|

市场调查报告书

商品编码

1692466

无损检测 (NDT) 软体 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Non-Destructive Testing (NDT) Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

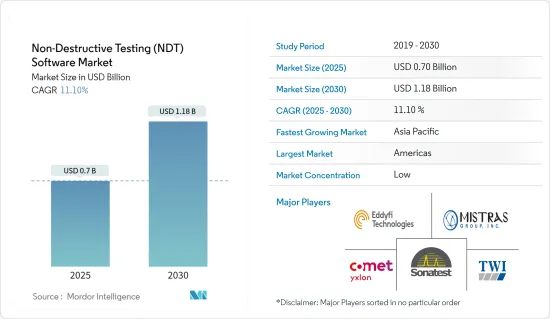

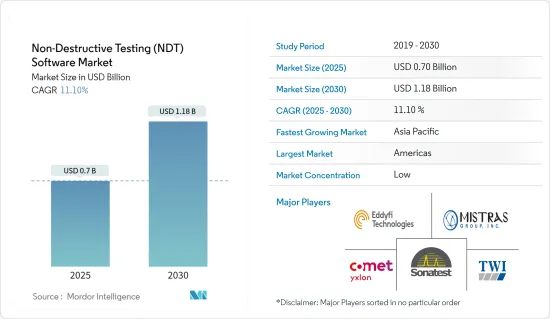

预计 2025 年无损检测软体市场规模将达到 7 亿美元,到 2030 年预计将达到 11.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.1%。

主要亮点

- NDT 软体在测试中发挥着至关重要的作用,它具有许多好处,包括简化测试程序、提高准确性和提高整体效率。 NDT 软体的主要优点之一是能够自动化和标准化测试程序。利用先进的演算法和数据分析技术,NDT 软体能够准确、一致地执行复杂的检查。这种自动化减少了人为错误的可能性,并确保检查程序符合既定的标准和规范。此外,检查程序的标准化可以与品管系统无缝集成,确保符合行业法规和标准。

- NDT 软体有助于即时收集和分析,从而实现即时回馈和决策。这种能力对于航太和製造等时间敏感型检查至关重要的行业尤其有价值。即时数据分析使技术人员能够快速识别缺陷或异常,从而及时干预并防止潜在的安全隐患和生产延误。

- NDT 软体的使用也有助于改善资料管理和文件。 NDT 软体可以透过数位记录和云端基础的储存检索检查资料、历史记录和检查报告。这简化了文件流程并为法规遵循和品质保证目的提供了全面的审核追踪。此外,详细、可自订的检查报告可以改善组织内部以及与外部相关人员的沟通和透明度。

- 此外,NDT 软体支援电脑断层扫描 (CT) 和数位射线照相等先进成像和分析技术的整合。这些技术可以对内部结构和缺陷进行详细的 3D 视觉化和分析,从而有效地洞察材料的完整性和品质。透过利用这种先进的影像处理功能,NST 软体使工程师能够检测到使用传统检查方法无法发现的微小缺陷,从而提高整体检查的准确性和可靠性。

- 然而,由于世界各国政府已经认识到半导体产业的重要性及其在经济復苏中的作用,并为在地采购和支持提供奖励,因此预计半导体产业将在预测期内復苏。

无损检测(NDT)软体市场趋势

石油和天然气产业经历大幅成长

- 石油和天然气产业分为上游、中游和下游三个阶段。上游部门负责涉及陆上和海上钻机的探勘和生产活动。

- 上游产业的 CUI 测试主要在海上设施进行。世界上大多数可用的石油钻井平台都位于海上。这对检查 CUI 的 NDT 软体产生了巨大的需求。

- 石油和天然气行业的无损检测对于设备完整性以及精製和钻井作业的安全性至关重要。为了确保潜在危险的化学品和流体安全地容纳在管道和压力容器内,必须使用超音波和涡流无损检测解决方案仔细检查焊接和金属是否有缺陷和腐蚀。

- 在石油和天然气行业,NDT 软体在缺陷检测、材料特性、完整性评估和安全保障方面发挥关键作用。例如,据欧佩克称,全球原油需求预计将转向汽油和乙烷等较轻的产品。到 2045 年,汽油需求预计将成长至每天 2,760 万桶。

亚太地区预计将创下最快成长

- 由于研究涵盖的所有主要终端用户行业的快速增长,预计亚太地区的无损检测软体市场将显着增长。随着市场上领先的供应商不断扩大其全球影响力,先进製造和产品测试解决方案的渗透率也不断提高。在与国际公司竞争时,品质和产品安全至关重要。

- 石化、造纸和纸浆、石油和天然气、汽车、航太和国防等製造业终端用户产业的成长预计将推动该地区的市场成长率。该地区对可再生能源日益增长的需求可能为所研究市场的成长增添有利的成长优势。

- 此外,该地区汽车行业的成长也支持了预测期内的市场成长。根据日本工业协会2023年发布的统计数据,日本新车註册量达到约399万辆,其中乘用车约176万辆。微型车、小型车的新註册量也超过了去年。日本新车註册量约478万辆,其中乘用车占多数。

- 据国土交通省称,截至 2023 年 5 月,电动车 (EV) 约占韩国汽车市场的 1.8%。此外,韩国政府也设定了2030年将电动和氢动力汽车在新车销售中的比例提升至33%的目标,这将进一步推动市场成长。

无损检测 (NDT) 软体产业概览

无损检测 (NDT) 软体市场分散,主要企业包括 Yxlon International Gmbh (Comet Holding Ag)、TWI Limited、Sonatest Ltd、Mistras Group 和 Eddyfi Technologies。这些公司拥有相当大的市场占有率,并致力于扩大海外基本客群。这些公司正在透过策略合作来增加市场占有率并提高盈利。

- 2023 年 8 月,贝克休斯宣布推出 Krautkramer RotoArray comPAct,这是一款用于对大型复合材料进行手动相位阵列(PA)超音波检测的可携式滚轮探头。这项新技术是对 Krautkramer 针对航空、航太和风力发电产业的 RotoArray 产品线的补充。 Krautkramer RotoArray comPAct 采用了贝克休斯新专利的紧凑技术,可实现更轻、更简单、更具成本效益的超音波(UT)相位阵列应用。

- 2023年5月,该公司的子公司Previan收购了Sensor Networks(SNI),成为头条新闻。 SNI 专注于感测工具和技术,可增强对安全关键部件的检查和远端监控,从而提高生产力。收购之后,SNI 加入了 Plevian 集团,而 NDT Solutions 现已由 Eddyfi Technologies 部门增强。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章市场动态

- 市场驱动因素

- 各行业的检查和安全改进需求

- 新科技的兴起(AI、IIOT、EVS等)

- 市场挑战

- 缺乏熟练的人力和培训设施

- 高成本,半导体短缺

第六章市场区隔

- 按类型

- 标准软体

- 整合软体

- 按最终用户产业

- 石油和天然气

- 电力和能源

- 航太与国防

- 汽车与运输

- 电子产品

- 其他最终用户产业

- 按地区

- 美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 中东和非洲

第七章竞争格局

- 公司简介

- Yxlon International GmbH(Comet Holding AG)

- TWI Limited

- Sonatest Ltd

- Mistras Group

- Eddyfi Technologies

- Spinnsol

- Evident Corporation(Bain Capital LP)

- Baker Hughes

- Eclipse Scientific(Acuren)

- Durr NDT GmbH & Co. KG

- Carl Zeiss AG

- Volume Graphics(Hexagon AB)

第8章消费行为分析

- 目前的痛点和机会

- 各产业的竞争因素/消费者偏好

第九章 供应商排名分析

第十章:市场的未来

The Non-Destructive Testing Software Market size is estimated at USD 0.70 billion in 2025, and is expected to reach USD 1.18 billion by 2030, at a CAGR of 11.1% during the forecast period (2025-2030).

Key Highlights

- NDT software plays a crucial role in testing, offering numerous advantages that streamline testing procedures, improve accuracy, and enhance overall efficiency. One of the primary advantages of the NDT software is its ability to automate and standardize testing procedures. By utilizing advanced algorithms and data analysis techniques, NDT software can perform complex inspections with precision and consistency. This automation reduces the potential for human error and ensures that testing procedures adhere to established standards and specifications. Additionally, the standardization of testing procedures enables seamless integration with quality control systems, ensuring compliance with industry regulations and standards.

- NDT software facilitates real-time collection and analysis, allowing immediate feedback and decision-making. This capability is especially valuable in industries where time-sensitive inspections are critical, such as aerospace and manufacturing. Real-time data analysis enables technicians to identify defects or anomalies promptly, leading to timely interventions and preventing potential safety hazards or production delays.

- The use of NDT software also contributes to enhanced data management and documentation. NDT software enables the organization to retrieve inspection data, historical records, and testing reports through digital record-keeping and cloud-based storage. This streamlines the documentation process and provides a comprehensive audit trail for regulatory compliance and quality assurance purposes. Additionally, generating detailed and customizable inspection reports enhances communication and transparency within the organization and with external stakeholders.

- Moreover, NDT software supports the integration of advanced imaging and analysis techniques, such as computed tomography (CT) scanning and digital radiography. These techniques provide detailed 3D visualization and analysis of internal structures and defects, offering efficient insights into material integrity and quality. By harnessing these advanced imaging capabilities, NST software empowers technicians to detect subtle defects that may be undetectable through traditional testing methods, thereby improving overall inspection accuracy and reliability.

- However, with several governments worldwide recognizing the importance of the semiconductor industry and its role in economic recovery and incentivizing local sourcing and support, the industry is anticipated to recover during the forecast period.

Non-Destructive Testing (NDT) Software Market Trends

Oil and Gas Sector to Witness Major Growth

- The oil and gas industry operates in three sectors: upstream, midstream, and downstream. The upstream sector is responsible for exploration and production activities that involve working in onshore and offshore rigs.

- CUI testing in the upstream industry mainly happens in offshore establishments. Most of the functional oil rigs in the world are offshore. This creates a massive demand for NDT software to confirm CUI.

- NDT in the oil and gas industry is critical for equipment integrity and the safety of petroleum refining and extraction operations. Safely containing potentially hazardous chemicals and fluids within pipes and pressure vessels requires careful inspection of welds and metals for flaws and corrosion using ultrasonic and eddy current NDT testing solutions.

- In the oil and gas industry, the NDT software plays an essential role in flaw detection, material characterization, integrity assessment, and safety assurance. For instance, according to OPEC, the global demand for crude oil is expected to be aimed toward light products, such as gasoline and ethane. In 2045, gasoline demand is forecasted to climb to 27.6 million barrels per day.

Asia-Pacific is Expected to Register the Fastest Growth

- The Asia-Pacific region is expected to grow significantly in the non-destructive testing software market as all the major end-user industries of the market studied are witnessing rapid growth. The penetration of advanced manufacturing and product testing solutions is also growing as significant vendors operating in the market are expanding their global footprint. Quality and product safety are crucial for them to compete with international players.

- The growing manufacturing end-user industries such as petrochemical, paper and pulp, oil and gas, automotive, aerospace, defense, and others are set to boost the market growth rate in the region. The growing demand for renewable energy in the region will add a lucrative growth advantage to the growth of the studied market.

- Moreover, the region's growing automotive industry also supports the market growth during the projected timeline. According to the statistics published by the Japan Automobile Manufacturers Association in 2023, the total number of new car registrations in Japan reached about 3.99 million units, of which about 1.76 million were standard-size vehicles. The number of newly registered mini cars called kei cars and compact cars also increased compared to the previous year. Japan's total number of new motor vehicle registrations reached roughly 4.78 million units, with passenger vehicles representing the vast majority.

- According to the Ministry of Land, Infrastructure, and Transport, electric vehicles (EVs) accounted for about 1.8% of South Korea's automobile market as of May 2023. In addition, the South Korean government has set a goal of increasing the share of electric and hydrogen vehicles in new car sales to 33 by 2030, further supporting the market growth.

Non-Destructive Testing (NDT) Software Industry Overview

The non-destructive testing (NDT) software market is fragmented and consists of some influential players like Yxlon International Gmbh (Comet Holding Ag), TWI Limited, Sonatest Ltd, Mistras Group, and Eddyfi Technologies. These players have a noticeable market share and are concentrating on expanding their customer base across foreign countries. These businesses leverage strategic collaborative actions to improve their market percentage and enhance profitability.

- August 2023: Baker Hughes announced the launch of Krautkramer RotoArray comPAct, a portable roller probe for manual phased array (PA) ultrasonic inspection of large-scale composite materials. The new technology complements the Krautkramer RotoArray product line for the aviation, space exploration, and wind energy industries. Krautkramer RotoArray comPAct is equipped with new Baker Hughes patented compact technology, enabling lighter, simpler, and more cost-effective ultrasound (UT) phased array applications.

- May 2023: Previan, a business under the company's umbrella, made headlines with its acquisition of Sensor Networks Inc. (SNI). SNI specializes in sensing tools and technologies that enhance the inspection and remote monitoring of safety-critical components, boosting productivity. SNI joined the Previan Group following the acquisition, with its NDT solutions now bolstered by the Eddyfi Technologies business unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Improved Inspection and Safety Across Industries

- 5.1.2 Rise of Emerging Technologies (AI, IIOT, EVS Etc.)

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Personnel and Training Facilities

- 5.2.2 High Cost of the Software and Equipment Combined With Semiconductor Shortages

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Standard Software

- 6.1.2 Integrated Software

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Power and Energy

- 6.2.3 Aerospace and Defense

- 6.2.4 Automotive and Transportation

- 6.2.5 Electronics

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Yxlon International GmbH (Comet Holding AG)

- 7.1.2 TWI Limited

- 7.1.3 Sonatest Ltd

- 7.1.4 Mistras Group

- 7.1.5 Eddyfi Technologies

- 7.1.6 Spinnsol

- 7.1.7 Evident Corporation (Bain Capital LP)

- 7.1.8 Baker Hughes

- 7.1.9 Eclipse Scientific (Acuren)

- 7.1.10 Du?rr NDT GmbH & Co. KG

- 7.1.11 Carl Zeiss AG

- 7.1.12 Volume Graphics (Hexagon AB)

8 CONSUMER BEHAVIOR ANALYSIS

- 8.1 Current Pain Points and Opportunities

- 8.2 Competitive Factors/Consumer Preferences by Industries