|

市场调查报告书

商品编码

1692159

加速度和偏航率感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Acceleration And Yaw Rate Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

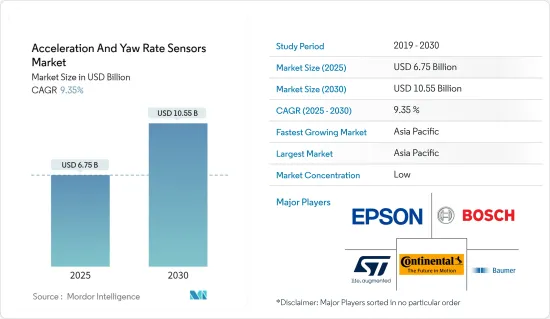

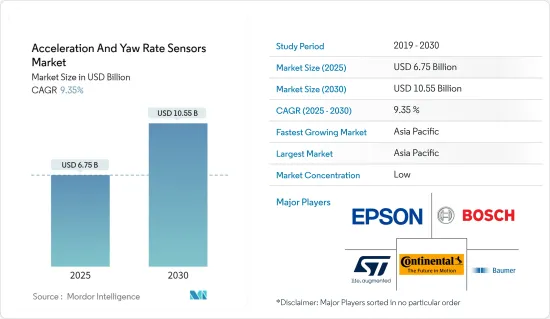

加速度和偏航率感测器市场规模预计在 2025 年为 67.5 亿美元,预计到 2030 年将达到 105.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.35%。

偏航率感知器测量车辆绕其垂直轴的旋转,同时测量垂直于行驶方向的加速度。偏航率以度/秒为单位进行测量。如果车辆在 2 秒内旋转 900 次,则偏航率为 450。透过以电子方式评估测量值,感测器能够区分正常转弯和车辆的打滑运动。

主要亮点

- 偏航率感测器是一种陀螺仪装置,可侦测车辆绕其垂直轴的角运动。输出通常以度/秒或弧度/秒錶示。滑移角与偏航角速度有关,是车辆行驶方向与自然方向之间所形成的夹角。利用科氏效应来计算该值。科氏效应提供了精确的测量和结果。因此,预计它将保持其在市场上的主导地位。科氏加速度是透过微机械型振动元件上的微机械捕获加速感应器测的。加速度与偏航率和振动速度的乘积成比例,并由电子方式维持。

- ADAS(进阶驾驶辅助系统)和网路连线汽车技术日益普及,其动力源自于消费者对提高车辆安全性、保障性和舒适性的需求日益增长。 ADAS(高级驾驶辅助系统)透过整合感测器、摄影机和通讯系统来帮助改变驾驶体验,以在各种情况下为驾驶员提供协助。

- 需求激增反映了人们对车辆的集体渴望,这些车辆优先考虑安全性,具有防撞和车道维持辅助等功能,并提供连接性以改善导航、提供即时资讯和个性化的舒适设定。这一趋势凸显了消费者对更聪明、更安全的驾驶体验不断变化的期望。

- 近年来,由于消费者应对气候变迁和减少温室气体排放的愿望,对替代燃料汽车的兴趣和偏好显着增加。这项转变是朝着更永续和环保的交通途径迈出的一大步。

- 在汽车产业,对先进感测器技术的需求正在激增,将汽车转变为智慧系统。虽然已开发经济体已经接受了这一发展,但新兴经济体的汽车感测器售后市场面临独特的挑战,可能会阻碍加速度和偏航率感测器的成长。其中一个主要障碍是新兴国家售后市场基础设施不发达。与已开发市场不同,新兴市场往往缺乏强大的专业感测器服务提供者网络,阻碍了提供优质的感测器更换和及时的维护服务。

加速度和偏航率感测器市场趋势

乘用车占很大市场占有率

- 乘用车的不断发展和对汽车安全功能的需求不断增长,推动了对加速度和偏航率感测器的需求。这些感测器是汽车稳定控制的关键部件,即使在最具挑战性的驾驶条件下也能提高安全性、安全性和控制力。这些感测器用于许多安全功能,例如安全气囊、牵引力控制、ADAS(高级驾驶辅助系统)和防撞系统。

- 乘用车中的偏航率感知器用于测量车辆的转速,通常称为偏航率。这些资料对于电子稳定控制 (ESC) 和牵引力控制等稳定控制系统至关重要,并构成其基础。它还可以帮助诊断车辆性能问题并向驾驶辅助系统提供资料。

- 特别是小型乘用车,由于自动驾驶和汽车电气化等趋势的引入,市场预计将经历高速成长。为了满足日益增长的需求,汽车製造商正集中投资并推出新车型,以扩大其影响力并提高市场竞争力。根据加拿大丰业银行预测,2023年亚洲乘用车销售量将达到约3,650万辆,北美乘用车销售量将达1,830万辆。

- 2023年5月,比亚迪宣布在欧洲建立新的乘用车工厂。作为其成长策略的一部分,该公司还计划在泰国建立一家乘用车厂。

- 同样,铃木汽车公司在2023年10月表示,其目标是到2030年在其最大的单一市场印度销售300万辆乘用车,并重申未来十年将其在印度的产能增加一倍至400万辆的计划。

- 此外,世界各国政府和消费者都在增加对电动车的支出,地方政府也提供购买补贴和免税以鼓励人们使用电动车。此外,各国政府也正在加速推动电气化计划,加大对充电基础设施的投入,迈向全电动化未来,进而支持市场成长。

亚太地区可望占据主要市场占有率

- 近年来,中国汽车工业取得了长足的成长和发展。中国汽车产业拥有全球最大的电动车市场和产业,拥有强大的供应链和大量的研发活动。中国政府将汽车产业,包括汽车零件产业,视为国家重点产业之一。中央政府预计,到 2025 年,中国的汽车产量将达到 3,500 万辆。中国最近指示汽车製造商到 2030 年,电动车 (EV) 的销量比传统汽车多 40%。随着汽车产业的这些进步,研究市场预计将会成长。

- 此外,随着工业 4.0 和物联网的到来,製造业发生了巨大转变,要求企业采用敏捷、智慧和创新的方式来推动生产,利用技术透过自动化补充和增强人力,并减少因製程故障而导致的工业事故。中国汽车产业大力采用先进製造技术,以提高产量、改善产品组装和成品水准并降低整体成本。预计中国汽车行业的成长将支持该市场的成长。

- 此外,根据中国工业协会(CAAM)的数据,2022年中国将生产约2,384万辆乘用车和319万辆商用车。

- 根据 IBEF 的汽车产业报告,印度的中产阶级正在不断壮大,而且年轻人口占很大比例,这意味着两轮车在数量上占据市场主导地位。此外,企业对开拓农村市场的兴趣日益浓厚,进一步推动了该产业的成长。物流和客运行业的成长正在推动商用车的需求。预计未来市场的成长将受到汽车电气化等新兴趋势的推动,尤其是小型车和三轮车的电气化。

- 印度是世界上最大的拖拉机製造商、第二大客车製造商和第三大重型卡车製造商,在全球重型汽车市场占有重要地位。印度22财年的汽车产量约为2,293万辆。

- 印度也是一个主要的汽车出口国,预计预测期内出口将大幅成长。此外,印度政府推出的多项倡议,如报废政策、2026汽车任务计画、与生产挂钩的奖励计画等,可能会使印度成为两轮车和四轮车市场的领导者。

加速度和偏航率感测器市场概况

加速和偏航率感测器市场高度分散,主要企业包括 Epson Europe Electronics Gmbh(Seiko Epson Corp.)、Bosch Sensortec Gmbh(罗伯特博世公司)、义法半导体公司、大陆集团和堡盟集团。市场参与者正在采取合作和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 9 月 - 在 Intergeo 2023 上,Silicon Sensing 团队将展示其最新系列基于坚固、高性能惯性和电子机械系统 (MEMS) 的传感器。此外,我们也讨论了即将推向市场的新一代技术。这些基于 MEMS 的尖端系统和感测器提供的性能等级可与关键领域的更大、更重、更昂贵的光纤陀螺仪 (FOG) 装置相媲美。

- 2023 年 8 月 - DTS 将被奖励南加州最佳职场场所。这项享有盛誉的奖项认可了 DTS 为营造每个人都发挥重要作用的协作环境所做的不懈奉献和努力。此外,这项成就强化了 DTS 的核心价值观,即开发为社会带来价值的突破性产品、培养团队成员之间的友爱精神、促进个人成长并营造积极的氛围。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业供应链分析

第五章 市场动态

- 市场驱动因素

- 消费者对车辆安全性、保障性和舒适性的需求不断增长

- 消费者越来越倾向于使用替代燃料汽车以减少温室排放

- 市场限制

- 新兴国家汽车感测器售后市场尚未开发

第六章 市场细分

- 按类型

- 压电型

- 微机械型

- 按应用

- 航太

- 车

- 搭乘用车

- 轻型商用车

- 重型商用车

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Epson Europe Electronics GmbH(Seiko Epson Corporation)

- Bosch Sensortec GmbH(Robert Bosch GmbH)

- STMicroelectronics NV

- Continental AG

- Baumer Holding AG

- DIS Sensors BV

- Silicon Sensing Systems Ltd

- Xsens Technologies BV

- Diversified Technical Systems Inc.

- MEMSIC Semiconductor(Tianjin)Co. Ltd

- CTS Corporation

第八章投资分析

第九章:市场的未来

The Acceleration And Yaw Rate Sensors Market size is estimated at USD 6.75 billion in 2025, and is expected to reach USD 10.55 billion by 2030, at a CAGR of 9.35% during the forecast period (2025-2030).

A yaw rate sensor measures the vehicle's rotation around its vertical axis while measuring the acceleration at right angles to the driving direction at the same time. The yaw rate is measured in degrees per second. If a vehicle makes a 900 turn in two seconds, it will have a yaw rate of 450. The sensor can differentiate between normal cornering and vehicle skidding movements by electronically evaluating the measured values.

Key Highlights

- A yaw rate sensor is a gyroscope gadget that detects a vehicle's angular motion around its vertical axis. The output is usually expressed in degrees per second or radians per second. The slip angle, related to the yaw rate, is the angle formed between the vehicle's driving and natural direction. The Coriolis effect is used to calculate this value. The Coriolis effect provides precise readings and results. Thus, it is projected to maintain its market dominance. Coriolis acceleration is sensed through a micromechanical capture acceleration sensor on the oscillating element in the micromechanical type. The acceleration is proportional to the product of the yaw rate and the oscillation speed, which is maintained electronically.

- The growing popularity of advanced driver assistance systems (ADAS) and connected vehicle technology is propelled by heightened consumer demand for enhanced safety, security, and comfort in automobiles. As these technologies advance, they contribute to a transformative driving experience by integrating sensors, cameras, and communication systems to assist drivers in various situations.

- The surge in demand reflects a collective desire for vehicles that prioritize safety with features like collision avoidance and lane-keeping assistance and offer connectivity for improved navigation, real-time information, and personalized comfort settings. This trend underscores the evolving expectations of consumers who seek a more smart and secure driving environment.

- In recent years, there has been a notable surge in consumer interest and preference for alternative fuel vehicles, driven by a collective desire to combat climate change and reduce greenhouse gas (GHG) emissions. The shift marks a significant step toward a more sustainable and eco-friendly transportation landscape.

- The automotive industry has witnessed a surge in the demand for advanced sensor technologies, transforming vehicles into smart systems. While developed economies have embraced this evolution, the aftermarket for automotive sensors in emerging economies faces unique challenges that may impede the growth of acceleration and yaw rate sensors. One of the primary hurdles lies in the underdeveloped nature of the aftermarket infrastructure in emerging economies. Unlike their developed counterparts, these markets often lack a robust network of specialized sensor service providers, hindering the availability of quality sensor replacements and timely maintenance services.

Acceleration And Yaw Rate Sensors Market Trends

Passenger Cars to Hold Major Market Share

- The growing developments of passenger vehicles and rising demand for safety features in cars have fueled the demand for acceleration and yaw rate sensors. These sensors are key components in a vehicle's stability control to provide increased security, safety, and control even in the most difficult driving conditions. These sensors are used in numerous safety features such as airbags, traction control, advanced driver assistance systems (ADAS), collision avoidance systems, and others.

- The yaw rate sensor in passenger cars is used to measure the rotational speed of a vehicle, often referred to as the yaw rate. This data is essential for stability control systems, such as electronic stability control (ESC) and traction control, as it provides the basis for their operation. They are also helpful in diagnosing vehicle performance issues and providing data for driver assistance systems.

- The market is expected to witness high growth due to the introduction of trends such as autonomous driving and the electrification of vehicles, particularly in small passenger automobiles. To meet this growing demand, various automaker players focus on investing and introducing new vehicle models to expand their footprint and gain a competitive edge in the market. According to Scotiabank, in Asia, passenger car sales reached around 36.5 million units in 2023, and in North America, it reached 18.3 million units.

- In May 2023, BYD announced the establishment of a new passenger vehicle plant in Europe. The company is also planning to construct a vehicle plant in Thailand as a part of its growth strategy.

- Similarly, in October 2023, Suzuki Motor Corporation announced that it is targeting the sales of 3 million passenger vehicles in India, its single-largest market, by 2030, reiterating its plans to double its manufacturing capacity in the country to 4 million units over the next decade.

- Furthermore, governments and consumers around the globe are increasing their spending on electric cars, and regional governments are also providing purchase subsidies and tax waivers to promote the adoption of electric vehicles. Various governments are also spending on charging infrastructure to accelerate electrification plans and aiming for a fully electric future, thus supporting the market's growth.

Asia-Pacific is Expected to Hold Significant Market Share

- The automotive industry in China has experienced significant growth and development in recent years. The Chinese industry has the largest EV market and industry in the world, with a robust supply chain and significant research and development activities. The Chinese government views its automotive industry, including the auto parts sector, as one of the prominent industries. The central government expects China's automobile output to reach 35 million units by 2025. China recently instructed automakers to sell 40% more electric vehicles (EVs) than conventional vehicles by 2030. As a result of these advancements in the automotive industry, there is likely to be growth in the market studied.

- Moreover, massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production, with technologies that complement and augment human labor with automation and reduce industrial accidents caused by process failure. The automotive sector in China has been a significant adopter of advanced manufacturing techniques for increasing their production output, achieving higher levels of fit and finish for their products, and reducing overall costs. The growing automotive sector in China is anticipated to support the growth of the market studied.

- Further, according to the China Association of Automobile Manufacturers(CAAM), in 2022, approximately 23.84 million passenger cars and 3.19 million commercial vehicles were produced in China.

- According to the IBEF automobile industry report, the two-wheelers segment dominates the market in terms of volume due to a growing middle-class population, and a considerable percentage of India's population is young. Moreover, the rising interest of companies in examining the rural markets is further aiding the sector's growth. The growing logistics and passenger transportation industries are driving the demand for commercial vehicles. Future market growth is expected to be fueled by new trends, including the electrification of vehicles, particularly small passenger automobiles and three-wheelers.

- India also enjoys a powerful position in the global heavy vehicles market as it is the largest tractor manufacturer, second-largest bus producer, and third-largest heavy truck manufacturer globally. India's annual production of automobiles in FY22 was approximately 22.93 million vehicles.

- India is also a major auto exporter and has substantial export growth expectations for the forecast period. Additionally, several initiatives by the Government of India, like the scrappage policy, Automotive Mission Plan 2026, and production-linked incentive schemes in the Indian market, are likely to make India a prominent player in the two-wheeler and four-wheeler markets.

Acceleration And Yaw Rate Sensors Market Overview

The acceleration and yaw rate sensors market is highly fragmented, with the presence of major players like Epson Europe Electronics Gmbh (Seiko Epson Corporation), Bosch Sensortec Gmbh (Robert Bosch Gmbh), STMicroelectronics NV, Continental AG, and Baumer Group. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2023 - During Intergeo 2023, the Silicon Sensing team showcased the latest lineup of robust and high-performing inertial systems and a variety of sensors based on micro-electro-mechanical systems (MEMS). Additionally, they engaged in discussions regarding the imminent market-ready technology of a new generation. These cutting-edge MEMS-based systems and sensors provide comparable performance levels to larger, heavier, and more expensive fiber optic gyroscope (FOG) units in crucial domains.

- August 2023 - DTS received the accolade of being acknowledged as one of the top workplaces in Southern California. This acknowledgment serves as a testament to DTS's unwavering dedication to fostering a collaborative environment where every individual has played a significant role in achieving this esteemed recognition. Furthermore, this achievement reinforces DTS's core principles of developing groundbreaking products that bring value to society, nurturing a sense of camaraderie among team members, promoting personal growth, and cultivating a positive atmosphere.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surging Consumer Demand for Vehicle Safety, Security, and Comfort

- 5.1.2 Growing Inclination of Consumers Toward Alternative Fuel Vehicles to Reduce GHG Emissions

- 5.2 Market Restraints

- 5.2.1 Underdeveloped Aftermarket for Automotive Sensors in Emerging Economies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Piezoelectric Type

- 6.1.2 Micromechanical Type

- 6.2 By Application

- 6.2.1 Aerospace

- 6.2.2 Automotive

- 6.2.2.1 Passenger Cars

- 6.2.2.2 Light Commercial Vehicles

- 6.2.2.3 Heavy Commercial Vehicles

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Epson Europe Electronics GmbH (Seiko Epson Corporation)

- 7.1.2 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 7.1.3 STMicroelectronics NV

- 7.1.4 Continental AG

- 7.1.5 Baumer Holding AG

- 7.1.6 DIS Sensors BV

- 7.1.7 Silicon Sensing Systems Ltd

- 7.1.8 Xsens Technologies BV

- 7.1.9 Diversified Technical Systems Inc.

- 7.1.10 MEMSIC Semiconductor (Tianjin) Co. Ltd

- 7.1.11 CTS Corporation