (Private) Limited)

- 7.1.9 Compass Group PLC

- 7.1.10 Cushman & Wakefield PLC

- 7.1.11 Exceltec Property Management Pte. Ltd

- 7.1.12 Jones Lang LaSalle Incorporated (JLL Incorporated)

- 7.1.13 OCS Group International Limited

- 7.1.14 Savills Singapore (Savills)

- 7.1.15 Serco Group PLC

- 7.1.16 United Tech Engineering Pte. Ltd

- 7.1.17 UTiZ Facilities Management Services (UTiZ Global Ventures Pvt Ltd)

- 7.1.18 Vinci Facilities Limited