|

市场调查报告书

商品编码

1692478

全球IP电话和 UCAAS:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Global IP Telephony & Ucaas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

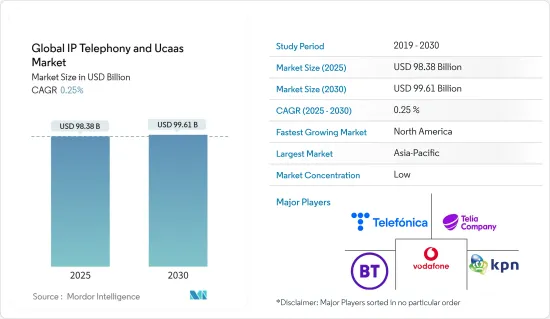

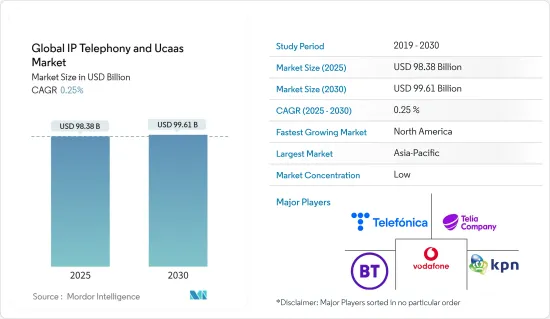

预计 2025 年全球IP电话和 Ucaas 市场规模将达到 983.8 亿美元,预计到 2030 年将达到 996.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 0.25%。

2020年是疫情和经济放缓的一年,导致供应商对IP电话市场的累积收入贡献下降。由于前所未有的疫情, IP电话设备销售量急剧下降,以及第一季无缝託管 VoIP 服务交付不佳,对市场产生了负面影响。同时,由于远距办公的员工数量增加以及使用线上媒体进行官方互动,对云端基础的UCaaS 的需求也在增加。

主要亮点

- 整合通讯即即服务(UCaaS) 是指提供者透过网路向公众提供一系列通讯应用程式、软体产品和流程的服务模式。 IP电话是指使用网路连线传送和接收语音资料的电话系统。

- 近年来,IP技术使用多种通讯协定透过公共交换电话网路交换语音、传真和其他形式的资料。互联网通讯协定已成为所有资料通讯通讯的传输。商业电话系统已经能够为企业提供更多服务。 IP 技术在单一网路上提供了完整的通讯包。

- 整合通讯提供了更易于管理的成本结构和更低的采购成本。虽然在某些情况下IP电话或硬体电话是必要的或需要的,但许多企业开始使用可以复製桌上型电话功能的软体电话和智慧型手机应用程式。然而,计量收费的订阅模式正在成为 UCaaS 和IP电话解决方案的趋势,因为它们为客户提供了最佳的成本结构。

- 随着 UC 支出的增加,组织内的购买力也随之增加。传统上,IT 部门负责下达 UC 预算,但云端运算也使业务线能够投资于 UC 应用。

- 现代职场是数位化的并且不断变化。员工期望职场更加开放、协作更好、技术更先进、弹性更高。随着劳动力变得更加分散,许多员工在远距工作,而其他员工则在传统办公室工作,公司需要合适的工具来保持分散劳动力的联繫。

IP电话和UCaaS市场趋势

BFSI 部门预计将推动市场成长

- 整合通讯即服务(UCaaS) 已成为 BFSI 领域一种经济高效的解决方案。银行和金融业主要投资 UCaaS 以更好地了解所有管道上的客户互动,从而实现大规模部署所需的可扩展性。

- UCaaS 服务有助于提高可用性和扩充性,同时增强协作。 UCaaS 解决方案使公司能够专注于业务成长而不是维护。企业可以不购买那些具有他们永远不会使用的功能的 UC 软体,从而节省金钱。 UCaaS 服务包含各种互动式语音应答 (IVR)、视讯会议、即时聊天、电子邮件、统一通讯、VoIP 服务和其他客户管理功能。

- 此外,BFSI 公司需要各部门之间进行广泛的合作。这意味着资产和财务经理需要与分析师交谈,客户支援人员需要跨时区协作。这种有效的协作需要消除摩擦的软体解决方案。

- 例如,UCaaS 让不同的团队能够无缝协作。但由于 UCaaS 在云端运行,团队成员可以从任何装置、任何地点存取资讯。客服中心供电督导可以透过智慧型手机即时监控进展。金融研究分析师无需同处一室即可分析资料。 UCaaS 帮助金融服务公司最大限度地发挥其人力资本。

- 公司正在寻找减少开支并可能产生内部收益的方法。透过云端提供对必要文件和资料的存取是一种可行的解决方案,从而导致了 BYOD(自带设备)的广泛采用。银行和金融机构正在迅速效仿,鑑于业务的全球化,远端存取资料已成为该行业必不可少的能力。

北美预计将创下最快成长

- 北美的主导地位可以归因于近期 IT 消费化和 5G 连接的爆炸性应用所推动的移动性激增。

- 在美国,零售、银行和金融、医疗保健、资讯科技和通讯的最终用户要求在所有通讯(包括语音、视讯和聊天)中获得更直接、更无缝的体验,无论他们身在何处。为了满足这些需求,企业正在寻求来自他们可以信赖的单一供应商的统一部署和管理解决方案来处理他们的 UCC 需求。随着 5G 的出现,将远端连线工具整合到单一 UCaaS 平台上可能会成为可能。

- 5G不仅对消费者有利,对依赖整合通讯的企业也同样有利且有价值。由于5G,网路速度将会改变。目前的平均速度为每秒 1GB,将增加到每秒约 20GB。随着频宽容量和速度的提高,VoIP产业也将蓬勃发展。 5G和VoIP的结合将为消费者提供相当于光纤宽频的连线。

- 这使得 VoIP 可以大规模普及。全球营运的企业将受益于 VoIP 和 5G 的结合,因为它将降低通讯成本。

- 随着 5G 和边缘网路的兴起,供应商可以期待即时通讯市场发生令人兴奋的变化。凭藉改进的安全性、简化的配置和一套託管服务工具,UCaaS 为无数的创造性服务和託管服务工具提供了一个平台,可以帮助供应商在不久的将来实现收益最大化。

- 美国是5G市场领先的创新者和投资者之一,对5G部署的投资不断增加。该国通讯业占全球5G技术消费的很大一部分。

IP电话和 UCaaS 行业概览

IP电话和 UCaaS 市场竞争非常激烈。近年来市场竞争愈发激烈。此外,各公司正在采取措施在这个快速成长的市场中获得竞争优势。

- 2022 年 2 月-沃达丰与 Ring Central 在英国联合推出 Vodafone Business UC 与统一云端通讯平台 Ring Central。沃达丰商业和 Ring Central 将于 2021 年首先向英国客户和欧洲沃达丰商业跨国客户推出这项新服务。随后,包括西班牙、德国和义大利在内的更多国家也将陆续推出该服务,该平台将根据每个国家的本地需求进行客製化。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业相关人员分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 计量收费模式的出现推动了对传统 UC 解决方案的需求

- 不断变化的劳动力动态将带来新的企业协作形式

- 市场挑战

- 缺乏向现代整合通讯过渡的准备

- IP电话系统语音品质差

第六章市场区隔

- 按公司规模

- 中小型企业(员工人数不超过 500 人)

- 大型公司(员工超过 500 人)

- 按应用

- BFSI

- 零售

- 卫生保健

- 政府和公共机构

- IT/电讯

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Vodafone

- Telia Company

- Telefonica

- KPN

- BT

- Orange Business Solutions

- Verizon Communications Inc.

- 8X8 Inc.

- Mitel Networks Corporation

- Gamma Telecom

- Nextiva

- Soluno

- Cisco Systems

- VADS Berhad

- Singapore Telecommunications Limited

- PLDT Enterprise

- NTT Communication Corporation

- Telstra Corporation Limited

- PCCW Global

- Maxis Communications

第八章投资分析

第九章:未来趋势

The Global IP Telephony & Ucaas Market size is estimated at USD 98.38 billion in 2025, and is expected to reach USD 99.61 billion by 2030, at a CAGR of 0.25% during the forecast period (2025-2030).

As 2020 marked the whole year of pandemic and economic slowdown, the IP telephony market cumulative revenue contribution by vendors declined. The sharp decline in sales volume for IP phones coupled with a hiccup in initial quarters to provide seamless hosted VoIP service due to unprecedented pandemic affected the market negatively. While cloud-based UCaaS demand increased as employees resorted to remote work and used online mediums for official interactions.

Key Highlights

- Unified communications-as-a-service (UCaaS) refers to a service model where the provider delivers different telecom or communications applications, software products, and processes generally over the web. Moreover, IP telephony refers to any phone system that uses an internet connection to send and receive voice data.

- Recently, IP technology has used a variety of protocols to exchange voice, fax, and other forms over the public switched telephone network. The internet protocol became the transport for all data communication. The business telephone system is now able to deliver much more to enterprises. The IP technology has provided a complete communication package over a single network.

- Unified communications provide a more manageable cost structure and a lower acquisition cost. While IP telephony and hardware phones may be required or desired, many businesses get started using a softphone or smartphone app that can replicate the functions of a desktop telephone. However, the pay-as-you-go subscription model is in trend across UCaaS and IP telephony solutions as it provides the best cost structure to customers.

- As UC spending increases, the buying power within the organization rises. Traditionally, IT departments were handing the UC budgets, but the cloud has enabled lines of business to also invest in UC apps.

- The modern workplace is digitizing and shifting. Employees expect more openness, improved collaboration, better technology, and higher flexibility in a workplace. As the workforce continues to become more distributed, with many employees going remote and others working from traditional offices, organizations need the right tools to keep their dispersed workforce always connected.

IP Telephony & UCaaS Market Trends

The BFSI Segment is Expected to Drive the Market Growth

- Unified Communications as a Service (UCaaS) emerged as a cost-effective solution for the BFSI sector. Banks and financial sectors primarily invest in UCaaS to better understand customer communications across all channels to attain the scalability required for large-scale implementation.

- UCaaS services help increase availability and scalability while enhancing collaboration. UCaaS solutions allow enterprises to focus on the growth of their business rather than their maintenance. Businesses need not pay for UC software with features that they will never use, thereby saving money. UCaaS services broadly incorporate interactive voice response (IVR), video conferencing, live chat, e-mails, unified messaging, VoIP services, and other client management capabilities.

- Moreover, BFSI companies require extensive collaboration across a range of departments. For this, wealth and finance managers need to speak to analysts while customer support staff collaborate across time zones. This effective collaboration requires software solutions that eliminate friction.

- For instance, UCaaS allows diverse teams to coordinate and collaborate seamlessly. However, UCaaS operates in the cloud, and team members can access information on any device at any location. Call center supervisors can monitor progress on a smartphone in real-time. Financial research analysts can analyze data without ever being in the same room. UCaaS helps financial services companies get the most out of their human capital.

- Enterprises are searching for ways that cut down on expenses and have the potential to generate internal revenues. Making essential files and data accessible through the cloud was a feasible solution, which led to the proliferation of the BYOD (Bring Your Own Device) trend. Banks and financial institutions are quickly following suit, and given the globalized nature of their business, remote access to data becomes an essential feature for this industry.

North America is Expected to Register the Fastest Growth

- The country's supremacy may be ascribed to the recent surge in mobility and explosion of 5G connection due to the consumerization of IT, which has aided enterprises in adopting IP telephony and UCaaS to allow remote employees to simulate in-office work experiences.

- In the US, end-users such as retail, banking and finance, healthcare, information technology, and telecommunications seek a more direct and seamless experience for all oftheir communications-audio, video, and chat-no matter where they are. To fulfill this need, enterprises are looking for a unified deployment and management solution from a single vendor they can rely on to handle their UCC requirements. They'll be able to integrate remote connectivity tools on a single UCaaS platform with the advent of 5G.

- 5G will be advantageous to consumers, but it will also be beneficial and precious to enterprises that rely on Unified Communications. The internet's speed will alter as a result of 5G. The current average pace of 1GB per second will be increased to approximately 20GB per second. The VoIP industry will develop as bandwidth capacity and speed rise. The combination of 5G and VoIP will provide consumers with the equivalent of a fiber-optic broadband connection.

- This will ensure that VoIP can be used on a massive scale. Companies with worldwide operations will benefit from VoIP combined with 5G since communication costs would be reduced.

- As a result of the rise of 5G and edge networking, vendors could expect exciting changes in the real-time communication market. UCaaS provides a place for endless creative services and a collection of managed services tools that may help suppliers maximize revenue generation in the near years due to improved security, simpler provisioning, and a set of managed services tools.

- The United States is one of the foremost innovators and investors in the 5G market due to increasing investment for 5G deployment. The telecom industry in the country accounts for a significant portion of the global consumption of 5G technology.

IP Telephony & UCaaS Industry Overview

The IP Telephony & Ucaas market is highly competitive. The market has gained a competitive edge in recent years. Additionally, the players are being taken to gain a competitive edge in this fast-growing market.

- February 2022- Vodafone and Ring Central jointly launch Vodafone Business UC with Ring Central, a unified cloud communications platform, in the UK. In Initial, Vodafone Business and Ring Central has introduced new services to customers in the United Kingdom and Vodafone Business' multinational customers in Europe in 2021. More countries will follow, including Spain, Germany, and Italy, with the platform tailored to local delivery in each.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholders Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of pay-as-you-go model Driving Demand Over Lagacy UC Solution

- 5.1.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of enterprise Collaboration

- 5.2 Market Challenges

- 5.2.1 Low Readiness to Move to Modern Unified Communication

- 5.2.2 Poor Voice Quality in IP Telephony Systems

6 MARKET SEGMENTATION

- 6.1 By Size of Enterprise

- 6.1.1 Small and Medium Enterprises (Up to 500 Employees)

- 6.1.2 Large Enterprises (More than 500 Employees)

- 6.2 By Application

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Healthcare

- 6.2.4 Government and Public Sector

- 6.2.5 IT and Telecom

- 6.2.6 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vodafone

- 7.1.2 Telia Company

- 7.1.3 Telefonica

- 7.1.4 KPN

- 7.1.5 BT

- 7.1.6 Orange Business Solutions

- 7.1.7 Verizon Communications Inc.

- 7.1.8 8X8 Inc.

- 7.1.9 Mitel Networks Corporation

- 7.1.10 Gamma Telecom

- 7.1.11 Nextiva

- 7.1.12 Soluno

- 7.1.13 Cisco Systems

- 7.1.14 VADS Berhad

- 7.1.15 Singapore Telecommunications Limited

- 7.1.16 PLDT Enterprise

- 7.1.17 NTT Communication Corporation

- 7.1.18 Telstra Corporation Limited

- 7.1.19 PCCW Global

- 7.1.20 Maxis Communications