|

市场调查报告书

商品编码

1692506

泰国网路安全:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Thailand Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

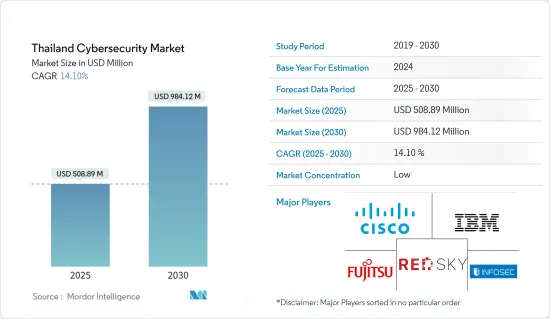

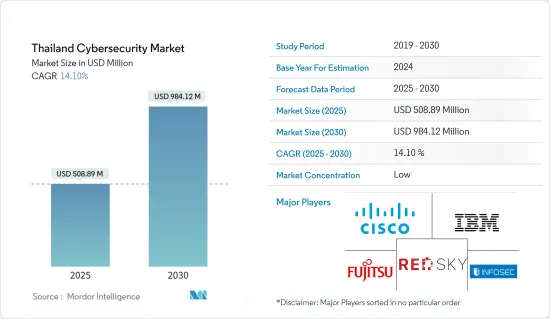

泰国网路安全市场规模预计在 2025 年为 5.0889 亿美元,预计到 2030 年将达到 9.8412 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.1%。

泰国作为数位经济国家,随着高速互联网基础设施建设、网上银行服务的增长以及对云端基础软体的需求不断增加,软体解决方案、互联网和连网型设备的使用在终端用户行业中日益增多,也增加了网路攻击的风险。

主要亮点

- 儘管泰国正在优先发展一个框架,以确保其数位经济具备网路防护能力,但熟练的网路安全人才的短缺对网路安全市场相关人员构成了挑战,这可能会在预测期内减缓市场成长。

- 例如,2023年9月,国家网路安全局(NCSA)秘书长强调泰国在网路安全人才方面存在巨大缺口,指出只有0.5%的泰国公务员在IT领域工作,在网路安全领域工作的比例就更小。

- 网路安全人才的短缺可能会影响网路安全解决方案的发展。缺乏熟练的网路安全人才可能会导致预测期内网路安全解决方案的采用出现严重不足。

- 数位转型的趋势正在席捲多个产业,迫使企业重新思考其网路安全态势。随着日本各行业拥抱数位转型,企业意识到保护其数位资产免受日益严重的网路攻击是一项关键要求。需求激增可归因于云端运算、巨量资料和物联网 (IoT) 等数位技术的广泛采用,这些技术扩大了攻击面并增加了保护敏感资讯的复杂性。

- 云端优先战略的盛行推动了泰国对强有力的网路安全措施的需求。随着企业将业务和资料转移到云端环境以获得更大的扩充性和灵活性,他们面临着独特的安全挑战。云端运算固有的风险,例如资料外洩、未授权存取和合规性问题,正在推动对专业云端安全解决方案的需求。

- 采用云端优先策略需要采取网路安全措施,以保护传输中的资料、保护云端基础设施并确保云端中强大的识别及存取管理。泰国的网路安全市场正在积极应对这些挑战,提供客製化解决方案来解决云端安全的复杂性,这反映了该行业对不断发展的技术趋势的适应性。

- 随着数位环境的发展和网路威胁变得越来越复杂,对合格且经验丰富的网路安全专业人员的需求日益增长。该领域对更多熟练专业人员的需求阻碍了网路安全解决方案的有效部署和管理,形成了影响泰国整体网路安全市场的瓶颈。

- 由于网路银行服务的扩展和网路交易的增加,包括泰国在内的东南亚国家的数位付款兴起,这增加了对该国此类付款活动的数位基础设施进行网路攻击的风险,从而增加了预测期内对网路安全解决方案的需求。

泰国网路安全市场趋势

云端安全成长强劲

- 泰国网路安全市场对云端安全的需求受到庞大的云端区域存在和不断变化的监管环境以及企业向云端迁移的激增所驱动,这需要新的方法来确保线上基础设施、应用程式和平台上的资料安全。

- 云端运算改变了全国公共和私营部门组织使用、共用和储存资料、应用程式和工作负载的方式。然而,这也为组织带来了新的安全威胁和挑战。此外,洩漏到云端和公共云端服务的资料量也进一步增加了对云端安全解决方案的需求。此外,随着全国各地的组织迅速将工作负载转移到云端,资料保护、可见性和控制力的丧失已成为主要问题,从而推动了对云端安全解决方案的需求。

- 在推动数位化的最终用户以及「云端优先」政策等政府倡议的推动下,该国处于云端运算应用的前沿。作为国家云端优先政策的一部分,政府已与Google和微软等云端供应商合作,鼓励政府机构使用公共云端供应商。预计这些努力将进一步推动该国政府机构和私人终端用户公司采用云端安全解决方案。

- 此外,Google、微软和 AWS 等云端市场供应商正在泰国推出云端区域,使云端服务的强大功能和优势更贴近泰国企业和组织,使他们能够推出先进的云端技术进行数位转型。然而,随着泰国企业响应泰国政府的「云端优先」政策转向云端,了解安全要求以确保资料、应用程式和平台的安全变得越来越重要。预计这些发展将在预测期内推动该国最终用户组织对云端安全解决方案的巨大需求。

- 据泰国数位经济促进局 (DEPA) 称,2021 年泰国数位服务市场规模为 3,467 亿泰铢(99.1 亿美元)。预计到 2024 年,这一数字将达到 7,000 亿泰铢(200 亿美元)。此外,到2022年,泰国数位市值将达到约2.6兆泰铢(740亿美元)。随着泰国数位经济的扩张,企业和政府机构预计将加强采用和实施扩充性的IT基础设施、云端服务和其他数位技术。数位活动的活性化进一步增加了采取强有力的网路安全措施来保护宝贵资产和敏感资讯的需求。

BFSI 是最大的最终用户

- 泰国的 BFSI 产业的网路安全态势正在发生重大变化,主要受金融服务的数位转型、云端运算采用以及机器学习和人工智慧等先进技术的整合等因素推动,以增强银行和金融业务。此外,金融公司资料外洩和网路攻击的增加进一步增加了该国 BFSI 产业采用网路安全解决方案的需求。

- 泰国安全虚拟私人网路 (VPN) 服务供应商 SurfShark 于 2023 年 7 月发布的统计数据指出,泰国发生了大量线上帐户外洩事件,显示存在网路犯罪风险,刺激了该国对网路安全解决方案的机会。

- 此外,泰国金融领域的技术渗透率和数位管道(如行动银行和网路银行)的提高,扩大了 BFSI 领域的网路威胁面。行动银行、数付款管道和 BFSI 领域线上交易的扩张为网路安全带来了新的挑战,并推动了对先进网路安全解决方案的需求,以防止诈骗、资料外洩和其他网路风险。

- 此外,过去几年针对银行和金融公司的网路攻击明显增加,因此需要采取强有力的网路安全措施来保护客户资料。例如,2023年9月,泰国领先的数位金融平台之一CardX揭露了一起资料外洩事件,洩漏了与个人贷款和现金卡申请相关的客户的个人资讯。这些资讯包括客户的姓名、地址、电话号码、电子邮件等。

- 此外,日本的 BFSI 产业正经历重大变革时期时期,受技术进步、监管变化、客户偏好变化和创新金融模式兴起的推动,需要防范网路攻击和资料外洩。例如,包括泰国银行(BoT)和泰国银行协会(TBA)下属的商业银行在内的银行机构正在升级其数位技术,以应对网路风险并加强网路安全。这些因素可能会活性化BFSI 领域对网路安全措施的投资,以应对网路风险。

泰国网路安全产业概况

泰国的网路安全市场高度分散,主要参与者包括 IBM 公司、思科系统公司、富士通泰国(富士通集团公司)、Red Sky Digital 和 Check Point 软体技术有限公司。该市场中的公司正在采用联盟和收购等策略来增强其产品供应并获得永续的竞争优势。

2023 年 9 月 - 富士通有限公司和富士通泰国有限公司宣布收购泰国 SAP 顾问公司创新顾问服务公司,扩大在该国的託管服务组合。

2023 年 3 月—思科 Webex 已获得泰国电子交易发展局 (ETDA) 的认证,该局是泰国王国的一个公共机构,旨在开发可靠、安全且免受网路安全威胁的电子交易。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 数位化和对可扩展IT基础设施日益增长的需求

- 需要因应各种趋势带来的风险,包括第三方供应商风险、MSSP 的演变以及云端优先策略的采用

- 市场限制

- 网路安全专家短缺

- 高度依赖传统身分验证方法且缺乏准备

- 趋势分析

- 越来越多的泰国公司正在利用人工智慧来加强其网路安全战略

- 随着企业转向云端基础的交付模式,云端安全将呈指数级增长

第六章市场区隔

- 按服务

- 安全类型

- 云端安全

- 资料安全

- 身分和存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他安全

- 按服务

- 安全类型

- 按部署

- 云

- 本地

- 按最终用户

- BFSI

- 卫生保健

- 製造业

- 政府和国防

- 资讯科技/通讯

- 其他最终用户

第七章竞争格局

- 公司简介

- IBM Corporation

- Cisco Systems Inc

- Fujitsu Thailand Co. Ltd.

- Red Sky Digital Ventures Ltd.

- Info Security Consultant Co. Ltd.

- Dell Technologies Inc.

- Fortinet Inc.

- CGA Group Co. Ltd.

- Intel Security(Intel Corporation)

第八章投资分析

第九章:市场的未来

The Thailand Cybersecurity Market size is estimated at USD 508.89 million in 2025, and is expected to reach USD 984.12 million by 2030, at a CAGR of 14.1% during the forecast period (2025-2030).

The increasing usage of software solutions, Internet, and connected devices across the end-user industries in Thailand, in line with the country's priority on developing a digital economy, infrastructural development for high-speed Internet, growth of online banking services, and the demand for cloud-based software, are raising the risk of cyber attacks in Thailand is driving the requirement of cyber security solutions in the country, which may fuel the market's growth.

Key Highlights

- The country has been prioritizing developing frameworks for making its digital economy cyber-resilient; however, the lack of skilled cyber security personnel makes it a challenge for the stakeholders of the cyber security market and may lower the market's growth during the forecast period.

- For instance, in September 2023, the Secretary General of the National Cyber Security Agency (NCSA) highlighted a significant talent gap in Thailand's cybersecurity workforce, mentioning that only 0.5% of Thai bureaucrats are in the IT field and an even more minor fraction work in cybersecurity, which may impact the country's objective in strengthening national cybersecurity.

- This lack of a cyber security workforce may affect the growth of cyber security solutions as, without skilled cyber security personnel, the market may witness a significant shortage in implementing cyber security solutions during the forecast period.

- The widespread shift in multiple industries toward digital transformation has driven companies to reassess their cybersecurity measures. As the country adopts digital transformation across various sectors, organizations recognize the critical requirement to safeguard their digital assets against growing cyberattacks. This surge in demand may be attributed to the widespread adoption of digital technologies, including cloud computing, big data, and the Internet of Things (IoT), which has expanded the attack surface and increased the complexity of safeguarding sensitive information.

- The widespread adoption of a cloud-first strategy is driving the need for robust cybersecurity measures in Thailand. As organizations migrate their operations and data to cloud environments to enhance scalability and flexibility, they face distinctive security challenges. The inherent risks associated with cloud computing, including data breaches, unauthorized access, and compliance issues, have propelled the demand for specialized cloud security solutions.

- Adopting a cloud-first strategy necessitates cybersecurity measures that can secure data in transit, protect cloud infrastructure, and ensure robust identity and access management in the cloud. The cybersecurity market in Thailand is actively responding to these challenges by offering tailored solutions to address the complexities of cloud security, reflecting the industry's adaptability to evolving technology trends.

- The need for qualified and experienced cybersecurity specialists has increased as the digital landscape evolves and cyber threats get more complex. The need for more skilled professionals in this field hinders the effective implementation and management of cybersecurity solutions, creating a bottleneck that impacts the overall cybersecurity market in Thailand.

- The growth of digital payments in Southeast Asian countries, including Thailand, has emerged due to the growth of online banking services and the growth of online transactions, which has raised the risk of cyber attacks on the digital infrastructure of these payment activities in the country, increasing the demand for cyber security solutions during the forecast period.

Thailand Cybersecurity Market Trends

Cloud Security to Register Major Growth

- The cloud security demand in the Thailand cybersecurity market is driven by the considerable presence of cloud regions and the evolving regulatory landscape, coupled with high growth in cloud migration among businesses, which requires new approaches to ensure that data remains secure across online infrastructure, applications, and platforms.

- Cloud computing has transformed how public and private sector organizations in the country use, share, and store data, applications, and workloads. However, it has also introduced new security threats and challenges to organizations. Moreover, significant data going into the cloud and public cloud services further increase the exposure, thus positively driving the demand for cloud security solutions. Moreover, as organizations across the country shift workloads to the cloud rapidly, data protection, loss of visibility, and control are emerging as major concerns, driving the demand for cloud security solutions.

- The country is at the forefront of cloud adoption, augmented by the end-user drive for digitalization and government initiatives such as cloud-first policy. The country's government is partnering with cloud vendors such as Google and Microsoft to facilitate governmental agencies using public cloud providers as part of the country's cloud-first policy. Such initiatives are further expected to bolster the adoption of cloud security solutions in government institutions as well as private end-user businesses of the country.

- Furthermore, cloud market vendors such as Google, Microsoft, and AWS have launched cloud regions in the country to bring the power and benefits of cloud services closer to businesses and organizations in Thailand, enabling them to leverage advanced cloud technologies for their digital transformation initiatives. However, as businesses in the country continue to migrate to the cloud per the Thai government's cloud-first policy, understanding the security requirements for keeping data, applications, and platforms safe is becoming increasingly crucial. Thus, such developments are analyzed to result in significant demand for cloud security solutions in the country's end-user businesses during the forecast period.

- According to the Digital Economy Promotion Agency (DEPA), the market value of digital services in Thailand was reported to be THB 346.7 billion (USD 9.91 billion) in 2021. By 2024, this amount is anticipated to reach THB 700 billion (USD 20 billion). Moreover, in 2022, Thailand's digital market value was around THB 2.6 trillion (USD 74 billion). As Thailand's digital economy expands, businesses and government organizations are expected to strengthen their efforts to adopt and implement scalable IT infrastructure, cloud services, and other digital technologies. This increased digital activity further enhances the need for robust cybersecurity measures to protect valuable assets and sensitive information.

BFSI to be the Largest End User

- The BFSI industry in Thailand is witnessing a significant shift in its cybersecurity security measures, primarily driven by factors such as the digital transformation of financial services, cloud adoption, and the integration of advanced technologies like machine learning and artificial intelligence to enhance banking and finance operations. In addition, growing data breaches and cyberattacks in financial firms further necessitate adopting cybersecurity solutions in the country's BFSI sector.

- SurfShark, a secure VPN (Virtual Private Network) service provider in Thailand, published statistics in July 2023 stating that Thailand has been registering a significant number of online account breaches, showing the risk of cyber crimes, fueling the demand opportunity for cyber security solutions in Thailand.

- Furthermore, with the growing technological penetration and digital channels, such as mobile banking, Internet banking, etc., in the country's financial sector, the attack surface for cyber threats in the BFSI sector has expanded. The expansion of mobile banking, digital payment platforms, and online transactions in the country's BFSI sector has created new challenges for cybersecurity, thus driving the demand for advanced cybersecurity solutions to protect against fraud, data breaches, and other cyber risks.

- Moreover, the growth in cyberattacks in banks and financial firms has witnessed a significant rise in the past few years, necessitating the demand for robust cybersecurity measures to protect customer data. For instance, in September 2023, CardX, one of Thailand's major digital financial platforms, disclosed a data leak that exposed their customers' personal information related to personal loan and cash card applications. This information includes the customer's first and last name, address, telephone number, and email.

- Furthermore, the country's BFSI sector is undergoing a significant transformation due to technological advancements, regulatory changes, evolving customer preferences, and the rise of innovative financial models, necessitating the need to safeguard against cyberattacks and data breaches. For instance, banking institutions, including the Bank of Thai (BoT) and commercial bank members of the Thai Bankers' Association (TBA), have been upgrading their digital technology to handle cyber risks and strengthen cybersecurity. Such factors will boost investment in cybersecurity measures in the BFSI sector to guard against cyber risks.

Thailand Cybersecurity Industry Overview

The Thailand cybersecurity market is highly fragmented, with the presence of major players like IBM Corporation, Cisco Systems Inc., Fujitsu Thailand Co. Ltd (Fujitsu Group), Red Sky Digital Co.Ltd, and Check Point Software Technologies Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

September 2023 - Fujitsu Limited and Fujitsu Thailand Limited announced the acquisition of Thailand-based SAP consultancy Innovation Consulting Services to increase its managed service portfolio in the country, which may further use this expansion to offer cyber security services to the existing customers of the acquired company during the forecast period.

March 2023 - Webex by Cisco achieved Thailand's Electronic Transactions Development Agency (ETDA) certification, a public agency in the Kingdom of Thailand established to develop electronic transactions that are reliable, secure, and safe from cybersecurity threats, which shows the company's priority in offering cyber resilient solutions in the market and enhancing its cyber security solutions offering to support its market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Need to Tackle Risks from Various Trends such as Third-party Vendor Risks, the Evolution of MSSPs, and Adoption of Cloud-first Strategy

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.3 Trends Analysis

- 5.3.1 Organizations in Thailand Increasingly Leveraging AI to Enhance their Cyber Security Strategy

- 5.3.2 Exponential Growth to be Witnessed in Cloud Security Owing to Shift Toward Cloud-based Delivery Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Security Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government and Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc

- 7.1.3 Fujitsu Thailand Co. Ltd.

- 7.1.4 Red Sky Digital Ventures Ltd.

- 7.1.5 Info Security Consultant Co. Ltd.

- 7.1.6 Dell Technologies Inc.

- 7.1.7 Fortinet Inc.

- 7.1.8 CGA Group Co. Ltd.

- 7.1.9 Intel Security (Intel Corporation)