|

市场调查报告书

商品编码

1692482

美国IT 服务:市场占有率分析、产业趋势与成长预测(2025-2030 年)United States (US) IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

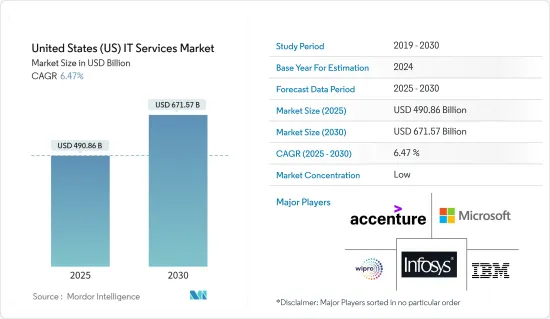

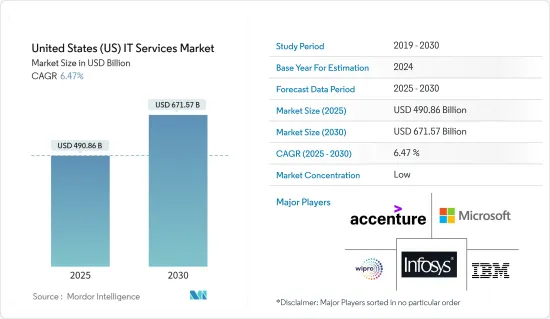

美国IT 服务市场规模预计在 2025 年为 4,908.6 亿美元,预计到 2030 年将达到 6,715.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.47%。

企业非常重视数位化,包括利用先进技术来推动成长同时降低成本、更多地使用云端技术以及利用商业商业智慧来预测和优化营运以增加收益。人们对资料安全和隐私保护的日益关注正在推动各行各业企业对 IT 服务的需求。

主要亮点

- 在数位转型时代,随着企业升级其内部IT基础设施服务并将部分业务迁移到云端,IT决策者面临法规遵循、安全性和降低风险的问题。

- 此外,企业越来越意识到,将资料迁移到云端,而不是建置和维护新的资讯储存设施,可以节省成本和资源,从而推动了该地区对云端处理解决方案的需求以及按需 IT 服务的采用。

- 该地区的 IT 服务可能会受到 5G、区块链、AR 和 AI 等趋势的影响。 5G技术的出现很可能会让企业建立自己的网路。数位化转型有望实现基于本地频谱带的新网路创建以及现有网路升级到 LTE。

- IT服务市场的前景光明。然而,资料外洩增加、产品定製成本担忧以及资料迁移等因素对市场构成了威胁。

- 根据美国人口普查局的数据,自新冠疫情爆发以来,美国零售电子商务销售额逐季成长。电子商务销售额的大幅成长可能为疫情后的市场公司创造成长机会。自从疫情爆发以来,我们看到在 IT 服务市场进行大规模投资的公司数量明显增加。这种成长主要是由满足各个终端用户产业和电力混合工作环境不断变化的数位转型需求的需求所驱动。

美国IT服务市场趋势

IT外包占很大市场占有率

- 大多数美国公司已将IT业务外包给新兴经济体,以节省人事费用。预计在预测期内,IBM、DXC 和 Cognizant 等美国主要 IT 外包公司的存在将推动该国离岸和在岸 IT 外包市场的发展。

- 该国私营企业和政府企业正在快速数位化,为 TCS 和 Infosys 等供应商创造了机会,透过签约公司提供 IT 外包服务来扩展业务。

- 例如,美国雇主在僱用美国员工时会考虑一系列成本参数。这些成本包括招聘、办公空间、电脑设备、办公家具、监督/培训、品质保证、工资/薪水、联邦保险缴款法(FICA)、医疗保险、失业保险、劳工保险、员工社会福利、退休计划、带薪休假、病假、员工离职率、办公用品、人力资源部门以及对政府法规遵守情况的监督。

- 随着这些成本的累积,IT外包的选择变得更加现实。全球 IT 服务供应商也纷纷扩大在该国的业务。这些发展清楚地显示了本地企业对 IT 外包需求的快速成长。为了向智慧製造、保险、航太和国防领域的客户提供数位转型服务,HCL Technologies 在该国设立了全球交付中心。

- Onix Networking Corp、Innowise Inc等多家在美国营运的中型IT服务公司,已与微软、Google等全球科技公司建立合作关係,以增强其IT外包服务能力,并支持美国市场的成长。例如,Onyx在2023年2月宣布与Google Cloud Partner Advantage计画合作,并获得了应用开发合作伙伴专业认证。这扩展了该公司的 IT 外包服务,为其提供了使用 Google Cloud 技术在应用开发领域建立客户解决方案的能力和容量。

- 美国的数位化趋势以及工业4.0导致IT服务回流,即将业务回归美国。随着政府寻求创造国内就业机会和振兴美国经济,这一趋势正在增强,这可能会支持该国 IT 外包公司的市场扩张,并在预测期内推动市场发展。

- 美国劳工统计局预测,从现在到 2026 年,就业成长率将达到 31%。此外,预计在此期间将创造约 255,400 个 IT 工作。在美国,公共部门僱用了约36万人,资讯产业僱用了约8.3万人。

最大的终端用户产业是医疗保健

- 近年来,先进的新兴技术已经改变了美国的医疗保健。为了应对不断变化的法规环境,医院和诊所正在采用新技术来提高病患照护的品质。全国各地的医疗机构都已成为高科技业务,将先进的技术交到有能力的专业人员手中。

- 我们在医疗保健领域的 IT 服务能够实施洞察主导的解决方案,以实现高效和数位化的医疗保健,满足个人组织、小型或大型多服务组织和专利权。此外,这些服务可协助医疗保健客户简化综合护理服务并改善临床、财务和营运结果。

- 此外,随着医疗保健机构专注于数位化医疗保健业务以改善护理,美国医疗保健领域对 IT 服务的采用正在迅速增加。因此,各种 IT 服务提供者正在该地区实施医疗保健 IT 服务。

- 例如,Damco 符合 HIPAA 标准的远端医疗解决方案使医疗保健提供者能够提供高品质、安全的远端医疗服务,作为传统医疗保健模式的替代方案。该公司的 IT 服务使患者能够透过网路和行动装置与医生联繫、利用视讯会议和语音通话、线上预约、接受即时咨询和远端获取详细的治疗信息,无论身在何处都能获得医疗服务。

- 此外,政府预计医疗保健支出将达到 7,1,470 亿美元,这将促进市场的成长。在美国,医疗保健领域的数位转型意味着整合整个企业的数位化能力和流程,包括付款人、提供者和其他组织。

- 透过结合数位系统和流程,数位转型的医疗保健可以为患者提供个人化、全通路的体验。电子健康记录和其他倡议实现医疗保健互通性的倡议的进步反映了美国医疗保健领域近期向数位转型的转变。这些发展正在推动美国对 IT 服务的采用。

美国IT服务市场概况

美国IT 服务市场较为分散,目前正在研究中,但由 IBM、TCS、Wipro、微软和凯捷等大型公司主导。为了维持市场地位并留住客户,这些产业领导者采取强有力的竞争策略并不断改进服务。这种激烈的竞争是市场格局的特征,由于这些公司会客製化其服务以满足客户的不同需求,预计竞争对手之间的敌意将在整个预测期内持续存在。

- 2023 年 10 月,IBM 宣布了其託管检测和响应服务的下一代发展,该服务由新的 AI 技术提供支持,包括自动升级或关闭高达 85% 的警报的能力。新的威胁侦测和回应服务 (TDR) 提供全天候监控、调查和自动修復客户混合云端环境中所有相关技术的安全警报,包括现有的安全工具和投资、云端、内部部署和操作技术(OT)。

- 2023年7月,塔塔咨询服务公司(TCS)将扩大与通用电气医疗科技公司(GE Healthcare)的长期伙伴关係关係,以加速GE Healthcare的IT营运模式转型。此次合作将专注于透过监督GE 医疗的应用程式组合和实施促进创新的新营运模式,实现 GE 医疗全球 IT 能力的数位现代化。 TCS监督企业 IT 应用的开发、维护、合理化和标准化。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

- 监管状况

第五章市场动态

- 市场驱动因素

- 加速数位转型并跨产业采用新技术

- 更重视透过外包非核心业务来发挥核心竞争力

- 市场限制

- 资料安全、客製化、资料迁移

- 一级和二级 IT 服务供应商的比较分析

- 内部与外包分析

第六章市场区隔

- 按类型

- IT咨询与实施

- IT外包

- 业务流程外包

- 其他类型

- 按最终用户

- 製造业

- 政府

- BFSI

- 卫生保健

- 零售和消费品

- 后勤

- 其他最终用户

第七章竞争格局

- 公司简介

- IBM Corporation

- Accenture PLC

- Microsoft Corporation

- Infosys Limited

- Wipro Limited

- TATA Consultancy Services Limited

- Capgemini SE

- Atos SE

- HCL Technologies Limited

- Leidos Holdings, Inc.

- Sphere Partners LLC

- Kanda Software

- Fingent Corp.

- Intetics Inc.

- Integris

- Synoptek, LLC

- Simform

- MAS Global Consulting

- Algoworks Solutions Inc

- Icreon Holdings Inc

- DevDigital LLC

- Slalom, Inc.

- VATES SA

- Computer Solution East, Inc.

- Perficient, Inc.

- Innowise Group

- Velvetech LLC

- CHI Software

- Edafio Technology Partners

- VLink, Inc.

- Ardem Incorporated

- Unity Communications

- Accedia

- Intersog

- Galaxy Weblinks LTD

- Wave Access USA

- Centricsit LLC

- A3 Logics

- Bottle Rocket LLC

- Premier BPO, LLC

- Sumerge

- Peak Support, LLC

- Progent Corporation

- Sciencesoft USA Corporation

- Intellectsoft US LLC

第八章投资分析

第九章:市场的未来

The United States IT Services Market size is estimated at USD 490.86 billion in 2025, and is expected to reach USD 671.57 billion by 2030, at a CAGR of 6.47% during the forecast period (2025-2030).

Firms focusing more on digital with access to advanced technologies for driving growth while decreasing cost, growing usage of cloud technologies, and using business intelligence for forecasting and optimizing company operations to earn more increased revenues are a few of the critical IT Services Market drivers and trends fueling the growth of the market. Growing data security and privacy protection considerations drive the demand for IT services from companies across various industry verticals.

Key Highlights

- IT decision-makers face regulatory compliance, security, and risk reduction issues as businesses in the digital transformation era upgrade their on-premises IT infrastructure services and move some of their operations to the cloud.

- Moreover, The demand for cloud computing solutions and, consequently, the adoption of ondemand IT services in the region is driven by increasing awareness amongst businesses that they can save money and resources by shifting their data to a cloud rather than building or maintaining new information storage.

- The IT services acorss the region are likely to be influenced by trends such as 5G, Blockchain, AR and AI. It's likely that companies will be able to set up networks in their premises with the arrival of 5G technology. It is expected that digital transformation will allow the establishment of new networks based on local frequency bands or to upgrade existing ones for LTE.

- IT service market has a positive outlook in the country. Still, factors such as growing data breaches, cost concerns over product customization, and data migration are some of the reasons posing a threat to the market.

- According to the US Census Bureau, post-COVID-19, retail e-commerce sales in the United States were rise over the previous quarter. The opportunity for market players to grow after the pandemic would be created by such a huge increase in ecommerce sales. There has been a noticeable increase in organisations that have made significant investments to the IT services market since the pandemic. The need to address evolving digital transformation requirements in different end user industries and to strengthen the hybrid workplace environment is primarily driving this growth.

United States (US) IT Services Market Trends

IT Outsourcing to Hold Major Market Share

- The majority of US companies have long outsourced IT work to developing economies to save on labor costs. The country houses major IT outsourcing players such as IBM, DXC, and Cognizant, which fuels the country's offshore and onshore IT outsourcing market during the forecast period.

- The country has been registering significant digital transformations across all private and government-owned businesses, creating an opportunity for market vendors, such as TCS, Infosys, etc., to expand their businesses by contracting with the enterprises for their IT outsourcing service offerings.

- A US-based employer, for instance, considers a set of cost parameters while hiring a US-based employee. These costs include recruiting, office space, computer equipment, office furniture, supervision/training, quality assurance, wage/salary, Federal Insurance Contributions Act (FICA), Medicare, unemployment insurance, workman's comp, benefits, retirement plan, paid holidays, sick days, employee turnover, office supplies, human resources department, and government regulations compliance oversight.

- Amongst these cost stacks, the IT outsourcing option becomes more viable. The global IT services vendors also Additionally, the global IT services vendors resorted to expanding their footprints in the country. Such action clearly indicates demand soaring for IT outsourcing from local companies. In order to offer digital transformation services to clients in the smart manufacturing, insurance, aerospace and defence sectors, HCL Technologies has established a global delivery centre in the country.

- Many midscale IT service companies operating in the US, such as Onix Networking Corp, Innowise Inc., etc., have been partnering with global technology companies, such as Microsoft and Google, to increase their IT outsourcing service capabilities, supporting the market growth in the country. For instance, in February 2023, Onix announced that it has collaborated in the Google Cloud Partner Advantage program to gain the application Development Partner Specialization. It expanded its IT outsourcing service, offering the capability and capacity to build customer solutions in the Application Development field using Google Cloud technology.

- The digitization trend in the country with Industry 4.0 has led to the reshoring of IT services, i.e., bringing operations back to the US shores. This has become increasingly popular as the government has been aiming to create domestic jobs and help in the resurgence of the American economy, which can support the market expansion of IT outsourcing companies in the country and drive the market during the forecast period.

- The Bureau of Labor Statistics in the United States estimates that there will be a 31% increase in employment between now and 2026. In addition, in this period, approximately 255,400 IT jobs are expected to be created. About 0.36 million people were employed by the public sector and about 0.083 million for information industries within the United States.

Healthcare to be the Largest End-user Industry

- Advanced and emerging technologies have recently transformed healthcare in the United States. In response to the changing regulatory environment, hospitals and doctor's offices have introduced new technology that improves quality of care for patients. High technology operations are now being carried out at medical facilities in the country, placing advanced technologies in the hands of talented professionals.

- IT services in the healthcare sector enable the implementation of insights-driven solutions for efficient and digitally accessible healthcare that suit individual organizations to small or big multiservice organizations and franchises. Additionally, these services help healthcare customers streamline integrated care delivery for better clinical, financial, and operational outcomes.

- Moreover, the implementation of IT services in the healthcare sector is rapidly rising across the United States as healthcare organizations focus on digitizing healthcare practices for improved care. Therefore, various IT service providers are introducing healthcare IT services in the region.

- For example, Damco's HIPAA complaint telemedicine solution enables healthcare providers to offer quality and safe telehealth services that give a more favourable alternative to traditional medical models. By using the Internet and mobile devices to connect with doctorsleveraging videoconferencing or audiophone call communications, booking online appointments, undergoing real time consultations, getting more information about medical treatments remotely, this company's IT service enables patients to access healthcare services from wherever they are.

- Furthermore, the government has forecasted the healthcare expenditure to reach USD 7.147 trillion, thereby contributing to the market growth. In the United States, digital transformation in healthcare involves the integration of digital functions or processes across the enterprise - be it a payer, a provider, or another organization.

- By combining digital systems and processes, digitally transformed healthcare can offer its patients individualized and omnichannel experiences. Advancements in electronic medical records or other initiatives striving for medical interoperability reflect the recent shift toward the digital transformation of healthcare in the United States. Such developments are boosting the adoption of IT services in the United States.

United States (US) IT Services Market Overview

The USA IT service market is fragemnted and is under examination is currently dominated by major players, including IBM, TCS, Wipro, Microsoft, and Capgemini, all of whom boast substantial client bases. These industry leaders are continuously elevating their offerings, employing robust competitive strategies to maintain their market presence and retain their clientele. This intense competition characterizes the market landscape, with high levels of rivalry expected to persist throughout the forecasted period as these players tailor their services to meet the diverse needs of their customers.

- In October 2023 - IBM has announced the next evolution of its managed detection and response service offerings with new AI technologies, including the ability to automatically escalate or close up to 85% of alerts, while helping to accelerate security response timelines for clients. Where the new Threat Detection and Response Services (TDR) provide 24x7 monitoring, investigation, and automated remediation of security alerts from all relevant technologies across client's hybrid cloud environments - including existing security tools and investments, as well as cloud, on-premise, and operational technologies (OT)

- In July 2023, Tata Consultancy Services (TCS) extended its longstanding partnership with GE HealthCare Technologies Inc. (GE HealthCare) to facilitate the transformation of GE Healthcare's IT operating model. This collaboration will primarily focus on digitally revamping GE HealthCare's global IT function by introducing a novel operating model for overseeing its application portfolio and fostering innovation. TCS will oversee the development, maintenance, rationalization, and standardization of its enterprise IT applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the market

- 4.5 Regulatory Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Acceleration of Digital Transformation Across Industries and Adoption of New Technologies

- 5.1.2 Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 5.2 Market Restraints

- 5.2.1 Data Security, Customization, and Data Migration

- 5.3 Comparative Insights: Tier 1 (Large) vs Tier 2 (Medium) IT Services Vendors

- 5.4 In-housing and Outsourcing Analysis

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 IT Consulting and Implementation

- 6.1.2 IT Outsourcing

- 6.1.3 Business Process Outsourcing

- 6.1.4 Other Types

- 6.2 By End-User

- 6.2.1 Manufacturing

- 6.2.2 Government

- 6.2.3 BFSI

- 6.2.4 Healthcare

- 6.2.5 Retail and Consumer Goods

- 6.2.6 Logistics

- 6.2.7 Other End-Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Accenture PLC

- 7.1.3 Microsoft Corporation

- 7.1.4 Infosys Limited

- 7.1.5 Wipro Limited

- 7.1.6 TATA Consultancy Services Limited

- 7.1.7 Capgemini SE

- 7.1.8 Atos SE

- 7.1.9 HCL Technologies Limited

- 7.1.10 Leidos Holdings, Inc.

- 7.1.11 Sphere Partners LLC

- 7.1.12 Kanda Software

- 7.1.13 Fingent Corp.

- 7.1.14 Intetics Inc.

- 7.1.15 Integris

- 7.1.16 Synoptek, LLC

- 7.1.17 Simform

- 7.1.18 MAS Global Consulting

- 7.1.19 Algoworks Solutions Inc

- 7.1.20 Icreon Holdings Inc

- 7.1.21 DevDigital LLC

- 7.1.22 Slalom, Inc.

- 7.1.23 VATES S.A.

- 7.1.24 Computer Solution East, Inc.

- 7.1.25 Perficient, Inc.

- 7.1.26 Innowise Group

- 7.1.27 Velvetech LLC

- 7.1.28 CHI Software

- 7.1.29 Edafio Technology Partners

- 7.1.30 VLink, Inc.

- 7.1.31 Ardem Incorporated

- 7.1.32 Unity Communications

- 7.1.33 Accedia

- 7.1.34 Intersog

- 7.1.35 Galaxy Weblinks LTD

- 7.1.36 Wave Access USA

- 7.1.37 Centricsit LLC

- 7.1.38 A3 Logics

- 7.1.39 Bottle Rocket LLC

- 7.1.40 Premier BPO, LLC

- 7.1.41 Sumerge

- 7.1.42 Peak Support, LLC

- 7.1.43 Progent Corporation

- 7.1.44 Sciencesoft USA Corporation

- 7.1.45 Intellectsoft US LLC