|

市场调查报告书

商品编码

1692461

机械轴封:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Mechanical Seals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

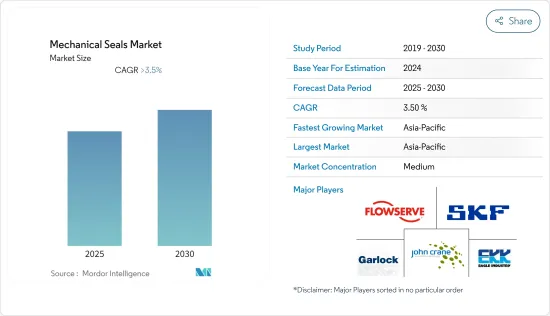

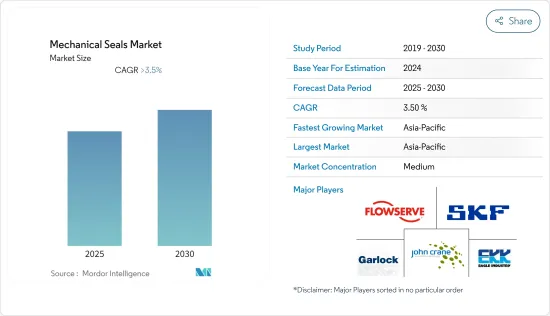

预计预测期内机械轴封市场将以超过 3.5% 的复合年增长率成长。

新冠疫情影响了全球大多数产业,机械轴封产业也受到影响。此外,许多终端用户产业也受到了疫情的影响。这限制了市场的成长。然而,2022年情况又回到了正轨,市场正在稳定并良好成长。

主要亮点

- 推动机械轴封市场发展的主要因素之一是石油和天然气行业日益增长的需求。

- 此外,发电需求的增加也是推动市场发展的主要因素。

- 然而,替代方案的引入正在阻碍市场的成长。

- 即将进行的石油和天然气计划以及车载状态监测可能会在未来几年为市场提供机会。

- 由于中国、日本和韩国等国家的需求不断增长,亚太地区占据了最高的市场占有率。

机械轴封市场趋势

电力产业有望成为成长最快的终端用户产业

- 机械轴封用于各种应用,例如发电厂中的泵浦、搅拌机、曝气器和其他设备,包括煤炭和天然气发电厂、核能发电厂、水力发电厂和地热发电厂。之所以使用电力产业,是因为满足性能目标取决于许多因素,包括设备设计、操作条件和支援系统。

- 发电厂产业需要密封系统提供最佳的运作可靠性、易于维护、低洩漏率和适当的环境保护。机械轴封解决方案和服务可提高运作可靠性、延长设备运作、减少密封用水量和消费量,并确保符合成本效益的环境要求,进而增强发电厂的製造性能。

- 全球电力需求不断增加,预计各个电力产业的运转率都将上升。为了满足过剩的需求,各种产能的增加可能很快就会到来。

- 根据国际能源总署 (IEA) 的数据,2022 年 2 月净生产量为 887.5兆瓦时 (TWh),较 2022 年 1 月下降 11.6%,但较 2021 年 2 月增长 1.4%。

- 全球电力需求在 2020 年小幅下降之后,2021 年增加了 6%。这一增长接近 1,500 TWh,是自 2010 年金融危机以来绝对值最高的年增长率,也是按年龄层计算的最大增幅。中国占全球整体成长的一半以上,平均需求成长10%。

- 2021年,欧亚大陆电力消耗量与前一年同期比较%,约800亿千瓦时,为苏联解体以来绝对值最大增幅。预计2021年电力需求将成长4%,而2019年和2020年分别下降了1.3%和4%,接近2019年疫情前的水准。

- 可再生能源发电目前引领新增电力投资,2022年将达到近3,000亿美元。在俄乌衝突的情况下,由于各国更重视能源安全,欧洲国家的投资水准将会更高。一些欧盟国家已经制定了新的目标和计画来推动太阳能和风能,特别是离岸风力发电。预计这将为设备OEM、计划开发商和售后服务提供者创造重大投资机会,刺激所调查市场的需求。

- 预计所有上述因素都将对预测期内所研究市场的需求产生重大影响。

亚太地区占市场主导地位

- 亚太地区在机械轴封市场占据主导地位,预计未来将继续保持这一地位。日本、中国、韩国和印度等国家由于其经济的快速变化而成为亚太地区的主要贡献者。

- 中国旨在透过推动页岩气田等国内计划来减少对天然气进口日益增长的依赖,以确保能源供应。预计政府将出资推出新的措施来提高国内产量,特别是页岩气等所谓的非传统资源。据估计,到2035年,中国的页岩气产量将达到约2,800亿立方公尺。因此,中国政府提高页岩气产量的努力和计画预计将在未来几年为机械密封创造机会。

- 此外,2021年12月,中国宣布计画在未来15年内建造至少150座新核子反应炉,投资4,400亿美元。该国拥有大量核子反应炉: 19 座正在建设中,43 座等待许可, 核子反应炉已宣布建设。这228座核子反应炉的总合容量为246吉瓦。预计中国火电和核能发电厂的兴起将在预测期内推动机械轴封市场的发展。

- 受聚合物、特种化学品和农业化学品需求成长的推动,印度化学工业预计将强劲成长。 2021年3月,印度政府宣布,预计未来五年需求将以每年约9%的速度成长,目前有168个投资前景和29个正在开发的计划,预计到2025年该领域的投资额将达到8,000亿印度卢比。

- 日本计画在2025年在17个地点新建22座燃煤发电厂,其中包括目前正在兴建的横须贺燃煤发电厂(1.3GW)。横须贺燃煤发电厂将拥有两台 650MW 超超临界 (USC) 燃煤机组,计画分别于 2023 年和 2024 年运作。

- 2020年,日本有33座运转中的核子反应炉, 2座在建中,27座核子反应炉。日本计划在2030年将核能在其总能源结构中的份额提高到至少20%。预计该国对核能的依赖将在预测期内推动市场发展。

- 由于上述趋势,亚太地区很可能在预测期内占据市场主导地位。

机械轴封业概况

机械轴封市场部分整合。市场的主要企业包括(不分先后顺序)Flowserve Corporation、SKF、John Crane、Eagle Industry、Garlock 以及其他国内外公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 石油和天然气产业的需求不断成长

- 发电需求不断成长

- 限制因素

- 介绍替代密封方法

- 电子封条在自动化製造设备的应用

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 密封类型

- 帮浦密封件

- 压缩机密封

- 搅拌机密封

- 最终用户产业

- 力量

- 石油和天然气

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AW Chesterton Company.

- Dana Limited

- Eagle Industry Co., Ltd.

- Flexaseal Engineered Seals and Systems, LLC.

- Flowserve Corporation.

- Gallagher Fluid Seals, Inc.

- Garlock

- HUTCHINSON

- John Crane

- SKF

- Technetics Group.

第七章 市场机会与未来趋势

- 即将进行的石油和天然气计划

- 车载状态监测

The Mechanical Seals Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The outbreak of the novel coronavirus has impacted most industries worldwide, including the mechanical seal industry. Also, many end-user industries were impacted due to pandemics. That restricted the growth of the market. However, in 2022, the situation is coming on track, and now the market is stable and growing steadily.

Key Highlights

- One of the major factors driving the mechanical seals market is the growing demand from the oil and gas industries.

- Another major driving factor of the market studied includes the increasing demand for power generation.

- However, the introduction of alternative methods of sealing leakages is hindering the market growth.

- Upcoming oil and gas projects and onboard condition monitoring will likely create opportunities for the market in the coming years.

- Asia-Pacific region accounts for the highest market share due to increasing demand in countries like China, Japan, and South Korea.

Mechanical Seals Market Trends

Power Industry is Expected to be the Fastest Growing End-User Industry

- Mechanical seals are utilized in a variety of applications such as pumps, mixers, aerators, and other equipment in power plants ranging from coal and natural gas to nuclear, hydroelectric, and geothermal energy. The power industry is used because its ability to satisfy performance goals depends on various factors, such as equipment design, operating conditions, and support systems.

- The power plant industry demands sealing systems with optimum operating reliability, ease of maintenance, low leakage rates, and appropriate environmental protection measures. Mechanical seal solutions and services improve power plant manufacturing performance by increasing operational dependability, improving equipment uptime, reducing seal water usage and energy consumption, and ensuring cost-effective environmental compliance.

- Rising electricity demand across the globe is expected to increase the capacity utilization of different power sectors. Various capacity additions will likely be made shortly to fulfill the excess demand.

- According to International Energy Agency, in February 2022, the total net electricity production was 887.5 terawatt-hour (TWh), down 11.6% from January 2022 but up 1.4% from February 2021.

- The global electricity demand grew by 6% in 2021, after a modest decline in 2020. With almost 1,500 TWh, it was the largest annual growth in absolute terms and the largest % of age increase since the financial crisis in 2010. China accounted for over half of worldwide growth, with average demand increasing by 10%.

- In 2021, Eurasia's electricity consumption climbed by 6% year on year, or about 80 TWh, the biggest rise in absolute terms since the dissolution of the Soviet Union. In 2021, the electricity demand increased by 4%, falling by 1.3% in 2019 and 4% in 2020 and approaching the pre-pandemic level of 2019.

- With nearly USD 300 billion in 2022, renewable energy now leads to new power generation investments. In the case of the Russian-Ukraine conflict, European countries' investment levels will now be higher as countries lay a larger focus on energy security. Several EU countries set new targets and programs to boost solar and wind energy, particularly offshore wind. This will create significant investment opportunities for equipment OEMs, project developers, and after-service providers, which is expected to stimulate the demand for the market studied.

- All the factors above are expected to significantly impact the demand for the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is dominating the mechanical seals market and is expected to continue this shortly. Countries like Japan, China, South Korea, and India are the major contributor to the Asia-Pacific region due to the economies rapidly undergoing economic changes.

- China targets to slash its growing dependence on gas imports by boosting domestic projects like shale fields as the security of its energy supply. The government is expected to fund new efforts to boost domestic production, particularly from so-called unconventional sources like shale gas. It is also estimated that China's shale gas production to reach around 280 billion cubic meters by 2035. Thus, the Chinese government's effort and plan to boost its shale gas production are expected to create an opportunity for mechanical seals in the coming years.

- Furthermore, in December 2021, China announced its plan to build at least 150 new nuclear reactors in the next 15 years with an investment of USD 440 billion. The country has 19 reactors under construction, 43 reactors awaiting permits, and a massive 166 reactors that have been announced. The combined capacity of these 228 reactors is 246GW. China's growing thermal and nuclear power plants are expected to drive the market for mechanical seals during the forecast period.

- India is expected to witness robust growth in its chemical industry, fueled by the growing demand for polymers, specialty chemicals, and agrochemicals. In March 2021, the government informed that an INR 8 lakh crore investment is anticipated in the sector by 2025, with opportunities offered by the increase in demand by about 9% per annum over the next five years, with about 168 investment prospects and about 29 projects under development.

- Japan plans to build 22 new coal-fired power plants at 17 different sites by 2025. Among them is the 1.3GW Yokosuka coal-fired facility, which is under construction. Yokosuka coal-based power plant is to be equipped with two ultra-supercritical (USC) coal-fired units of 650 MW, and these units are scheduled to come online by 2023 and 2024, respectively.

- In 2020, Japan had 33 operable nuclear reactors, two under construction, and 27 shut down. The country plans to increase its nuclear energy share in the total energy up to at least 20% by 2030. The country's dependence on nuclear power to generate electricity is expected to drive the market during the forecast period.

- Hence, owing to the abovementioned trends, Asia Pacific is likely to dominate the market studied during the forecast period.

Mechanical Seals Industry Overview

The mechanical seals market is partially consolidated in nature. Some of the major players in the market include Flowserve Corporation., SKF, John Crane, Eagle Industry Co., Ltd. and Garlock among other domestic and global players (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Oil And Gas Industries

- 4.1.2 Increasing Demand for Power Generation

- 4.2 Restraints

- 4.2.1 Introduction of Alternate Methods of Sealing Leakages

- 4.2.2 Use of Electronic Seals in Automated Manufacturing Units

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Seal Type

- 5.1.1 Pump Seals

- 5.1.2 Compressor Seals

- 5.1.3 Mixer Seals

- 5.2 End-user Industry

- 5.2.1 Power

- 5.2.2 Oil and Gas

- 5.2.3 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A.W. Chesterton Company.

- 6.4.2 Dana Limited

- 6.4.3 Eagle Industry Co., Ltd.

- 6.4.4 Flexaseal Engineered Seals and Systems, LLC.

- 6.4.5 Flowserve Corporation.

- 6.4.6 Gallagher Fluid Seals, Inc.

- 6.4.7 Garlock

- 6.4.8 HUTCHINSON

- 6.4.9 John Crane

- 6.4.10 SKF

- 6.4.11 Technetics Group.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Oil and Gas Projects

- 7.1.1 On-board Condition Monitoring