|

市场调查报告书

商品编码

1692155

印度 PLM -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India PLM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

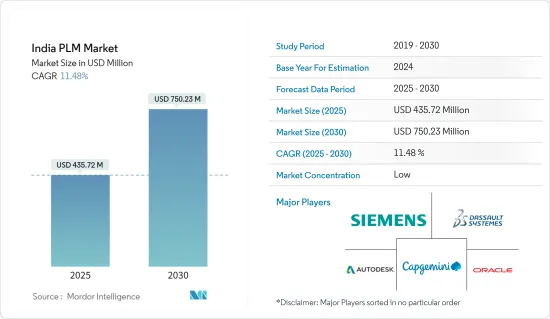

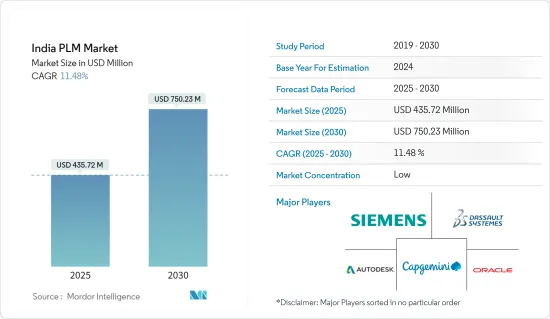

印度 PLM 市场规模预计在 2025 年为 4.3572 亿美元,预计到 2030 年将达到 7.5023 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.48%。

主要亮点

- PLM 整合价值链上的所有合作伙伴,以在整个生命週期中管理和开发产品。 PLM协助资料品管、企业产品记录、企业视觉化、客户需求管理、产品成本和品管以及材料和设备管理。 PLM 还支援各种品管标准,使製造商能够支援特定的品质认证(如 ISO 9001)、内部标准以及产品开发生命週期各个阶段的 BOM 按需分析。

- 随着透过物联网技术的应用,智慧互联产品的普及率不断提高,製造商正在寻求将机械和电子元件与软体解决方案结合。

- 工业物联网 (IIoT) 和工业 4.0 是整个物流开发、生产和管理的新技术方法的核心。这些是工业领域的主导趋势,机器和设备透过网路连接。

- 缺乏对 PLM 解决方案的认识可能会阻碍市场成长。对于专注于操作层面的 PLM 实施指南的研究也比较缺乏。更具体地说,缺乏研究检视在现实世界的工业 PLM 实施中哪些策略是相关的、使用了哪些策略、为什么(或为什么不)以及检验它们时的价值。

- COVID-19 疫情对 PLM 市场产生了正面影响。由于采取了封锁措施以阻止病毒传播,疫情对全球经济产生了重大影响。人们被迫待在家里并远距工作,以尽量减少与他人的接触。这反过来又刺激了物联网的成长,有助于发展云端基础的PLM 市场。

印度PLM市场趋势

中小企业智慧产品研发活动推动市场

- 近年来,IT产业对国内工业收益和就业机会贡献巨大。虽然软体开发服务最初推动了印度的 IT 产业,但这种趋势正在改变。印度正成为跨国IT公司的研发中心。几家总部位于印度的大型跨国IT公司也设立了研发和研发中心。印度政府认为,研发对于实施「数位印度」、「印度製造」和「Start-Ups印度」等新倡议至关重要,并已推出「IMPRINT」等新的研发计画。

- 据 IBEF 称,印度约有 6.33 亿家中小型企业。全国中小企业登记註册数量由2019年的2,121万户增加到2020年的2,513万户,较与前一年同期比较增加18.5%。截至2020年,全国註册微企业数量由2019年的1,870万户增加到2,206万户,其中小型企业由241万户增加到295万户。同期,中型市场公司数量略有增加,从 9,403 家增加到 10,981 家。

- 目前,中小型企业和微型和中小型企业僱用了超过 1.3 亿人,为印度製造业 GDP 贡献了 6.11%,为服务业 GDP 贡献了 24.63%,为製造业产出贡献了 33.4%。

- 根据 2020 年的一项调查,约有 37% 的印度公司拥有基于云端的数位基础设施。据估计,到 2022 年,超过 60% 的基础设施将位于云端,从而牺牲第三方託管、本地或专属式的可用性。

- 过去五十年来,微型、小型和中型企业(MSME)部门已成为印度经济中非常活跃且充满活力的部门。它以仅次于农业的较低资本成本,培养创业精神,创造大量就业机会,为国家经济社会发展做出了重大贡献。新兴经济体与大型企业形成互补,为国家工业综合发展有重大贡献。

南印度将成为主要市场区域

- 南印度地区包括泰米尔纳德邦、卡纳塔克邦、特伦甘纳邦、喀拉拉邦、安得拉邦、拉克沙群岛和本地治里等邦和联邦属地。该地区是 PLM 市场的关键区域,因为该地区拥有强大而多样化的製造业,涵盖了 PLM 市场几乎所有主要的最终用户行业,包括汽车和辅助设备、工程和工业机械、航太、IT、ITeS 以及航空航天和国防。该地区也是多家新兴科技企业的所在地,包括电动车製造企业。

- 泰米尔纳德邦拥有多元化的製造业,在汽车和汽车零件、工程、製药、服饰、纺织品、皮革製品、化学品和塑胶等多个行业中排名第一。其工厂数量和产业工人数量均居全州第一。

- 泰米尔纳德邦的清奈-斯里佩鲁姆布杜尔-奥拉加达姆和霍苏尔、安得拉邦的斯里城以及卡纳塔克邦的班加罗尔-比达迪是该国主要的汽车集群。现代马达、Yamaha汽车、施维英汽车、戴姆勒商用车、宝马、雷诺-日产、BharatBenz、Eicher、福特、阿萧克利兰、五十铃、皇家恩菲尔德、日本小松公司和 TAFE 在泰米尔纳德邦和安得拉邦的汽车丛集中设有製造工厂。同样,Mahindra REVA Electric、Toyota Kirloskar、Continental、TVS Motors 和 Ashok Leyland 也在卡纳塔克邦和霍苏尔(泰米尔纳德邦)设立了製造部门。

- 特伦甘纳邦的海德拉巴梅达克和卡纳塔克邦的班加罗尔是印度最重要的製药丛集之一。海德拉巴占印度原料药产量的近40%,占原料药原料药出口的约50%。海德拉巴基因组谷是印度第一个有计划、有系统的专注于生命科学的丛集。此外,海得拉巴还设计了製药城。此外,卡纳塔克邦拥有 35 多个临床研究机构和 12 个药物不良反应研究中心。该邦占印度医药出口的 12% 左右,占印度医药收入的近 10%。

印度PLM产业概况

随着许多技术先进的大型企业进入印度产品生命週期管理市场,该市场的竞争预计将更加激烈。为了保持市场占有率并留住新旧客户,公司会定期改变其定价结构,这会给其他公司带来更多费用的压力,从而使市场竞争更加激烈。

- 2022 年 4 月 - PTC 宣布推出其产品生命週期管理 (PLM) 软体 Windchill+。 Windchill+ 是该公司市场领先的 Windchill 软体的新世代产品,采用现代软体即服务 (SaaS) 架构交付。透过利用 SaaS 的优势,Windchill+ 促进了围绕产品数据的协作,使产品开发组织能够更快地将产品推向市场并加速 PLM 部署。

- 2022 年 1 月 - 电动车 (EV)新兴企业Simple Energy 宣布与全球技术领导者西门子合作,利用新时代技术增强电动车移动解决方案。透过此次合作,SimpleEnergy 将采用西门子云端基础的产品生命週期管理 (PLM) 软体 Teamcenter X,为其电动车解决方案建立坚实的数位化基础。除了西门子,Simple Energy 还与西门子技术合作伙伴 Prolim 合作,共用世界一流的技术,以加强印度成为世界电动车之都的努力。

- 2021 年 12 月 - 达梭系统与印度理工学院 (ISM) 丹巴德的技术创新中心 TEXMiN 基金会合作,在印度建立卓越中心,为采矿业和相关行业提供专业技术支援并培养未来的劳动力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 对提高效率、生产力和满足不断变化的需求的需求日益增长

- 中小企业智慧产品研发活动

- 市场挑战

- 缺乏意识和投资报酬率担忧

- PLM 解决方案/平台洞察

第六章市场区隔

- 按组件

- 解决方案

- 按服务

- 按地区

- 北

- 南方

- 东

- 西方

- 按最终用户产业

- 汽车及配件

- 工程和工业机械

- FMCG

- 航太与国防

- 高科技电子产品

- 其他最终用户产业

第七章竞争格局

- 公司简介

- Siemens Digital Industries Software

- Dassault Systemes SE

- Autodesk Inc.

- Ansys Inc.

- PTC Inc.

- Altair Engineering Inc.

- MSC Software Corporation India Pvt. Ltd

- Oracle Corporation

- SolidCAM GmbH

- Capgemini

- Tata Technologies

- HCL Technologies Ltd

第 8 章 PLM 提供者

第九章 供应商排名分析

第十章投资分析

第十一章投资分析市场未来展望

The India PLM Market size is estimated at USD 435.72 million in 2025, and is expected to reach USD 750.23 million by 2030, at a CAGR of 11.48% during the forecast period (2025-2030).

Key Highlights

- PLM unites all the partners involved in the value chain to manage and develop products throughout the product's lifecycle. PLMs may assist with data quality management, enterprise product record, enterprise visualization, customer need management, product cost and quality management, and materials and equipment management. PLM also aids in different quality management standards, allowing manufacturers to meet specific quality certifications, like ISO 9001, internal standards, and the on-demand analysis of the BOM during all phases of the product development lifecycle.

- The growth in the adoption of smart connected products due to the adoption of the IoT technology is pursuing the manufacturers to integrate the mechanical and electronic components with software solutions.

- The Industrial Internet of Things (IIoT) and Industry 4.0 are at the center of the new technological approaches for developing, producing, and managing the entire logistics chain. They dominate the industrial sector trends, with machinery and devices being connected via the internet.

- Lack of awareness regarding the PLM solution can hinder the market's growth. Also, the lack of research on PLM implementation guidelines that focus on the operational level. More specifically, there is a lack of studies examining what policies are relevant for and used in real industrial PLM implementations, why (or why not) they are used, and their value if applied.

- The COVID-19 pandemic has impacted the PLM market positively. The pandemic has affected the global economy profoundly, as lockdowns have been imposed to contain the spread of the virus. People have been compelled to stay at home and work remotely to minimize human contact, thus boosting the growth of the IoT, which, in turn, is driving the development of the cloud-based PLM market.

India PLM Market Trends

Research and Development Activities From SMBs to Develop Smart Products to Drive the Market

- In the recent past, the IT industry has emerged as a significant contributor to the industry revenue and employment opportunity provider in the country. Though software development services have initially driven the Indian IT industry, the trend is changing. The country is becoming an R&D hub of multinational IT companies. Several India-based multinational IT giants also have set up their R&D and innovation centers. The Government views R&D as essential for implementing new initiatives such as Digital India, Make in India, and Startup India and has launched new schemes in R&D such as IMPRINT, etc.

- According to IBEF, India has ~6.33 crore micro, small and medium enterprises. Registered SMBs grew 18.5% YoY to 25.13 lakh units in 2020, from 21.21 lakh units in 2019. As of 2020, registered SMBs were dominated by micro-enterprises at 22.06 lakh units, over 18.70 lakh in 2019, while small enterprise units went up from 2.41 lakh to 2.95 lakh. Midsized businesses marginally increased from 9,403 units to 10,981 units in the same period.

- SMBs and MSMEs currently employ >130 million people and contribute ~6.11% to India's manufacturing GDP, 24.63% of the GDP from service activities, and 33.4% of manufacturing output.

- A survey conducted in 2020 shows that around 37 percent of Indian enterprises had their digital infrastructure in the cloud. It was estimated that by 2022, more than 60 percent of the infrastructure would be in the cloud, which would be at the expense of third-party co-location and on-premise or captive availability.

- The Micro, Small, and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. It contributes significantly to the economic and social development of the country by fostering entrepreneurship and generating large employment opportunities at comparatively lower capital costs, next only to agriculture. MSMEs are complementary to large industries as ancillary units, and this sector contributes significantly to the inclusive industrial development of the country.

South India to be the Prominent Region for the Market

- South Indian region includes states and union territories, including Tamil Nadu, Karnataka, Telangana, Kerala, Andhra Pradesh, Lakshadweep, and Puducherry, and is a prominent region for the PLM market owing to the robust and diversified manufacturing industry that spans almost all major end-user industries of the PLM market, including automotive and ancillary, engineering and industrial machinery, pharmaceuticals, IT, and ITeS, Aerospace and Defense, among others. The region also hosts several growing modern technology businesses, such as electric vehicle manufacturing.

- Tamil Nadu has a diversified manufacturing sector and features among the leaders in several industries like automobiles and auto components, engineering, pharmaceuticals, garments, textile products, leather products, chemicals, plastics, etc. It ranks first among the states in terms of the number of factories and industrial workers.

- Chennai-Sriperumbudur-Oragadam and Hosur in Tamil Nadu, Sri City in Andhra Pradesh, and Bengaluru-Bidadi in Karnataka are major automobile clusters in the country. Hyundai Motor, Yamaha Motors, Schwing Stetter, Daimler Commercial Vehicles, BMW, Renault Nissan, Bharat Benz, Eicher, Ford, Ashok Leyland, Isuzu, Royal Enfield, Komatsu, and TAFE have their manufacturing facilities in Tamil Nadu and Andhra Pradesh auto cluster. Similarly, Mahindra Reva Electric, Toyota Kirloskar, Continental, TVS Motors, Ashok Leyland, and other companies set up their production sites in Karnataka and Hosur (Tamil Nadu).

- Hyderabad-Medak in Telangana and Bengaluru in Karnataka is one of India's most significant pharmaceutical clusters. Hyderabad contributes nearly 40% of the total Indian bulk drug production and around 50% of the bulk drug exports. Genome Valley in Hyderabad is India's first planned and systematically developed cluster dedicated to life sciences. Moreover, Pharma City is being designed in Hyderabad. Furthermore, Karnataka houses more than 35 clinical research organizations and 12 Adverse Drug Reaction Reporting Centers. The state contributes around 12% of India's pharmaceutical exports and nearly 10% of India's pharmaceutical revenues.

India PLM Industry Overview

With many large, technologically advanced players in the industry, the rivalry in the India Product Lifecycle Management Market is expected to be higher. To maintain the market share and retain new and existing consumers, the companies are regularly altering their pricing schemes, which creates pricing pressure on other companies, thereby augmenting the competition in the market.

- April 2022 - PTC announced the availability of its Windchill+ product lifecycle management (PLM) software. Windchill+ is a new generation of the company's market-leading Windchill software delivered via a modern software-as-a-service (SaaS) architecture. By leveraging the benefits of SaaS, Windchill+ facilitates collaboration around product data and enables product development organizations to bring products to market faster and accelerate PLM deployment.

- January 2022 - Simple Energy, an electric vehicle (EV) start-up, announced its partnership with global technology leader Siemens to boost EV mobility solutions with new-age technologies. As per the partnership, Simple Energy will adopt Siemens' Teamcenter X, a cloud-based Product Lifecycle Management (PLM) software, which will help the company establish a robust digital foundation for its e-mobility solutions. Along with Siemens, Simple Energy has also roped in Prolim, Siemens' Technology Partner, to share its world-class technologies to strengthen India's bid to become the EV capital of the world.

- December 2021 - Dassault Systemes partnered with TEXMiN Foundation, the technology innovation hub of IIT (ISM) Dhanbad, to set up a center of excellence in India to provide technical support and prepare the workforce of the future, specific to the mining and allied industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need For Higher Efficiency, Productivity And Meeting The Changing Demands

- 5.1.2 Research And Development Activities From SMBs To Develop Smart Products

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and ROI Concerns.

- 5.3 PLM Solution/platform Insights

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Region

- 6.2.1 North

- 6.2.2 South

- 6.2.3 East

- 6.2.4 West

- 6.3 By End-user Industry

- 6.3.1 Automotive And Ancillary

- 6.3.2 Engineering And Industrial Machinery

- 6.3.3 FMCG

- 6.3.4 Aerospace & Defense

- 6.3.5 High-tech And Electronics

- 6.3.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens Digital Industries Software

- 7.1.2 Dassault Systemes SE

- 7.1.3 Autodesk Inc.

- 7.1.4 Ansys Inc.

- 7.1.5 PTC Inc.

- 7.1.6 Altair Engineering Inc.

- 7.1.7 MSC Software Corporation India Pvt. Ltd

- 7.1.8 Oracle Corporation

- 7.1.9 SolidCAM GmbH

- 7.1.10 Capgemini

- 7.1.11 Tata Technologies

- 7.1.12 HCL Technologies Ltd