|

市场调查报告书

商品编码

1692532

电源供应器 (PSU) - 市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Power Supply Units (PSU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

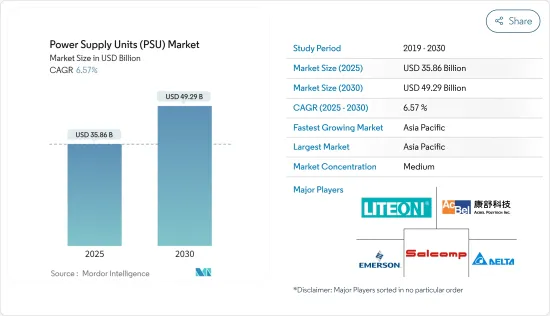

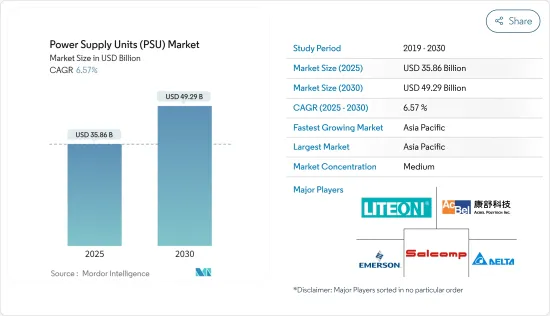

电源装置市场规模预计在 2025 年为 358.6 亿美元,预计到 2030 年将达到 492.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.57%。

由于智慧家居系统和大楼自动化系统的普及,该市场正在经历显着的成长。家用电子电器、医疗、军事和航太等各行业对电源的高需求正在为市场创造商机。

关键亮点

- 电源装置是向电气负载供电的电气设备。电源装置的主要目的是将来自电源的电流转换为驱动负载所需的适当电压、电流和频率。因此,电源装置有时被称为电源转换器。有些电源装置是独立装置,而有些则是其供电负载的组成部分。多年来,电源技术的进步带来了许多好处。精密的电路和元件可以使电源装置提供稳定的电压输出,同时最大限度地减少能源浪费。

- 纵观历史,人类一直利用太阳能、风能和水能作为能源来源。然而,随着技术的进步,这些古老的能源形式演变成先进的发电来源。同时,电源设备正逐年变得越来越受欢迎,因为它们在为电气负载提供能源以供消耗和运作方面发挥着至关重要的作用。各行各业和工业设备对电源的需求不断增长,预计将进一步推动这一需求。

- 电源装置的主要目的是将来自电源的电流转换为操作负载所需的适当电压、电流和频率。这种转换可以涉及将交流电转换为直流电或将直流电转换为直流电。因此,电源装置通常被称为电源转换器。电源装置的主要功能是监控和调节电流和电压,以便向负载输送正确的能量。有些电源装置内建于电器产品中,而其他电源装置则单独安装,以防止电器产品出现电气故障。

- 大多数可供购买的电子设备必须符合 EMC 和 EMI(电磁相容性和电磁干扰)规定。这些规定确保设备不会干扰其他设备的运行,并且外部电噪声不会干扰经过认证的设备的正常运行。直流电源装置必须经过认证并符合法规要求。如果不这样做,可能会导致这些电源设备的销售下降。

- 家用电子电器和汽车领域对电源的需求显着增长,这主要是由于电动车的兴起。预计对自动化技术日益增长的需求将进一步推动市场的发展。

电源供应器(PSU)市场趋势

消费行动市场将强劲成长

- 智慧型手錶、健身追踪器等穿戴式装置的日益普及,推动了对紧凑、高效电源解决方案的需求。这些设备需要节能组件来延长电池寿命并实现不间断使用,从而推动了对各种电源的需求。

- AC-DC 电源广泛应用于各种电子设备,包括电脑、行动电话(包括壁式充电器)和电视。这些电源装置广泛应用于各种环境和条件下,其中家用电子电器产品是一个突出的实施领域。由于家用电子电器的使用范围不断扩大,预计对电源装置的需求将进一步增加。

- 智慧型手机和平板设备依靠稳定的电源进行充电,它们使用直流电来确保这些设备获得稳定的能源供应,而不会出现可能损害其精密内部组件的波动。这是因为行动电话电池储存的是直流电,比交流电更容易储存。由于外部电源通常是交流电,因此必须使用整流器将交流电转换为直流电,然后才能为行动电话或其他便携式设备充电。随着对此类转换能力的需求增加,市场机会预计将会扩大。

- 据 GSMA 称,亚太地区、拉丁美洲和撒哈拉以南非洲地区的智慧型手机普及率预计将最高。智慧型手机的平均售价正在下降,各种措施正在成功推动其普及。到2030年,智慧型手机连线数预计将达到90亿,占总连线数的92%。网路普及率的提高、智慧型手机供应商的行销活动以及社交媒体用户数量的增加预计将推动智慧型手机的销售,从而导致对电源设备的需求大幅增加。

亚太地区:预计大幅成长

- 由于中国、印度和韩国等重要国家的存在,亚太地区是市场成长最大的地区之一。工业信部表示,随着技术创新和品牌建立能力的增强,我国家用电子电器产品产销售量稳居世界领先地位。增加对该地区的投资以提高消费性电子产品的生产能力有望帮助市场获得发展动力。

- 同样,5G网路和物联网(IoT)等技术进步也在推动电子产品的快速普及。旨在彻底改变电子产业的「数位印度」和「智慧城市」计划等措施进一步推动了电子市场对物联网的需求。这些努力是推动市场成长的因素之一。

- 该地区是知名医疗设备製造商生产和采购医疗设备的理想之地。市场成长的动力来自于定期体检的日益普及和医疗设备技术的进步。亚太地区许多国家正在投资医疗设备市场,这可能会增加对 AC/DC 转换器的需求。

- 例如,根据印度政府预测,到2025年,印度医疗设备市场规模将达到500亿美元。由于投资增加,该领域正在稳步增长。为了进一步鼓励国内生产,政府推出了与生产挂钩的激励计划,为医疗设备提供价值 4 亿美元的财政奖励。因此,许多公司正在大力投资增强医疗设备的生产能力,包括具有短路保护和过热保护等先进保护功能的 AC/DC 转换器。

电源供应器(PSU)市场概览

电源装置市场是半固体的,主要参与者包括台达电子公司、艾默生电气公司、光宝科技公司、康舒科技公司和 Salcomp PLC。该市场的参与企业正在采取合作和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2023 年 10 月,Ryton 宣布将在其更新的产品组合中增加用于电动车 (EV) 的 3 级直流快速充电器。这些电动车充电器具有多个电压输入,可轻鬆与现有电气框架集成,使客户能够快速部署产品,同时避免额外的框架和安装成本。这些充电器可以调整到美国控制传输基座上的任何输入电压设置,而无需衍生基座控制。

- 2023 年 7 月,AcBel Polytech Inc. 收购了 ABB 电力转换部门 100% 的股份。透过此次收购,该公司旨在扩展其最尖端科技创造和系统解决方案专业知识,为其众多关键业务部门的客户带来强劲的成长机会。此外,此次收购还将使 AcBel 扩大其在美国的基本客群、增强其本地服务能力并扩展其全球製造设施网路。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 工业供应链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章市场动态

- 市场驱动因素

- 家庭和大楼自动化系统的采用日益增多

- 节能设备的需求不断增加

- 市场限制

- 严格的法规遵循和安全标准

第六章市场区隔

- 依设备类型

- AC-DC电源

- DC-DC转换器

- 按最终用户产业

- 通讯

- 工业的

- 消费/移动

- 车

- 运输

- 照明

- 其他的

- 按地区

- 美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 中东和非洲

第七章竞争格局

- 公司简介

- Delta Electronics Inc.

- Emerson Electric Co.

- Lite-On Technology Corporation

- Acbel Polytech Inc.

- Salcomp PLC

- Mean Well Enterprises Co. Ltd

- Siemens AG

- Murata Manufacturing Co. Ltd

- TDK-Lambda Corporation(TDK Corporation)

第八章投资分析

第九章:市场的未来

The Power Supply Units Market size is estimated at USD 35.86 billion in 2025, and is expected to reach USD 49.29 billion by 2030, at a CAGR of 6.57% during the forecast period (2025-2030).

The market has experienced significant growth due to the increasing popularity of home and building automation systems. There is a high demand for power supply in various industries, such as consumer electronics, medical & healthcare, and military & aerospace, which presents a profitable opportunity for the market.

Key Highlights

- A power supply is an electrical apparatus that delivers electric power to an electrical load. The primary objective of a power supply is to transform electric current from a source into the appropriate voltage, current, and frequency required to energize the load. Consequently, power supplies are occasionally denoted as electric power converters. Certain power supplies are independent units, whereas others are integrated into the load appliances they energize. The progressions in power supply technology throughout the years have yielded numerous benefits. Through the utilization of sophisticated circuitry and components, power supplies can furnish a steady voltage output while minimizing energy wastage.

- Throughout history, humans have been utilizing the sun, wind, and water as sources of energy. However, with the advancements in technology, these ancient energy forms have evolved into advanced power generation sources. In line with this, power supply devices become increasingly popular over the years, as they play a crucial role in providing energy to electric loads for consumption and operation. The growing demand for power supply in various industries and industrial equipment is anticipated to boost its demand further.

- The primary purpose of a power supply is to transform electric current from a source into the appropriate voltage, current, and frequency required to operate the load. This conversion may involve either changing AC to DC or DC to DC. As a result, power supplies are often referred to as electric power converters. The primary function of a power supply is to monitor and adjust the current and voltage of electrical power to ensure that the correct amount of energy is delivered to the load. While some power supplies are integrated into electrical appliances, others are installed separately to prevent any electrical malfunctions in the appliances.

- The majority of electronic devices available for purchase must adhere to EMC and EMI (electromagnetic compatibility and electromagnetic interference) regulations. These regulations ensure that the devices do not interfere with the operation of other equipment and that external electrical noise does not hinder the proper functioning of certified equipment. DC power supplies must undergo certification and comply with regulatory requirements. Failure to do so may result in declining sales of these power supplies.

- There has been a noticeable increase in demand for power supply devices in consumer electronics and automotive sectors, largely due to the growing adoption of electric vehicles. The rising demand for automation technologies is expected to propel the market further.

Power Supply Units (PSU) Market Trends

Consumer and Mobile Segment to Witness Major Growth

- The increasing popularity of wearable devices such as smartwatches, fitness trackers, and other devices is fueling demand for compact and efficient power supply solutions. These devices need power-efficient components to enhance battery life and enable uninterrupted usage, driving demand for various power supply devices.

- AC-DC power supplies are extensively used in various electronic devices such as computers, cell phones (e.g., wall chargers), and televisions. These power supplies are widely employed in diverse settings and conditions, with consumer electronics being a prominent implementation domain. The growing use of consumer electronic devices is anticipated to drive the need for power supply devices further.

- Smartphones and tablet devices rely on a stable power source for charging and use DC power supplies to ensure these gadgets receive a consistent energy supply without any fluctuations that could potentially harm their sensitive internal components. This is because cell phone batteries store DC power, which is easier to store compared to AC power. As the external power supply is typically AC, the conversion of AC to DC using a rectifier is necessary before charging cell phones or other portable devices. This expected enhancement in the market opportunities is due to the increasing demand for such conversion capabilities.

- According to GSMA, the Asia-Pacific, Latin America, and Sub-Saharan Africa are expected to experience the largest surge in smartphone adoption due to the growing affordability of these devices. The average selling prices of smartphones are decreasing, and various initiatives are proving successful in driving uptake. It is projected that by 2030, there will be 9 billion smartphone connections, which will account for 92% of total connections. The increasing Internet penetration, marketing activities by smartphone vendors, and increasing subscriptions in social media are expected to boost smartphone sales, leading to a significant increase in demand for power supplies.

Asia-Pacific Projected to Witness Significant Growth

- Asia-Pacific is one of the largest regions in terms of the growth of the market, with the presence of significant countries like China, India, South Korea, etc. According to the Ministry of Industry and Information Technology, China has secured the top position worldwide in the production and sales of consumer electronics through its enhanced innovation and brand-building capacity. With the increasing investments in the region to enhance its consumer electronics production capabilities, the market is expected to gain traction.

- Similarly, technological advancements such as the implementation of 5G networks and the Internet of Things (IoT) are propelling the rapid adoption of electronic products. Initiatives such as 'Digital India' and 'Smart City' projects, which are set to revolutionize the electronic products industry, are further boosting the demand for IoT in the electronics devices market. Such initiatives are some of the factors driving the market's growth.

- The region is ideal for prominent medical device manufacturers to produce and procure medical devices. The market's growth is attributed to the rising adoption of routine healthcare check-ups and medical device technology advancements. Many countries in Asia-Pacific are investing in the medical devices market, which is likely to augment the AC/DC converters demand.

- For instance, according to the Government of India, the Indian medical devices market is projected to reach USD 50 billion by 2025. This sector has been experiencing steady growth due to increased investments. To further promote domestic production, the government has introduced the Production Linked Incentive Schemes, offering financial incentives worth USD 400 million for medical devices. Consequently, numerous companies are making substantial investments to enhance the production capabilities of healthcare equipment, including AC/DC converters with advanced protection features like short-circuit and over-temperature protection.

Power Supply Units (PSU) Market Overview

The power supply devices market is semi-consolidated with the presence of major players like Delta Electronics Inc., Emerson Electric Co., LITE-ON Technology Corporation, Acbel Polytech Inc., and Salcomp PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023: LITEON announced its latest portfolio addition, a Level 3 Electric Vehicle (EV) DC fast charger. These EV chargers effortlessly coordinate with the existing electrical framework due to their multi-voltage input, which empowers clients to rapidly introduce the item while dodging extra framework and establishment costs. These can be coordinates in any input voltage setup found in the US control conveyance foundation without deriving from the base control obtained.

- July 2023: AcBel Polytech Inc. acquired a 100% stake in ABB Ltd's Power Conversion division. Through this acquisition, the company aims to create cutting-edge technology and expand its expertise in system solutions designed to fuel strong growth opportunities for customers in many of its core business sectors. Moreover, it will allow AcBel to grow its customer base in the United States, strengthen its local service capabilities, and extend its network of global manufacturing facilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Home and Building Automation Systems

- 5.1.2 Increasing Demand for Energy-efficient Devices

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Compliance and Safety Standards

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 AC-DC Power Supplies

- 6.1.2 DC-DC Converters

- 6.2 By End-user Industry

- 6.2.1 Communication

- 6.2.2 Industrial

- 6.2.3 Consumer and Mobile

- 6.2.4 Automotive

- 6.2.5 Transportation

- 6.2.6 Lighting

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delta Electronics Inc.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Lite-On Technology Corporation

- 7.1.4 Acbel Polytech Inc.

- 7.1.5 Salcomp PLC

- 7.1.6 Mean Well Enterprises Co. Ltd

- 7.1.7 Siemens AG

- 7.1.8 Murata Manufacturing Co. Ltd

- 7.1.9 TDK-Lambda Corporation (TDK Corporation)