|

市场调查报告书

商品编码

1692438

欧洲精密农业:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Precision Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

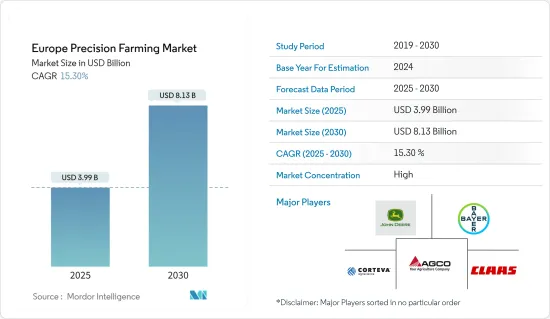

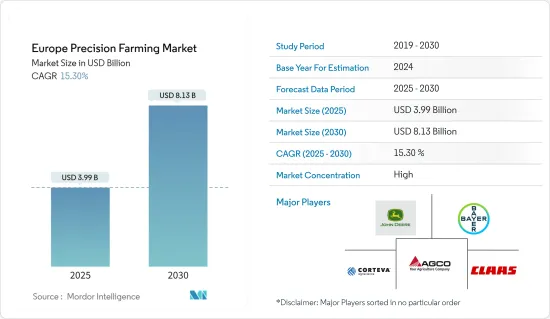

预计 2025 年欧洲精密农业市场规模为 39.9 亿美元,到 2030 年将达到 81.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.3%。

主要亮点

- 在技术进步和人们对永续农业方法日益增长的兴趣的推动下,欧洲精密农业市场正在快速增长。农民正在使用 GPS、无人机和物联网设备等工具来提高作物产量并更有效地管理资源。

- 政府的支持对于扩大市场起着至关重要的作用。欧盟的「地平线欧洲」计画(2021-2027年)预算约为1,040亿美元,用于推动精密农业的应用。该倡议鼓励创新和合作,以加速全部区域精密农业技术的开发和实施。

- 该市场的关键技术包括导引系统、遥感探测和可变速率技术。这些工具改善了作物监测、土壤健康评估和农场生产力。将即时资料与高级分析相结合,可以让农民根据特定的作物需求做出更明智的决策。根据欧盟《2023年精密农业政策与实施展望》,英国在该地区采用精密农业方面处于领先地位,其中英国的采用率为85%,其次是爱尔兰农民,为43%。德国和丹麦也是这些技术的主要采用者。

- 消费者对永续食品生产的兴趣日益增加,这与透过有效利用资源减少环境影响的精密农业实践相吻合。这一趋势顺应了市场需求,并为农民在优质、环保的市场中创造了机会。随着技术的不断进步和对永续农业的强大政策支持,欧洲精密农业的未来前景光明。

欧洲精密农业市场的趋势

劳动力短缺推动欧洲农业采用精密农业

- 欧盟新鲜农产品产业严重依赖欧盟和非欧盟国家的劳动力。德国、义大利、西班牙、法国和波兰僱用了大量季节性移工。欧盟拥有约 910 万个农场,农业用地面积达 1.57 亿公顷,由于移民政策趋严和季节性工人减少,欧盟正面临日益严重的劳动力短缺问题。这种情况加速了精密农业技术的采用,该技术提供自动化解决方案,减少对劳动力的依赖,同时提高农业部门的效率、生产力和永续性。

- 欧盟正在经历劳动人口的下降,尤其是在农业发挥关键经济作用的农村地区。欧盟农业劳动力指数下降了约15.8%,显示可用工人数量整体下降趋势。这种人口挑战使得寻找足够的劳动力进行种植、收割、加工和其他活动变得越来越困难。因此,农民越来越多地采用精密农业技术来解决劳动力短缺问题。

- 2023年,欧洲各国政府启动了「农业和农村数位化」计划,以促进数位技术和资料主导方法在农业领域的整合。该计划将使超过 274,000 个农场受益,旨在透过先进的数位工具提高效率和生产力。该计划透过鼓励采用 GPS、感测器和资料分析等精准技术,直接支持欧洲精密农业市场的成长。这种向自动化的转变不仅有助于缓解劳动力短缺,而且还能使农业更有效率和永续性。

德国精密农业应用日益普及

- 德国生产商越来越多地使用现代农业技术,凸显了向精密农业的重大转变。截至 2022 年,德国拥有约 1,160 万公顷农田,是欧洲最大的农业区之一。广阔的农业景观为精密农业技术的采用提供了巨大的机会。此外,虽然许多农民正在采用资料主导的方法,例如 GPS 辅助面积测量和土壤采样,但更先进的技术,例如定点播种和施肥,仍然并不普遍。

- 在德国,精密农业正成为农业承包服务的重要组成部分,尤其是在500公顷以上的农场。这项技术在监测土壤条件和植物健康方面发挥重要作用,有助于改善生长管理。人们对特定农场无人机应用的兴趣日益浓厚,预计将进一步推动模组化精密农业工具的采用,从而促进市场成长。德国JKI认证中心以其专业喷嘴测试的严格标准而闻名,是该国农业无人机的强制性认证。例如,DJI T30无人机于2022年在德国核准,可用于山地葡萄园作业。

- 人们对粮食安全和更好的营养管理日益增长的关注正在推动精密农业技术在全国范围内的传播。德国对永续农业的承诺,透过「数位农业2025」计画等措施加强,正在加速数位工具在农业实践中的应用。这些进步对于解决劳动力短缺和环境永续性等挑战至关重要,同时还可以透过使用土壤感测器和无人机等技术提高作物产量并降低投入成本。

欧洲精密农业产业概况

欧洲精密农业市场高度集中。迪尔公司、拜耳作物科学、爱科集团、克拉斯集团和科迪华。是市场的主要企业。在欧洲运营的公司专注于研发和产品推出以及创新和伙伴关係。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 政府支持和补贴

- 技术进步

- 对永续农业的需求不断增加

- 市场限制

- 监管和标准化挑战

- 初始成本高

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 科技

- 导引系统

- 全球定位系统(GPS)/全球导航卫星系统(GNSS)

- 全球资讯系统(GIS)

- 遥感探测

- 可变速率技术

- 变数施肥

- 变数播种

- 变数农药

- 无人机和无人驾驶飞机

- 其他技术

- 导引系统

- 成分

- 硬体

- 软体

- 服务

- 应用

- 产量监测

- 可变速率应用

- 字段映射

- 土壤监测

- 作物侦察

- 其他应用

- 地区

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- AGCO Corporation

- TopCon Corporation

- Corteva(Granular Inc.)

- CNH Industrial NV(Raven)

- Deere & Company

- Teejet Technologies

- CLAAS KGaA mbH(365FarmNet)

- AG Leader Technology Inc.

- Pottinger Landtechnik Gmbh group(MaterMacc)

- Bayer Cropscience AG

第七章 市场机会与未来趋势

简介目录

Product Code: 91048

The Europe Precision Farming Market size is estimated at USD 3.99 billion in 2025, and is expected to reach USD 8.13 billion by 2030, at a CAGR of 15.3% during the forecast period (2025-2030).

Key Highlights

- The precision farming market in Europe is experiencing rapid growth, propelled by technological advancements and an increased focus on sustainable agricultural practices. Farmers are utilizing tools such as GPS, drones, and IoT devices to improve crop yields and manage resources more efficiently.

- Government support plays a crucial role in the market's expansion. The European Union's Horizon Europe Programme (2021-2027), with a budget of about USD 104 billion, promotes the adoption of precision farming. This initiative encourages innovation and collaboration, facilitating the development and implementation of precision farming technologies across the region.

- Key technologies in the market include guidance systems, remote sensing, and variable rate technology. These tools enhance crop monitoring, soil health assessments, and farm productivity. Integrating real-time data and advanced analytics enables farmers to make more informed decisions tailored to their specific crop requirements. According to the European Union Precision Agriculture Policy & Adoption Outlook 2023, the United Kingdom leads in precision agriculture adoption in the region, with Scotland at 85% adoption within the UK, followed by 43% of Irish farmers. Germany and Denmark are also major adopters of these technologies.

- The growing consumer interest in sustainable food production aligns with precision farming practices, which reduce environmental impact through efficient resource use. This trend addresses market demands and presents opportunities for farmers in premium, eco-friendly markets. With ongoing technological progress and strong policy support for sustainable agriculture, the future of precision farming in Europe appears promising.

Europe Precision Farming Market Trends

Labor Shortages Drive Precision Farming Adoption in European Agriculture

- The European Union's fruit and vegetable sector relies heavily on non-national labor from both EU and non-EU countries. Germany, Italy, Spain, France, and Poland employ significant numbers of seasonal migrant workers. With about 9.1 million farms across 157 million hectares of agricultural land, the EU faces increasing labor shortages due to stricter immigration policies and declining availability of seasonal workers. This situation has accelerated the adoption of precision farming technologies, which offer automated solutions to reduce labor dependency while improving efficiency, productivity, and sustainability in the agricultural sector.

- The EU is experiencing a declining labor force, particularly in rural areas where agriculture plays a key economic role. The EU agricultural labor force index decreased by about 15.8%, indicating an overall downward trend in the number of available workers. This demographic challenge has made it increasingly difficult to find sufficient labor for tasks such as planting, harvesting, and processing. Consequently, farmers are increasingly adopting precision farming technologies to address these labor shortages.

- In 2023, the European government initiated a digitalization program for agriculture and rural areas, promoting the integration of digital technologies and data-driven approaches in farming. This initiative benefits over 274,000 farms, aiming to enhance efficiency and productivity through advanced digital tools. The program directly supports the growth of the Europe Precision Farming Market by encouraging the adoption of precision technologies such as GPS, sensors, and data analytics. This shift towards automation not only helps alleviate the labor shortage but also improves efficiency and sustainability in agriculture.

Growing adoption of precision farming in Germany

- The increasing use of modern farming techniques by German growers highlights a significant shift towards precision farming. Germany boasts about 11.6 million hectares of agricultural land as of 2022, positioning it as one of Europe's largest farming regions. This extensive agricultural landscape offers a significant opportunity for the adoption of precision farming technologies. Moreover, many farmers are adopting data-driven methods, such as GPS-based area measurements and soil sampling, although more advanced techniques like site-specific sowing and fertilizing are still less common.

- In Germany, precision farming is increasingly becoming a crucial part of agricultural contractor services, particularly on farms exceeding 500 hectares. This technology plays a significant role in monitoring soil conditions and plant health, leading to improved growth management. The rising interest in drone applications for specific farm areas is projected to further promote the adoption of modular precision farming tools, contributing to market growth. The German Julius Kuhn-Institut (JKI) is renowned for its stringent standards in professional nozzle testing, a certification that is mandatory for agricultural drones in the country. For instance, DJI T30 drones received approval in 2022 for mountain vineyard operations in Germany.

- The growing focus on food security and better nutrient management is driving the widespread adoption of precision farming technologies across the nation. Germany's commitment to sustainable agriculture, reinforced by initiatives such as the "Digital Farming 2025" program, is accelerating the use of digital tools in farming practices. These advancements are critical for addressing challenges like labor shortages and environmental sustainability, while also enhancing crop yields and reducing input costs through the use of technologies such as soil sensors and drones.

Europe Precision Farming Industry Overview

The European precision farming market is highly concentrated. Deere & Company, Bayer Crop Science, Agco corporation, CLAAS KGaA mbH and Corteva. are the key players in the market. The companies operating in Europe are focusing on R&D and product launches, along with innovations and partnerships.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Support and Subsidies

- 4.2.2 Technological Advancements

- 4.2.3 Increasing Demand for Sustainable Agriculture

- 4.3 Market Restraints

- 4.3.1 Regulatory and Standardization Challenges

- 4.3.2 High Initial Cost

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power Of Suppliers

- 4.4.2 Bargaining Power Of Buyers

- 4.4.3 Threat Of New Entrants

- 4.4.4 Threat Of Substitute Products And Services

- 4.4.5 Degree Of Competition

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Guidance System

- 5.1.1.1 Global Positioning System (GPS)/ Global Satellite Navigation System (GNSS)

- 5.1.1.2 Global Information System (GIS)

- 5.1.2 Remote Sensing

- 5.1.3 Variable Rate Technology

- 5.1.3.1 Variable Rate Fertilizer

- 5.1.3.2 Variable Rate Seeding

- 5.1.3.3 Variable Rate Pesticide

- 5.1.4 Drones and UAVs

- 5.1.5 Other Technologies

- 5.1.1 Guidance System

- 5.2 Components

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 Application

- 5.3.1 Yield Monitoring

- 5.3.2 Variable Rate Application

- 5.3.3 Field Mapping

- 5.3.4 Soil Monitoring

- 5.3.5 Crop Scouting

- 5.3.6 Other Application

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO Corporation

- 6.3.2 TopCon Corporation

- 6.3.3 Corteva (Granular Inc.)

- 6.3.4 CNH Industrial N.V. (Raven)

- 6.3.5 Deere & Company

- 6.3.6 Teejet Technologies

- 6.3.7 CLAAS KGaA mbH (365FarmNet)

- 6.3.8 AG Leader Technology Inc.

- 6.3.9 Pottinger Landtechnik Gmbh group (MaterMacc)

- 6.3.10 Bayer Cropscience AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219