|

市场调查报告书

商品编码

1692119

菲律宾设施管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Philippines Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

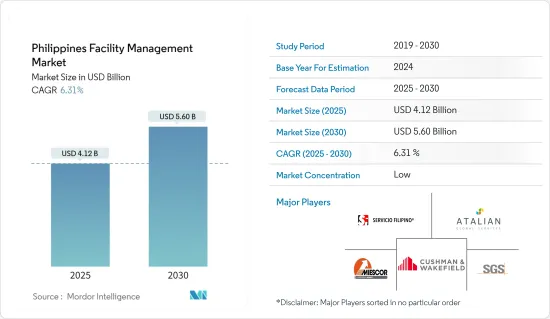

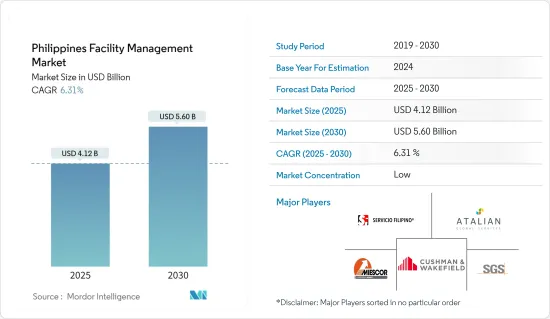

菲律宾设施管理市场规模预计在 2025 年为 41.2 亿美元,预计到 2030 年将达到 56 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.31%。

蓬勃发展的菲律宾设施管理市场是多方面的。由于该行业应用范围广泛、技术整合牢固且日益重视永续性,因此为本地和国际投资者提供了绝佳的潜力。设施管理将对菲律宾未来的商业格局产生重大影响,随着菲律宾继续优先考虑强劲、永续和技术先进的职场环境,设施管理将促进持续的成长和创新。

政府对国家基础设施发展和透过官民合作关係模式进行的建设计划的支持正在推动市场成长。这是因为该国新开发的基础设施需要 FM 服务来管理和维护这些设施。

例如,2023年1月,该国国家经济发展局宣布,超过3,600个基础建设计划,价值3,720亿美元,计画在2028年完工。此外,该国还计划新增206个计划,价值1590亿美元,其中136个为物理连通性项目,9个为数位连通性项目,42个为水资源项目,8个为卫生项目,2个为电力和能源项目等。

此外,国内各大企业也纷纷拓展业务,在设施管理(FM)市场软体和硬体两方面都创造了商机。例如,2023 年 4 月,SM 投资公司宣布将投资约 900 亿菲律宾披索(16.4 亿美元)的资本支出,以推动住宅开发、购物中心和零售扩张。该公司计划在 2023 年开设至少三家购物中心。

同样,2023 年 6 月,PLDT 集团宣布计划在菲律宾建造第 12 个资料中心设施,以实现数位创新并提升该国的区域竞争力。透过该设施,该公司旨在帮助菲律宾成为亚洲的下一个超大规模资料中心业者枢纽,并支持其数位转型之旅。

然而,菲律宾市场成长面临的一个重大挑战是菲律宾工业部门,无论规模和类型,都需要更多地了解 FM 服务及其好处。例如,大多数在菲律宾营运的跨国公司都知道FM的好处,但大多数最终用户和中小型企业仍继续避免使用它。

菲律宾的 COVID-19 疫情和政府措施为疫情后的 FM 服务创造了机会,这得益于组织优先事项和清洁服务的在家工作趋势。

菲律宾设施管理市场趋势

内部设施管理部门预计将占据主要市场占有率

- 内部设施管理服务由客户僱用的专用资源提供,以监控和管理绩效。菲律宾对内部设施经理的需求日益增长,他们需要管理以业务为中心的区域,例如人流量大的区域和繁忙高阶主管使用的会议室。此外,内部设施管理还提供合作伙伴组织可能不会在其标准套餐中提供的培训和必要的专业认证。

- 内部设施管理涉及僱用专门人员来维护和管理设施的各种功能属性。网路安全援助等服务通常在内部运作和监控,以确保设施的安全和完整性。由于管理端到端设施需求和创建一致服务水准的需求不断增长,综合设施管理 (IFM) 在菲律宾得到迅速应用。综合设施管理对于主动应对潜在的干扰至关重要。它代表了一种新的设施管理方法,可提高效率、简化工作流程并简化业务。

- 据国家经济发展局称,菲律宾到 2024 年将有大约 22 个计划正在筹备中,到 2028 年将有大约计划项目正在筹备中。随着基础设施建设的持续发展,需要透过引入专业服务来简化营运成本,因此设施管理服务也在增加。此设施管理提供解决方案和设备,以确保建筑物运作顺利进行且不会出现任何故障。这些服务将人员、地点和流程整合在一起,使居住在公寓和建筑物中的人们的生活更加轻鬆。

- 工业 4.0 的出现使得菲律宾对内部设施经理的需求日益增长。这进一步加速了对智慧维护流程的需求,以防止设备故障并优化停机时间。人工智慧、自动化、工业物联网等领域的进步正在推动设施管理人员迅速采用维护 4.0。

- 2023 年 2 月,马尼拉水务公司与 Damosa Land Corp. 合作,管理工业的水设施。马尼拉水务公司的子公司马尼拉水务菲律宾新创公司(MWPV)将斥资约 220 万美元来营运和管理安弗罗工业(AIE)的水系统,安弗罗工业区是达莫萨土地公司为贸易和农业开发的工业。此次伙伴关係旨在透过将新增设施整合到 AIE 现有系统中来满足预计每天 260 万公升的需求,从而刺激该国对託管设施的需求。

- 菲律宾被公认为亚洲最具活力的市场之一,其经济持续快速成长。菲律宾房地产行业被认为是最具弹性的行业之一。该国优秀的融资服务、资本实力和亲商文化鼓励最佳的内部设施管理解决方案。

预计商业部门将占据大部分市场份额

- 菲律宾的商业机构需要擅长商业建筑的清洁、维护和安全管理的设施经理。商业物业管理公司负责协调和服务一个组织的内部部门和外部相关人员。 FM 与供应商协商合约、指定当地供应商并协调租户和服务提供者之间的联络。

- 根据高纬环球(Cushman & Wakefield)最近的一项调查显示,线上旅游公司Booking.com的菲律宾分店已选择该服务提供者来寻找新空间,以进一步扩大Booking.com的新办公室。为了帮助一家旅游公司实现迁至菲律宾马尼拉大都会马卡蒂中央商务区 (CBD) 的目标,Cushman & Wakefield 透过与业主协商,租赁了客户现有办公室旁的一小块空置空间,从而找到了理想的空间。由于 Cushman & Wakefield 提供的设施管理服务,Booking.com 能够以比原始建筑租金低 15% 的价格租用额外的空间。

- 在菲律宾,商业空间硬体设施管理正在经历强劲成长,因为它可以为企业提供空调、电力、供排水以及商业区维护等专业服务。例如,菲律宾航空业的互联互通日益密切,跨系统资料整合的需求也日益增长,以提高整个互联航空生态系统的效率。

- 2023 年 6 月,菲律宾亚洲航空母公司 Capital A 在菲律宾推出了物流业务和飞机维护、维修和大修设施。 Capital A 的工程业务为集团的民航机提供重型维修、维修和大修(MRO)服务,推动市场成长。

- 菲律宾零售物业业者正在寻求外包管理业务,以便腾出更多时间和精力进行投资。单一来源设施管理解决方案可以帮助简化决策过程、创造规模经济并发现新机会,为您的目的地建立合适的团队。商业房地产所有者需要拥有专业知识的合作伙伴来帮助他们实现关键的脱碳目标。

- 管理和维护大型商业设施(包括其係统和基础设施)需要时间和精力。因此,菲律宾的许多零售物业营运商都转向第三方物业管理服务提供商,而不是聘请专业 IT 人才,有助于推动该领域的市场成长。根据菲律宾统计局统计,每平方公尺商业建筑的平均成本为199.64美元,引领企业投资建设活动,进一步推动设施管理市场的发展。

菲律宾设施管理市场概况

菲律宾设施管理市场较为分散,主要参与者包括 Atalian Global Services Philippines Inc.、Servicio Filipino Inc.、Meralco Industrial Engineering Services Corporation、SGS Philippines Inc. 和 Cushman &Wakefield PLC。市场参与者正在采取联盟、合併、创新和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 6 月,JLL 菲律宾从国际 ISO 认证机构 BQSR Certifications Inc. 获得了设施管理 ISO 41001:2018 认证。

- 2023 年 2 月 Cushman & Wakefield PLC 在菲律宾马尼拉开设共享服务中心 (SSC)。该中心位于马尼拉大都会博尼法西奥世界城第 9 大道和第 32 街的 BDO 生态大厦 32 楼。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对菲律宾设施管理市场的影响

- 全球设施管理成本指数

第五章 市场动态

- 市场驱动因素

- BPO 产业对办公空间的需求不断增长

- 增加公共和私人对基础建设的投资

- 市场限制

- 设施管理服务意识下降

第六章 市场细分

- 按类型

- 企业设施管理

- 外包设施管理

- 单一设施管理

- 捆绑设施管理

- 整合性机构管理

- 依产品类型

- 硬体设施管理

- 软设施管理

- 按最终用户产业

- 商业设施

- 设施

- 公共/基础设施

- 工业

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Atalian Global Services Philippines Inc.

- Servicio Filipino Inc.

- Meralco Industrial Engineering Services Corporation

- SGS Philippines Inc.

- Cushman & Wakefield LLC

- Sodexo Group

- Santos Knight Frank Inc.(Knight Frank LLP)

- Century Properties Management Inc.

- Mansion Maintenance Co. Inc.

- Kontrac Facilities Management Services Inc.

- CBRE Group Inc.

- Jones Lang LaSalle Inc.

- Artelia Group

- WeCare Facility Management Services Inc.

- Hydron Corporation

第八章投资分析

第九章:市场的未来

The Philippines Facility Management Market size is estimated at USD 4.12 billion in 2025, and is expected to reach USD 5.60 billion by 2030, at a CAGR of 6.31% during the forecast period (2025-2030).

The booming facility management market in the Philippines has many different aspects. The industry offers excellent potential for domestic and international investors due to its wide range of applications, solid technology integration, and growing focus on sustainability. Facilities management is positioned for continuous growth and innovation, successfully influencing the future of the business environments in the Philippines as the country continues to prioritize robust, sustainable, and technologically advanced work environments.

The country's infrastructure development and government support for building projects in the public-private partnership model drive the market's growth. This is because the newly developed infrastructure in the country will necessitate FM services to manage and maintain the facilities.

For example, in January 2023, the country's National Economic and Development Authority announced that over 3,600 infrastructure projects, with a combined cost of USD 372 billion, are scheduled for completion by 2028. In addition, the country has planned to add 206 projects worth USD 159 billion, out of which 136 are related to physical connectivity, nine to digital connectivity, 42 to water resources, eight to health, and two to power and energy, etc.

Additionally, the country is witnessing several expansions by leading organizations, creating an opportunity in the soft and hard FM (facility management) market. For instance, in April 2023, SM Investment Corporation announced to invest approximately PHP 90 billion (USD 1.64 billion) in capital expenditure to propel its expansion of residential developments, malls, and retail stores. The company intended to open at least three malls in 2023.

Similarly, in June 2023, The PLDT Group announced plans to build a 12th data center facility in the Philippines to deliver digital innovation and boost the country's regional competitiveness. Through this facility, the company aims to help the Philippines be the next hyper-scaler hub of Asia and support the digital transformation journey.

However, the need for more awareness of FM services and their benefits among the country's industrial sector of all sizes and types is the major challenge for the market's growth in the Philippines. For instance, most end users and small and medium-sized businesses continue to avoid FM because they are either unaware of or possibly skeptical of such long-term benefits, even though most multinational corporations operating in the country know them.

The COVID-19 pandemic and government initiatives in the Philippines created an opportunity for FM services post-pandemic, supported by the organization's priorities in cleaning services and the work-from-office trend.

Philippines Facility Management Market Trends

The In-house Facility Management Segment is Expected to Hold Significant Market Share

- In-house facility management services are provided by a dedicated resource employed by the client for performance monitoring and control. There is a rising demand for in-house facility managers in the Philippines to manage business-specific areas, including heavy burst-traffic zones and conference rooms used by busy executives. Additionally, in-house facility management provides training and required specialized certifications that a partner organization may not offer in their standard packages.

- In-house facility management involves recruiting specialized personnel to maintain and manage various functional attributes of a facility. Services such as cybersecurity assistance are often operated and monitored in-house to ensure the safety and integrity of the facilities. Integrated facilities management (IFM) is witnessing rapid adoption in the Philippines due to the growing demands to manage end-to-end facility needs and create consistent service levels. Integrated facility management is crucial to respond to potential disruptions proactively. It has emerged as a new approach to drive efficiencies in facility management, simplify workflows, and streamline operations.

- As per the National Economic and Development Authority, there are around 22 ongoing projects in the Philippines till 2024 and around 10 ongoing projects till 2028. With infrastructure development, facility management services also rise due to the requirement of achieving operational cost efficiency by deploying professional services. This facility management provides solutions and equipment to ensure that building operations run smoothly without any disturbances. Through these services, people, places, and processes are integrated, enabling the comfortable life of people living in the apartments or buildings.

- With the advent of Industry 4.0, in-house facility managers are in high demand in the Philippines. This further accelerates the need for a smart maintenance process to prevent equipment breakdown and optimize downtime. With advancements like AI, automation, and IIoT, facility managers strive to implement Maintenance 4.0 quickly.

- In February 2023, Manila Water Co. Inc. partnered with Damosa Land Inc. to manage water facilities for an industrial estate. Manila Water's subsidiary, Manila Water Philippines Ventures Inc. (MWPV), is spending about USD 2.20 million to operate and manage the water system of Anflo Industrial Estate (AIE), Damosa Land's industrial development for trade and agriculture. The partnership aims to meet the estimated demand of 2.6 million liters per day by integrating additional facilities into AIE's existing systems, generating demand for facilities management in the country.

- The Philippines is recognized as one of the most dynamic markets in Asia, whose fast-emerging economy consistently sustains its growth. The country's real estate industry is considered one of the most resilient. Its excellent financing services, capitalization, and pro-business climate drive the best in-house facility management solutions.

The Commercial Segment is Expected to Hold Significant Share in the Market

- Commercial facilities in the Philippines need expert facility managers for cleaning, maintenance, and security management of commercial buildings. Commercial facility management firms coordinate between an organization's internal departments and external parties to provide services. The FM would negotiate vendor contracts, assign local vendors, and liaise between tenants and service providers.

- There has been a rise in adaptive commercial spaces in the Philippines, and according to a recent study by Cushman & Wakefield, the Philippines branch of Booking.com, an online travel agency, selected the service provider to find a new space for Booking.com's new office for further expansion. To fulfill the travel agency's aim of shifting to a new area in the Central Business District (CBD) of Makati, a city in the Philippines' Metro Manila region, Cushman & Wakefield identified an ideal space by negotiating with the owners to lease a small vacant space adjoining the client's current office. Booking.com was able to lease extra space with a 15% discount from the building's original rental rate, all due to the facility management services provided by Cushman & Wakefield.

- In the Philippines, hard facility management is gaining significant growth for commercial spaces as it can provide businesses with access to expert services in HVAC, electrical, plumbing, and maintenance of a commercial area. For instance, the country's aviation industry has become more connected, augmenting the need to integrate data between systems to increase efficiency across the connected aviation ecosystem.

- In June 2023, AirAsia Philippines' parent company, Capital A, launched a logistics business and an aircraft maintenance, repair, and overhaul facility in the country. Capital A's engineering business provides heavy maintenance, repairs, and overhaul (MRO) services for the group's commercial aircraft, propelling the market growth.

- Commercial facility operators in the country are looking to outsource the manaPhilippines'eir businesses to focus more time and attention on investments. A single-source facility management solution helps them streamline decision-making, creating economies of scale and identifying new opportunities for creating destination-worthy groups. Also, owners of commercial facilities need to have a partner with the expertise to achieve crucial decarbonization goals.

- Managing and maintaining a large commercial facility, including its systems and infrastructure, can take time and effort. Therefore, many commercial space operators in the Philippines use a third-party facility management service provider instead of building their dedicated IT workforce, propelling the market growth in the segment. As per the Philippines Statistics Authority, the average commercial construction cost per square meter stood at USD 199.64, which insists that the players invest in construction activities, further driving the facility management market.

Philippines Facility Management Market Overview

The Philippine facility management market is fragmented, with major players like Atalian Global Services Philippines Inc., Servicio Filipino Inc., Meralco Industrial Engineering Services Corporation, SGS Philippines Inc., and Cushman & Wakefield PLC. Players in the market are adopting strategies such as partnerships, mergers, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023: JLL Philippines received the ISO 41001:2018 certificate in Facilities Management from BQSR Certifications Inc., a globally recognized ISO certification body accredited by the International Accreditation Service.

- February 2023: Cushman & Wakefield PLC opened a Shared Services Center (SSC) in Manila, Philippines. The center is located on the 32nd floor of the BDO Ecotower along 9th and 32nd Street, Bonifacio Global City, Metro Manila.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Philippine Facility Management Market

- 4.4 Indicative Global Facility Management Cost Index

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Office Space from the BPO Sector

- 5.1.2 Increasing Investment in Public and Private Infrastructure Development

- 5.2 Market Restraints

- 5.2.1 Lower Awareness of Facility Management Services

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 In-house Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single Facility Management

- 6.1.2.2 Bundled Facility Management

- 6.1.2.3 Integrated Facility Management

- 6.2 By Offering Type

- 6.2.1 Hard Facility Management

- 6.2.2 Soft Facility Management

- 6.3 By End-user Industry

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atalian Global Services Philippines Inc.

- 7.1.2 Servicio Filipino Inc.

- 7.1.3 Meralco Industrial Engineering Services Corporation

- 7.1.4 SGS Philippines Inc.

- 7.1.5 Cushman & Wakefield LLC

- 7.1.6 Sodexo Group

- 7.1.7 Santos Knight Frank Inc. (Knight Frank LLP)

- 7.1.8 Century Properties Management Inc.

- 7.1.9 Mansion Maintenance Co. Inc.

- 7.1.10 Kontrac Facilities Management Services Inc.

- 7.1.11 CBRE Group Inc.

- 7.1.12 Jones Lang LaSalle Inc.

- 7.1.13 Artelia Group

- 7.1.14 WeCare Facility Management Services Inc.

- 7.1.15 Hydron Corporation