|

市场调查报告书

商品编码

1692157

中东和非洲软包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Middle East And Africa Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

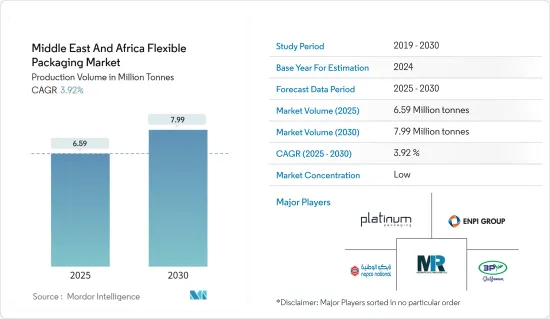

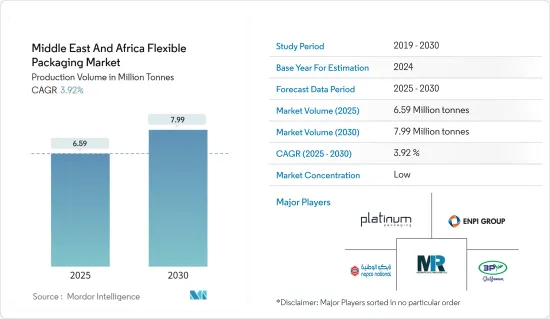

根据产量计算,中东和非洲的软包装市场规模预计将从 2025 年的 659 万吨扩大到 2030 年的 799 万吨,预测期内(2025-2030 年)的复合年增长率为 3.92%。

灵活的包装可以提供更经济、更可客製化的产品包装选择。它在需要多功能包装的行业中特别有用,例如食品和饮料、个人护理和药物。软包装由于其效率和成本效益而变得越来越受欢迎。

主要亮点

- 受消费者期望变化和人口成长的推动,该地区的包装业务在过去十年中一直保持持续成长。随着该地区见证包装材料的各种创新,它可能会继续关注永续性和环境方面。对纸张、纸板、再生 PET (rPET) 和生质塑胶等可回收和永续包装材料的需求不断增长,正在推动市场成长。

- 此外,阿联酋消费者食品偏好的变化为包装行业,尤其是食品和饮料行业带来了巨大的成长机会。根据阿联酋金融机构 Alpen Capital 的报告,由于中东和非洲地区的战略定位和不断增长的人口,该地区的食品业预计将实现成长。疫情爆发以来,网路食品宅配激增,增加了对包装纸、套标和标籤等软包装的需求,推动了产业成长。

- 此外,西方饮食习惯在国内消费者的影响日益增强,也推动了对包装食品的需求。移民、游客和年轻消费者进一步推动了这一趋势,他们推动了对已调理食品、包装和冷冻食品的需求。

- 立式袋对于包装食品製造商非常有利,因为与硬包装相比,它们更轻、使用的材料更少且运输成本更低。由于该地区饮料业对袋装饮料的消费量不断增加,预计市场需求将会增加。

- 由于回收基础设施有限,中东地区的软包装产业面临重大挑战。随着全球和地区对永续性问题的关注日益加深,这个问题变得越来越突出。儘管人们对环境问题的意识不断增强,政府也采取了各种措施来促进回收和减少废弃物,但对适当的回收设施和系统的需求仍然是一个主要障碍。这种情况为该地区的软包装製造商和用户带来了复杂的动态,他们难以平衡市场需求和新兴的永续性要求。

中东和非洲软包装市场的趋势

食品业是最大的终端用户

- 由于食品加工技术的进步和消费者生活方式的改变,中东包装食品市场正在成长。预计这些因素将在预测期内增加产品需求并推动软包装的成长。

- 此外,中东地区人口不断增长,对肉类、鱼贝类和家禽的需求不断增加,也推动了对软质塑胶包装的需求。由于製造商寻求满足消费者对便利性和延长保质期的偏好,包装材料和设计的创新也助长了这一趋势。

- 此外,阿拉伯联合大公国和沙乌地阿拉伯等中东国家的电子商务成长也推动了对方便食品的需求。这一趋势正在重塑薄膜、包装纸、小袋和袋子等软包装的模式,这些包装有助于长时间保持食物的新鲜和温暖。

- 海湾合作委员会地区是中东和非洲的主要地区,该地区的食品业在疫情后已经恢復。人口的成长、劳动人口的增加以及大量外籍人士的涌入推动了该地区食品产业的发展。该地区追求高营养价值的消费者对健康饮食习惯的认识不断提高,导致对生鲜食品食品和有机食品的需求增加。由于塑胶袋重量轻、强度高,因此在食品包装中使用塑胶袋和塑胶袋推动了对软质塑胶包装的需求。

- 根据Alpen Capital的报告,随着人均收入和人口成长,海湾合作委员会国家的食品消费量预计将在2027年增加到5,620万吨。据估计,沙乌地阿拉伯是该地区最大的食品消费量,其次是阿拉伯联合大公国和巴林。

沙乌地阿拉伯占主要市场占有率

- 沙乌地阿拉伯位于三大洲交汇处的战略位置,使其成为进入中东、非洲和亚洲市场的关键网路基地台。沙乌地阿拉伯发达的基础设施、高效的交通网络和先进的物流设施为全球贸易和投资机会提供了显着优势。

- 对于寻求新机会和成长的企业来说,沙乌地阿拉伯是一个具有吸引力的目的地。沙乌地阿拉伯雄心勃勃的经济改革、战略倡议和不断发展的商业环境正在将该国转变为潜在的全球商业中心。这项转型体现了沙乌地阿拉伯在国际市场上日益增长的重要性,并正在吸引全球包装企业越来越多的关注。

- 随着食品、零售、消费品和医药等行业对软包装解决方案的需求不断增长,越来越多的公司将目光转向沙乌地阿拉伯。沙乌地阿拉伯的战略位置使其在塑造区域和国际贸易、投资和创新方面发挥关键作用。

- 已调理食品和冷冻食品部门提供食用前无需或只需极少准备的已调理食品。由于快节奏的城市生活方式和多元文化的影响,这个细分市场在中东国家,尤其是沙乌地阿拉伯越来越受欢迎。

- 沙乌地阿拉伯加工肉品、海鲜和肉类替代品的市场正在成长。 2023年的市场规模约为1,499.10吨。预计到 2027 年这一数量将增加到约 1,839.50 吨,反映出消费者对加工肉品的偏好不断变化和增加。

中东和非洲软包装产业概况

中东和非洲的软包装市场较为分散,有多家参与者分布在该地区。竞争程度取决于影响市场的各种因素,例如品牌识别、强大的竞争策略、透明度和公司集中度。市场的主要参与者包括 Napco National、3P Gulf Group、Platinum Packaging Ltd、Aalmir Plastic Industries LLC、ENPI Group 等。

- 2024 年 6 月 - 领先的永续包装解决方案主要企业Furutamaiki 透露了整合其在阿拉伯联合大公国 (UAE) 的软包装製造业务的计划。该策略包括维护杰贝阿里的设施,同时大幅扩大拉斯海马的设施。该公司表示,此举旨在精简业务,提高竞争地位,为未来的区域扩张做好准备。

- 2024 年 5 月 - Napco National 策略性收购阿联酋品牌 Alsharq Plas LLC,以扩大其包装部门。收购完成后,Alsharq Plas LLC 将更名为 Napco Sharq Plas LLC。此举增强了两家公司满足海湾合作委员会地区客户不断变化的需求的能力。此外,此次收购预计将提高 Napco National 的市占率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业生态系分析:供应商、材料製造商等。

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争强度

- 替代品的威胁

- 进出口分析

第五章 市场动态

- 市场驱动因素

- 加工食品需求稳定成长

- 市场限制

- 原料成本高且回收基础设施有限

- 市场机会

- 对永续包装解决方案的需求不断增加

第六章 市场细分

- 依材料类型

- 塑胶

- 聚乙烯 (PE)

- 聚丙烯(PP)

- 聚对苯二甲酸乙二醇酯(PET)

- 其他塑胶(PVC、PA等)

- 纸

- 铝

- 可堆肥材料(PLA、PBS、PHA、PBAT等)

- 塑胶

- 依产品类型

- 袋子和包包

- 薄膜包装

- 热成型薄膜

- 拉伸膜

- 收缩膜

- 捲边膜

- 标籤和套管

- 盖子和内衬

- 泡壳包装

- 按最终用户产业

- 食物

- 饮料

- 药品

- 化妆品和个人护理

- 家居用品

- 宠物护理

- 烟草

- 其他终端用户产业(电子、化工、农产品等)

- 按国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 摩洛哥

- 埃及

- 南非

第七章 竞争格局

- 公司简介

- Napco National

- 3P Gulf Group

- Platinum Packaging Ltd

- Aalmir Plastic Industries LLC

- ENPI Group

- Amber Packaging Industries LLC

- Emirates Printing Press(LLC)

- Huhtamaki Flexibles UAE(Huhtamki Oyj)

- Gulf East Paper and Plastic Industries LLC

- Radiant Packaging Industry LLC

- Arabian Flexible Packaging LLC

- Integrated Plastics Packaging LLC

- Constantia Flexibles Afripack(Constantia Flexibles)

- SwissPac UAE

- Hotpack Packaging Industries LLC

- Falcon Pack

第八章 投资展望

第九章:未来市场展望

The Middle East And Africa Flexible Packaging Market size in terms of production volume is expected to grow from 6.59 million tonnes in 2025 to 7.99 million tonnes by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

Flexible packaging allows more economical and customizable options for packaging products. It is particularly useful in industries requiring versatile packaging, including food and beverage, personal care, and pharmaceutical industries. Flexible packaging has grown popular due to its high efficiency and cost-effectiveness.

Key Highlights

- The packaging business in the region has experienced consistent growth over the last decade due to changing consumer expectations and a rising population. Sustainability and environmental aspects might continue to be emphasized in the region as the market is witnessing various innovations in packaging materials. Increased demand for recyclable and sustainable packaging materials, such as paper and cardboard, recycled PET (rPET), and bioplastics, are driving market growth.

- Moreover, the changing consumer food preferences in the United Arab Emirates have created significant growth opportunities in the packaging industry, especially for the food and beverage industry. According to a report by Alpen Capital, a financial institute in the United Arab Emirates, the food industry in the Middle East and African region is estimated to grow due to its strategic location and growing population. Post-pandemic, the surge in online food delivery has enhanced the demand for flexible packaging such as wraps, sleeves, labels, and others, driving industry growth.

- Additionally, the increasing influence of Western eating habits among domestic consumers has boosted the demand for packaged foods. This trend is further supported by immigrants, tourists, and young consumers driving the demand for ready-to-eat, processed, and frozen foods.

- The lighter weight, reduced material use, and lower shipping cost of stand-up pouches than the rigid packaging benefit the packaged food producers. With the beverage industry increasingly consuming pouches in the region, the demand from the market is expected to increase.

- The Middle East faces significant challenges in the flexible packaging industry due to its limited recycling infrastructure. This issue has become increasingly prominent as sustainability concerns gain traction globally and within the region. Despite growing awareness of the environmental problems and implementing various government initiatives to promote recycling and waste reduction, the need for adequate recycling facilities and systems continues to pose a substantial obstacle. This situation creates a complex dynamic for flexible packaging manufacturers and users in the region as they strive to balance market demands with emerging sustainability requirements.

Middle East and Africa Flexible Packaging Market Trends

Food Industry to be the Largest End User

- The Middle East packaged food market is experiencing growth due to advancements in food processing techniques and changing consumer lifestyles. These factors are expected to increase product demand, driving the growth of flexible packaging during the forecast period.

- Further, the rising Middle Eastern population and a growing appetite for meat, seafood, and poultry fuel the demand for flexible plastic packaging. Innovations in packaging materials and designs also contribute to this trend, as manufacturers seek to meet consumer preferences for convenience and extended shelf life.

- In addition, the growth of e-commerce in Middle Eastern countries, such as the United Arab Emirates and Saudi Arabia, is driving demand for convenience food. This trend is reshaping the flexible packaging landscape, including films, wraps, pouches, and bags, which help maintain food freshness and warmth for extended periods.

- The food industry in the GCC region, a major chunk of Middle East and Africa, recovered after the pandemic. The growing population, coupled with the increasing number of working professionals and many expatriates, is a major driver for the region's food industry. Growing awareness of healthy eating habits of consumers in the region seeking high nutritional value has led to rising demand for fresh and organic food items. The use of plastic bags and pouches for food packaging, as pouches are low in weight and strength, drives the demand for flexible plastic packaging.

- According to a report by Alpen Capital, food consumption in GCC countries is estimated to grow to 56.2 million metric tons in 2027, driven by the increase in per capita income and growing population. Saudi Arabia is estimated to be the largest country in the region in terms of food consumption, followed by the United Arab Emirates and Bahrain.

Saudi Arabia Holds Major Market Share

- Saudi Arabia's strategic location at the intersection of three continents positions it as a critical access point to markets in the Middle East, Africa, and Asia. The country's well-developed infrastructure, efficient transportation networks, and advanced logistics facilities provide significant advantages for global trade and investment opportunities.

- Saudi Arabia has positioned itself as an attractive destination for businesses seeking new opportunities and growth. The Kingdom's ambitious economic reforms, strategic initiatives, and evolving business landscape transform it into a potential global business center. This transformation has garnered increasing attention from packaging businesses worldwide, reflecting Saudi Arabia's growing importance in the international market.

- With the demand for flexible packaging solutions rising in sectors like food, retail, consumer goods, and pharmaceuticals, businesses are increasingly eyeing Saudi Arabia. The country's strategic positioning will make it a key player in shaping regional and international trade, investment, and innovation.

- The Ready-to-Eat Meals and Frozen Food segment offers prepared food that requires minimal or no preparation before consumption. This segment is gaining popularity in Middle Eastern countries, particularly in Saudi Arabia, due to the fast-paced urban lifestyle and diverse cultural influences.

- The Saudi Arabian market for processed meat, seafood, and meat alternatives is experiencing growth. In 2023, the market volume was approximately 1,499.10 metric tons. Projections indicate an increase to about 1,839.50 metric tons by 2027, reflecting the country's changing and growing consumer preferences for processed meat.

Middle East and Africa Flexible Packaging Industry Overview

The Middle East and Africa Flexible Packaging Market are fragmented, with multiple players in the market operating regionally. The degree of competition depends on various factors affecting the market, such as brand identity, powerful competitive strategy, degree of transparency, and firm concentration ratio. Some of the major players in the market are Napco National, 3P Gulf Group, Platinum Packaging Ltd, Aalmir Plastic Industries LLC, and ENPI Group, among others.

- June 2024 - Huhtamaki, a key player in sustainable packaging solutions, has revealed plans to consolidate its Flexible Packaging manufacturing operations in the United Arab Emirates (UAE). The strategy involves retaining its Jebel Ali facility while significantly enlarging its Ras Al Khaimah site. According to the company, this move aims to streamline operations, elevate competitiveness, and fortify its foothold for future regional expansion.

- May 2024 - Napco National expanded its packaging division by strategically acquiring Alsharq Plas LLC, a brand based in the United Arab Emirates. Post-acquisition, Alsharq Plas LLC will be rebranded as Napco Sharq Plas LLC. This move is poised to bolster both companies' capabilities in meeting the increasingly sophisticated demands of customers in the GCC region. Furthermore, the acquisition is expected to bolster Napco National's market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis Suppliers, Material Manufacturers, etc.

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Import-Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Rise in Demand for Processing Food

- 5.2 Market Restraints

- 5.2.1 High Raw Material Costs and Limited Recycling Infrastructure

- 5.3 Market Opportunities

- 5.3.1 Growing Demand for Sustainable Packaging Solution

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastics

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Polypropylene (PP)

- 6.1.1.3 Polyethylene Terephthalate (PET )

- 6.1.1.4 Other Plastics (PVC, PA, etc.)

- 6.1.2 Paper

- 6.1.3 Aluminum

- 6.1.4 Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

- 6.1.1 Plastics

- 6.2 By Product Type

- 6.2.1 Pouches And Bags

- 6.2.2 Films And Wraps

- 6.2.2.1 Thermoforming Film

- 6.2.2.2 Stretch Films

- 6.2.2.3 Shrink Film

- 6.2.2.4 Cling Film

- 6.2.3 Labels And Sleeves

- 6.2.4 Lidding And Liners

- 6.2.5 Blister Packaging

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.2 Beverages

- 6.3.3 Pharmaceuticals

- 6.3.4 Cosmetics And Personal Care

- 6.3.5 Household Care

- 6.3.6 Pet Care

- 6.3.7 Tobacco

- 6.3.8 Other End-user Industries (Electronics, Chemicals, Agricultural Products etc.)

- 6.4 By Country

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 Morocco

- 6.4.4 Egypt

- 6.4.5 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Napco National

- 7.1.2 3P Gulf Group

- 7.1.3 Platinum Packaging Ltd

- 7.1.4 Aalmir Plastic Industries LLC

- 7.1.5 ENPI Group

- 7.1.6 Amber Packaging Industries LLC

- 7.1.7 Emirates Printing Press (LLC)

- 7.1.8 Huhtamaki Flexibles UAE (Huhtamki Oyj)

- 7.1.9 Gulf East Paper and Plastic Industries LLC

- 7.1.10 Radiant Packaging Industry LLC

- 7.1.11 Arabian Flexible Packaging LLC

- 7.1.12 Integrated Plastics Packaging LLC

- 7.1.13 Constantia Flexibles Afripack (Constantia Flexibles)

- 7.1.14 SwissPac UAE

- 7.1.15 Hotpack Packaging Industries LLC

- 7.1.16 Falcon Pack