|

市场调查报告书

商品编码

1692582

亚太地区汽车黏合剂和密封剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Asia-Pacific Automotive Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

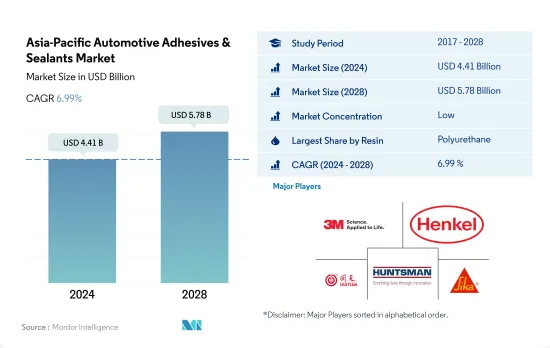

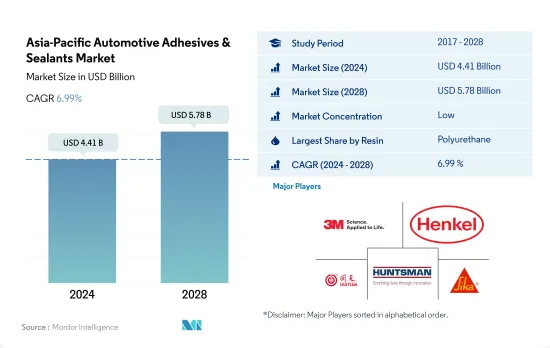

预计 2024 年亚太地区汽车黏合剂和密封剂市场规模将达到 44.1 亿美元,预计到 2028 年将达到 57.8 亿美元,预测期内(2024-2028 年)的复合年增长率为 6.99%。

汽车产业采用永续性概念和增加电动车产量将推动市场需求

- 聚氨酯树脂占据亚太地区汽车黏合剂和密封剂市场的最大份额。由于聚氨酯接着剂在北美拥有众多生产设施,其使用范围高于其他树脂。 2017年至2019年,受汽车产量下降影响,消费成长下降约-5%。新冠疫情之后,消费成长率与前一年同期比较%。预计聚氨酯接着剂在 2022-2028 年预测期内的复合年增长率将达到 4.5%。

- 环氧胶黏剂和丙烯酸胶黏剂在亚太汽车胶黏剂市场也占有重要地位。然而,用于製造环氧胶黏剂的原料本质上是危险的,因此受到 AICS、PICCS、IECSC 和 NZIoC 等地方政府机构的监管。环氧树脂胶黏剂是第二大消费材料,预计在 2022-2028 年预测期内复合年增长率约为 4.2%。继环氧胶黏剂领域之后,丙烯酸胶黏剂领域预计在 2022-2028 年预测期内以约 4.5% 的复合年增长率成长。

- 氰基丙烯酸酯和硅胶密封胶等黏合剂正在兴起。汽车产业对永续性的采用已显着增加,电动车的产量也显着增加。因此,这些黏合剂在汽车电子组件中的使用越来越多,这可能会导致未来几年需求的增加。就产量而言,预计在 2022-2028 年预测期内,氰基丙烯酸酯黏合剂和硅胶黏合剂的复合年增长率将分别超过 3.41% 和 4.05%。

中国作为领先的汽车製造商,主导市场主导地位

- 亚太地区是全球最大的汽车生产地区,中国、印度、日本等国家均名列全球主要汽车生产国。该地区的汽车产量预计将从 2021 年的 4,790 万辆增长 2022 年的 5.9%。

- 2020年,中国、印度、马来西亚、日本、印尼等多个国家都受到了新冠肺炎疫情的影响。由于生产设施关闭、国际边境关闭以及多个国家原材料短缺,汽车黏合剂和密封剂的消费量与 2019 年相比下降了近 13.3%。

- 亚太地区是黏合剂和密封剂生产不断增长的地区,中国凭藉其高品质的国内生产设施成为最大的汽车黏合剂和密封剂生产国。中国有 100 多家黏合剂和密封剂製造商,其产品销往世界各地。印度也是汽车生产大国,预计2022年汽车产量将比2021年增加6.5%,达610万辆。

- 随着许多国家实施推广电动车的政策,该地区的电动车产量正在上升。中国和印度是电动车不断成长的市场。预计这些因素将在预测期内推动汽车黏合剂和密封剂的需求。例如,2021年中国电动车产量将达到111万辆,较2020年成长1.05%。

亚太汽车胶黏剂和密封剂市场趋势

电动车的普及正在推动该产业

- 亚太地区汽车产业是市场主导产业之一,汽车销量大幅成长。在所有国家中,中国是最大的汽车生产国,占该地区汽车产量的57%左右,其次是日本(17%)、印度(10%)和韩国(8%)。

- 该地区的汽车销售和产量均大幅下降,影响了黏合剂的使用。 2017- 与前一年同期比较变动为-1.8%,而2018-19年度则进一步下降-6.4%。 2019-20年度,受新冠疫情影响,该地区产量再次受到负面影响,较去年同期与前一年同期比较10.2%。由于製造工厂停工和供应链中断,汽车零件短缺,生产水准受到限制。然而,预计汽车需求将在 2021 年再次增加并持续增长,从而导致预测期内全部区域的黏合剂使用量增加。

- 亚太电动车市场为黏合剂市场带来了另一个成长机会。电动和混合动力汽车的产量和采用率的不断提高,推动了汽车电子组装中黏合剂的使用量。中国是世界上最大的电动车生产国,也是全部区域最大的电动车生产国。 2016年至2021年,商用电动车保有量从562,603辆成长至1,116,382辆,成长率约98%。预计这些因素将增加对黏合剂的需求,有助于预测期内的市场成长。

亚太地区汽车胶合剂和密封剂产业概况

亚太汽车黏合剂和密封剂市场分散,前五大公司占据13.25%的市场份额。该市场的主要企业是:3M、汉高股份公司、湖北迴天新材料、亨斯迈国际有限责任公司和西卡股份公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 车

- 法律规范

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 价值炼和通路分析

第五章市场区隔

- 树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- VAE・EVA

- 其他树脂

- 科技

- 热熔胶

- 反应性

- 密封剂

- 溶剂型

- 紫外线固化胶合剂

- 水性

- 国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 其他亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- SHINSUNG PETROCHEMICAL

- Sika AG

- ThreeBond Holdings Co., Ltd.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92419

The Asia-Pacific Automotive Adhesives & Sealants Market size is estimated at 4.41 billion USD in 2024, and is expected to reach 5.78 billion USD by 2028, growing at a CAGR of 6.99% during the forecast period (2024-2028).

The adoption of sustainability in the automotive industry coupled with growing EV production to aid market demand

- Across the Asia-Pacific automotive adhesives and sealants market, polyurethane resins account for the largest share. The scope of polyurethane adhesive in North America is higher than other resins since the region includes many production facilities. From 2017 to 2019, the consumption growth rate declined by about -5% due to a reduction in automotive production. After the COVID-19 pandemic, the consumption growth rate rose by 10% Y-o-Y. Polyurethane adhesives are expected to record a CAGR of 4.5% during the forecast period 2022 to 2028.

- Epoxy and acrylic adhesives also have a significant presence in the Asia-Pacific automotive adhesives market. However, for epoxy, the upcoming year could be a great challenge as the raw materials used to produce epoxy adhesives are hazardous in nature and, thus, are getting regulated by government bodies in the region, such as AICS, PICCS, IECSC, and NZIoC. Epoxy adhesive is the second-largest consumed material and is expected to record a CAGR of about 4.2% during the forecast period 2022-2028. The epoxy adhesives segment is followed by the acrylic adhesives segment, which is expected to record a CAGR of about 4.5% during the forecast period 2022-2028.

- Adhesives such as cyanoacrylate and silicone sealants are on a growing trend. The adoption of sustainability in the automotive industry is increasing significantly, and EV production is increasing to a large extent. As a result, the usage of these adhesives for electronic component assembly in automobiles is increasing, which, as a result, may lead to increased demand over the coming years. Cyanoacrylate and silicone adhesives are expected to record CAGRs of above 3.41% and 4.05%, respectively, in terms of volume during the forecast period 2022-2028.

China to hold the pole position in the market owing to being major automobile manufacturer

- The Asia-Pacific is the largest producer of vehicles in the world, as countries like China, India, and Japan are among the major vehicle producers across the globe. Vehicle production in the region was expected to grow by 5.9% in 2022 from 47.9 million units in 2021.

- In 2020, many countries, including China, India, Malaysia, Japan, and Indonesia, were impacted by the COVID-19 pandemic. The consumption of automotive adhesives and sealants declined by nearly 13.3% compared to 2019 due to the shutdown of production facilities, the closing of international borders, and raw material shortages in several countries.

- Asia-Pacific is a growing region in the production of adhesives and sealants, of which China is the largest producer of automotive adhesives and sealants owing to the high-quality production facilities in the country. China has over 100 adhesives and sealants manufacturers supplying products worldwide. India is also a leading producer of vehicles, and it was expected to produce 6.1 million units of vehicles in 2022, which is 6.5% more than in 2021.

- The production of electric vehicles is increasing in the region due to the policies implemented by many countries to promote electric vehicles. China and India are the growing markets for electric vehicles. These factors are expected to drive the demand for automotive adhesives and sealants in the forecast period. For instance, electric vehicle production in China amounted to 1.11 million units in 2021, an increase of 1.05% more than in 2020.

Asia-Pacific Automotive Adhesives & Sealants Market Trends

Increasing adoption of electric vehicles to drive the industry

- The Asia-Pacific automotive industry is one of the leading industries in the market, as the sales of automotive vehicles are largely increasing. Among all the countries, China is the largest automotive producer, accounting for about 57% of the regional production, followed by Japan with 17%, India with 10%, and South Korea with 8%.

- Vehicle sales in the region have majorly declined along with production, owing to which the utilization of adhesives has been impacted. While the Y-o-Y variation in 2017-18 was -1.8%, it fell further by -6.4% in 2018-19. In 2019-20, regional production was again impacted negatively and recorded a -10.2% decline from the previous year due to the COVID-19 pandemic. The shutdown of manufacturing facilities and the shortage of vehicle components due to disruptions in the supply chain constrained the production level. However, in 2021, the demand for automobiles rose again and is expected to continue, thereby increasing the utilization of adhesives across the region over the forecast period.

- The EV market in Asia-Pacific offers another opportunity for the adhesives market to grow. The rising production and adoption of EVs and hybrid vehicles are boosting the usage of adhesives for electronic component assembly in vehicles. China is the largest producer of EVs globally as well as across the region. From 2016 to 2021, the volume of commercial electric vehicles increased from 562,603 to 1,116,382 units, recording a growth rate of about 98%. These factors are expected to increase the demand for adhesives and result in the higher market growth over the forecast period.

Asia-Pacific Automotive Adhesives & Sealants Industry Overview

The Asia-Pacific Automotive Adhesives & Sealants Market is fragmented, with the top five companies occupying 13.25%. The major players in this market are 3M, Henkel AG & Co. KGaA, Hubei Huitian New Materials Co. Ltd, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Automotive

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 UV Cured Adhesives

- 5.2.6 Water-borne

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Hubei Huitian New Materials Co. Ltd

- 6.4.7 Huntsman International LLC

- 6.4.8 SHINSUNG PETROCHEMICAL

- 6.4.9 Sika AG

- 6.4.10 ThreeBond Holdings Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219