|

市场调查报告书

商品编码

1693398

印度密封胶:市场占有率分析、产业趋势与统计、2025-2030 年成长预测India Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

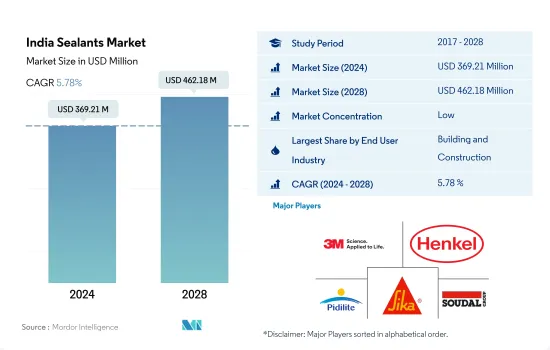

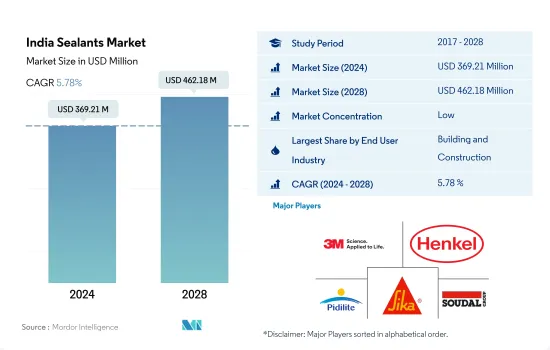

印度密封剂市场规模预计在 2024 年为 3.6921 亿美元,预计到 2028 年将达到 4.6218 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.78%。

汽车市场和建筑业的蓬勃发展预计将推动印度密封胶的消费

- 建筑业在印度的密封剂市场中占据主导地位,其次是其他终端用户行业,因为密封剂在建筑和建设活动中有多种应用,例如防水、防风雨密封、裂缝密封和接缝密封。建筑密封剂具有较长的使用寿命,并且易于应用于各种基材。 2021年,印度建筑业约占该国GDP的9%,抵销了新冠疫情带来的不利影响。印度政府持续推动低能耗建筑和永续发展,预计预测期内对密封剂的需求将逐步增加。

- 电气设备製造中使用各种密封剂进行灌封和保护应用。它们用于密封感测器、电缆等。预计2021年印度电子市场将占该国GDP的近2.5%,并且由于通讯和家用电子电器市场的需求不断增长,未来几年可能会出现可观的增长。预计这将推动其他终端用户工业领域对密封剂的需求。印度的机车、船舶和 DIY 行业正在呈现显着增长,预计到 2028 年将推动对基本密封剂的需求。

- 密封剂在汽车工业中有着广泛的用途,主要用于引擎和汽车垫圈,并为各种基材提供广泛的黏合性。由于消费者趋势向个人出行转变,印度的汽车製造业取得了良好的成长,预计这一趋势将在未来持续下去。因此,预计此类趋势将在 2022-2028 年预测期内推动对密封剂的需求。

印度密封胶市场趋势

政府在住宅领域的投资和倡议,例如「全民住宅」和 Pradhan Mantri Awas Yojana (PMAY),正在推动建筑业的发展

- 建筑业是印度第二大产业,对GDP的贡献率约为9%,并在2019年呈现出良好的成长动能。然而,新冠疫情爆发导致政府短暂封锁,建筑业因此大幅下滑。建设业是印度第二大产业,对GDP的贡献率约9%。预计到 2025 年,印度将成为世界第三大建筑市场。此外,预计预测期内(2022-2028 年),建筑业的复合年增长率约为 3.79%。

- 在住宅领域,政府正在未来几年推动大型计划。印度政府的「全民住宅」计画旨在到 2022 年为都市区贫困阶级建造超过 2,000 万套经济适用住宅。这将极大地促进住宅(市场上最大的类别),到 2023 年,住宅建设将占到该行业总量的三分之一以上。此外,诸如 Pradhan Mantri Awas Yojana (PMAY) 等倡议旨在到 2022 年为大量人口提供经济适用住宅。政府也致力于为建造或购买首套房屋的人提供部分抵押房屋抵押贷款利息补贴。

- 印度建筑领域也吸引了大量外国投资者的兴趣。 2000 年 4 月至 2020 年 3 月,建筑和开发领域(乡镇、住宅、建筑基础设施和建筑开发计划)的外国直接投资 (FDI) 达到 256.6 亿美元。全国范围内基础设施和建筑业发展的增加将导致对黏合剂和密封剂的需求增加。

政府推出的 e-AMRIT 等措施以及汽车贷款利率降低 2-3% 将推动汽车製造业

- 到2020年,印度的汽车工业将成为亚太地区第四大汽车工业。政府在2021年拨款4.32兆印度卢比扩建道路等措施也导致道路上车辆数量的增加。预计这一成长趋势将持续到2028年。

- 由于全国范围内的封锁、供应链中断和整体经济放缓,新冠疫情导致乘用车销售量从 2019 年的 338 万辆下降到 2021 年的 239 万辆。不过,由于政府采取措施支持汽车製造业,包括将汽车贷款利率降低 2-3 个百分点,2022 年 3 月新车销售量升至 272 万辆。在乘用车领域,玛鲁蒂铃木是最大的汽车品牌,2021 年的市场占有率为 52%。预计这一成长趋势将在预测期内(2022-2028 年)持续下去。

- 商用车方面,塔塔汽车销售量最大,2022年3月市场占有率接近43%。商用车销量从2021年的568,560辆增加至2022年3月的716,570辆,这得益于2020年新冠疫情引发的亏损经济復苏。商用车销量从2021年的568,560辆增加至2022年3月的716,570辆,这得益于2020年新冠疫情引发的亏损经济復苏。

- 印度政府透过 e-AMRIT 等倡议推动电动车製造业的发展,这将推动 2028 年前电动车产量的增加。与 2020 年相比,2021 年印度的电动车销量将成长 108%。

印度密封胶产业概况

印度密封剂市场较为分散,前五大公司占21.68%的市占率。该市场的主要企业有:3M、汉高股份公司、Pidilite Industries Ltd.、西卡股份公司和Soudal Holding NV。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 法律规范

- 印度

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 医疗保健

- 其他的

- 树脂

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 硅胶

- 其他的

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- ASTRAL ADHESIVES

- Dow

- Henkel AG & Co. KGaA

- Jubilant Industries Ltd.

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

第七章 CEO 的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92454

The India Sealants Market size is estimated at 369.21 million USD in 2024, and is expected to reach 462.18 million USD by 2028, growing at a CAGR of 5.78% during the forecast period (2024-2028).

Emerging automotive market and construction industry are expected to boost the consumption of sealants in India

- The construction industry dominates the Indian sealants market, followed by other end-user industries due to the diverse applications of sealants in building and construction activities, such as waterproofing, weather-sealing, cracks-sealing, and joint-sealing. Construction sealants are designed for longevity and ease of application on different substrates. The Indian construction sector accounted for about 9% of the nation's GDP in 2021 by offsetting the adverse impacts of the COVID-19 pandemic. The Indian government continuously promotes low-energy buildings and sustainable development, which is expected to increase the demand for sealants over the forecast period gradually.

- Various sealants are used in electrical equipment manufacturing for potting and protecting applications. They are used for sealing sensors and cables, etc. The Indian electronics market accounted for nearly 2.5% of the country's GDP in 2021 and is likely to record promising growth over the coming years due to the growing demand from the telecommunication and domestic appliances market. This, in turn, will foster the demand for sealants in the other end-user industry segment. India has showcased considerable growth in the locomotive, marine, and DIY industries, which is expected to boost the demand for the required sealants by 2028.

- Sealants have diverse applications in the automotive industry and exhibit extensive bonding to various substrates, mainly used for engines and car gaskets. India has achieved decent growth in automotive production due to the shifting consumer trend toward personal mobility, which is likely to continue over the coming years. Thus, such a trend is expected to augment the demand for sealants over the forecast period 2022-2028.

India Sealants Market Trends

Government investments and initiatives such as Housing for All and Pradhan Mantri Awas Yojana (PMAY) for the housing sector to lead the construction industry

- The construction industry is the second-largest industry in India, with a GDP contribution of about 9%, and it showed promising growth in 2019. However, due to the outbreak of COVID-19, the construction sector witnessed a significant decline, owing to the lockdown by the government for a brief period. The construction industry is the second-largest industry in India, with a GDP contribution of about 9%. India is expected to become the third-largest construction market in the world by 2025. Moreover, the construction industry is expected to register a CAGR of about 3.79% during the forecast period (2022 - 2028).

- In the residential segment, the government is pushing huge projects in the next few years. The government's 'Housing for All initiative aims to build more than 20 million affordable homes for the urban poor by 2022. This will provide a significant boost to residential construction (the market's largest category) and accounts for more than a third of the industry's total value by 2023. Furthermore, initiatives such as Pradhan Mantri Awas Yojana (PMAY) are intended to provide affordable homes to many people by 2022. The government is also into providing some subsidiary on interest on housing loans if a citizen builds/buys their first house.

- India is also witnessing significant interest from international investors in the construction space. Foreign Direct Investment (FDI) in the construction development sector (townships, housing, built-up infrastructure, and construction development projects) stood at USD 25.66 billion from April 2000 to March 2020. The increasing infrastructure and construction development across the nation leads to an increase in the demand for adhesives and sealants.

Rising government initiatives such as e-AMRIT and auto loan interest rates decrease by 2-3% to lead the automotive manufacturing

- The Indian automotive industry was the fourth largest in the Asia-Pacific by volume in 2020. With the government initiatives such as the expansion of roads in 2021 by allocation of funds of INR 4.32 trillion, the number of vehicles has also increased on roads. This trend of growth is expected to sustain in the coming years up to 2028.

- Due to the COVID-19 pandemic, there was a dip in sales of passenger vehicles from 3.38 million in 2019 to 2.39 million in 2021 because of nationwide lockdown, supply chain disruptions, and overall economic slowdown. But, with the government initiatives to support the automobile manufacturing sector, such as decreasing interest rates for auto loans by 2-3%, it moved up to 2.72 million vehicles by March 2022. Maruti Suzuki is the largest in the passenger vehicles segment, with a market share of 52% in 2021. This growth trend is expected to sustain in the forecast period, which is 2022-2028.

- In the case of commercial vehicles, Tata Motors is the largest vehicle producer by number, with a market share of nearly 43% in March 2022. The commercial vehicle sales increased from 568,560 in 2021 to 716570 by March 2022 because of recovering loss-ridden economy due to the impact of COVID-19 in 2020. With this growing post-pandemic economy, it is expected to increase in the mentioned period.

- The electric vehicle manufacturing push by the Indian government with initiatives such as e-AMRIT will lead increase in the production of electric vehicles in years up to 2028. The increase in the number of electric vehicles being sold in India increased by 108% in 2021 compared to 2020.

India Sealants Industry Overview

The India Sealants Market is fragmented, with the top five companies occupying 21.68%. The major players in this market are 3M, Henkel AG & Co. KGaA, Pidilite Industries Ltd., Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 India

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 ASTRAL ADHESIVES

- 6.4.4 Dow

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Jubilant Industries Ltd.

- 6.4.7 Pidilite Industries Ltd.

- 6.4.8 Sika AG

- 6.4.9 Soudal Holding N.V.

- 6.4.10 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219