|

市场调查报告书

商品编码

1692520

越南容器玻璃市场:市场占有率分析、产业趋势与成长预测(2025-2030)Vietnam Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

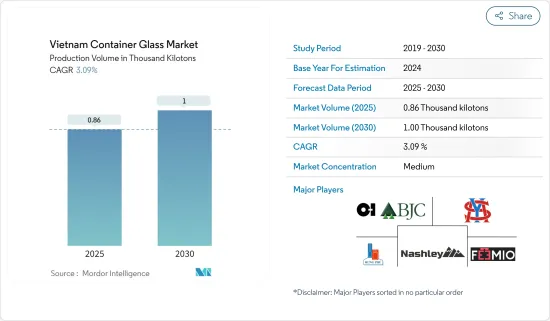

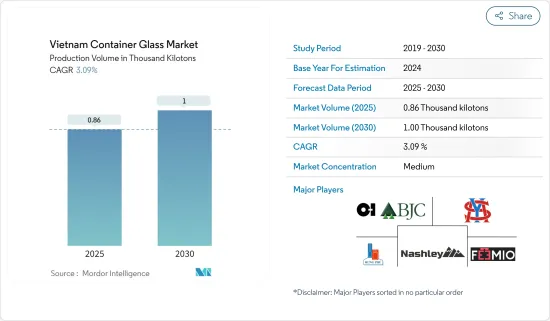

根据产量计算,越南容器玻璃市场规模预计将从 2025 年的 86 万吨扩大到 2030 年的 100 万吨,预测期内(2025-2030 年)的复合年增长率为 3.09%。

关键亮点

- 随着越南都市化进程不断加快,人们对各种食品和饮料的需求也日益增长。该国民众对外出用餐和简便食品的偏好正在取代传统的家庭烹饪和杂货店购物。推动这一转变的主要因素包括中产阶级的快速成长和人口结构的年轻化。随着便利商店、咖啡店、小吃店以及更多一般零售和餐旅服务业的蓬勃发展,对玻璃瓶包装的需求预计将大幅增长。

- 食品和饮料消费量的增加是推动玻璃瓶和各种其他包装形式需求的主要因素。该国食品和饮料消费量的增加直接影响零售业的成长,为玻璃瓶製造商将越南视为东南亚的重要市场提供了丰厚的机会。例如,根据越南统计总局的数据,2022年该国食品和饮料消费量达到1,027兆越南盾(约421.1亿美元),2023年将增加至1,123兆越南盾(约460.4亿美元)。

- 此外,消费者对安全和环保包装的偏好日益增长,推动了越南各领域的玻璃包装的成长。此外,压花、模塑和艺术加工等技术进步也增加了玻璃包装的吸引力。

- 值得注意的是,对环保解决方案的需求不断增长以及食品和饮料行业的需求不断增长,进一步推动了越南玻璃包装市场的发展。此外,对玻璃包装研发和技术创新的投入不断增加也在推动市场的发展。

- 然而,塑胶、铝和软材料等替代包装的兴起正在阻碍市场成长。这些替代品往往对製造商和消费者都有吸引力,因为它们经济实惠、重量轻且易于运输。此外,可回收塑胶和生物分解性包装等材料的进步正在减少对传统玻璃容器的需求。

越南容器玻璃市场趋势

饮料消费量增加推动市场

- 消费者越来越意识到包装对环境的影响。玻璃可回收,与塑胶相比,被认为是更永续的选择。这种对环保包装的偏好可能会刺激对容器玻璃的需求。

- 随着饮料消费量的增加,对饮料包装解决方案(包括玻璃瓶)的需求也增加。玻璃能够保持口味和品质,使其成为多种饮料的首选包装材料,包括软性饮料、啤酒、葡萄酒和烈酒。

- 根据美国农业部对外农业服务局和越南统计总局的数据,越南饮料业预计2023年将成长101.3%,在2020年和2021年因疫情而下滑之后,将实现復苏并接近疫情前的水平。不过,2022年强劲復苏,飙升至132.3%,显示进入强劲復苏阶段。

- 日益严格的健康和安全法规也会影响包装的选择。玻璃具有化学惰性,不会与内容物发生反应,因此是更安全的饮料包装选择。遵守这些法规将推动对容器玻璃的需求。

- 对各种口味饮料(尤其是苏打水)的需求不断增长,可能会对越南玻璃瓶的成长做出重大贡献。调味苏打水通常被宣传为高檔、健康的饮料。寻求异国风和异国风味的消费者可能会更喜欢能够维持产品品质和口味的优质包装。玻璃瓶非常适合此用途,因为它们不会发生反应,并且比塑胶瓶更好地保留饮料的风味和碳酸化。

化妆品领域成长率最高

- 化妆品品牌经常使用独特、美观的玻璃罐和瓶子来在拥挤的市场中区分其产品,无论是护肤还是香水。随着电子商务领域的成长,品牌之间的竞争将会加剧,从而导致越来越多地使用独特的玻璃包装来脱颖而出。

- 随着越来越多的国内美容和个人护理品牌的出现和发展,这可能会促进对国产玻璃罐和玻璃瓶的需求不断增长。这种成长将在越南美容产业和容器玻璃製造商之间建立共生关係,进而对容器玻璃市场的成长产生正面影响。

- 化妆品行业线上和线下通路的销售额都在成长,预计这将增加对容器玻璃的需求。据韩国贸易协会称,2023 年第三季度,越南从韩国进口了价值约 3.05 亿美元的化妆品,高于 2022 年的 3.2702 亿美元。越南对化妆品的稳定需求表明市场正在成长,并为国内供应商提供了向国内化妆品製造商供应容器玻璃包装的机会。

- 2023年12月,越南卫生署(MoH)提案了一项旨在加强化妆品管理的新法令。卫生部已正式向政府提交必要文件,征求其对提案法令的意见和核准。预计新法令将对化妆品实施更严格的品质和安全标准。玻璃瓶惰性,不会与内容物相互作用,因此通常更受青睐,因为它们能够保持高品质化妆品配方的完整性。因此,更严格的法规可能会推动偏好玻璃包装容器。

越南容器玻璃产业概况

越南的容器玻璃市场相当集中,拥有相对较少的大型公司,例如OI BJC Vietnam Glass Co.、San Miguel Yamamura Packaging Corporation和越南Nashley Technology Joint Stock Company。然而,由于每家公司都生产类似的产品,因此产业内的竞争非常激烈。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 注重循环经济的工业生态系分析

- 越南玻璃包装产业标准与法规

- 原料价格趋势分析:玻璃屑、沙子、容器用玻璃

- 贸易分析

- 越南的容器玻璃产业

第五章市场动态

- 市场驱动因素

- 响应生产者延伸责任(EPR),提高民众环保意识

- 越南饮料消费量增加

- 市场限制

- 替代包装选择挑战市场成长

第六章 玻璃瓶的替代见解与替代品

第七章玻璃收集与回收的经济分析

第八章市场区隔

- 按最终用户产业

- 饮料

- 酒精

- 啤酒和苹果酒

- 葡萄酒和烈酒

- 其他酒精饮料

- 非酒精性

- 碳酸饮料

- 牛奶

- 水和其他非酒精饮料(例如果汁)

- 食物

- 化妆品

- 製药

- 其他的

- 饮料

第九章竞争格局

- 公司简介

- OI BJC Vietnam Glass Co.

- San Miguel Yamamura Packaging Corporation

- Hung Phu Glass Joint Stock Company

- Vietnam Nashley Technology Joint Stock Company

- Feemio Group Co. Ltd

- Pavico Co. Ltd

第十章:未来市场展望

The Vietnam Container Glass Market size in terms of production volume is expected to grow from 0.86 thousand kilotons in 2025 to 1.00 thousand kilotons by 2030, at a CAGR of 3.09% during the forecast period (2025-2030).

Key Highlights

- Vietnam's increasing urbanization spurs a growing appetite for diverse food and beverages. The country's inclination towards dining out and favouring convenience foods is eclipsing its traditional emphasis on home-cooked meals and grocery shopping. This transition is chiefly propelled by factors such as the swift growth of the middle class and the country's predominantly youthful population. With convenience stores, coffee shops, snack outlets, and the more comprehensive retail and hospitality landscape thriving, the demand for glass bottle packaging is poised for a significant upswing.

- The country's increasing consumption of food and beverages is the primary driver behind the significant demand for various packaging modes, notably glass bottles. The rising consumption of food and beverages in the country has directly influenced the growth of the retail industry, presenting a lucrative opportunity for glass bottle manufacturers to view Vietnam as a significant market in Southeast Asia. For instance, according to the General Statistics Office of Vietnam, the country's food and beverage consumption was VND 1,027 trillion (USD 42.11 billion) in 2022, and it is increased to VND 1,123 trillion (USD 46.04 billion) by 2023.

- Furthermore, the rising consumer preferences for safe and eco-friendly packaging are propelling the growth of glass packaging across various segments in Vietnam. Additionally, technological advancements, including embossing, shaping, and artistic finishes, enhance the appeal of glass packaging.

- Notably, the escalating demand for eco-friendly solutions and a surging appetite from the food and beverage sector are further fueling Vietnam's glass packaging market. The market is also benefiting from increased investments in research and development, which are driving innovations in glass packaging.

- However, the rise of alternative packaging options, including plastic, aluminum, and flexible materials, is hindering market growth. These alternatives tend to be more cost-effective, lighter, and easier to transport, appealing to both manufacturers and consumers. Further Additionally more, advancements in materials, such as recyclable plastics and biodegradable packaging, are diminishing the demand for conventional glass containers.

Vietnam Container Glass Market Trends

Increasing Beverage Consumption in the Country to Drive the Market

- Consumers are increasingly aware of the environmental impact of packaging materials. Glass is recyclable and perceived as a more sustainable option compared to plastics. This preference for environmentally friendly packaging can drive up the demand for container glass.

- With the increase in beverage consumption, there is a higher demand for beverage packaging solutions, including glass bottles. Glass is a preferred packaging material for many types of beverages, including soft drinks, beer, wine, and spirits, due to its ability to preserve taste and quality.

- According to the USDA Foreign Agricultural Service and General Statistics Office of Vietnam, in 2023, the beverage industry experienced a growth rate of 101.3% , showing recovery and nearing pre-pandemic levels after decline in 2020 and 2021 due to pandemic. However, the industry saw a major rebound in 2022 with a notable spik to 132.3%, indicating strong recovery phase.

- Stricter health and safety regulations can also influence packaging choices. Glass is chemically inert and does not interact with the contents, making it a safer choice for beverage packaging. Compliance with these regulations can thus boost the demand for container glass.

- The increasing demand for a diverse range of flavored beverages, particularly sparkling water, can significantly contribute to the growth of glass bottles in Vietnam. Flavored sparkling water is often marketed as a premium, health-conscious beverage. Consumers looking for unique and exotic flavors are likely to prefer premium packaging that maintains the quality and taste of the product. Glass bottles are ideal for this purpose due to their non-reactive nature, preserving the beverage's flavor and carbonation better than plastic.

Cosmetics Segment to Witness Highest Growth Rate

- Brands often use unique and aesthetically glass jars and bottles to differentiate their products, such as skincare and fragrances, in a crowded market. As the e-commerce sector grows, the competition among brands will increase, leading to greater use of distinctive glass packaging to stand out.

- As more domestic beauty and personal care brands emerge and grow, they will contribute to increasing the demand for locally produced glass jars and bottles. This growth can also create a symbiotic relationship between the beauty industry and container glass manufacturers in Vietnam, consequently positively impacting the container glass market growth.

- With the cosmetics industry experiencing increased sales through both online and offline channels, the demand for container glass is expected to rise. According to the Korea International Trade Association, Vietnam imported around USD 305 million worth of cosmetics from South Korea in the third quarter of 2023, compared to USD 327.02 million in 2022. This consistent demand for cosmetics in Vietnam indicates a growing market, offering opportunities for domestic vendors to supply container glass packaging to cosmetics manufacturers in the country.

- In December 2023, the Vietnam Ministry of Health (MoH) proposed a new Decree aimed at enhancing the management of cosmetics. The MoH has formally submitted the necessary documentation to the Government, seeking feedback and approval for the proposed Decree. The new decree is likely to impose stricter quality and safety standards on cosmetic products. Glass jars, which are inert and do not interact with their contents, are often preferred for their ability to maintain the integrity of high-quality cosmetic formulations. As a result, stricter regulations could lead to an increased preference for container glass packaging.

Vietnam Container Glass Industry Overview

The Vietnam container glass market is moderately consolidated with the presence of relatively small number of large companies like O-I BJC Vietnam Glass Co., San Miguel Yamamura Packaging Corporation, and Vietnam Nashley Technology Joint Stock Company, which tend to operate in several regions and diversify their portfolios. However, companies create similar products, thus increasing competition in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Ecosystem Analysis with Emphasis on Circular Economy

- 4.4 Industry Standards and Regulations for Glass Packaging in Vietnam

- 4.5 Raw Material Price Trend Analysis Cullet, Sand, and Container Glass

- 4.6 Trade Analysis

- 4.7 Vietnam Container Glass Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Awareness among the Population in Response to Extended Producer Responsibility (EPR)

- 5.1.2 The Increasing Beverage Consumption in the Country

- 5.2 Market Restraints

- 5.2.1 Alternative Packaging Options Challenging the Market Growth

6 SUBSTITUTION INSIGHTS OF GLASS BOTTLES WITH ALTERNATIVES

7 ECONOMIC ANALYSIS OF GLASS COLLECTION AND RECYCLING

8 MARKET SEGMENTATION

- 8.1 By End-user Industry

- 8.1.1 Beverage

- 8.1.1.1 Alcoholic

- 8.1.1.1.1 Beer and Cider

- 8.1.1.1.2 Wine and Spirits

- 8.1.1.1.3 Other Alcoholic Beverages

- 8.1.1.2 Non-Alcoholic

- 8.1.1.2.1 Carbonated Soft Drinks

- 8.1.1.2.2 Milk

- 8.1.1.2.3 Water and Other Non-alcoholic Beverages (Juices, Among others)

- 8.1.2 Food

- 8.1.3 Cosmetics

- 8.1.4 Pharmaceuticals

- 8.1.5 Other End-user Industries

- 8.1.1 Beverage

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 O-I BJC Vietnam Glass Co.

- 9.1.2 San Miguel Yamamura Packaging Corporation

- 9.1.3 Hung Phu Glass Joint Stock Company

- 9.1.4 Vietnam Nashley Technology Joint Stock Company

- 9.1.5 Feemio Group Co. Ltd

- 9.1.6 Pavico Co. Ltd