|

市场调查报告书

商品编码

1692525

电池-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Battery Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

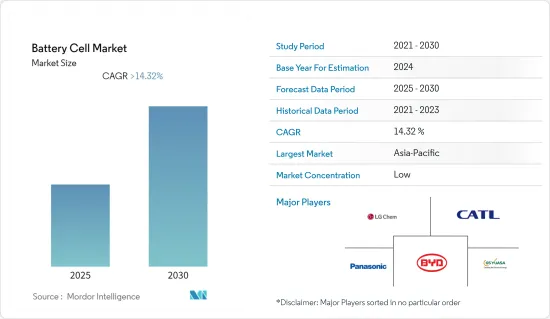

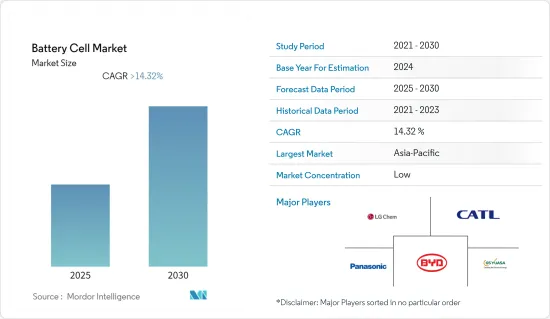

预计预测期内电池市场复合年增长率将超过 14.32%。

2020年,该国受到了新冠疫情的影响,但目前已恢復并达到疫情前的水平。预计预测期内电池需求的成长将推动市场成长。受锂离子电池价格下跌的影响,电动车的快速普及也有望推动市场的成长。然而,缺乏直接获取电池金属的管道正在抑制市场的成长。随着技术的进步,智慧型设备的价格预计将下降,使普通消费者能够更负担得起,这有望在预测期内提供成长机会。

亚太地区占据市场主导地位,预计在预测期内将出现最高的复合年增长率。大部分需求来自中国和印度等国家。

电池市场趋势

方形电池片预计将占据市场主导地位

方形电池是 20 世纪 90 年代初引入电池行业的一种电池。现代方形电池满足了对更薄尺寸的需求,并采用像口香糖盒或小巧克力棒一样的精美包装。矩形单元透过分层方法实现了空间的最佳利用。其他设计则被捲起并压平成伪棱柱形果冻捲。这些电池主要用于行动电话、平板电脑和薄型笔记型电脑,容量从 800 mAh 到 4,000 mAh 不等。

方形电池尺寸较大,封装在焊接铝外壳中,容量从 20 到 50 Ah。它们主要用于能源储存系统以及混合动力汽车和电动汽车的电动动力传动系统。因此,方形电池的尺寸较大,不适合电动自行车和行动电话等小型设备。锂方形电池是物料输送设备 (MHE) 的首选技术。因此,这些电池类型更适合能源密集型应用。

这些电池类型因其大容量和棱柱形外形而广受欢迎,可以轻鬆连接四个电池以创建 12V 电池组,从而提高空间利用率并实现设计灵活性。它具有最高的标称容量(以 Ah 为单位)和能量(以 kWh 为单位),并且整体电池能量密度高于其他电池。这些电池单元不会受到膨胀的影响。与其他电池相比,这些优势使其受到最终用户的欢迎。然而,与圆柱形设计相比,它们的製造成本更高,温度控管效率更低,循环寿命更短。

2022 年 1 月,韩国电池巨头 LG Energy Solution 透露,计划在其锂离子电池产品线中增加方形电池类型。该公司表示,可能会在其产品组合中增加矩形格式,以扩大客户群。该公司的本土竞争对手,如三星 SDI 和 SK On,正在向磷酸铁锂 (LFP) 方形电池过渡,目前这项倡议由中国 CATL主导,顶级电动车製造商特斯拉和大众汽车是 2021 年最早采用方形电池的公司之一。

在大众决定到2030年在其高达80%的电动车中使用方形电池后,韩国企业三星SDI和SK On也将注意力转向了方形封装。 2022年7月,大众集团宣布将在德国萨尔兹吉特建立首座电池电芯工厂。该公司宣布将在高达80%的车型中采用棱镜型统一电池。该工厂计划于 2025 年开始生产,新电池工厂(暱称 Salzgiga)的年生产能力将达到 40 GWh,足以满足约 50 万辆电动车的需求。

因此,由于上述因素,预计方形电池部分在预测期内将显着增长。

亚太地区预计将经历强劲成长

亚太地区是最大的消费性电子设备製造地和出口地,其中主要以中国为主,因为中国拥有较高的生产能力。预计该地区将在预测期内主导消费性电子製造业。因此,亚太电池市场预计将受益于家用电子电器领域的成长。

中国是世界领先的电池生产国和使用国之一,其电池用途广泛。 2020年,中国生产了全球76%的锂离子电池和44%的电动车。中国是电子产业的中心,2021 年,行动电话出口总额的近 48.4% 来自中国,这使得中国成为电池产业的重要市场参与企业。

韩国是圆柱形和方形电池的主要消费国,这些电池主要用于家用电子电器产品、家用电器和电动车电池。随着近年来韩国半导体出口预计将放缓,电动车电池已成为未来几年有望推动韩国经济发展的新支柱。

2022年7月,GODI成为印度首家获得印度标准局(BIS)认证的21,700个圆柱形NMC811 3.65V-4.5Ah锂离子电池的公司。该公司计划在 2024 年成立一座锂离子电池製造厂。新认证的电池预计将满足印度电动车和储能係统产业的需求。因此,预计此类即将到来的投资将在预测期内推动印度电池市场的成长。

因此,由于上述因素,预计亚太地区在预测期内将显着增长。

电池产业概况

全球电池市场呈现细分化趋势。该市场的主要企业(不分先后顺序)包括 LG 化学有限公司、宁德时代新能源科技股份有限公司、比亚迪股份有限公司、GS 汤浅株式会社和松下株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 按类型

- 棱镜类型

- 圆柱形

- 小袋

- 按应用

- 汽车电池(HEV、PHEV、EV)

- 工业电池(动力、固定(电信、UPS、能源储存系统(ESS) 等))

- 可携式电池(家用电子电器产品等)

- 电动工具电池

- SLI 电池

- 其他的

- 按地区

- 北美洲

- 亚太地区

- 欧洲

- 中东和非洲

- 南美洲

第六章竞争格局

- 併购、合作与合资

- 主要企业策略

- 公司简介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc.

- EnerSys

- GS Yuasa Corporation

- Shenzhen ACE Battery Co. Ltd

- LG Energy Solution Ltd

- Panasonic Corporation

第七章 市场机会与未来趋势

The Battery Cell Market is expected to register a CAGR of greater than 14.32% during the forecast period.

Although the market studied was affected by the COVID-19 pandemic in 2020, it recovered and reached pre-pandemic levels. The growing demand for battery cells is expected to boost the market's growth during the forecast period. The rapid adoption of electric vehicles, mainly fostered by the declining price of lithium-ion batteries, is also expected to drive the growth of the market studied. However, the lack of direct access to battery metals is restraining the market's growth. With technological advancements, the price of smart gadgets is expected to decline, making them more affordable to the public, which is expected to provide growth opportunities during the forecast period.

Asia-Pacific dominates the market and is expected to witness the highest CAGR during the forecast period. The majority of the demand comes from countries like China and India.

Battery Cell Market Trends

Prismatic Cell Segment is Expected to Dominate the Market

Prismatic cells are a type of battery cell in the battery industry that were introduced in the early 1990s. The modern prismatic cell fulfills the demand for thinner sizes and comes wrapped in elegant packages like a box of chewing gum or a small chocolate bar. The prismatic cells make optimal use of space by using the layered approach. Other designs are wound and flattened into a pseudo-prismatic jelly roll. These cells are mostly found in cell phones, tablets, and low-profile laptops ranging from 800 mAh to 4,000 mAh.

Prismatic cells are also available in large formats packaged in welded aluminum housings and deliver capacities of 20-50 Ah. These are primarily used in energy storage systems and for electric powertrains in hybrid and electric vehicles. Hence, the larger size of the prismatic cells makes them bad candidates for smaller devices like e-bikes and cellphones. Lithium prismatic cells are the preferred technology for material handling equipment (MHE), as the technology provides the best ratio of power and energy per volume unit. Therefore, these battery cell types are better suited for energy-intensive applications.

These battery cell types have gained popularity due to their large capacity and prismatic shape, making it easy to connect four cells and create a 12V battery pack, providing improved space utilization and allowing flexible design. It has the highest Ah nominal capacity and kWh energy and a higher overall battery energy density than other cells. These battery cells are not subject to swelling. Such advantages over other battery cell types make it preferable to the end users. However, it can be more expensive to manufacture, less efficient in thermal management, and have a shorter cycle life than the cylindrical design.

In January 2022, South Korean battery major LG Energy Solution Ltd planned to add a prismatic cell type to its lithium-ion battery lineup. The company revealed that it could add the prismatic form to its portfolio to broaden its customer base. The company's local competitors like Samsung SDI and SK On are moving onto prismatic cells with lithium-iron-phosphate (LFP), currently led by China's CATL, as top EV makers Tesla and Volkswagen adopted prismatic type earlier in 2021.

Korean players, both Samsung SDI and SK On, turned attention to rectangular packaging after Volkswagen decided that up to 80% of its electric vehicles would use prismatic batteries by 2030. In July 2022, Volkswagen Group announced the setup of its first battery cell factory in Salzgitter, Germany. It unveiled the prismatic unified cell would be used in up to 80% of its models. The plant is expected to start production by 2025, and the new cell plant, nicknamed SalzGiga, is expected to reach an annual capacity of 40 GWh, enough for about 500,000 electric vehicles.

Hence, due to the above-mentioned factors, the prismatic cell segment is expected to witness significant growth during the forecast period.

Asia Pacific is Expected to Witness Significant Growth

Asia-Pacific is the biggest manufacturer and exporter of consumer electronics, mainly dominated by China due to its large production capabilities. The region is expected to dominate the consumer electronics manufacturing sector during the forecast period. Hence, the Asia-Pacific battery market is expected to benefit from the growth of the consumer electronics sector.

China is one of the leading countries in the world that manufacture and utilizes batteries in a wide range of applications. In 2020, China manufactured 76% of the global lithium-ion battery and 44% of the global electric vehicles. The country is a hub of the electronic sector, i.e., nearly 48.4% of the total mobile phone export was from China in 2021, making China a significant market player in the battery cell industry.

South Korea is a major consumer of cylindrical and prismatic cells, primarily used in consumer electronics, household items, and electric vehicle batteries. Amid concerns about an anticipated slowdown in South Korean semiconductor exports in recent years, batteries for electric vehicles are emerging as a new pillar, which is expected to propel the country's economy in the coming years.

In July 2022, GODI became the first company in India to receive Bureau of Indian Standard (BIS) certification for its 21700 cylindrical NMC811 3.65V-4.5Ah lithium-ion cells. The company aims to set up a lithium-ion cell manufacturing factory by 2024. The newly certified cells are likely to cater to the needs of the EV and ESS sectors in India. Thus, such upcoming investments are expected to drive the battery cell market's growth in India during the forecast period.

Hence, due to the above-mentioned factors, the Asia-Pacific segment is expected to witness significant growth during the forecast period.

Battery Cell Industry Overview

The global battery cell market is fragmented. Some key players in this market (in no particular order) include LG Chem Ltd, Contemporary Amperex Technology Co. Limited, BYD Company Limited, GS Yuasa Corporation, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Prismatic

- 5.1.2 Cylindrical

- 5.1.3 Pouch

- 5.2 By Application

- 5.2.1 Automotive Batteries (HEV, PHEV, EV)

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics etc.)

- 5.2.4 Power Tools Batteries

- 5.2.5 SLI Batteries

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 Middle East and Africa

- 5.3.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Collaborations, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc.

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Shenzhen ACE Battery Co. Ltd

- 6.3.7 LG Energy Solution Ltd

- 6.3.8 Panasonic Corporation