|

市场调查报告书

商品编码

1692528

射频和微波二极体:市场占有率分析、行业趋势和成长预测(2025-2030 年)RF And Microwave Diodes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

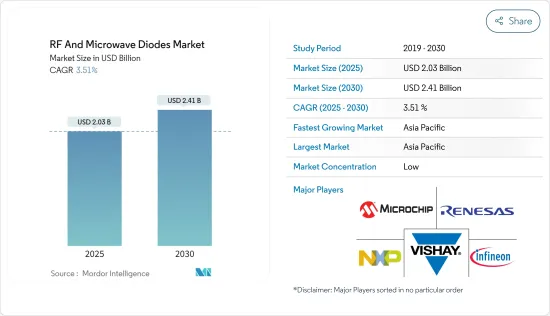

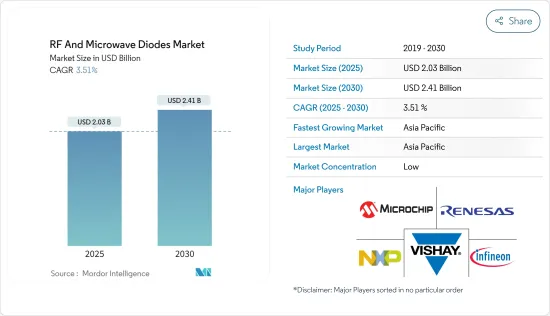

预计到 2025 年射频和微波二极体市场规模将达到 20.3 亿美元,到 2030 年将达到 24.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.51%。

关键亮点

- 射频和微波二极体是专门用于管理无线电和微波频段高频讯号的电子元件。这些二极体在整流、调变、混合和切换射频和微波讯号方面发挥着至关重要的作用。它的存在对于各种电子系统和电路的开发至关重要,使得能够在各种通讯平台上传输和接收讯号。它以其性能、最小噪音和快速切换能力而闻名。射频和微波二极体对于需要高效讯号处理和放大的应用至关重要。

- 此外,射频和微波二极体是各种应用中必不可少的组件,包括雷达系统、卫星通讯、无线网路和电子战。本市场概览对射频和微波二极体市场进行了全面分析,涵盖了其重要性、关键发现、市场趋势、区域细分、竞争格局、细分和未来展望。

- 此外,由于对无线通讯技术的需求不断增加以及通讯领域的进步,射频和微波二极体市场正在经历强劲成长。据爱立信称,到 2023 年,北美将成为 5G 固定无线接入 (FWA) 部署的前沿,届时 70% 的供应商将提供该技术。

- 此外,北美的所有供应商都提供某种形式的固定无线存取 (FWA)。 FWA 连线使用行动技术在两个固定点之间提供宽频连线。因此,5G FWA被认为是快速提供家庭网路连线的有效解决方案。因此,市场对 FWA 的采用率显着提高,促进了市场成长。无线通讯技术需求的激增正在推动射频和微波二极体市场的成长。通讯领域的进步为市场扩张带来了新的机会。

- 射频和微波二极体製造商依赖硅、砷化镓以及金属和化学品混合物等原料。这些原物料价格的波动直接影响生产成本,进而影响製造商的盈利,形成价格动态。此外,射频和微波二极体的定价根据产品特性和客户要求而略有不同。

- 2022-2023年将是新冠疫情后全球家用电子电器市场关键而又充满挑战的时期。尤其是乌克兰衝突和通货膨胀飙升的影响,严重打击了全球消费者的信心。此外,作为主要销售基地的中国在 2022 年春季受到封锁的打击,导致销售进一步放缓。这些挫折凸显了一个更广泛的问题:产品生命週期的成熟。

射频和微波二极体市场趋势

汽车领域的需求不断增长

- 离散半导体在汽车产业中被广泛使用,尤其是汽车内部的电子系统。各种分离式功率元件(例如 RF 和微波二极体)在从 ADAS 到汽车娱乐系统的众多汽车应用中发挥关键作用。

- 离散半导体通常用于汽车领域,尤其是汽车内部的电子系统。从 ADAS 到汽车娱乐系统等许多汽车应用中,各种分离式功率元件(例如 RF 和微波二极体)都不可或缺。

- 在汽车电子领域,射频和微波二极体透过将电流引导至特定方向发挥至关重要的作用。由硅或锗等半导体材料製成的二极体含有PN结,具有整流、讯号调变、讯号检测、稳压、发光等多种功能。二极体独特的导电性能使其成为电源保护和电子电路中必不可少的元件。随着汽车领域电子元件的使用不断增加,对二极体的需求预计将大幅增加。

- 根据国际能源总署预测,2023年全球将註册近1,400万辆新电动车,使道路上行驶的电动车总数达到4,000万辆。这与 2023 年版《全球电动车展望》(GEVO 至 2023 年)的销售预测大致一致。 2023年电动车销量预计将较去年与前一年同期比较大幅成长35%,达到350万辆。到2023年,电动车将占汽车总销量的18%左右,高于前一年的14%和2018年的2%。这些趋势显示电动车市场正在稳步成长。预计这种成长将创造进一步的市场需求。

- 随着新应用的出现,半导体在汽车产业的应用预计将会成长。半导体技术在汽车设计中发挥关键作用,目前汽车设计包括广泛的远端资讯处理和资讯娱乐功能。这种转变使汽车变成了移动热点,为驾驶员提供各种信息,包括防撞和可用的停车位。消费者对非豪华汽车中豪华车功能的需求不断增加,推动了全球对射频和微波二极体的需求。

亚太地区实现强劲成长

- 由于都市化加快、可支配收入增加以及医疗保健条件改善,亚太地区为射频二极体市场提供了良好的成长机会。进入市场强调产品客製化、建立策略伙伴关係和投资研发。

- 受汽车和家用电子电器领域通讯服务日益普及的推动,亚太市场正经历强劲成长。这一快速增长是由该地区庞大的人口、不断增长的可支配收入和快速的都市化所推动的,从而刺激了对射频二极管产品和服务的需求增加。

- 此外,在亚太地区,对于很大一部分人口来说,行动连线被视为网路存取的主要方式,尤其是唯一的选择。根据国际电信联盟预测,到2023年,全球行动宽频用户数量预计将达到70.3亿,高于2007年的2.68亿。值得注意的是,亚太地区在行动宽频用户数量方面处于市场领先地位,到2022年,行动宽频用户数量将超过39亿。

- 此外,中国、韩国、印度和新加坡等亚太国家对消费性电子产品的需求不断增长,促使许多公司在该地区建立製造工厂。丰富的原材料和具有成本效益的推出和人事费用使得企业可以轻鬆地在该地区进行生产。此外,汽车产业正在快速成长。

- 随着5G技术的普及,预计亚太地区5G技术的采用将会增加。根据GSMA预测,到2025年,中国的5G行动连线数将位居世界第一,达到10亿个,其次是日本,5G连线数将达到1.29亿个。

- 随着中国、韩国、印度和新加坡等亚太国家对消费性电子产品的需求不断增加,许多公司正在该地区建立製造工厂。丰富的原材料、低廉的推出和人事费用使得该地区成为企业进行生产的有利地点。

射频和微波二极体产业概况

射频和微波二极体市场竞争激烈,全球有许多大大小小的参与企业。领先的公司致力于产品创新、合作、合併和收购,以保持领先地位。该市场的主要企业包括微晶片科技、英飞凌科技和恩智浦半导体。

- 2024 年 6 月,Nexperia 推出了一款新型 650 V、10 A 碳化硅 (SiC) 萧特基二极体 (PSC1065H-Q),该二极体符合汽车标准,并采用 R2P (Real-Two-Pin) DPAK 封装。此二极体适用于各种汽车应用,包括电动车 (EV),可满足开关电源、AC-DC 和 DC-DC 转换器、电池充电基础设施、马达驱动器、不断电系统和太阳能逆变器等严苛的高电压、大电流环境的挑战。

- 2024年2月,东芝公司推出整合高速RF二极体的DTMOSVI(HSD)功率MOSFET。这些 MOSFET 专为开关电源而设计,适用于资料中心和光伏电源调节器。此次发布宣布了东芝公司 DTMOSVI 系列的最新创新,该系列以其超级结结构而闻名。初始产品名称为“TK042N65Z5”和“TK095N65Z5”。它们是采用 TO-247 封装的 650V N 通道功率 MOSFET,计划很快开始发货。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 宏观经济因素如何影响市场

第五章市场动态

- 市场驱动因素

- 各行各业对先进、复杂电子设备的需求不断增长

- 无线通讯设备需求不断成长

- 市场问题

- 影响零件生产的原物料价格波动

第六章市场区隔

- 按类型

- PIN二极体

- 肖特基二极体

- 调谐变容二极体

- 耿氏二极体

- 隧道二极体

- 齐纳二极体

- 其他二极体

- 按最终用户产业

- 车

- 家用电子电器

- 通讯

- 製造业

- 医疗保健

- 航太与国防

- 其他终端用户产业(电力、石油和天然气等)

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Microchip Technology Inc.

- Infineon Technologies AG

- Diodes Incorporated

- MACOM Technology Solutions Holdings Inc.

- Nexperia Holding BV(Wingtech Technology Co. Ltd)

- Onsemi(Semiconductor Components Industries LLC)

- ROHM Co. Ltd

- Vishay Intertechnology Inc.

- Toshiba Corporation

- Renesas Electronics Corporation

- STMicroelectronics NV

- Panjit International Inc.

- Good-Ark Semiconductor

第八章投资分析

第九章:未来趋势

The RF And Microwave Diodes Market size is estimated at USD 2.03 billion in 2025, and is expected to reach USD 2.41 billion by 2030, at a CAGR of 3.51% during the forecast period (2025-2030).

Key Highlights

- RF and microwave diodes are electronic components specifically created to manage high-frequency signals within the radio and microwave frequency spectrums. These diodes play important roles in rectifying, modulating, mixing, and switching RF and microwave signals. Their presence is vital in the development of diverse electronic systems and circuits, allowing for the transmission and reception of signals across various communication platforms. It is known for its performance, minimal noise, and rapid switching abilities. RF and microwave diodes are indispensable in applications that demand effective signal processing and amplification.

- Additionally, RF and microwave diodes are essential components in a variety of applications, including radar systems, satellite communications, wireless networks, and electronic warfare. This market overview offers a thorough analysis of the RF and microwave diodes market, covering its significance, important findings, market trends, regional breakdown, competitive landscape, segmentation, and future prospects.

- Further, the RF and microwave diodes market is experiencing strong growth due to the rising need for wireless communication technologies and advancements in the telecommunications sector. According to Ericsson, North America has been at the forefront of 5G fixed wireless access (FWA) adoption in 2023, with 70% of providers offering the technology.

- Furthermore, all providers in North America have implemented some form of fixed wireless access (FWA). FWA connections utilize mobile technology to deliver broadband connectivity between two fixed points. Therefore, 5G FWA is considered to be an efficient solution for quickly providing home internet access. As a result, there has been a significant adoption of FWA in the market, which is contributing to market growth. The surge in demand for wireless communication technologies is fueling growth in the RF and microwave diodes market. Advancements in the telecommunications sector are opening up new opportunities for market expansion.

- Manufacturers of RF and microwave diodes rely on raw materials like silicon, gallium arsenide, and a mix of metals and chemicals. Price shifts in these materials directly affect production costs and, consequently, the profitability of these manufacturers, shaping the pricing dynamics. Moreover, the pricing of RF and microwave diodes is further nuanced by distinct product attributes and customer demands.

- Time period 2022 and 2023 was observed to be a pivotal and challenging duration for the global consumer electronics market post-COVID-19. The market faced a confluence of challenges, notably the repercussions of the Ukraine conflict and soaring inflation, which significantly dampened consumer sentiment worldwide. Adding to the woes, China, a key sales hub, grappled with lockdowns in the spring of 2022, further denting sales. These setbacks underscored a broader issue: the maturing product life cycle, which was a primary driver of the declining demand.

RF & Microwave Diodes Market Trends

Growing Demand in Automotive Sector

- Discrete semiconductors are commonly utilized in the automotive industry, particularly in electronic systems within vehicles. Various discrete power devices, like RF and Microwave diodes, play a crucial role in numerous automotive applications, from ADAS to in-vehicle entertainment systems.

- Discrete semiconductors are often used in the automotive sector, especially in electronic systems found in vehicles. Various discrete power devices, such as RF and microwave diodes, are essential in many automotive applications ranging from ADAS to in-vehicle entertainment systems.

- In automotive electronics, RF and Microwave diodes play an important role by allowing current to flow in a specific direction. Made of semiconductor materials such as silicon or germanium, diodes have a PN junction and serve multiple functions like rectification, signal modulation, signal detection, voltage stabilization, and light emission. The unique conductive properties of diodes make them essential for power protection and electronic circuits. With the growing use of electronic components in the automotive sector, the need for diodes is expected to rise significantly.

- As per the IEA, nearly 14 million new electric cars were registered globally in 2023, bringing the total number of electric cars on the roads to 40 million. This closely aligns with the sales forecast from the 2023 edition of the Global EV Outlook (GEVO-2023). Sales of electric cars in 2023 saw a significant rise of 3.5 million compared to the previous year, marking a 35% year-on-year growth. Electric cars comprised approximately 18% of all car sales in 2023, up from 14% in the last year to just 2% in 2018. These trends suggest that the electric car market is growing steadily. This growth is expected to create more demand in the market.

- The automotive industry is anticipated to see a growth in the use of semiconductors as new applications emerge. Semiconductor technology plays a significant role in vehicle designs, with cars now incorporating various telematics and infotainment features. This transformation has turned cars into mobile hotspots, providing drivers with information on various aspects, such as collision avoidance and available parking spots. The rising consumer demand for luxury car features in non-luxury cars has increased global demand for RF and microwave diodes.

Asia Pacific to Register Major Growth

- The Asia-Pacific region offers promising growth opportunities for the RF Diodes market, which is driven by rapid urbanization, increasing disposable incomes, and improved healthcare access. Market expansion efforts emphasize product customization, forming strategic partnerships, and investing in research and development.

- The Asia-Pacific market is witnessing robust growth, driven by the rising adoption of communication services in the automotive and consumer electronics sectors. This surge is buoyed by the region's sizable population, escalating disposable incomes, and rapid urbanization, fueling a heightened demand for RF diode products and services.

- Additionally, in the Asia Pacific region, mobile connectivity is considered the primary form of internet access, especially since it is the only option for most of the population. According to the ITU, the global number of mobile broadband subscriptions has significantly increased from 268 million in 2007 to an estimated 7.03 billion in 2023. It is worth noting that the Asia-Pacific region is leading the market with the highest number of mobile broadband subscriptions, surpassing 3.9 billion subscriptions as of 2022.

- Moreover, the growing demand for consumer electronics in Asia Pacific nations like China, the Republic of Korea, India, and Singapore has motivated many companies to establish regional manufacturing facilities. The availability of abundant raw materials and cost-effective start-up and labor expenses are facilitating businesses in setting up production hubs in the area. Additionally, there is notable growth in the automotive industry.

- The adoption of 5G technology is expected to increase in the Asia-Pacific region as the technology becomes more widely available. According to GSMA, China is projected to have the largest number of 5G mobile connections by 2025, with 1 billion connections, while Japan is expected to have 129 million 5G connections.

- The Asia-Pacific countries, including China, the Republic of Korea, India, and Singapore, are experiencing an increasing demand for consumer electronics, prompting many companies to establish manufacturing facilities in the region. The availability of abundant raw materials and affordable start-up and labor expenses are facilitating businesses in setting up production centers in the area.

RF & Microwave Diodes Industry Overview

The RF and Microwave Diodes Market is highly competitive, owing to the presence of various small and large players across the globe. Major players are involved in product innovation, partnerships, mergers, and acquisitions, among others, to have a competitive edge over others. Some prominent players in the market include Microchip Technology, Infineon Technologies, NXP Semiconductors, etc.

- June 2024: Nexperia launched its new 650 V, 10 A silicon carbide (SiC) Schottky diode (PSC1065H-Q) that is automotive-qualified and available in real-two-pin (R2P) DPAK packaging. This diode is suitable for a variety of applications in electric vehicles (EVs) and other automobiles, addressing the challenges of demanding high voltage and high current environments such as switched-mode power supplies, AC-DC and DC-DC converters, battery charging infrastructure, motor drives, uninterruptible power supplies, and photovoltaic inverters.

- February 2024: Toshiba introduced the DTMOSVI (HSD) power MOSFETs, which feature high-speed RF diodes. These MOSFETs were designed for switching power supplies and intended for use in data centers and photovoltaic power conditioners. This release showcases the latest innovation in Toshiba's DTMOSVI series, known for its super junction structure. The initial products, named "TK042N65Z5" and "TK095N65Z5," are 650V N-channel power MOSFETs in TO-247 packages and will be available for shipment soon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products and Services

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Advanced and Complex Electronic Devices in Multiple Industries

- 5.1.2 Increasing Demand for Wireless Communication Devices

- 5.2 Market Challenges

- 5.2.1 Volatile Prices of Raw Materials Impacting Component Production

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PIN Diodes

- 6.1.2 Schottky Diodes

- 6.1.3 Tuning Varactor Diodes

- 6.1.4 Gunn Diodes

- 6.1.5 Tunnel Diodes

- 6.1.6 Zener Diodes

- 6.1.7 Other Diodes

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communications

- 6.2.4 Manufacturing

- 6.2.5 Medical

- 6.2.6 Aerospace and Defense

- 6.2.7 Other End-user Industries (Power Utilities, Oil and Gas, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microchip Technology Inc.

- 7.1.2 Infineon Technologies AG

- 7.1.3 Diodes Incorporated

- 7.1.4 MACOM Technology Solutions Holdings Inc.

- 7.1.5 Nexperia Holding BV (Wingtech Technology Co. Ltd)

- 7.1.6 Onsemi (Semiconductor Components Industries LLC)

- 7.1.7 ROHM Co. Ltd

- 7.1.8 Vishay Intertechnology Inc.

- 7.1.9 Toshiba Corporation

- 7.1.10 Renesas Electronics Corporation

- 7.1.11 STMicroelectronics NV

- 7.1.12 Panjit International Inc.

- 7.1.13 Good-Ark Semiconductor