|

市场调查报告书

商品编码

1692498

菲律宾资料中心市场占有率分析、行业趋势和成长预测(2025-2030 年)Philippines Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

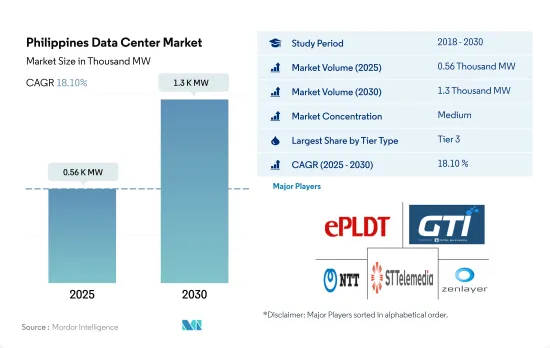

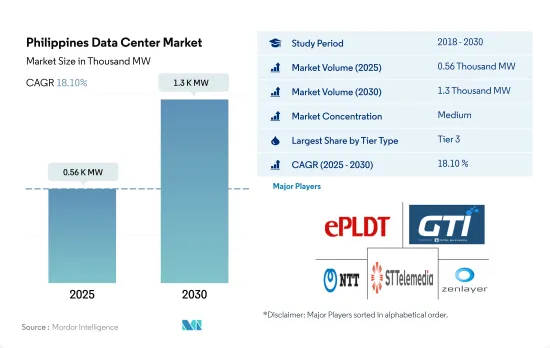

菲律宾资料中心市场规模预计在 2025 年达到 560kW,预计 2030 年达到 1,300kW,复合年增长率为 18.10%。

预计主机託管收益将在 2025 年达到 3.92 亿美元,到 2030 年达到 11.62 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.27%。

到 2023 年,Tier 3 资料中心将占据大部分份额,而 Tier 4 资料中心在整个预测期内将实现最快的成长。

- 由于设施不可靠且停机时间较长,一级市场的成长预计仍将保持低迷。 Tier 2 细分市场的 IT 负载容量预计将从 2021 年的 125.6 MW 成长到 2029 年的 172.6 MW,复合年增长率为 4.33%。这些资料中心因其以实惠的价格提供的性能而最受中小型企业的青睐。然而,由于每年有 22 小时的停机时间,企业可能不愿意并且犹豫是否选择资料中心。

- 菲律宾资料中心市场 Tier 3 部分的 IT 负载容量预计将从 2021 年的 78.3MW 成长到 2029 年的 489.3MW,复合年增长率为 25.75%。这些资料中心提供 99.98% 的执行时间,具有 N+1 冗余,每年仅停机 1.6 小时。这些优势使其备受大型企业的青睐。

- 目前,该地区的 Tier 3 资料中心非常普遍,一些设施已将其结构和服务升级到所需的标准。企业更希望新建的设施符合 Tier 3 或 Tier 4 标准。

- 菲律宾资料中心市场 Tier 4 部分的 IT 负载容量预计到 2029 年将达到 70MW。这些资料中心预计将于 2023 年开始运作,因其高可靠性和约 26.3 分钟的低停机时间而受到青睐。菲律宾目前没有经过 Tier 4 认证的主机託管设施。然而,ePLDT 宣布其位于圣罗莎的第 11 个资料中心将达到 Tier 4 级别,并将于 2023 年运作。

- 新的资料中心营运商更喜欢为其基础设施配备 Tier 4 级认证,因为它具有很高的可靠性。

菲律宾资料中心市场趋势

菲律宾消费者每天花在智慧型手机的时间达 10 小时,每天传输大量资料。

- 2022年菲律宾智慧型手机用户数将达到约1.01亿,预计2029年将达到1.81亿,复合年增长率为8.79%。

- 疫情过后,智慧型手机的需求显着成长,因为它们在浏览网页、金融交易、网路购物等方面非常方便。人们正在适应城市生活方式,并使用这些设备实现家庭自动化功能、线上游戏、串流内容、浏览新闻、网路购物等。能够立即完成几乎任何事情的便利性增加了用户数量,预计随着人口的增长,用户数量还会增加。

- 菲律宾是世界上唯一用户平均每天花在手机上10小时的国家。随着通讯网路的发展和设施的改善,用户能够在智慧型手机上实现良好的行动资料通讯速度,从而提高功能和体验。手机网路游戏品质的提升、网路游戏举办的活动等也进一步拉动了智慧型手机的需求。现在,配备更强大处理器、更好显示器和电池的行动电话可以以廉价的价格购买。 74% 的用户更喜欢手机游戏而不是 PC 或主机游戏。

DITO、Globe 和 Smart 等行动通讯业者的 5G 网路扩展将推动资料中心市场

- 菲律宾消费者目前拥有很大比例的4G和3G服务。 5G 网路服务预计将于 2021 年底推出,客户将于 2022 年第一季开始采用。

- 菲律宾提供5G服务的设施包括DITO、Globe和Smart。这些公司正在扩大其业务范围以加强其网路连接。

- 例如,Smart已计划在2022年将5G变电站的数量增加到7,300个,以加强其5G网路。

菲律宾资料中心产业概况

菲律宾资料中心市场适度整合,前五大公司占据54.17%的市场。该市场的主要企业有:ePLDT Inc.、GTI Corporation、NTT Ltd、STT GDC Pte Ltd 和 Zenlayer Inc.(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 市场展望

- 负载能力

- 占地面积

- 主机代管收入

- 安装的机架数量

- 机架空间利用率

- 海底电缆

第五章 产业主要趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动数据速度

- 宽频数据速度

- 光纤连接网路

- 法律规范

- 菲律宾

- 价值炼和通路分析

第六章市场区隔

- 热点

- NCR(马尼拉大都会)

- 其他地区

- 资料中心规模

- 大规模

- 大规模

- 中等规模

- 百万

- 小规模

- 等级类型

- 1级和2级

- 第 3 层

- 第 4 层

- 吸收量

- 未使用

- 使用

- 按主机託管类型

- 超大规模

- 零售

- 批发的

- 按最终用户

- BFSI

- 云

- 电子商务

- 政府

- 製造业

- 媒体与娱乐

- 电信

- 其他最终用户

第七章竞争格局

- 市场占有率分析

- 商业状况

- 公司简介.

- Bitstop

- Dataone

- ePLDT Inc.

- GTI Corporation

- NTT Ltd

- Space DC Pte Ltd

- STT GDC Pte Ltd

- VSTECS Phils Inc.

- Zenlayer Inc.

- LIST OF COMPANIES STUDIED

第八章:CEO面临的关键策略问题

第九章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 数据包

- 词彙表

The Philippines Data Center Market size is estimated at 0.56 thousand MW in 2025, and is expected to reach 1.3 thousand MW by 2030, growing at a CAGR of 18.10%. Further, the market is expected to generate colocation revenue of USD 392 Million in 2025 and is projected to reach USD 1,162 Million by 2030, growing at a CAGR of 24.27% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, Tier 4 is fastest growing through out the forecasted period

- Growth in the tier 1 segment is expected to be stagnant due to the unreliability and longer downtimes of facilities. The IT load capacity of the tier 2 segment is expected to increase from 125.6 MW in 2021 to 172.6 MW by 2029 at a CAGR of 4.33%. These data centers are preferred mainly by small businesses due to the performance they offer at an affordable cost. However, a downtime of 22 hours annually, at times, makes companies reluctant and hesitant to opt for them.

- The IT load capacity of the tier 3 segment of the data center market in the Philippines is anticipated to increase from 78.3 MW in 2021 to 489.3 MW by 2029 at a CAGR of 25.75%. These data centers offer an uptime of 99.98% with N+1 redundancies, and they only have around 1.6 hours of downtime in a year. These advantages have made them highly preferable by large businesses.

- Currently, tier 3 data centers are highly prevalent in the region, as some facilities have upgraded their structures and services to the required standards. Operators prefer newly constructed facilities to be tier 3 and tier 4 ready.

- The IT load capacity of the tier 4 segment of the data center market in the Philippines is expected to reach 70 MW by 2029. These data centers are expected to be operational in 2023 and are preferred due to their high reliability and lower downtime of around 26.3 minutes. Currently, the Philippines has no colocation facility with Tier 4 certification. However, ePLDT announced that its 11th data center in Santa Rosa would be tier 4 and would be launched by 2023.

- Operators of new data centers prefer Tier 4 grade certifications for their infrastructure facilities due to the high reliability offered.

Philippines Data Center Market Trends

Philippines consumers spends 10hr/day on smartphone, generating huge amount of data transfer daily, this would drive data center market

- The Philippines had around 101 million smartphone users in 2022, which is expected to reach 181 million by 2029 at a CAGR of 8.79%.

- Post-pandemic, the demand for smartphones has significantly increased as they turned out to be useful for browsing, financial transactions, online shopping, and others. People are adopting urban lifestyles and use these gadgets for automation functions in their homes, online gaming, streaming content, browsing news, and online shopping. The convenience of doing almost everything instantly has increased the number of users and is expected to increase with the increasing population.

- The Philippines is the only country in the world where users, on average, spend an average of 10 hours a day on the phone. As the telecom network developed and improved its facilities, users could attain good mobile data speeds on their smartphones which increased their functionality and experience. Online games on mobile have improved their quality, and the events organized by them have furthermore increased the demand for smartphones. As phones with higher processors, better displays, and batteries are available at a budget price. 74% of the users prefer mobile gaming over PC and console gaming.

Expansion of 5G network by mobile operators such as DITO, Globe, and Smart boost the data center market

- Consumers in the Philippines currently use 4G and 3G services in greater proportion. 5G network services were launched at the end of 2021 and were increasingly adopted by customers in the first quarter of 2022.

- Facilities offering 5G services in the Philippines are DITO, Globe, and Smart. These companies are expanding their bases to strengthen their network connectivity.

- For instance, Smart increased the count of its 5G substations to 7300 in 2022 to strengthen its 5G networks.

Philippines Data Center Industry Overview

The Philippines Data Center Market is moderately consolidated, with the top five companies occupying 54.17%. The major players in this market are ePLDT Inc., GTI Corporation, NTT Ltd, STT GDC Pte Ltd and Zenlayer Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Philippines

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 NCR (Metro Manila)

- 6.1.2 Rest of Philippines

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Bitstop

- 7.3.2 Dataone

- 7.3.3 ePLDT Inc.

- 7.3.4 GTI Corporation

- 7.3.5 NTT Ltd

- 7.3.6 Space DC Pte Ltd

- 7.3.7 STT GDC Pte Ltd

- 7.3.8 VSTECS Phils Inc.

- 7.3.9 Zenlayer Inc.

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms