|

市场调查报告书

商品编码

1692445

中东和非洲的设施管理:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)MEA Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

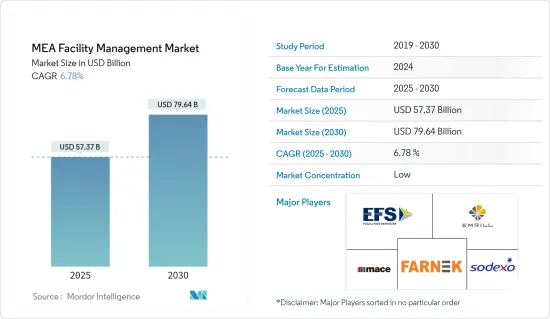

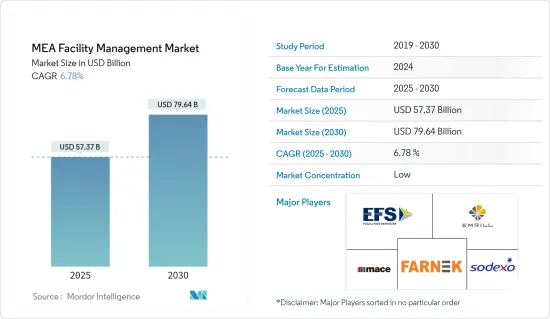

中东和非洲设施管理市场规模预计在 2025 年为 573.7 亿美元,预计到 2030 年将达到 796.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.78%。

在中东,建筑、基础设施和能源领域的私人和公共计划对设施管理服务的需求庞大。此区域市场的特点是电脑辅助设施管理 (CAFM) 和楼宇管理系统 (BMS) 等技术的整合。这些技术以及远端监控、物联网、行动解决方案、机器人、人工智慧等预计将在确保外包 FM 合约(尤其是设施管理服务)的可行性方面发挥核心作用。

主要亮点

- 预计在预测期内,对清洁、消毒和空间管理实践的重视程度不断提高,以及正在进行的几个基础设施计划将推动设施管理市场稳步成长。该地区极端的气候条件使得对硬体和软体设施管理服务的需求增加。

- 由于商业房地产需求不断增长,沙乌地阿拉伯、阿拉伯联合大公国和卡达可被视为该地区设施管理市场的关键成长地区。杜拜和沙乌地阿拉伯正在提供宽鬆的税收制度并发展商业生态系统,以加强吸引全球公司的竞争力。随着企业的涌入,该地区对设施管理服务的需求预计将上升。

- 此外,该地区各国的经济发展对所研究的市场产生了正面影响。目前的市场动态正在推动对外包设施管理服务的需求不断增长,而不再依赖内部服务。此外,政府的优惠支持透过资金援助和政策刺激了对设施管理服务的需求,从而促进了大规模基础设施建设。

- 随着地方监管机构概述业主和开发人员应如何优化其资产,对 FM 服务的需求正在增长。然而,不断上升的就业成本和技术纯熟劳工的短缺,导致当地市场公司转向合作和收购,以汇集人才并履行长期合约义务。

中东和非洲设施管理市场的趋势

设施管理外包领域推动市场成长

- 与更成熟的市场相比,中东和非洲的外包设施管理产业仍处于成长阶段。零售和房地产等行业越来越重视采用绿色建筑,预计将刺激该地区设施管理外包的成长。例如,EchoStone 宣布计划在 2023 年之前在尼日利亚拉各斯建造 182,000 座经济实惠且经过认证的绿色建筑。

- 设施管理在商业建筑和工业计划中的应用日益广泛,推动了设施管理外包(包括软服务)的成长。推动中东设施管理市场发展的主要因素之一是建设活动的增加。例如,沙乌地阿拉伯正在大力投资建造铁路、公路、港口和机场。因此,设施管理服务外包可望为大型计划市场带来新的机会。

- 随着该地区目前正在进行多个大型计划,设施管理外包服务持续成长。新兴国家承担了国内商业领域的大部分发展计划。随着持续的投资和技术的提升,沙乌地阿拉伯正在投资各种各样的计划。沙乌地阿拉伯计画在2035年向非碳氢化合物产业投资约1兆美元。重点计划包括奇迪亚娱乐城、阿卜杜拉国王金融区、Neom、红海计划和Amaala。

- 卡达国家愿景(QNV)2030是一项长期经济发展计画。卡达正在大力投资除石油和天然气之外的基础设施项目。交通通讯部(MoTC)是交通运输业的主要监管机构,负责监督各个交通运输业者和计划所有者的业务,为供应商委託设施管理服务创造机会。

- 此外,卡达正透过政府和私营部门合作进行中央铁路和公路计划,最近开放了一个新的商业港口并对哈马德国际机场(HIA)进行了大规模容量升级,物流流和多式联运网络的发展正在以惊人的速度进展。为了支持这些建设计划,设施管理服务外包有望成为现实。预计这将推动设施管理市场的新成长机会。

预计商业领域将主导市场

- 随着当地企业从疫情中復苏并引导员工返回办公室,商业空间的空置率将会下降。该地区对软设施管理服务的需求大幅增加,特别是清洁办公空间和维护卫生通讯协定的清洁服务。

- 外国公司对各领域的投资流入有利于满足日益增长的办公室需求,从而推动商业房地产行业的发展。此外,该地区商业房地产领域的需求将转化为对设施管理服务(尤其是维护和清洁)的需求增加。

- 此外,办公大楼的增加也需要设施管理。例如,阿布达比的 Reem Mall 就是这样一个大型计划,它将透过支持拥有 450 多家商店、大卖场、电影院和两个美食广场的商业食品店来促进商业零售业的发展。海湾合作委员会和北非国家正在建造多个此类计划。

- 科威特是中东和非洲发展最快的 IT 中心。科威特凭藉着2035愿景,预计将成为该地区的金融和商业中心。科威特IT中心的快速发展直接影响了该国对设施管理服务的需求。

- 开罗仍然是埃及商业房地产行业发展的主要活动中心。取消门对门限制导致人员和组织流动增加,使他们能够恢復办公室工作。此外,大开罗地区的一些外国组织也增加了对办公空间的需求。设施管理服务预计也会产生强烈的正面影响。

- 海湾合作委员会零售业近期面临前所未有的需求,开发商和零售商受益于强劲的经济成长和激增的客流量。预计未来阿布达比和杜拜的需求仍将保持强劲。预计阿布达比和杜拜的租金都将缓慢成长。

中东和非洲设施管理产业概况

中东和非洲设施管理市场分散,由许多拥有数十年行业经验的公司组成。这些 FM 供应商采取了利用其专业知识并大力投资广告的竞争策略。市场主要由区域性公司主导,例如:EFS Facilities Services Group、Emrill Services LLC、Farnek Services LLC 和 Sodexo, Inc. 本地企业提供具有竞争力的价格,降低了供应商的议价能力,并为买家提供了以最小的转换成本转换设施管理供应商的选择。

- 2023 年 9 月 CFAO 集团是一家活跃于非洲交通、基础设施、医疗保健、消费和能源领域的公司,透过实施可负担和永续作为其「与非洲携手,服务非洲」使命的一部分,已成为非洲基础设施领域的重要合作伙伴。目标是透过专注于该地区的永续基础设施、可再生能源和设施管理解决方案,进一步为解决这些挑战做出贡献。

- 2024 年 5 月清洁服务供应商 Crystal Facilities Management 推出了创新解决方案,以在沙乌地阿拉伯推广全面的设施管理服务和咨询。该公司在沙乌地阿拉伯利雅德提供商业清洁、承包商清洁、办公室清洁、保全、害虫防治、废弃物管理和清洁服务,以帮助其客户实现目标。该公司宣布将利用其行业经验,透过设施管理服务的咨询、设计和交付,提供高品质的 IFM 解决方案,推动积极的变革。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场动态

- 市场驱动因素

- 预计正在筹备的大型计划将推动建筑业的发展,并推动对设施管理和服务的需求

- 对软设施管理服务的需求不断增加

- 市场限制

- 区域市场分散

第六章市场区隔

- 按类型

- 内部设施管理

- 外包设施管理

- 单调频

- 捆绑调频

- 整合调频

- 按最终用户

- 商业设施

- 设施

- 公共/基础设施

- 产业

- 卫生保健

- 其他最终用户

- 按国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 科威特

- 南非

- 埃及

- 奈及利亚

第七章竞争格局

- 公司简介

- Engie Cofely Energy Services LLC(Engie SA)

- EFS Facilities Services Group

- Ejadah Asset Management Group

- Emrill Services LLC

- Farnek Services LLC

- Initial Saudi Arabia Company Limited

- Kharafi National for Infrastructure Projects Developments Construction and Services SAE

- Mace Group Limited

- Serco Group PLC

- Sodexo Inc.

- Ecolab Inc.

第八章投资分析

第九章:未来趋势

The MEA Facility Management Market size is estimated at USD 57.37 billion in 2025, and is expected to reach USD 79.64 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

Private and public projects, including construction, infrastructural, and energy projects, are creating a massive demand for facility management services in the Middle East. The regional market is characterized by the integration of technologies, such as computer-aided facility management (CAFM) and building management systems (BMS), which are anticipated to take center stage along with remote monitoring, internet of things, mobile solutions, robotics, and AI to ensure the viability of FM contracts, particularly outsourced facility management services.

Key Highlights

- Driven by the growing emphasis on cleaning, disinfection, space management practices, and several ongoing infrastructural projects, the facility management market is anticipated to grow steadily during the forecast period. The region's extreme climatic conditions have further necessitated the use of hard and soft facility management services.

- Saudi Arabia, the United Arab Emirates, and Qatar can be identified as critical growth areas for the facility management market in the region, owing to their increasing demand for commercial real estate. The intensifying competition between Dubai and Saudi Arabia to host global companies has resulted in relaxing taxation and ensuring the provision of a supportive business ecosystem in the region. With the influx of businesses, the area is expected to see a boost in demand for facility management services.

- Furthermore, the economic development of various countries in the region has positively influenced the studied market. Current market dynamics highlight the increasing demand for outsourcing facility management services, moving away from in-house services. In addition to this, favorable government support is helping to induce large-scale infrastructural development through monetary aid and policies designed to steer the demand for facility management services.

- With regional regulatory bodies outlining how real estate owners and developers should optimize their assets, the demand for FM services is rising. However, with the increased cost of hiring and the lack of a skilled workforce, the regional market players are engaging in partnerships and acquisitions to pool talent and deliver long-term contractual obligations.

MEA Facility Management Market Trends

The Outsourced Facility Management Segment is Driving the Market's Growth

- The Middle East and Africa outsourced facility management segment is still in the growth stage compared to more established and mature markets. The increasing emphasis on adopting green buildings across sectors, such as retail and real estate, is expected to stimulate the growth of outsourced facility management in the region. For instance, EchoStone announced plans to build 182,000 affordable, certified green buildings in Lagos, Nigeria, by 2023.

- The growing use of facility management in commercial buildings and industrial projects is driving the growth of outsourced facility management, including soft services. One of the major factors driving the facility management market in the Middle East is growing construction activity. For instance, Saudi Arabia has invested heavily in constructing railways, roads, ports, and airports. Thus, outsourced facility management services are anticipated to bring new opportunities to the market for large-scale projects.

- Outsourced Facility management services across the region are growing owing to several megaprojects currently being undertaken. KSA is working on most development projects in the country's commercial sector. With continuing investment and technological enhancements, Saudi Arabia invests in diverse projects. Saudi plans to invest approximately USD 1 trillion in its non-hydrocarbon industry by 2035. Some key projects include Qiddiya Entertainment City, King Abdullah Financial District, Neom, the Red Sea Project, and Amaala.

- Qatar National Vision (QNV) 2030 is a long-term economic development plan. Qatar invests heavily in infrastructure programs focused on its non-oil and gas sectors. The Ministry of Transport and Communications (MoTC) functions as the primary regulator of the transportation sector, overseeing the work of individual transport operators and project owners, and creates an opportunity for the vendors' outsourced facility management services.

- Additionally, in collaboration with its government and private sector, Qatar is working on central rail and expressway projects, the recent opening of the new commercial seaport and significant capacity upgrades at Hamad International Airport (HIA), logistics flows, and multimodal transportation networks are being developed at a remarkable pace. To support these construction projects, facility management services are expected to be outsourced. This will drive new growth opportunities in the facility management market.

The Commercial Segment is Expected to Dominate the Market

- As regional companies recover from the pandemic and instruct employees to return to the office, the vacancy rate will decline in commercial spaces. The demand for soft facility management services in the region has witnessed a significant spike, focusing on cleaning services to disinfect office spaces and maintain hygiene protocols.

- The inflow of investments from foreign companies in different sectors has positively attributed to the growing need for offices boosting the commercial real estate sector. Furthermore, the demand for the commercial real estate sector in the region translates to a higher requirement for facility management services for maintenance and cleaning, among others.

- Moreover, the increase in office buildings also demands facilities management. For instance, Reem Mall in Abu Dhabi marks one of the megaprojects to boost the commercial retail sector by facilitating more than 450 stores for retail, a hypermarket, a multiplex cinema, and two food courts, supporting commercial food outlets. Several such projects are under construction in the GCC and Northern African countries.

- Kuwait is a fast-emerging IT hub in Middle East and Africa. With its 2035 Vision, Kuwait is poised to become the area's financial and commercial center. The rapid development of IT hubs in Kuwait directly influences the country's demand for facility management services.

- Cairo remains the primary activity center in developing Egypt's commercial real estate sector. The lifting of lockdown restrictions has increased the mobility of people and organizations, allowing them to re-convene work from the office, which is also set to increase the occupancy rate in the country. Furthermore, the entry of several foreign organizations into the Greater Cairo region has boosted the demand for office space. It is expected to have a strong positive impact on facility management services.

- The retail sector in the GCC has faced unprecedented levels of demand in the recent past, where developers and retailers have benefited from strong economic growth and surging footfall numbers. The demand in both Abu Dhabi and Dubai is likely to remain strong. Rental rates are anticipated to increase, with a moderate rate of rental growth in both Abu Dhabi and Dubai.

MEA Facility Management Industry Overview

The Middle East and Africa facility management market is fragmented, with many players having decades of industry experience. These FM vendors are incorporating competitive strategies by leveraging their expertise and are significantly investing in advertising. The market is dominated by regional players such as EFS Facilities Services Group, Emrill Services LLC, Farnek Services LLC, and Sodexo, Inc. Local players are offering competitive pricing, reducing the suppliers' bargaining power and giving buyers an option to switch their facility management vendors with minimal switching costs.

- September 2023: The CFAO Group, a player in the fields of mobility, infrastructure, healthcare, consumer, and energy in Africa, became a key partner in Africa's infrastructure sector by implementing affordable and sustainable development as part of its With Africa For Africa mission. The aim is to contribute more to addressing the challenges by focusing on sustainable infrastructure, renewable energy, and facility management solutions in the region.

- May 2024: Crystal Facilities Management, which delivers cleaning services, introduced innovative solutions to help drive integrated facilities management services and consultancy to the KSA. The company offers commercial cleaning, contractor cleaning, office cleaning, security, pest control, waste management, and janitorial services in Riyadh, Saudi Arabia, helping clients achieve their objectives. The company announced that it is leveraging its industry experience to deliver high-quality IFM solutions that will drive positive change through consultation, design, and delivery of facility management services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Megaprojects in the Pipeline is Expected to Boost the Construction Sector Driving the Need for Facility Management Services

- 5.1.2 Increasing Demand for Soft Facility Management Services

- 5.2 Market Restraints

- 5.2.1 Fragmented Nature of the Market in the Region

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By End User

- 6.2.1 Commercial

- 6.2.2 Institutional

- 6.2.3 Public/Infrastructure

- 6.2.4 Industrial

- 6.2.5 Healthcare

- 6.2.6 Other End Users

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Qatar

- 6.3.4 Kuwait

- 6.3.5 South Africa

- 6.3.6 Egypt

- 6.3.7 Nigeria

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Engie Cofely Energy Services LLC (Engie SA)

- 7.1.2 EFS Facilities Services Group

- 7.1.3 Ejadah Asset Management Group

- 7.1.4 Emrill Services LLC

- 7.1.5 Farnek Services LLC

- 7.1.6 Initial Saudi Arabia Company Limited

- 7.1.7 Kharafi National for Infrastructure Projects Developments Construction and Services SAE

- 7.1.8 Mace Group Limited

- 7.1.9 Serco Group PLC

- 7.1.10 Sodexo Inc.

- 7.1.11 Ecolab Inc.