|

市场调查报告书

商品编码

1692164

中东和非洲的纸杯:市场占有率分析、行业趋势和成长预测(2025-2030 年)Middle-East and Africa Paper Cups - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

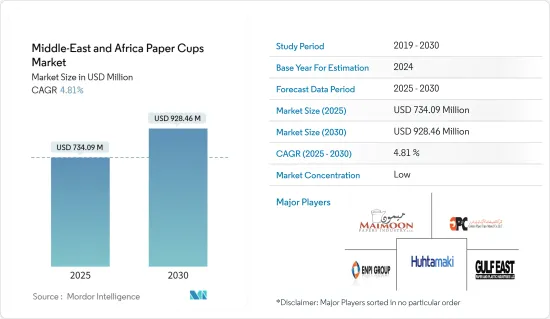

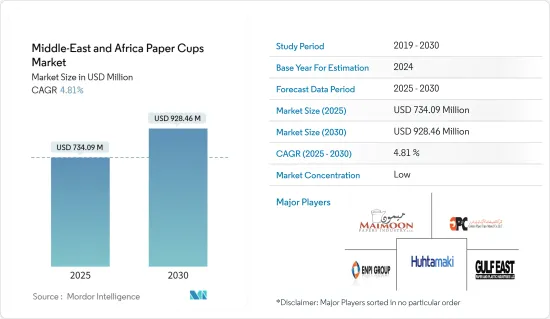

预计 2025 年中东和非洲纸杯市场规模将达到 7.3409 亿美元,到 2030 年将达到 9.2846 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.81%。

主要亮点

- 纸杯是由救生材料开发而成,至今仍具有相同的健康和安全价值。纸杯用于盛装咖啡、茶等食物和饮料,以及盛装冰淇淋和汤等食物。

- 纸杯的可回收性是推动纸杯市场成长的关键因素之一。由于纸杯是由纸製成的,因此可以无限期地回收。依照环保法规生产,用户无浪费顾虑,并可享有包装带来的成本效益。供应商可以透过他们的产品为永续性目标做出贡献。

- 快餐店越来越多地采用一次性杯子来盛装冷热饮品,这可能会在未来几年推动其需求。此外,预计在许多商业和住宅聚会中饮用水杯的使用量将会增加,从而增加需求。

- 此外,外带饮料的日益普及以及餐饮店数量的增加正在推动中东和非洲纸杯市场的发展。食品和饮料行业正变得越来越活跃。这种转变为包装生产商提供了多种选择,以满足食品和饮料行业的创新包装需求。

- 製造公司面临着适应不断变化的业务和营运环境的挑战。第四次工业革命带来了新的挑战,需要用不同的方法来解决问题。

- 随着 COVID-19 传播速度减缓,焦点转向涵盖市场中断及其对包装市场的影响。

- 围绕包装的一些最大优先事项和讨论都围绕着永续性展开。塑胶的使用、回收以及生物基材料的开发等争议性问题引起了激烈的争论和消费者的压力。

中东和非洲纸杯市场趋势

快餐店蓬勃发展

- 预计预测期内中东的速食和快餐服务业务将大幅扩张。推动市场扩张的主要因素是消费者偏好的变化和劳动力的成长。在娱乐选择较少的波湾合作理事会(GCC) 中,外出用餐是一项相对常见的活动。

- 超过三分之一的顾客来商场只是为了吃饭,而不是购物。大多数快餐店都使用一次性纸杯来盛装热饮和冷饮。这导致全部区域对纸杯的需求迅速增长。中东地区各地纷纷开设新道路、机场、购物中心、公园和娱乐中心,为许多食品和饮料连锁店的分店提供了便利。此外,随着人们在户外度过的机会越来越多,对快餐、即食食品和饮料的需求也在增加。

- 在该地区拥有可观营业收益的国际公司包括达美乐比萨、麦当劳和肯德基。例如,2022年12月,达美乐在中东、北非、巴基斯坦、埃及和摩洛哥的特许经营商AlamarFoods在杜拜成功开设了第600家门市。随着快餐店需求的增加,纸杯的需求可能会随着饮料需求的增加而增加。

- 许多咖啡馆和餐厅只专注于路边取餐或外带。一些门市正在减少店内容量,并设置富有创意的配送选项,以确保在封锁期间能够送达食物。食品和饮料行业预计将大幅增加对纸杯解决方案的需求。这主要是因为卫生产品的需求不断增加,而纸张正成为可行的包装材料。

- 该地区的咖啡馆和咖啡店行业似乎准备扩张。虽然传统咖啡店已经存在很长时间了,但中东的年轻城市居民和外籍人士越来越多地寻找具有西方美学的咖啡馆。咖啡馆就像全方位服务的餐厅和快餐店一样,是您可以与朋友一起閒逛或使用免费 Wi-Fi 在电脑上完成一些工作的地方。

沙乌地阿拉伯占主要市场占有率

- 由于旅游业的繁荣,沙乌地阿拉伯纸杯市场预计将大幅成长。社群媒体的使用正在增加,沙乌地阿拉伯社会的很大一部分人接触到了西方文化。科技和社会规范变得越来越宽鬆,创造了选择的自由。这有利于食品服务扩大消费者群体,促进销售并促进销售成长。

- 这主要是由于航空业、劳工营、武装部队、医院、大学、学校、朝觐/朝觐、婚礼和其他庆祝活动对已调理食品和饮料的需求增加。包装食品和食品饮料的需求不断增长,越来越多的跨国公司进入市场。

- 当地消费者变得越来越挑剔,寻求更多独特的体验。随着消费者越来越重视优质体验而非便利性,体验趋势正从速食转向速食休閒。

- 由于宅配的需求旺盛,预计市场将会成长。在沙乌地阿拉伯,宅配到职场的服务正变得越来越普遍。此外,随着娱乐和体育设施的种类按照2030年愿景的目标不断增加,参与公共场所活动的人们对于送餐的需求也将增加。

中东及非洲纸杯产业概况

由于有大量提供纸杯的区域和本地供应商,中东和非洲的纸杯市场是一个分散的市场。市场的主要企业包括 ENPI 集团、Huhtamaki 集团、Gulf East Paper & Plastic Group 等。

2022 年 11 月,HotpackGlobal 在卡达开设了一家製造工厂。这座最先进的製造厂专门用于生产 Hotpack 的各种纸製品,包括折迭式纸盒、瓦楞纸盒、纸袋和杯子。它位于多哈新工业区。

2022年10月,德百推出最新创新产品:德百纸盖。 Detpak 纸盖采用与普通咖啡杯相同的纸製成,并采用薄聚合物层压板製成,因此可以牢固地容纳液体。这是我们秉持着「设计负责」理念推出的领先纸製品系列的最新产品。使用此盖子可使外带咖啡中的一次性塑胶使用量减少 83%。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 生态系分析

- 进出口分析

第五章市场动态

- 市场驱动因素

- 随时随地饮料消费需求不断成长

- 永续性措施和最新创新对产品保质期发挥作用

- 市场挑战

- 市场分化加剧和材料依赖性增强将影响利润率

第六章市场区隔

- 按罩杯类型

- 热纸杯

- 冷纸杯

- 按应用

- 速食店

- 商用

- 其他用途

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

第七章竞争格局

- 公司简介

- Enpi Group

- Huhtamaki Group

- Gulf East Paper & Plastic Group

- Golden Paper Cups Manufacturing LLC

- MAIMOON Papers Industry LLC

- Hotpack Packaging Industries LLC

- Graphic Packaging International

- Saqr Pack

- Arkan Mfg Paper Cup Company

- Saham Group

- Ultracare LLC

- Bony Packaging

- Pack-Zone

- Detpak South Africa(Pty)Ltd

- Alfa Pack

- Falcon Pack

第八章投资分析

第九章:市场的未来

The Middle-East and Africa Paper Cups Market size is estimated at USD 734.09 million in 2025, and is expected to reach USD 928.46 million by 2030, at a CAGR of 4.81% during the forecast period (2025-2030).

Key Highlights

- Paper cups were developed from life-saving material and still deliver the same health and safety values today. Paper cups serve hot and cold beverages such as coffee or tea and hold food items such as ice creams and soups.

- The recyclability of paper cups is one of the key factors driving the growth of the paper cup market. These cups can be recycled indefinitely because they are made of paper. Manufactured per environmental regulations, users benefit from the cost advantages of packaging while eliminating disposal concerns. It helps the vendors to contribute to the sustainability goals through their products.

- The increasing adoption of disposable cups to serve hot and cold beverages in quick-service restaurants will likely drive their demand in the coming years. In addition, the rising usage of such cups for drinking water in several commercial and residential parties is expected to conduct their demand.

- Moreover, the growing popularity of on-the-go beverages and the number of food service outlets propel the Middle East and African paper cup market. The food and beverage industry is becoming increasingly dynamic. This transition provides packaging producers several options for meeting innovative packaging needs in the food & beverage industry.

- The manufacturing industry faces the challenge of adapting to an ever-changing business and operational environment. The fourth industrial revolution has brought a new set of challenges that requires a different approach to the problem.

- As the spread of COVID-19 decelerated, the shift in focus is now to encompass the market disruptions and their effects on the packaging markets.

- Some of the biggest packaging priorities and discussions revolved around sustainability. The highly debatable use of plastics, recycling, and development of bio-materials, to name a few, have been subject to intense discussion and consumer pressure.

MEA Paper Cups Market Trends

Quick Service Restaurants to Witness the Growth

- The fast food and quick service restaurant business in the Middle East is expected to expand significantly over the forecast period. The market's expansion is primarily fueled by shifting consumer preferences as well as an increase in the number of working populations. Eating out is a relatively common activity in the Gulf Cooperation Council (GCC), where there are often few entertainment options.

- More than a third of mall patrons come just for the food, not to shop. Most quick-service restaurants use disposable paper cups for hot and cold beverages. Therefore, there is a rapid demand for paper cups across the region. New roads and airports, malls, parks, and entertainment centers across the Middle East also allow numerous food and beverage chains to open. Also, frequent travel on the road spikes the demand for fast and ready-to-eat food and beverages.

- Notably, international companies with significant operating revenues in the area include Domino's Pizza Inc., McDonald's Corp., and KFC Inc. For instance, in December 2022, AlamarFoods, the franchisee for Domino's across the Middle East, North Africa, Pakistan, Egypt, and Morocco, successfully established its 600th location in Dubai. With the rising demand for quick-service restaurants, the proportional demand for beverages would increase the need for paper cups in the region.

- Numerous cafes and restaurants have focused more on curbside pickup or carryout only. Some stores reduced their in-store capacity and established inventive delivery options to ensure food delivery during the lockdowns. The food and beverage industry is anticipated to significantly increase demand for paper cup solutions. This is mainly because of the growing need for hygiene products that have made the paper a viable packaging material.

- The region's cafe and tea shop industry appears poised for expansion. Traditional tea shops have been around for a while, but young Middle Eastern urbanites and foreigners seek more cafes with a Western aesthetic. Cafes are places where one can hang out with friends or work on a computer while using free Wi-Fi, just like full-service restaurants and fast-food restaurants.

Saudi Arabia to Hold Major Market Share

- The paper cup market in Saudi Arabia is expected to grow significantly due to increased travel. The rising use of social media has exposed a significant proportion of Saudi society to Western culture. Technology and increasingly relaxed social norms are leading to emerging freedom of choice. This benefits food service by expanding the consumer base, boosting sales, and driving transaction volume growth.

- The airline industry's increased demand for prepared foods and beverages, labor camps, the military, hospitals, universities, schools, Umrah/Hajj, and catering for weddings and other celebrations are key factors. Demand for packaged foods and beverages is growing, and more multinational companies are entering the market.

- Local consumers are becoming increasingly selective in their desire for more unique experiences. The increased focus on experience is shifting from Fast Food to Fast Casual formats as consumers attach increased weight to a quality experience rather than just convenience.

- The market is expected to grow due to the high demand for home delivery. It is increasingly common for food to be delivered to workplaces across Saudi Arabia. Also, as the range of entertainment and sporting venues increases in line with the aims of Vision 2030, so will the demand for food delivery to those attending events in public spaces.

MEA Paper Cups Industry Overview

The Middle-East and Africa paper cup market is fragmented market due to the presence of considerable regional and local vendors providing paper cups. Key players in the market are ENPI Group, Huhtamaki Group, Gulf East Paper & Plastic Group, and others.

In November 2022, HotpackGlobal opened a manufacturing facility in Qatar. The cutting-edge manufacturing facility is a specialized factory that will create a wide range of Hotpack'spaper products, including folding and corrugated cartons, paper bags, and cups. It is situated in Doha's new industrial region.

In October 2022, Detpak introduced its newest innovative product: the Detpak paper lid. The Detpak paper lid is constructed using the same paper that most coffee cups are generally made from and with a thin polymer lamination that enables the packaging to hold liquid securely. It is the most recent addition to a line of leading paper goods driven by the principle of "Responsible by Design." By using this lid, take-out coffees utilize 83% less single-use plastic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Import And Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand For on-the-go Consumption of Beverages

- 5.1.2 Sustainability Measures Coupled with Recent Innovations have Played a Role in Shelf Life of Products

- 5.2 Market Challenges

- 5.2.1 Ongoing Market Fragmentatio and the Dependence on Materials Expected to Affect Margins

6 MARKET SEGMENTATION

- 6.1 By Cup Type

- 6.1.1 Hot Paper Cup

- 6.1.2 Cold Paper Cup

- 6.2 By Application

- 6.2.1 Quick Service Restaurants

- 6.2.2 Institutional

- 6.2.3 Other Applications

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 South Africa

- 6.3.4 Nigeria

- 6.3.5 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Enpi Group

- 7.1.2 Huhtamaki Group

- 7.1.3 Gulf East Paper & Plastic Group

- 7.1.4 Golden Paper Cups Manufacturing LLC

- 7.1.5 MAIMOON Papers Industry LLC

- 7.1.6 Hotpack Packaging Industries LLC

- 7.1.7 Graphic Packaging International

- 7.1.8 Saqr Pack

- 7.1.9 Arkan Mfg Paper Cup Company

- 7.1.10 Saham Group

- 7.1.11 Ultracare LLC

- 7.1.12 Bony Packaging

- 7.1.13 Pack- Zone

- 7.1.14 Detpak South Africa (Pty) Ltd

- 7.1.15 Alfa Pack

- 7.1.16 Falcon Pack